New base 529 special 29 january 2015

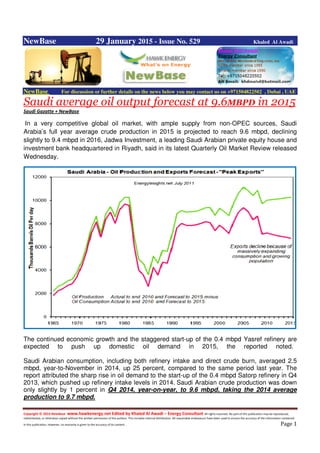

- 1. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 1 NewBase 29 January 2015 - Issue No. 529 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Saudi average oil output forecast at 9.6MBPD in 2015 Saudi Gazatte + NewBase In a very competitive global oil market, with ample supply from non-OPEC sources, Saudi Arabia’s full year average crude production in 2015 is projected to reach 9.6 mbpd, declining slightly to 9.4 mbpd in 2016, Jadwa Investment, a leading Saudi Arabian private equity house and investment bank headquartered in Riyadh, said in its latest Quarterly Oil Market Review released Wednesday. The continued economic growth and the staggered start-up of the 0.4 mbpd Yasref refinery are expected to push up domestic oil demand in 2015, the reported noted. Saudi Arabian consumption, including both refinery intake and direct crude burn, averaged 2.5 mbpd, year-to-November in 2014, up 25 percent, compared to the same period last year. The report attributed the sharp rise in oil demand to the start-up of the 0.4 mbpd Satorp refinery in Q4 2013, which pushed up refinery intake levels in 2014. Saudi Arabian crude production was down only slightly by 1 percent in Q4 2014, year-on-year, to 9.6 mbpd, taking the 2014 average production to 9.7 mbpd.

- 2. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 2 In 2014 Saudi Arabia witnessed increased competition in two of its key export markets, the US and China. Saudi exports to the US were steady at around 1.4 mbpd in H1 2014 but dropped to just below 1 mbpd in H2 2014. Saudi Arabia continues to face competition in the Asian market with other Middle Eastern suppliers also cutting official selling process (OSPs) to Asia, underling the trend in discounting. According to OPEC data, global demand in Q4 2014 increased by 1.4 mbpd, year-on- year, with 1.3 mbpd of increases from non- OECD countries and a rise in 0.1 mbpd in OECD countries. The report underscored that a $20 per barrel decline in oil prices will bring about and estimated 0.25 percent increase in global GDP over a year, which in turn, will spur demand for oil. Despite prices dropping below $50 per barrel at the beginning of January, the report sees prices recovering to $79 per barrel for 2015 as a whole, supported by stockpiling of crude, the occurrence of contango (under which circumstance the futures price of a commodity is above the expected future spot price) resulting in some surplus leaving the market, a quicker than projected reduction in US shale oil and a pickup in demand due to improvements in global economic growth. Brent prices dropped 25 percent in Q4 2014, to $77 per barrel, quarter-on-quarter, pushing full year 2014 prices to an average of $99.4 per barrel, below the previously forecast price of $102. The report projected that current low oil prices will persist into the first quarter of 2015 as surpluses in global oil balances peak in the absence of cuts from OPEC. Moreover, Jadwa report underlined that there is the possibility that US shale oil supply will not respond to lower prices until after the second half of 2015, resulting in a steeper surplus in global balances than forecast by OPEC.

- 3. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 3 Saudi petro-chem Sadara & Chemie-Cluster Bayern in JV Sadara + SG + NewBase Sadara Chemical Company (Sadara) and Chemie-Cluster Bayern GmbH (CCB) have signed recently an agreement to cooperate and jointly support the development of Chemical based value chains in PlasChem Park in Jubail. The agreement will primarily focus on the identification and attraction of German and European Small and Medium Enterprises (SMEs) working in the chemicals industries to establish a presence in PlasChem Park, which is a collaborative effort by Sadara and the Royal Commission for Jubail and Yanbu (RCJY). The signing was co-initiated by the German-Saudi Arabian Liaison Office for Economic Affairs. Mohammad Alazzaz, Director of Value Park at Sadara (right) and Daniel Gottschald, Managing Director of Chemie-Cluster Bayern GmbH (center) during the signing of cooperation agreement Under the terms of the agreement, Sadara and CCB will collaborate to identify promising market opportunities in Saudi Arabia for chemical companies, in particular SMEs with a specific interest in opening or expanding operations in the Kingdom and connect those companies with the right partners to drive their success.

