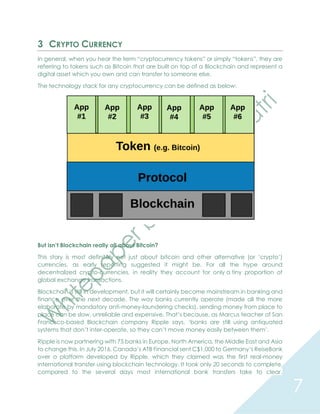

This document provides an overview of blockchain technology and investment options related to blockchain. It defines blockchain as a distributed public database that records digital transactions in a growing list of blocks. It discusses cryptocurrencies like Bitcoin that are built on blockchain networks. The document outlines several investment avenues for blockchain, including cryptocurrencies, crypto-currency syndicates, crowdfunding of blockchain startups, venture capital funds focused on fintech including blockchain, and potential blockchain-related public equities. It concludes that blockchain will significantly change finance and that cautious evaluation is needed before investing.