New base 12 august 2021 energy news issue 1448 by khaled al awad i

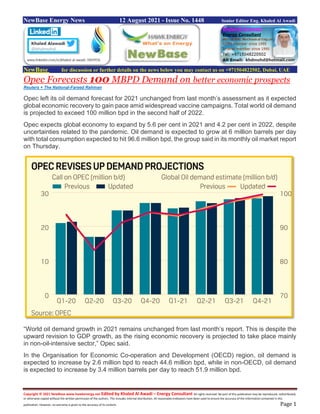

- 1. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 12 August 2021 - Issue No. 1448 Senior Editor Eng. Khaled Al Awadi NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Opec Forecasts 100 MBPD Demand on better economic prospects Reuters + The National-Fareed Rahman Opec left its oil demand forecast for 2021 unchanged from last month’s assessment as it expected global economic recovery to gain pace amid widespread vaccine campaigns. Total world oil demand is projected to exceed 100 million bpd in the second half of 2022. Opec expects global economy to expand by 5.6 per cent in 2021 and 4.2 per cent in 2022, despite uncertainties related to the pandemic. Oil demand is expected to grow at 6 million barrels per day with total consumption expected to hit 96.6 million bpd, the group said in its monthly oil market report on Thursday. “World oil demand growth in 2021 remains unchanged from last month’s report. This is despite the upward revision to GDP growth, as the rising economic recovery is projected to take place mainly in non-oil-intensive sector,” Opec said. In the Organisation for Economic Co-operation and Development (OECD) region, oil demand is expected to increase by 2.6 million bpd to reach 44.6 million bpd, while in non-OECD, oil demand is expected to increase by 3.4 million barrels per day to reach 51.9 million bpd.

- 2. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 Opec expects the global economy to expand by 5.6 per cent in 2021 and 4.2 per cent in 2022, despite uncertainties related to the pandemic and the pace of the vaccine introduction worldwide. Last month, the International Monetary Fund maintained its global economic forecast at 6 per cent but downgraded its growth outlook for emerging markets and developing economies owing to the uneven access to vaccines and the emergence of Covid-19 variants that are hindering the shape of the recovery. Opec also kept world oil demand for 2022 unchanged. It projects demand to increase by 3.3 million barrels per day as it assumed economic activity to mostly take place in non-oil intensive sectors. Total world oil demand is projected to exceed 100 million bpd in the second half of 2022 and reach 99.9 million bpd on average for 2022. “Economic activities are still projected to gain traction, supported by massive stimulus packages,” the group said. “Additionally, the Covid-19 pandemic is anticipated to be controlled by vaccination programmes and improved treatment, resulting in a further recovery in economic activity and a steady rise in oil demand in both the OECD and non-OECD.” Oil supply growth forecasts from non-Opec countries in 2021 and 2022 have also been revised up by 0.27 million bpd and 0.84 million bpd respectively owing to the “incorporation of the latest production adjustment decision of the non-Opec countries participating in the Declaration of Cooperation” deal after the Opec and non-Opec ministerial meeting last month. Opec+, led by Saudi Arabia and Russia, extended its agreement until the end of December 2022. The group reached a consensus over the phasing out of 5.8 million bpd of withheld supply after weeks of deadlock and will review the agreement at the end of the year. Brent, the global benchmark for two thirds of the world's oil, dropped 0.36 per cent to $71.18 per barrel at 4.09pm UAE time. US crude gauge West Texas Intermediate also slid 0.48 per cent to $68.92 per barrel.

- 3. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 India: Cars Fueled by Sugar Will Add to Food Inflation Risks Bloomberg + NewBase India is pushing for more cars to run on ethanol made from sugar, a move that risks raising the cost of the sweetener globally. The government will fast-track an ethanol program that will divert as much as 6 million tons of sugar toward fuel production annually by 2025, according to the food ministry. That’s almost the entire amount that India, the world’s second-biggest producer after Brazil, currently exports to the global market. Prime Minister Narendra Modi advanced in June a target for blending 20% ethanol in gasoline to 2025, five years earlier than planned. The advantages are multifold: it will reduce air pollution, cut India’s oil import bills, help soak up a domestic sugar glut and increase investment in rural areas. For the rest of the world, the move may be the biggest change in years for the sugar industry and could drive a bull market, according to Czapp, Czarnikow’s new portal for agri-food analysis. Prices have soared to the highest since 2017 amid a supply crunch, partly due to wild weather in Brazil. A further surge will add to food inflation risks, with global food costs already near a decade high. It’s “good news for the world if India diverts sugar to produce more ethanol as it will reduce the global surplus,” said Rahil Shaikh, managing director of Meir Commodities India Pvt, a trading company. “But eventually if there is higher demand, some countries including India will have to expand cane acreage.” To meet its 2025 target, India will have to almost triple ethanol production to about 10 billion liters a year, according to the country’s oil secretary Tarun Kapoor. This will require $7 billion of investment and the challenge would be to create the kind of capacity needed in a short span of three to four years.