- 4. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 4 A key factor of the agreement is the PlasChem Park project, a 12-square-kilometer site in Jubail Industrial City II, located next to Sadara’s new manufacturing complex and devoted exclusively to chemical and conversion industries. PlasChem Park offers tenants easy access to Sadara’s differentiated product slate, as well as inputs from other local petrochemical producers, enabling downstream industries based on polyurethane, amines, glycol ether, polyethylene, propylene glycol and other products. Building on the knowledge that both Sadara and CCB have developed the Saudi chemical market, the agreement will also help the two parties identify hidden local market potential where joint business development efforts can be more effective than those of individual SMEs. Member companies of the CCB network will benefit by being able to capitalize on downstream investment opportunities, thereby establishing or expanding their manufacturing presence into the Kingdom, leveraging the friendly business environment, the availability of differentiated raw materials, the robust infrastructure and the shared services to be made available at Sadara’s PlasChem Park complex. CCB is a German public-private partnership organization initiated by the state government of Bavaria, chemical industry associations, several Bavarian universities and research organizations. It represents a network of about 270 companies and research institutes from Bavaria’s chemical industries. CCB’s member companies have an export rate of more than 65% of their total sales and represent leading solution providers for a broad portfolio of chemical products and value chains. “Our partnership with CCB will support our ongoing efforts in the development of the Kingdom’s value-added downstream industry. The Kingdom is driving downstream development in many sectors, and we are actively working to develop new downstream opportunities in the chemicals industries. The rewards of this mutually beneficial relationship will spread throughout the Saudi economy and help diversify the Kingdom’s industrial portfolio,” said the Director of Value Park at Sadara, Mohammad Alazzaz. The Value Park team is responsible for promoting and developing differentiated chemical downstream opportunities to be located in the Jubail PlasChem Park.

- 5. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 5 Kuwait Cuts Diesel Fuel Prices After Political Pressure KUNA Kuwait has cut selling prices of diesel and kerosene at filling stations after political opposition to price hikes underlined the difficulty of reforming the country’s welfare system, even as the loss of oil revenues makes reform more urgent. On Jan. 1, the government raised the price of diesel at wholesalers and filling stations to 0.170 dinar (59 U.S. cents) per litre from 0.055 dinar. Kerosene prices also increased. The changes aimed to reduce the burden of lavish subsidies on state finances. State news agency KUNA estimated that diesel price reform would save the government around $1 billion a year. Although the new prices of diesel and kerosene were still among the lowest in the world, the politically sensitive decision prompted heavy criticism of government policy by some members of parliament, who argued it was unfair to consumers. On Wednesday, state refiner Kuwait National Petroleum Co (KNPC) cut diesel and kerosene prices back to 0.110 dinar, effective from Feb. 1, KUNA reported. It quoted KNPC spokesman Khalid al-Asousi as saying that from now on, domestic prices of the fuels would be reviewed monthly according to developments in the global markets. KNPC will continue to supply certain parties, including those with very large demand for the fuels, at the old, subsidised price of 0.055 dinar, he said. Cutting subsidies has become more important for Kuwait’s government with the plunge in global oil prices, which has slashed state export revenues. Earlier this week, the finance ministry projected a budget deficit of 8.23 billion dinars for the next fiscal year starting in April. After the controversy over the diesel subsidy reform, Oil Minister Ali al-Omair said early this month that the government had decided to postpone any removal of subsidies from petrol, electricity and water. He did not say when authorities might resume considering the reforms.

