New base 505 special 25 december 2014

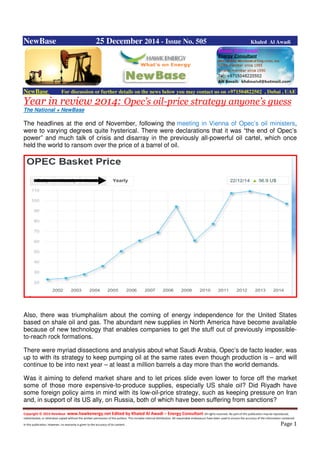

- 1. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 1 NewBase 25 December 2014 - Issue No. 505 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Year in review 2014: Opec’s oil-price strategy anyone’s guess The National + NewBase The headlines at the end of November, following the meeting in Vienna of Opec’s oil ministers, were to varying degrees quite hysterical. There were declarations that it was “the end of Opec’s power” and much talk of crisis and disarray in the previously all-powerful oil cartel, which once held the world to ransom over the price of a barrel of oil. Also, there was triumphalism about the coming of energy independence for the United States based on shale oil and gas. The abundant new supplies in North America have become available because of new technology that enables companies to get the stuff out of previously impossible- to-reach rock formations. There were myriad dissections and analysis about what Saudi Arabia, Opec’s de facto leader, was up to with its strategy to keep pumping oil at the same rates even though production is – and will continue to be into next year – at least a million barrels a day more than the world demands. Was it aiming to defend market share and to let prices slide even lower to force off the market some of those more expensive-to-produce supplies, especially US shale oil? Did Riyadh have some foreign policy aims in mind with its low-oil-price strategy, such as keeping pressure on Iran and, in support of its US ally, on Russia, both of which have been suffering from sanctions?

- 2. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 2 It is at times like this that some historical perspective is needed. Oil prices have indeed seen one of their most precipitous declines since last summer, when the price of world benchmark North Sea Brent crude was above US$115 (Dh422) a barrel. By early December, the decline was about 40 per cent, with Brent trading either side of $70. However, the decline followed a relatively long period of high and stable prices – Brent traded at an average of about $100 a barrel in the previous four years. For some countries, such as the UAE, Saudi Arabia and some other Arabian Gulf states, that represented a huge windfall and they built up enormous surpluses in wealth funds that they have used to invest in diversification, both of their investment portfolios and (to varying degrees) their economies. This was apparent in October’s global economic forecasts by the International Monetary Fund. While the IMF trimmed its forecast for next year’s global economic growth to 3.8 per cent from the 4 per cent it forecast in July, it said the outlook for the main Gulf oil-producing countries was fairly healthy. The growth forecast for the Middle East and North Africa region as a whole for this year was cut to 2.6 per cent from a 3.2 per cent forecast earlier in the year. But the IMF said growth in the six- nation Gulf Cooperation Council countries will remain strong, at an average 4.5 per cent in both 2014 and 2015. When Saudi oil minister Ali Al Naimi and his UAE counterpart Suhail Al Mazrouei repeatedly said that “there is no need to panic”, before, during and after the November Opec meeting, it is this background they must have had in mind. It’s true many Opec member countries are under severe strain. As Ann-Louise Hittle, head of macro oil research at the consultant Wood Mackenzie, points out: “The lower oil prices will be painful for Iran, already exposed to reduced oil exports from sanctions, and Venezuela, both of which have high fiscal break-even prices well over $100 a barrel.”

- 3. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 3 Kuwait commissions new LPG plant to raise capacity Middle East online + NewBase Kuwait has commissioned a new LPG ( Liquid Petroleum Gas ) gas treatment plant that will raise the energy-rich state's production capacity to more than 2 billion cubic feet a day, officials said on Wednesday. The new Liquefied Petroleum Gas plant will be capable of processing 805 million cubic feet (22.8 million cubic meters) of gas and 106,000 barrels of other gas products daily, the deputy CEO of national refiner Kuwait National Petroleum Co., Mutlaq al-Azemi, said. The plant, known as LPG Train-4, was constructed by Daelim, a South Korean firm, at a cost of $900 million (740 million euros). Azemi said Train-4 would be one of the Gulf's largest LPG plants and would also produce propane, butane and other products. Kuwait already has three smaller plants with a total capacity of 1.5 billion cubic feet, the majority of which is associated gas produced along with crude oil. All of Kuwait's gas goes to petrochemical manufacturing and to fuel power plants, Azemi said. Although it has plentiful domestic reserves, Kuwait has to import gas in summer to meet an increased demand from power stations. Azemi added that Kuwait planned to increase production of natural gas in the near future, he said, raising its daily output to 4 billion cubic feet by 2030. The emirate has signed a technical service contract with petrochemical giant Shell to boost production from a number of gas fields in its northern region.

