New base energy news issue 861 dated 30 may 2016

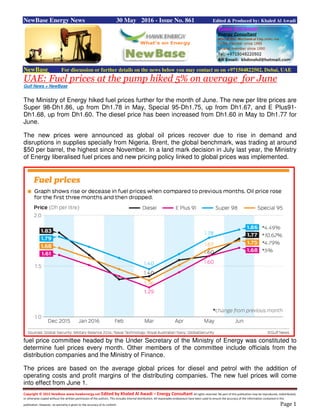

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 30 May 2016 - Issue No. 861 Edited & Produced by: Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE UAE: Fuel prices at the pump hiked 5% on average for June Gulf News + NewBase The Ministry of Energy hiked fuel prices further for the month of June. The new per litre prices are Super 98-Dh1.86, up from Dh1.78 in May, Special 95-Dh1.75, up from Dh1.67, and E Plus91- Dh1.68, up from Dh1.60. The diesel price has been increased from Dh1.60 in May to Dh1.77 for June. The new prices were announced as global oil prices recover due to rise in demand and disruptions in supplies specially from Nigeria. Brent, the global benchmark, was trading at around $50 per barrel, the highest since November. In a land mark decision in July last year, the Ministry of Energy liberalised fuel prices and new pricing policy linked to global prices was implemented. fuel price committee headed by the Under Secretary of the Ministry of Energy was constituted to determine fuel prices every month. Other members of the committee include officials from the distribution companies and the Ministry of Finance. The prices are based on the average global prices for diesel and petrol with the addition of operating costs and profit margins of the distributing companies. The new fuel prices will come into effect from June 1.

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 Recovery in oil prices is positive for UAE economy The recent rally in oil prices to around $50 per barrel will reflect positively on the UAE economy, a top ranking official from the Ministry of Economy said in Abu Dhabi on Sunday.“We see a positive trend in the oil prices which eventually will reflect positively on the UAE economy. From less than $30, oil prices have moved to $50 which is good,” said Abdul Aziz Al Shehhi, Under Secretary of the Ministry of Economy speaking to Gulf News on the sidelines of UAE-South Korea Joint Economic Committee meeting. Al Shehhi did not provide an estimate if oil prices would continue to rise further. A member of the Organisation of the Petroleum Exporting Countries (Opec), the UAE produces about 2.8 million barrels of oil per day with plans to expand the capacity to 3.5 million barrels per day. The UAE along with other Opec members have decided to keep the production levels unchanged despite drop in oil prices in their previous meetings in Vienna. The strategy paid off with a number of high cost producers in the US ceasing production due to low oil prices. Opec member countries will meet again on Thursday to take stock of the situation and determine the future strategy in supporting oil prices though no decision is expected at the meet, according to analysts. “The best Opec can do is to sit down and talk oil instead of letting politics and regional differences get in the way,” Ole Hansen, Head of Commodity Strategy at Saxo Bank said. “Saudi Arabia’s new oil minister is expected to repeat the hardline approach seen at the failed Doha meeting. How that will go down, especially with Iran remains to be seen.” “Rebuilding the group’s reputation should be a priority. Whether they succeed or not will determine the potential impact on the market.” In the last month’s meeting in Doha oil producing countries failed to reach an agreement to freeze production at January levels. Saudi Arabia, the biggest oil producer insisted that Iran, which did not participate in the meet join the deal as both countries compete to increase their market share.