- 6. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 6 S.Sudan: oil production rises to 169,000 bpd - oil ministry Reuters + NewBase South Sudan's oil production has risen by about 9,000 barrels per day (bpd) to 169,000 bpd from December last year, petroleum minister Stephen Dhieu Dau said on Tuesday, despite sporadic fighting near oil-producing fields. Production has been slashed by about a third since fighting broke out in the world's newest state in December 2013, with many South Sudanese oil wells damaged and output in decline at functioning fields due to a dearth of spare parts. 'We (were) producing at the average of 160,000 but it has been increased now from the beginning of this year. It has gotten to 168,000 to 169,000,' Dau told reporters in the capital Juba. He said all the production was taking place in Upper Nile State but did not elaborate why production was rising. South Sudan officials last year said that former foe Sudan was planning to send equipment and engineers to boost output in Upper Nile State and Unity State, the two oil-producing regions. South Sudan relies almost exclusively on oil for government funds. Last year oil revenues were hit by a decline in output and falling oil prices on global markets. Violence erupted over political tension between President Salva Kiir and his sacked deputy and rival, Riek Machar. The fighting has killed more than 10,000 people, caused more than 1.5 million to flee and driven the country of 11 million closer to famine.

- 7. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 7 US: Lower 48 states’ oil production outlook stable despite expected near-term reduction in rig count Source: U.S. Energy Information Administration, January Short-Term Energy Outlook The sharp decline in oil prices over the last quarter of 2014, which has continued in January, is already having a significant effect on drilling activity in the United States, as shown by the 16% decline in the number of active onshore drilling rigs in the Lower 48 states between the weeks ending on October 31, 2014 and January 23, 2015, according to data from Baker-Hughes. Moving from what has happened to forecasting the future is challenging, in part because market expectations of uncertainty in the price outlook have increased as reflected in the current values of futures and options contracts. When the latest edition of EIA's monthly Short-Term Energy Outlook (STEO) was issued on January 13, the 95% confidence interval for market expectations for prices in December 2015 was extremely wide, with upper and lower limits of $28/barrel (bbl) and $112/bbl, respectively. The growing uncertainty surrounding oil prices presents a major challenge to all price forecasts. EIA's January STEO forecasts Brent crude oil prices averaging $58/bbl in 2015 and $75/bbl in 2016, with annual average West Texas Intermediate (WTI) prices expected to be $3/bbl to $4/bbl lower. Should its price forecast be realized, EIA projects that the number of operating rigs will decrease by approximately 24% from January to October 2015 before beginning to rebound in November 2015. However, the outlook for Lower 48 production reflects more than just the rig count. Other key factors include the efficiency of drilling, which EIA tracks in its Drilling Productivity Report, the rate of decline in production from existing wells, and changes in the amount of time between the start of drilling (called spudding) and the completion of the well.

- 8. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 8 As discussed in a previous Today in Energy article on the effect of declining crude oil prices on U.S. production, permits and drilling in North Dakota declined during the financial downturn of 2008-09, but production rates did not decline as substantially. At the time of the July 2008 oil price peak, drilling activity in the Bakken-Three Forks formations outpaced well completion activity as increasing numbers of wells were drilled. Averaging about 70 days before the oil price peak, spud-to-completion times almost doubled within two months, reaching more than 130 days. This increase created a backlog of wells that had been drilled but not yet completed. As fewer wells were drilled during the subsequent drop in oil prices, the spud-to-completion times decreased. Increased drilling activity in the Bakken since 2011 has once again increased spud-to- completion times, which have stabilized at more than 120 days per well, almost twice previous minimum levels. This backlog of wells acts as a cushion for production rates, offsetting the more immediate decreases in drilling and permitting activity. At most major plays in the United States, the backlog currently ranges from three to seven months. When drilling activity remains at reduced levels long enough to outlast the cushioning effect of the well-completion backlog, the number of new wells brought online will begin to decrease, which can eventually reduce production rates. While the cushion provided by the well-completion backlog changes from formation to formation, EIA's forecast of rising crude oil prices in the second half of 2015, if realized, is expected to be accompanied by a stabilization of drilling activity that would be sufficient to prevent a substantial production decline in the Lower 48 region. Different outcomes are entirely possible under other price scenarios.