- 4. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 4 Kuwait's crude oil exports to China nearly double in Nov. KUNA + NewBase Kuwait's crude oil exports to China jumped 88.8 percent in November from a year earlier to 957,000 tons, equivalent to around 234,000 barrels per day (bpd), latest Chinese government data showed. Kuwaiti share of Chinese crude oil imports last month was 3.8 percent, compared to 2.2 percent the year before, according to the Chinese General Administration of Customs. In the January-November period, Kuwait exported 195,000 bpd to the world's second-largest oil consumer, up 8.3 percent on the year State-run Kuwait Petroleum Corporation (KPC) signed a landmark deal with China's top energy trader Unipec in September to supply 300,000 bpd of crude oil over the 10 years. It was the biggest-ever crude oil sales contract in KPC's history by volume and revenues, according to KPC. China's overall imports of crude oil in November increased 7.9 percent from a year earlier to 25.41 million tons, or 6.21 million bpd. Saudi Arabia remained China's top supplier, but its shipments declined 5.9 percent to 975,000 bpd from a year earlier, followed by Angola with 846,000 bpd, up 60.5 percent. Russia became third, with imports from the country jumping 65.5 percent to 810,000 bpd. Iraq ranked fourth and Oman fifth, respectively.

- 5. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 5 Cameroon:Golar in Cameroon floating liquefaction FLNG deal Golar LNG + NewBase Golar LNG signed a heads of agreement with Societe Nationale de Hydrocarbures and Perenco Cameroon for the development of an FLNG export project located 20km off the coast of Cameroon and utilizing Golar’s floating liquefaction technology (GoFLNG). The HOA is premised on the allocation of 500 bcf of natural gas reserves from offshore Kribi fields, which will be exported to global markets via the GoFLNG facility Golar HIlli, now under construction at the Keppel Shipyard in Singapore, Golar said in a statement. Golar will provide the liquefaction facilities and services under a tolling agreement to SNH and Perenco as owners of the upstream joint venture who also intend to produce LPG’s for the local market in association with the project. It is anticipated that the allocated reserves will be produced at the rate of some 1.2 million tonnes of LNG per annum over an approximate eight-year period. According to the statement, it is expected that during the first half of 2015 definitive commercial agreements will be executed and necessary licenses and approvals secured for the production, liquefaction, and export of the reserves, and that production will commence in the first half of 2017. The project will be the first floating LNG export project in Africa and will see Cameroon joining the small number of LNG exporting nations, Golar added.

- 6. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 6 US: Statoil optimises portfolio – realising USD 394 million from Marcellus asset . Press Release Statoil has agreed to reduce its working interest in the non-operated US southern Marcellus onshore asset from 29% to 23%, following a USD 394 million transaction with Southwestern Energy (the “transaction”). Torstein Hole (left), senior vice president for US onshore in Statoil and Andy Winkle, Statoil's vice president for the Marcellus asset, at a well pad in the Marcellus area. “The transaction reduces Statoil’s non-operated holdings at an attractive price, demonstrating the value of the Marcellus assets” said Torstein Hole, Statoil senior vice president and US onshore head. “Our new partnership with Southwestern Energy provides us with an opportunity to maximise the value of an important growth asset in our US onshore portfolio. Southwestern is a very dynamic operator that will maximise the value and return.” Drilling rig in the Marcellus area. (Photo: Helge Hansen) The transaction covers 515,000 acres in the southern part of the Marcellus, in which Statoil today holds an average working interest of 29%. The divested share of the Southern Marcellus represents approximately 30,000 acres. Statoil’s 2014 third quarter production from the Marcellus play amounted to 130,500 barrels of oil equivalent per day, of which approximately 4,000 barrels came from the assets included in the transaction. Southwestern is an experienced operator in the development and production of US onshore unconventionals. It announced the acquisition of Chesapeake Energy’s holdings in the Southern Marcellus asset on 16 October 2014. Statoil have agreed to give Chesapeake consent for their transaction with Southwestern. Statoil and Southwestern have now agreed to the partial sell-down of Statoil’s interest at an equivalent price to that agreed between Chesapeake and Southwestern. Statoil and Southwestern have put in place a new joint development agreement. Following the transaction, Statoil will hold around 23% of the underlying non-operated Southern Marcellus assets. The transaction is expected to close in Q1 2015.