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Egypt Boosts LNG Imports Until Production Is Optimized East Med Energy Egypt is expected to become self sufficient in natural gas by 2019. In the meantime, the country is increasing its Liquefied Natural Gas (LNG) import capacity to meet the growing local demand. Egypt will issue a tender within the coming few days to import 10 LNG ship cargoes for July and August delivery, said an official in the state gas company, EGAS. The official told Reuters that once the tender is complete; Egypt will consider importing 10 additional cargoes of LNG, either through direct contracts or through another international tender. The cargoes will be delivered to Ain Sokhna on the Gulf of Suez, where Egypt has two Floating Storage and Re-gasification Units (FSRU). They serve as the country’s import terminals. Those temporary import terminals, which started operation last year, are crucial in the interim period until the existing gas developments start commercial production early 2019. Egypt will also benefit from Jordan’s newly deployed FSRU in the region of Aqaba, according to press reports. The energy-starved country currently spends $250 million – $300 million per month on natural gas imports, said Egypt’s minister of petroleum and mineral resources, Tarek El Molla. El Molla disclosed that his country was looking to charter a third FSRU by the second quarter of next year. This will increase Egypt’s import capacity from just over 1 billion cubic feet per day (BCF/D) currently, to nearly 2 BCF/D by the end of next year. This will provide enough natural gas to fill the energy gap between domestic production and consumption. Egypt is trying to speed up production at recent discoveries to fill its energy gap as soon as possible. It expects to increase its natural gas production from 3.9 BCF/D currently, to 5.5 – 6 BCF/D by the end of 2019, said El Molla. The country currently has 12 natural gas field development projects underway, worth a total of $33 billion in investment, El Molla said early last week in an inauguration ceremony of a fertilizer plant in the port city of Damietta. The three largest projects, which include the giant Zohr field, are expected to collectively bring 4.6 BCF/D of gas online by the start of 2019, El Molla said. With declining oil and gas production and increasing domestic consumption, Egypt has turned into a net importer, after being a natural gas exporter earlier this decade.

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Qatar LNG well set to compete at lower prices, says Samba © Gulf Times 2016 Qatar's LNG industry is "well positioned to compete at lower prices" Samba Financial group has said and noted that the outlook for LNG prices "remains bearish" in 2017. Liquefied natural gas prices have continued to trend down this year and implied Asia spot price currently trades at around $4mbtu, Samba said in its latest "Qatar Chart Book". Many companies made billions of dollars of investment in LNG capacity during the boom years. This "wave of supply is coming online just at a time when global demand growth looks modest - leading to a massive oversupply of LNG." "We expect prices to stay at $4-5mbtu (million British thermal units) for the remainder of the year - a long way from the $14mbtu average in 2014," Samba said. Indeed, RasGas recently renegotiated long-term contracts for LNG sales to India. With this in mind, Samba has adjusted Qatar's total export revenues slightly lower to $60bn in 2016. This figure represents a fall from the 2014 level - resulting in a current account deficit of 6% of GDP, although Samba expects a "return to surplus" in 2017. Qatar's budget for 2016 "focuses on maintaining capital spending while consolidating expenditures" elsewhere. This should support sustained growth of around 4% over the next two years, Samba said.

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Qatar's budget for 2016 foresees the first deficit in 15 years, coming in at 4.8% of GDP based on oil prices of $48 for barrel (Samba anticipates a larger deficit of 5.8% based on its $40 estimate). Budgeted expenditures total $55.6bn, which represents a 7.3% cut from the last full- year budget. There is already evidence of fiscal consolidation; the subsidy on petrol has been cut with prices rising 30%-35% in January, while the price of gas and electricity has also increased. The Ministry of Finance announced that any deficits (Samba estimates 2016 -17 deficits will total $18bn) would be funded entirely through debt issuance (both domestic and external) rather than drawing on external savings. This will lead to an increase in the government's debt which, as a ratio to GDP is projected to approach 50% (in part due to lower nominal GDP). The Government has already issued $7.4bn worth of domestic bonds and sukuk since September 2015 as well as a $5bn syndicated loan, which was taken up by international banks. "A sovereign $5bn Eurobond is also due shortly," Samba said. The capacity of the domestic banking sector to absorb government debt was tested after the September and November bond and sukuk issuances, prompting a large spike in the interbank rate, Samba noted.