- 9. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 9 Oil Price Drop Special Coverage Iraq Oil Surge to Fan OPEC Rivalry That Triggered Slump Bloomberg + NewBase The battle for customers among OPEC members that helped trigger oil’s collapse is about to escalate. Iraqi crude production is climbing from a 35-year high as it adds growing Kurdish supplies to its exports, while southern oilfields remain unscathed by Islamic State militants. Finding customers for the new output means offering more attractive terms than rivals in the Organization of Petroleum Exporting Countries, say Citigroup Inc., DNB ASA and Barclays Plc. Oil’s biggest slump in six years gained momentum in October as a wave of discounts by Middle Eastern producers signaled OPEC members were intent on defending market share against booming shale output from the U.S. The price of Saudi crude for Asian buyers was cut to the lowest in at least 14 years last month, a move followed by Iraq, Kuwait and Iran. “This price war is not just between Saudi Arabia and the U.S., it’s also intra-OPEC,” said Seth Kleinman, head of European energy research at Citigroup in London. “Iraq and the U.A.E and everyone else is cutting prices to defend their own market share. Iraq is ramping up production and has rising volumes to move.” Brent crude, the international benchmark, fell 48 percent last year, the biggest drop since 2008 amid a production surplus estimated by OPEC at about 1.5 million barrels a day. The slide

- 10. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 10 continued this month to the lowest since March 2009. Brent for March settlement lost 67 cents to $48.93 a barrel on the ICE Futures Europe exchange in London at 12:12 p.m. Singapore time on Wednesday. Record Output The discount on shipments of Iraq’s Basrah Light grade to Asia -- at $3.70 a barrel to the average of regional benchmarks Oman and Dubai crude in February -- remains near the widest since at least August 2003. Saudi Arabia set the discount for its Arab Medium blend at $2.80 on Jan. 5. Iraqi crude output has hit a record 4 million barrels a day, Oil Minister Adel Abdul Mahdi said in Baghdad on Jan. 18. Average monthly output rose 290,000 barrels a day to 3.7 million in December, the most since 1979, the International Energy Agency, a Paris-based adviser to 29 developed nations, said in a report on Jan. 16. Exports from the Kirkuk oil field, which neighbors the Kurdish region in northeast Iraq, resumed for the first time since March following a deal in December between the central government and the semi-autonomous Kurds. Kirkuk crude, halted amid attacks by Islamist fighters, can now be shipped to Turkey using the Kurds’ pipeline. Exports from the south have also surged and are scheduled to reach a record 3.3 million barrels a day in February, the IEA estimates. Iraqi Production OPEC agreed in Vienna on Nov. 27 to maintain its production ceiling of 30 million barrels a day, resisting calls for cuts from members including Venezuela and Libya. The group pumped 30.2 million barrels a day last month, exceeding its target for the seventh consecutive month as Iraq expanded output by 150,000 barrels a day, according to data compiled by Bloomberg. Iraq needs to keep increasing oil production because tumbling global prices have reduced government revenue by about 50 percent, Deputy Prime Minister Rowsch Nuri Shaways said at the World Economic Forum in Davos, Switzerland on Jan. 21. “It is escalating the price war,” Torbjoern Kjus, an analyst at DNB in Oslo, said by e-mail. “For most OPEC producers the rationale is that the lower the oil price, the more they are incentivized to produce to make up for the price loss.” Saudi Discount In October, Saudi Arabia set the discount on its November sales to Asia to the widest since 2008, preceding a series of price cuts by other Gulf nations that Citigroup, Commerzbank AG and Iraq’s oil minister described as a “price war.” The reductions gave an early signal that OPEC’s Gulf members would opt to defend their market share against growing U.S. shale supplies, rather than cut output to boost prices. Brent futures have plunged 36 percent since the group’s decision to maintain production levels. “With so much crude expected to come on, you have to market a little bit aggressively sometimes just in order to get your crude to the market,” Eugene Lindell, the senior crude-market analyst at consultants JBC Energy GmbH, said by phone from Vienna on Jan. 22. “They’re already fairly steeply discounted if you look at Basrah Light versus Arab Medium, and it’s quite possible that discount could widen further.”