- 4. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 The government is offering financial support to sugar mills to set up or expand distilleries. Companies including Balrampur Chini Mills Ltd. will stop producing sugar at some mills and begin processing cane juice to make ethanol instead. Brazilian Model India is pursuing a similar strategy to Brazil, which has promoted sugarcane-based ethanol for more than 40 years to ease its sugar glut, cut dependency on oil imports and increase energy security. Today, Brazil owns the largest fleet of flex-fuel cars that can run on any blend of ethanol and gasoline. India will allow production of ethanol-based flex engines too, the Press Trust of India reported. Higher use of biofuels in transport can ease India’s economic burden from high crude prices and help the third-largest oil importer save $4 billion annually, according to government estimates. “They will kill two birds with one stone,” said Michael McDougall, the New York-based managing director of Paragon Global Markets. “It is a move in the right direction.” The plan will also cut India’s sugar export subsidies by about $500 million. The government helps cash-strapped mills to boost shipments as a way to support local prices and increase export competitiveness. Rivals including Brazil and Australia have complained about the subsidies to the World Trade Organization. This year, India is set to export a record amount of sugar again with the help of subsidies. Volumes are forecast at 6.5 million tons. “The surplus will be small after 2025 and the need to export will not remain at such high levels,” said Abinash Verma, director general of Indian Sugar Mills Association. “Depending on domestic and global prices, there may still be small quantities of exports,” he said, declining to give a forecast.

- 5. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 E.U: Low wind speeds hurt profits at 2 EU major energy firms CNBC- Anmar Frangoul The chief financial officer of German utility RWE on Thursday acknowledged the importance of weather to its renewables segment, as the company reported “much lower” wind volumes in Northern and Central Europe for the first half of 2021. In an interview with CNBC, Michael Müller stressed the need to have a broad range of assets in place to cope with potential fluctuations related to weather conditions. “I think what you need to do is balance your portfolio,” he said. “So, have a portfolio across different technologies … be it onshore, offshore, or solar or storages, and also across regions.” “And what we have seen in the first half is there was poorer wind in Europe but at the same time there was stronger wind in the U.S.” “So our idea is to have a balanced portfolio. But clearly, if you’re a renewables player, you are dependent to some degree on weather conditions.” For offshore wind, the Essen-headquartered firm’s adjusted earnings before interest, taxes, depreciation, and amortization came in at 459 million euros ($538.5 million) in January to June 2021. This compares to 585 million euros for the same timeframe last year. Its onshore-solar segment also took a knock, reporting a loss in adjusted EBITDA of 42 million euros. Referencing this part of its business, RWE said: “The extreme cold snap in Texas led to an earnings shortfall of around €400 million.” “Additional burdens resulted from below-average wind conditions at onshore wind farm locations in Northern and Central Europe,” it added.Adjusted EBITDA for the whole group in January to June 2021 came in at 1.75 billion euros, down from 1.83 billion euros in the same period a year earlier. Adjusted net income grew, however, hitting 870 million euros. KEY POINTS RWE’s chief financial officer stresses need to have broad range of assets in place to cope with potential fluctuations related to weather conditions. Danish energy firm Orsted states it will maintain its full-year guidance for 2021 even though lower wind speeds have affected output.

- 6. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Even with the above challenges, RWE described the first half of 2021 as being “very good” financially. “For fiscal 2021, RWE now expects to achieve adjusted EBITDA of between €3.0 billion and €3.4 billion at Group level, which is €350 million higher than forecast in March 2021,” it said. Orsted maintains guidance despite low wind speeds Thursday also saw Danish energy firm Orsted state it would maintain its full-year guidance for 2021 even though it flagged that lower wind speeds had affected output in the first six months of the year. In a statement, Orsted said operating profit for the first half of 2021 came in at 13.1 billion Danish krone (around $2.1 billion), a 3.3 billion krone jump compared to the same period in 2020. Nevertheless, the firm experienced challenges related to wind speeds. “Earnings from our offshore and onshore wind farms in operation were DKK 0.3 billion lower compared to the same period last year,” the company said. “The increased generation capacity from new wind farms in operation was more than offset by significantly lower wind speeds across our portfolio,” it added. Breaking things down, Orsted’s investor presentation said wind speeds in the second quarter of 2021 came in at 7.8 meters per second, which was “significantly lower than normal wind speeds” of 8.6 meters per second. Looking ahead, the company said it maintained its full-year EBITDA guidance of 15-16 billion Danish krone but added that it was expecting an “outcome in the low end of the guided range.” This was due to the lower wind speeds as well as “warranty provision towards our partners related to cable protection system issues at some of our wind farms.” Orsted is a major player in wind energy. In offshore wind alone, its installed capacity amounted to 7.6 gigawatts at the end of 2020.