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Kuwait to spend Dh422bn on oil projects The National +Arab News Kuwait has earmarked 34.5 billion dinars (Dh422.41) to spend on oil projects over the next five years, despite the slump in oil prices, a senior executive said on Sunday. “We have earmarked 34.5bn dinars for spending on oil projects over the next five years," Wafa Al Zaabi, the head of planning at Kuwait Petroleum, told an oil conference. “Over 30bn dinars will be spent on the local market and the rest abroad," she said. Over two-thirds of the spending, or 23bn dinars, has been allocated for exploration and production, Ms Al Zaabi said. Kuwait aims to raise its production capacity, currently just over 3 million barrels per day, to 4 million bpd by 2020 and maintain it for another decade. Among main projects, it plans to build four gathering centres, carry out a key project to boost heavy oil production and raise output of free natural gas to over two billion cubic feet daily, from 150 million cubic feet currently, Ms Al Zaabi said. Besides the upstream projects, Kuwait is currently implementing three downstream ventures costing over US$30bn. These include a new 615,000 bpd refinery and a clean fuel project to upgrade two of the three existing refineries, and a platform for LNG imports.

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Kuwait National Petroleum Company (KNPC), the state refining operation, is in final stages of talks with international institutions for US$6.4bn in the second tranche of loans to finance its multibillion-dollar Clean Fuels project, the state news agency Kuna reported on Sunday. The first portion, signed on April 28, was worth 1.2bn dinars with Kuwaiti lenders led by National Bank of Kuwait and Kuwait Finance House. KNPC is in the process of final legal reviews for the foreign loans and will determine the pricing and interest rates, Kuna quoted the company’s financial advisor Khalid Al Ajeel as saying. International lenders for the second tranche will include credit agencies from Europe, South Korea and Japan, Mr Al Ajeel said. Like other Arabian Gulf oil-exporting nations, Kuwait’s revenues have sharply dropped in the past 20 months due to a slump in oil prices. But the government has insisted it will continue capital investment as planned. Kuwait has amassed around $600bn in surpluses in the 16 years to 2014 due to high oil prices. Around 95 per cent of state revenues came from oil.

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 NewBase 30 May 2016 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE As crude hits $50 a barrel, rise on start of peak US demand season Reuters + NewBase Oil prices edged up in early trading on Monday as the peak demand U.S. summer driving season officially kicks off just as its crude production falls to its lowest level since September 2014. U.S. West Texas Intermediate (WTI) crude futures were trading at $49.44 per barrel at 0108 GMT, up 11 cents from their last settlement. International Brent futures were at $49.36 a barrel, up 4 cents. "Oil prices stayed within touch of $50 per barrel despite news that some Canadian oil sands producers were planning on restarting operations," ANZ said on Monday. Oil producer Suncor Energy is planning to ramp up output at its oil sands fields in Alberta this week after it was forced to shut down earlier in May due to massive wildfires. Despite the expected rise in Canadian output, ANZ bank said that WTI price support "still lingers" after the large fall in U.S. oil inventories late last week by 4.2 million barrels to 537 million barrels due to strong demand. Traders said that the official start to the U.S. peak demand summer driving season, which kicks off with Memorial Day on Monday, was the main reason for rising seasonal demand. This came just as U.S. crude oil production fell to 8.77 million barrels per day (bpd), the lowest level since September 2014, and down 8.77 percent since their June 2015 peak. In global oil markets, Brent prices have been supported by a series of supply disruptions in Nigeria, where militants have been staging a wave of attacks on oil pipelines, cutting the country's output to more than two decade lows. Oil price special coverage