- 11. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 11 Other analysts weren’t convinced. The price differentials set by producers are adjusted mostly to reflect changes in refiners’ profitability, rather than to serve as instruments for competition, according to Harry Tchilinguirian, head of commodity markets strategy at BNP Paribas SA in London. Kurdish Pipeline The accord on Dec. 2 between Iraq’s central authorities and the Kurdistan Regional Government, easing years of friction over the Kurds’ right to export oil independently, enables 550,000 barrels a day to be shipped via the Kurdish pipeline to the Turkish port of Ceyhan. About 250,000 will flow from Kurdish territory and 300,000 from Kirkuk in northern Iraq, previously blocked by Islamic State. Exports from the Kurdish region, which has independently signed deals with international companies deemed illegal by Baghdad, have been accelerating. The region is moving 400,000 barrels a day through the pipeline to Turkey it built last year, and will reach 1 million barrels a day on the link by the end of 2015, KRG Natural Resources Minister Ashti Hawrami said in London on Dec. 17. “Iraq’s holding on quite well,” Miswin Mahesh, an analyst at Barclays in London, said by phone on Jan. 21. “They’ll say they have every right to sell it on the market, and they might even sell at distressed prices.” UAE:Moody’s sees Abu Dhabi weathering slowing economy amid weak oil prices. The National + NewBase Abu Dhabi’s economic growth is forecast to slow this year if oil prices remain in their current range, although the credit rating agency Moody’s Investors Service said the government is in a strong position to weather the downturn. In its latest assessment, Moody’s estimated that the emirate’s economic growth rate would slow this year – to below 3 per cent, from an estimated 4.1 per cent last year – because of a huge drop in oil revenues. Nominal GDP – economic activity before accounting for inflation – will contract by 18 per cent this year if oil prices average US$55 a barrel, and by 25 per cent if oil prices average $40, Moody’s said. Abu Dhabi will be able to maintain spending by drawing on its vast assets and running a slight deficit (forecast to be 1.1 per cent of GDP this year). In the past month, the world benchmark North Sea Brent crude has averaged just below $50 a barrel, compared to an average last year of just below $100. Abu Dhabi’s nominal GDP is estimated to have been $262 billion last year, according to Moody’s, which cites national statistics and the IMF. Abu Dhabi’s economy is much more heavily dependent on oil than the UAE as a whole. The oil sector accounts for about 55 per cent of Abu Dhabi’s GDP, compared to 39 per cent for the UAE as a whole. Oil is more important than those percentages might indicate as it makes up about 80 per cent of the revenues of the Abu Dhabi government, which in turn shoulders a large share of the federal government’s financial burden. Although its budget runs at a deficit below $80 a barrel of oil, the

- 12. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 12 Abu Dhabi government maintains a high credit rating which Moody’s says “reflects our expectation that resources accumulated during the recent period of high oil prices and a prudent budgeting of oil proceeds will mitigate the negative consequences of oil price volatility on the country’s fiscal and external accounts”. But a prolonged period of lower oil prices is a potential threat. “What really is dragging on Abu Dhabi’s finances is spending on the federal budget – health, education, roads and the like,” said Mathias Angonin, a Dubai-based analyst in Moody’s sovereign risk group “All the increases in spending in recent years would be very hard to reverse.” Yet, Abu Dhabi – and the UAE as a whole – may be facing a very different financial future if oil prices do not return to the levels they averaged in the previous four years. “It is an end to the golden years,” said Mr Angonin. “Going forward, it is very unlikely we’ll go back to those conditions.” In Billions U$