- 7. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 7 John Knight, executive vice president for Global Strategy and Business Development at Statoil. (Photo: Ole Jørgen Bratland) "I am delighted that we have concluded this important transaction with Southwestern despite the turbulence in today's energy markets," said John Knight, executive vice president for Global Strategy and Business Development at Statoil. The transaction confirms the attractiveness of US unconventionals and the significant value created in developing the assets. Statoil has established a strong acreage foothold in US unconventionals since entering the Marcellus in a joint venture with Chesapeake in 2008. After initial entry into the Marcellus in 2008, Statoil entered into the Eagle Ford in 2010, acquired Brigham Exploration in Bakken in 2011 and the Marcellus-operated acreage acquisition in 2012. Since 2011, Statoil have been transitioning from a non-operator to an established unconventional operator and today its portfolio includes operated positions in each of these assets. Statoil ASA is an international energy company with operations in 36 countries. Building on 40 years of experience from oil and gas production on the Norwegian continental shelf, we are committed to accommodating the world's energy needs in a responsible manner, applying technology and creating innovative business solutions. We are headquartered in Stavanger, Norway, with 23,000 employees worldwide, and are listed on the Oslo and New York stock exchanges. Southwestern Energy Company is an independent energy company whose wholly-owned subsidiaries are engaged in natural gas and oil exploration, development and production, natural gas gathering and marketing. Additional information on the company can be found at http://www.swn.com.

- 8. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 8 Russia’s Gazprom sees gas production at all-time low Reuters + NewBase Russian gas giant Gazprom, hurt by Western sanctions over the Ukraine crisis and a long-running dispute with Kiev over prices, expects to produce the lowest amount of gas in its history this year. Company spokesman Sergei Kupriyanov told reporters yesterday that the company expected to produce 444.4bn cubic metres (bcm) of natural gas this year, an all-time low, down from 487.4bcm last year. In June Gazprom halted supplies to Ukraine, its second-largest market after Germany, amid a row over prices and unpaid debts and only resumed supplies this month. More recently Gazprom has also ended the South Stream gas pipeline project aimed at avoiding Ukraine to bring in 63bcm of Russian gas to Europe via the Black Sea. Europe has been seeking ways to cut its reliance on Russian gas supplies while Gazprom this month ended the South Stream gas pipeline project aimed at avoiding Ukraine to bring in 63bcm of Russian gas to Europe via the Black Sea. Gazprom, which supplies a third of the European Union’s gas consumption, estimates its exports to the EU and Turkey declined in 2014 by more than 9% to 147bcm. “It’s not relevant how much we will produce in 2015, output will depend on our ability to sell,” Kupriyanov said. Gazprom’s earlier forecast for 2015 called for a rise in gas production of 5%. Gazprom’s share of the lucrative domestic market is also shrinking as other producers, such as Novatek, Rosneft and Lukoil are more flexible in setting prices and other contractual terms with customers. According to Sberbank CIB investment bank, Gazprom’s rivals have almost doubled their share of the Russian gas market to 35% this year from 18% in 2009, when Gazprom’s production fell sharply to a low of 461.5 bcm. Kupriyanov also said yesterday that Gazprom had just received a $1.65bn payment from Ukraine to cover the country’s gas debts. Ukraine’s state-owned energy firm Naftogaz had used up only 300mn cubic metres of Russian gas so far in December out of 1bcm which Ukraine has already paid for, he said. The unused volumes will be shipped in January, he added.