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 Attention will also be on a meeting by the Organization of the Petroleum Exporting Countries (OPEC) in Vienna this week, although most analysts do not expect any decisions that would lead to changes in production. With the price of oil finally touching $50 a barrel this week, producers and speculators have been loading up on options to protect themselves from a downside risk, signaling there are still some jitters surrounding the recent rally. Deep out-of-the-money put options - options that would not be profitable until a substantial pullback in the price of oil - have shown a marked increase in implied volatility, a sign that producers are locking in prices close to levels for them to be profitable while speculators are protecting themselves from a potential correction. U.S. crude has nearly doubled from 12-year lows touched in February. Market sources say much of that rally was fueled by the perception of the improving fundamental picture, with falling U.S. output and global supply outages helping to rebalance a market reeling from oversupply for nearly two years. That has prompted hedging among producers. The current put skew - the difference in implied volatility for out-of-the-money and in-the-money options - is fairly typical of a market where producer hedging is prominent John Saucer, vice president of research and analytics at Mobius Risk Group in Houston, said implied volatility has lately been cheap, making options attractive for those either protecting against or betting on downside. Options expiring in 12 months show a strong bias in favor of out-of-the-money puts, which are trading at a much higher premium than similar out-of-the-money call options. That's in part due to producer hedging, which involves selling those long-dated calls while buying puts or put spreads. On Friday, the most actively traded are the $44 July puts, which had traded over 3,300 lots by noon ET (1600 GMT). Among longer-dated options, open interest in the $40 December 2016 puts has spiked 10 percent in the last 10 days to nearly 35,000 contracts. Open interest in $45 Dec. 2016 puts has risen about 10 percent in a similar time frame. For December 2017 maturities, the two most active options were the $40 and $45 puts. With crude at $50 a barrel, hedging could intensify, said Jesper Dannesboe, senior commodity strategist at Societe Generale. Next month's meeting of the Organization of the Petroleum Exporting Countries (OPEC) added to concerns. "Whether you're bullish or bearish, you're going to have jitters going into this week because you've got this huge variable event and there's some level of uncertainty," Saucer said.

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 NewBase Special Coverage News Agencies News Release 30 May 2016 Oil States Expected to Stick With Saudis : OPEC Reality Check Bloomberg - Caroline Alexander caroaalex OPEC members gathering in Vienna June 2 are expected to go along with a Saudi Arabia-led policy focused on squeezing out rivals amid signs the strategy is working. That means the meeting may be less fraught than the previous summit in December, which ended with public criticism of the Saudi position from Venezuela and Iran. By allowing prices to fall, high-cost producers are being forced out, easing the supply glut and spurring a rally of 80 percent since January to about $50 a barrel. All but one of 27 analysts surveyed by Bloomberg said the Organization of Petroleum Exporting Countries will stick with the strategy. An alternative proposal -- to freeze output -- was finally rejected in Doha last month. The group may also choose a secretary-general to replace Abdalla El-Badri, whose term has been extended after members failed to agree on a successor. In recent months, three new hopefuls have emerged to try and break the impasse: Nigeria’s Mohammed Barkindo, Indonesia’s Mahendra Siregar and Venezuela’s Ali Rodriguez. Following are the latest comments from OPEC members and analysts. The respective shares of supply are based on April levels. The estimates for the price each member needs to balance its budget are from the International Monetary Fund unless stated otherwise. ALGERIA Price needed: $87.6 Share of OPEC production: 3.3 percent Algeria tried, and failed, last year to organize a meeting of non-OPEC/OPEC members to push for output cuts, as years of declining crude production and low prices weighed on its fiscal deficit. A freeze by producers is needed immediately to stabilize prices, Salah Khebri, minister of energy and mines, said in an interview mid-May. “Our main message to the next OPEC meeting is that it needs to restore unity and work for the benefit of all members collectively,” he said.