- 13. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 13 Abu Dhabi’s ability to weather the storm comes from its very strong financial position, with reserves derived from several consecutive years of fiscal surpluses. Abu Dhabi’s sovereign wealth fund, the Abu Dhabi Investment Authority, is conservatively estimated by the Institute of International Finance to have been worth $498 billion as of 2014, Moody’s noted. Other strengths include a sound policy framework, political stability and a very high per capita income. Abu Dhabi’s central government debt is low, at $7.2bn, or 2.7 per cent of Abu Dhabi GDP However, Moody’s warned, “beyond 2015, a prolonged period of low oil prices would lead to the crystallisation of contingent liabilities on the government’s balance sheet, and accelerate the erosion of fiscal buffers.“ The condition liabilities refers to the debt that may be in semi-government institutions. Indeed, Abu Dhabi’s “credit constraints” include the “large contingent liabilities residing in the debt of its government-related issuers” as well as other emirate governments it supports. Even if oil prices rebound somewhat by the end of this year and beyond, Abu Dhabi – and the UAE as a whole – will need to continue the financial reforms that already been subject to a rollback in some subsidies, such as cheap utilities prices, as well as continued efforts to diversify the economy away form such heavy dependence on the hydrocarbon sector, Moody’s says. Russia unveils $35bn anti-crisis plan, Reuters + NewBase Russia announced a $35bn “anti-crisis” spending plan yesterday to bail out an economy battered by Western sanctions and falling oil prices, but gave few details of the deep cuts it said would be enacted this year to pay for it. The 2.34tn rouble spending plan includes 1.55bn roubles to support banks, most of which was already announced last year and which many analysts say is still a fraction of what Moscow will have to spend to keep its lenders afloat. The plan focuses mainly on bailing out banks and big companies to help them weather the immediate impact of the crisis, at the expense of long-term development programmes. Extra

- 14. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 14 money would also be spent to increase pensions in line with higher-than-expected inflation. “This plan is something like a cushion to avoid a rapid deterioration in Russia and support several of the most important economic agents (and provide) social support,” said Sberbank chief economist Yulia Tseplaeva. President Vladimir Putin has ordered that defence and social spending cannot be cut, underscoring his focus on preserving Russia’s international might and social stability. Despite these constraints, Finance Minister Anton Siluanov said on Tuesday that the anti-crisis plan would not add to total budget expenditures, because of budget reserves and cutbacks elsewhere. The plan said the government would cut “the majority” of its planned expenditures by 10% in 2015, except for defence, social spending and debt repayments, with a view to balancing the budget by 2017. But it gave few details on those cuts, beyond saying that some long-term investment projects would be delayed. Ivan Tchakarov, Russia economist at Citibank, said that the plan was necessarily vague, as Moscow has yet to revise its budget and macroeconomic forecasts for this year. “It’s a typical government-led programme. It focuses on subsidies,” he said. “I haven’t seen any particular measure that strikes me as a structural reform, it’s just talk.” Some major items in the plan are being financed from the National Wealth Fund, an $80bn sovereign fund that had previously been assigned to fund infrastructure projects. Among the priority measures, the largest single item is a 1tn rouble programme to recapitalise banks through the issue of government bonds, which has already been funded from last year’s federal budget. Banks will get a further 550bn roubles from the National Wealth Fund. This includes 300bn roubles for Vnesheconombank, the state development bank, to increase “lending to organisations of the real sector”. Many analysts think this is still a fraction of what Russia will have to spend to keep its banking sector afloat as businesses lose the ability to service their loans and banks are hit by much higher financing costs. Citibank’s Tchakarov said that the support measures were narrower than similar ones enacted in a previous crisis in 2008-2009, reflecting more limited resources this time. “Now they’re much more selective, with support for key strategic enterprises, which is why I think this time we are going to see some corporate and bank defaults,” he said. “You cannot support everyone in the current environment.” The plan “isn’t something to get too excited about”, he added. “But at least they still have some money to spend, some buffers to use.” Among the uncosted items, the plan said the government would collect proposals by January 30 for creating a “bad bank” to ring fence problematic banking assets. The plan includes 200bn roubles in state guarantees of loans of bonds needed “for carrying out investment projects,” as well as other goals approved by the government such as debt restructuring. The federal government will lend 160bn roubles to help regional governments, and 188bn roubles were allocated to raise pensions in line with inflation. Smaller or uncosted items in the plan included subsidies and tax breaks to industrial enterprises, small businesses and agriculture.

- 15. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 15 A picture is worth a thousand words, And it tells a story just as well This Week Brent crud oil prices fluctuations

- 16. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 16 NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Your Guide to Energy events in your area

- 17. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 17 NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile : +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years , he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation , operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally , via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 29 January 2015 K. Al Awadi

- 18. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 18