- 9. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 9 Oil and gas sales accounted for 68% of Russia’s total export revenues in 2013. Source: U.S. Energy Information Administration, Russia Federal Customs Service Russia is a major exporter of crude oil, petroleum products, and natural gas. Sales of these fuels accounted for 68% of Russia's total export revenues in 2013, based on data from Russia's Federal Customs Service. Russia received almost four times as much revenue from exports of crude oil and petroleum products as from natural gas. Crude oil exports alone were greater in value than the value of all non-oil and natural gas exports. Europe, including Turkey, receives most of Russia's exports of crude oil and products, as well as virtually all exports of natural gas. Asia (especially China) receives substantial volumes of crude oil and some liquefied natural gas (LNG) from Russia. Recently, Russia finalized a 30-year, $400 billion deal to supply China with natural gas from fields in Eastern Siberia, which will further increase Russian export revenues. North America imports some Russian petroleum products, particularly unfinished oils used in refineries. Although Russia exports less crude oil and less natural gas than it consumes domestically, domestic sales of crude oil and natural gas are much lower in value than exports because of vertical integration of the oil and natural gas industry and subsidized domestic prices. Many Russian oil firms are vertically integrated, owning both the oil fields and refineries that process crude oil. These firms can sell crude oil directly to their own refineries at low prices. Domestic natural gas prices are also subsidized, forcing Russian companies like Gazprom to use export revenue to fund investment in new infrastructure and projects. EIA estimates that Russian

- 10. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 10 domestic sales of natural gas and crude oil were about $20 billion in 2013, based on data from IHS Energy. Although revenue from domestic sales of crude oil and natural gas in 2013 was significantly lower than revenue from exports, Russian domestic sales of petroleum products, particularly motor gasoline and distillate fuel oil, were approximately $102 billion, similar to revenue from product exports. Oil and natural gas activities make up a large portion of Russia's federal budget. According to the Ministry of Finance, 50% of Russia's federal budget revenue in 2013 came from mineral extraction taxes and export customs duties on oil and natural gas.

- 11. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 11 Rosneft Increases its Stake in the National Oil Consortium to 80% Press release – Rosneft Rosneft and Lukoil signed a package of legally binding documents regarding Rosneft’s acquisition of 20% share in the National Oil Consortium LLC (NOC). Due to this deal the share of Rosneft in the charter capital of NOC will increase to 80%, with the remaining 20% owned by Gazprom Neft. Consolidation of the consortium management resulting from the deal will allow to substantially improve operational control and have positive impact on the Junin-6 project implementation efficiency. Commenting on the deal, Rosneft Head, Chairman of the NOC Board of Directors Igor Sechin said: "Rosneft consistently increases the volumes of cooperation with Venezuela. This year, for the first time, the Company obtained the right for commercialization of Venezuelan oil. Venezuela owns the most prospective resource base in the worlds’ oil industry. Therefore, taking into account the future decline of shale production in USA and Canada, it is Venezuelan oil that can become the substitutional element for the receding volumes of those markets”. About: NOC was created in October of 2008 as part of extended Russian-Venezuelan economic cooperation, at the initiative and with direct participation of Igor Sechin, the then Deputy Prime Minister in charge of the Russian fuel and energy complex In 2010, NOC and PDVSA of Venezuela set down the PetroMiranda joint venture to develop the Junin-6 Block, with 60% Venezuelan and 40% Russian shareholding. The Junin-6 Block is situated in the Orinoco river heavy oil belt geological oil reserves are estimated at 8.5 bln tons. It is expected that upon reaching the design production capacity, the field will be producing 450 thousand barrels of oil per day During 2014 Rosneft Group and PDVSA signed two long-term contracts for supplies of oil and oil products of Venezuelan production.