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 ANGOLA Price needed: $93.14 (RBC Capital Markets) Share of OPEC production: 5.4 percent Angola is seeking an IMF loan as state revenue plunges. Its over-reliance on strong oil prices leaves savings and levels of inward investment ‘‘highly vulnerable’’ to swings in the global economy, Fitch unit BMI Research said in e-mailed report. ECUADOR Price needed: $75.16 (RBC Capital Markets) Share of OPEC production: 1.7 percent Ecuador supported an oil-output freeze at the Doha meeting. Minister Jose Icaza met with his Venezuelan counterpart before the summit to discuss prices and seek to agree on a unified position. Icaza became Ecuador’s new oil minister in early May following the resignation of Carlos Pareja. INDONESIA Unlike other OPEC members, Indonesia is still a net oil importer so the fiscal break-even concept is not applicable. Share of OPEC production: 2.2% Indonesia rejoined OPEC at the Dec. 4 meeting, seven years after suspending its membership. It will stick to its plan to increase oil output this year even if some of the world’s biggest producers move to cap production, Energy and Mineral Resources Minister Sudirman Said said in February. IRAN Price needed: $61.5 Share of OPEC production: 11 percent The Persian Gulf nation is rebuilding its energy industry and restoring crude sales after the lifting of international restrictions in January. Exports are already at 2 million barrels a day, just short of pre-sanctions levels, the IEA said in a recent monthly oil market report. The head of the state oil company said the country -- a key advocate of output restraint in previous years -- has no plans to join any output freeze as it remains focused on restoring exports. IRAQ Price needed: $59.7 Share of OPEC production: 13 percent Production has jumped more than 40 percent since mid-2014 and exports are at near-record levels. But plunging government revenue is hampering the state’s ability to invest, and OPEC’s second-biggest crude producer is reaching the limits of its capacity to store and export oil,

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 according to analysts at Energy Aspects Ltd. and FGE. Oil Minister Adel Abdul Mahdi resigned in February amid ongoing political turmoil, his duties are being carried out by Fayyad Al-Nima. KUWAIT Price needed: $52.1 Share of OPEC production: 8.7 percent Kuwait plans to boost oil production to more than 3 million barrels a day within months, doubling output from where it stood during April’s oil-worker strike. Kuwait’s acting Oil Minister Anas Al- Saleh, said on May 18 that OPEC’s policy “has been working well.” LIBYA Price needed: $195.2 Share of OPEC production: 0.9 percent OPEC’s smallest producer. Competing administrations of Libya’s state-run National Oil Corp. in the east and west of the divided country agreed May 17 to resume exports from Hariga port to help revive production, which has dropped 80 percent since the 2011 uprising that ousted Muammar Qaddafi. It isn’t clear if it will send anyone to the meeting; it didn’t attend the Doha freeze talks in April. NIGERIA Price needed: $104.49 (RBC Capital Markets) Share of OPEC production: 5.1 percent A resurgence in militant attacks in Nigeria’s oil-producing region has cut output to the lowest in 27 years, helping buoy global prices. An armed group calling itself the Niger Delta Avengers has warned of more attacks to come. QATAR Price needed: $52.4 Share of OPEC production: 2 percent Mohammed Al Sada, Qatar’s minister of energy and industry who is also president of OPEC, said global demand is catching up with supply and the market should see a “rebalancing” in the second half of the year as cheaper crude has forced some production to close. Qatar is expected to swing into a budget deficit this year, according to the IMF. SAUDI ARABIA Price needed: $66.7 Share of OPEC production: 31 percent

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 Saudi Arabia will probably keep producing crude at near-record levels under new Energy Minister Khalid Al-Falih, an ally of Deputy Crown Prince Mohammed bin Salman. Prince Mohammed scuppered the oil-freeze plan, and Al-Falih’s appointment points to an “exceedingly high probability that there will be no Saudi agreement to freeze let alone cut production,” analysts including Ed Morse said in an e-mailed note dated May 9. UNITED ARAB EMIRATES Price needed: $71.8 Share of OPEC production: 8.9 percent U.A.E. still supports stability in the oil market, said Matar al Neyadi, the undersecretary of the energy ministry. VENEZUELA Price needed: $121.06 (RBC Capital Markets) Share of OPEC production: 7.4 percent Venezuela is one of the so-called Fragile Five OPEC members most at risk from significant instability amid the turmoil in prices, according to RBC Capital Markets LLC. Energy Minister Eulogio Del Pino was one of the most ardent advocates of the failed production-freeze agreement. While the country’s economy remains in critical condition, Caracas is probably resigned to the course set by Riyadh, said Jason Bordoff, director of the Center on Global Energy Policy at Columbia University in New York.

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 30 May 2016 K. Al Awadi

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15