- 12. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 12 China Commissions First Of 14 Planned Propylene Production Units Using Technology From Honeywell's UOP. Source Honeywell + NewBase UOP LLC, a Honeywell company, announced today that China has commissioned the first of 14 planned propylene production units using technology from Honeywell's UOP to help close the global supply and demand gap for the key plastic building block. China's Zhejiang Satellite Petrochemical Co. Ltd became the first Chinese producer to start production of propylene using UOP C3 Oleflex™ process technology, which efficiently produces propylene from propane. Zhejiang Satellite Petrochemical is currently producing high quality, on- spec product for acrylic acid and derivative production. Traditionally, propylene is a byproduct of making ethylene, another key plastics building block. However, a shift in how ethylene is produced globally has meant less propylene byproduct is being produced, sparking investment in technology to create propylene from propane. Since 2011, UOP has licensed the C3 Oleflex process to more than a dozen producers to meet rising demand, with a majority of licensed capacity in China. "China's propylene consumption accounts for more than 15 percent of worldwide demand and is growing at about 5 to 6 percent per year," said Pete Piotrowski, senior vice president and general manager of UOP's Process Technology and Equipment business. "Oleflex technology has been demonstrated to have the lowest cash cost of production due to its efficiency, providing a significant operating advantage to our licensees, and we look forward to showcasing the commercial success of this technology in China." Zhejiang Satellite Petrochemical Co. Ltd. will produce 450,000 metric tons annually (MTA) of propylene at its facility in Pinghu City in Zhejiang Province, China. Zhejiang Satellite Petrochemical Co. Ltd., formerly known as Zhejiang Julong Petrochemical Co. Ltd. (ZJLPC), produces materials used in various markets, including aviation, automobile production, oil mining, health care and textiles. Oleflex has been a leading technology for converting propane to propylene for more than 20 years. The C3 Oleflex process uses catalytic dehydrogenation to convert propane to propylene. Compared with competing processes, UOP's C3 Oleflex technology provides the lowest cash cost of production, the highest return on investment and the smallest environmental footprint. This superior performance is characterized by low capital cost, high propylene yields, low energy and water consumption, and use of a fully recyclable platinum alumina-based catalyst system. In addition to the C3 Oleflex process, UOP also licenses its C4 Oleflex technology, a butane dehydrogenation process to convert isobutane to isobutylene. Download the propylene gap infographic here.

- 13. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 13 Oil Price Drop Special Coverage Falling Oil Prices Threaten Fragile African Economies By Thalif Deen ,IPS The sharp decline in world petroleum prices – hailed as a bonanza to millions of motorists in the United States – is threatening to undermine the fragile economies of several African countries dependent on oil for their sustained growth. The most vulnerable in the world’s poorest continent include Nigeria, Angola, Equatorial Guinea, Gabon and Sudan – as well as developing nations such as Algeria, Libya and Egypt in North Africa. "In the long run, governments in these oil-exporting countries should use oil revenues to support productive sectors, employment generation, and also build financial reserves when oil prices are high." Dr. Shenggen Fan of IFPRI Dr. Kwame Akonor, associate professor of political science at Seton Hall University in New Jersey, who has written extensively on the politics and economics of the continent, told IPS recent trends and developments such as the outbreak of Ebola and the fall of global oil prices “shows how tepid and volatile African economies are.” In 2012, for instance, Sierra Leone and Liberia (two of the hardest hit countries with Ebola) were cited by the World Bank as the fastest growing sub-Saharan African countries, he pointed out. In a similar vein, countries such as Algeria, Equatorial Guinea and Gabon are considered top performing economies due to the large concentration of their oil and gas reserves. “But the ramifications of any economic crisis will undoubtedly negatively impact the fortunes of these countries,” said Akonor, who is also director of the University’s Centre for African Studies and the African Development Institute, a New York-based think tank. The world price for crude oil has declined from 107 dollars per barrel last June to less than 70 dollars last week. There are multiple reasons for the decline, including an increase in oil production, specifically in the United States; a fall in the global demand for oil due to a slow down of the world economy; and a positive fallout from conservation efforts. As the New York Times pointed out: “We simply don’t burn as much energy as we did a few years ago to achieve the same amount of mileage, heat or manufacturing production.”

- 14. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 14 There are also geopolitical reasons for the continued decline in oil prices because Saudi Arabia, one of the world’s largest producers, has refused to take any action to stop the fall. Despite the crisis, the Saudi oil minister Ali Al-Naimi was quoted as saying, “Why should I cut production?” This has led to the conspiracy theory it is working in collusion with the United States to undermine the oil-dependent economies of three major adversaries: Russia, Iran and Venezuela. Besides Saudi Arabia, the fall in prices is also affecting Iraq, Kuwait, United Arab Emirates (UAE), Qatar and Oman. But they are expected to overcome the crisis because of a collective estimated foreign exchange reserve amounting to over 1.5 trillion dollars. The drop in oil prices, however, will have the most damaging effects on Africa which has been battling poverty, food shortages, HIV/AIDS, and more recently, the outbreak of Ebola. The heaviest toll will be on Nigeria, the largest economy in Africa which depends on crude oil for about 80 percent of its revenues, according to the Wall Street Journal. The country’s currency, the naira, has declined about 15 percent since the beginning of the fall in oil prices. Dr. Shenggen Fan, director general of the International Food Policy Research Institute (IFPRI), sees both a positive and negative side to the current oil crisis. He told IPS the recent decline in oil prices will help reduce food prices. Since oil prices are highly co-related to food prices, high oil prices make agricultural production more expensive and thus cause food prices to increase, he added. “Now that oil prices are on a downward trend, this is, by and large, good for global food security and nutrition,” he said. Dr. Fan said poor producers and consumers in developing countries should be able to benefit from this – as long as their purchasing power increases. However, he cautioned, oil exporting countries may lose government revenues from low oil prices.

- 15. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 15 Indeed, crude oil producing nations in Africa have felt the pinch of declining oil prices given the dependence of their economies on crude oil, he noted. In the short run, he said, poor people may suffer, if their governments reduce food subsidies. “In the long run, governments in these oil-exporting countries should use oil revenues to support productive sectors, employment generation, and also build financial reserves when oil prices are high.” When oil prices are low, these governments should use reserves to ensure that poor people are protected through social safety net programmes, he added. Dr. Akonor told IPS as impressive as the current and long-term economic projections for Africa might seem, it does not change the precarious and fragile nature of the continent’s economic foundations. “The high debt overhang and the heavy reliance on raw materials (such as oil) and minerals for exports, makes African economies susceptible to shock and systemic risks,” he noted. Moreover, he said, the underlying human capital formation, especially amongst the burgeoning unemployed youth population, lacks the requisite skills that could lead to real sustainable growth and transformation. “What is needed then is the effective implementation of development strategies and policies that would lead to long-term structural transformation and durable human development,” he argued. One way to achieve this is through closer regional cooperation, given the small size of domestic markets and poor continental infrastructure. Transformative and human needs development must, amongst other things, address Africa’s poor infrastructure, said Dr. Akonor. According to the African Development Bank, the road access rate in Africa is only 34 percent, compared with 50 percent in other developing regions. Only 30 percent of Africans have access to electricity, compared to 70-90 percent in other developing countries. “What makes Africa’s development challenges vexing is that there has not been a shortage of autonomous development-related ideas between African leaders and interested publics,” Dr. Akonor said. One can argue that Africa has debated and produced too many blueprints and programmes for over half a century without any tangible results or follow through, he said. “Thus the major obstacle to durable economic performance in Africa has not been the ambitious nature of the development targets, but rather the absence of political will by African governments and the lack of consistency, coordination, and coherence at the sub regional, regional and even global levels to implement structural change,” Dr. Akonor declared. “Transformational development will require that Africa add value to, and diversify, its export commodities. Building a solid industrial base and infrastructural capacity are also necessary prerequisites toward autonomous structural change.” Dr. Fan told IPS that on the broader issue of the factors that influence food prices, it is important to realise the right price of food is not easy to determine. What is important is that the prices of food (including the natural resources that are used for food production) fully reflect their economic, social, and environmental costs and benefits in order to send the right signals to all actors along the food supply chain. “If this causes food prices to increase, social safety nets should be provided to protect poor people in the short term and also to help them move on to more productive activities in the long term,” Dr. Fan said. In so doing, their food security and nutrition is not compromised, he declared.

- 16. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 16 Iraq Says OPEC Will Need To Step In If Oil Prices Keep Falling By Bloomberg + NewBase The Organization of Petroleum Exporting Countries will have to “step in” if oil prices keep falling amid oversupply, Iraq’s Oil Minister Adel Abdul Mahdi said. OPEC decided on Nov. 27 to maintain its output at 30 million barrels a day to defend market share amid a glut that helped send oil prices to the lowest levels since 2009. Prices have dropped about 20 per cent since the meeting with the oversupply estimated by Qatar at two million barrels a day. “If prices keep falling to very low levels where the whole equation is not balanced, then definitely OPEC has to step in,” Abdul Mahdi said in an interview in Abu Dhabi yesterday. He didn’t say if that means cutting production. The group’s decision was taken after Saudi Arabia’s Oil Minister Ali al-Naimi said OPEC must protect its market share and let prices fall to trim output outside OPEC, Abdul Mahdi said. “We accepted the Saudi theory to correct the situation in the market as it made sense to all of us,” he said. The “fair price” of oil that was $100 to $105 a barrel is now closer to $70 to $80 a barrel, Abdul Mahdi said. Iraq’s cabinet yesterday approved a budget based on $60 oil. Global crude prices dropped about 45 per cent this year, heading for the biggest annual decline since 2008. Today’s price of $61.39 a barrel compares with $147.50 in July 2008. Saudi Arabia, the group’s biggest producer, doesn’t plan to pump less “whatever the price is,” Al-Naimi told the Middle East Economic Survey in report published Dec. 22. “We will fight for now as we have built financial reserves to help us stand longer,” Abdul Mahdi said. “We will surely not fight for a very long time but we can fight for a period of time.” When asked if OPEC can hold back from intervening in the market for one or two years, he said: “Yes.”

- 17. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 17 Oil drillers are under pressure to scrap rigs BY BLOOMBERG + NEWBASE Offshore oil-drilling contractors, who last year were able to charge record rates for their vessels, are now under pressure to scrap old rigs at an unprecedented pace. The recent five-year low in oil prices is threatening an industry already grappling with a flood of new vessels and weakening demand. More than 200 new rigs are scheduled to be delivered in the next six years. That's a 25 per cent jump from the number currently under contract. To cope, many rig owners will try to keep revenue up by culling older vessels to balance supply and demand. "The older assets, particularly those built before the 2000 time period, are really less desired by the industry," James West, an analyst at Evercore ISI in New York, said in a phone interview. Those vessels "are only causing the customer base to use those rigs against higher quality rigs to get pricing lower. The biggest drop in two years

- 18. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 18 About 140 older rigs would need to be scrapped to make way for the new vessels scheduled for delivery by 2020, according to Andrew Cosgrove, an analyst at Bloomberg Intelligence. That pace would double the number scrapped in the previous six years and even eclipse the 123 vessels retired since 2000, according to data Booming offshore exploration earlier in the decade encouraged a flurry of rig orders. That's now leading to a potential market crash in a global industry pegged to generate revenue of $61.5 billion this year. Low oil prices are compounding the problem, alarming investors Getting pneumonia Three of the five worst performers in the Standard & Poor's 500 Index this year are offshore rig contractors: Transocean, Noble Corporation and Ensco. Hercules Offshore, the largest provider of shallow-water rigs in the Gulf of Mexico, has fallen 84 per cent as producers consolidated and drilling was postponed "There is an old saying: If our customers get a cold, we get pneumonia," John Rynd, chief executive officer of Houston-based Hercules, told investors this month. "We're getting pneumonia right now. Next year may be worse. Explorers and producers are expected to cut offshore spending by 15 per cent, with 'grievous' cuts coming for exploration, Bill Herbert, an analyst at Simmons, said in an e-mail Earnings for the world's five biggest offshore rig contractors are expected to fall an average of 18 percent, according to analysts' estimates. Only one company is seen increasing profit in 2015: Seadrill. The third-biggest offshore rig contractor by market value has 75 per cent of its rigs backed by contracts next year, the highest among the five largest drillers, according to BI. Retiring older equipment that no longer meets current standards also eliminates a cash drain. Floating rigs left idle in a harbor can cost as much as $12,000 a day to sit "cold stacked," meaning they're not part of the supply of rigs being marketed for new work Scrapping floaters The contraction is already under way. Transocean, owner of the biggest fleet of offshore drilling rigs, said in a statement last week it will scrap seven 'floaters' in addition to the four it previously announced and will take a fourth-quarter charge in the range of $100 million to $140 million as a result. Floaters, typically for deep-water jobs, are distinguished from 'jackups'' which have retractable legs that moor onto the seafloor until drilling is done Transocean and Hercules are expected to scrap the most vessels in the near term, according to BI. Hercules has seven shallow-water rigs, all in the Gulf of Mexico, that have been cold-stacked for an average of five years A spokeswoman from Vernier, Switzerland-based Transocean declined to comment about further plans to decrease its fleet and referred to last week's statement, which said "additional rigs may be identified as candidates for scrapping."

- 19. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 19 NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Your Guide to Energy events in your area

- 20. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 20 NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MSc. & BSc. Mechanical Engineering (HON), USA ASME member since 1995 Emarat member since 1990 Mobile : +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years , he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation , operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally , via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 25 December 2014 K. Al Awadi

- 21. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 21