- 7. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Globally: Surging demand for renewables will boost these 3 metals, analysts predict .. CNBC - Chloe Taylor@CHLOETAYLOR141 A transition to renewable sources of energy will prompt a surge in demand for base metals in the coming years, Wood Mackenzie has predicted. In a report published Monday, analysts at the energy consultancy said that as governments fulfil commitments to limit global warming, a growing reliance on solar power would boost demand for several non-ferrous metals. KEY POINTS The report’s authors outlined three possible scenarios for the metals, with demand growth for each depending on the success of international efforts to limit global warming. Wood Mackenzie’s base case scenario assumes that by the end of the century, temperatures will have risen by 2.8 to 3 degrees Celsius from pre-industrial times. Three metals in particular were named by Wood Mackenzie as commodities to watch: aluminum, copper and zinc. The report’s authors outlined three possible scenarios for the metals, with demand growth for each depending on the success of international efforts to limit global warming. Under the Paris Agreement — a landmark deal adopted in 2015 and signed by 196 countries — nations agreed to a framework to prevent global temperatures from rising by any more than 2 degrees Celsius compared to pre-industrial levels, although the treaty aims to prevent global temperature rises exceeding 1.5 degrees Celsius. Aluminum Wood Mackenzie’s base case scenario assumes that by the end of the century, temperatures will have risen by 2.8 to 3 degrees Celsius from pre-industrial times. In this situation, aluminum demand from the solar power sector would rise from 2.4 million tons in 2020 to 4.6 million tons in 2040. Typically, aluminum is used in solar panel frames and their structural parts, Kamil Wlazly, a senior research analyst at Wood Mackenzie, noted. If the global temperature rise was kept between 1.5 and 2 degrees Celsius, however, it would mean that aluminum demand for solar power had reached between 8.5 million tons and 10 million tons a year by 2040, the analysts said.

- 8. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 In the most optimistic climate scenario, where renewable sources of energy were embraced more readily to cap warming at 1.5 degrees Celsius, demand from the solar sector would account for 12.6% of total global aluminum consumption by 2040 — up from 3% in 2020. Copper Demand for copper — used in high and low voltage transmission cables and thermal solar collectors — is also set for “notable gains” as solar energy becomes more mainstream, Wood Mackenzie said. The report’s base case scenario predicted that demand for copper arising from solar power generation would rise from 0.4 million tons in 2020 to 0.7 million tons a year by 2040. Mining industry ‘will struggle to supply enough copper’ in next 5 years: Anglo American CEO Copper consumption in the solar sector would increase to 1.3 million tons by 2040 if global warming was capped at 2 degrees Celsius. If temperature rises could be limited to 1.5 degrees Celsius, the industry’s consumption of the red metal was expected to jump to 1.6 million tons a year within the next two decades, the report claimed. Zinc Meanwhile, analysts noted that only zinc coatings could offer cheap, long-lasting corrosion protection, with the metal used in solar panels’ structural parts. Currently, solar power installations account for around 0.4 million tons of annual global zinc consumption, Wood Mackenzie said. If global temperatures were on track to rise by 2.8 to 3 degrees Celsius by the end of this century, this number was projected to grow to 0.8 million tons by 2040. With temperature rises limited to 2 degrees Celsius, zinc consumption would increase to 1.7 million tons a year by 2040. If warming was successfully limited to 1.5 degrees Celsius, zinc consumption in the solar sector would rise to 2.1 million tons a year by 2040, analysts predicted. Wood Mackenzie’s predictions for the three metals were only around demand coming from the solar power industry, and did not speculate on total global demand. Wlazly pointed out in Wood Mackenzie’s note on Monday that falling production costs and efficiency gains had lowered the price of solar power around the world. “As a result, solar has become cheaper than any other technology in many parts of the U.S. and several other countries across the globe,” he said. “As costs continue to fall, solar’s share of power supply will rise and begin to displace other forms of generation. This presents a huge opportunity for the base metals sector.”

- 9. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 U.S. natural gas inventories to enter winter heating season below average, Source: U.S. Energy Information Administration, Short-Term Energy Outlook (STEO) In our August 2021 Short-Term Energy Outlook (STEO), we forecast U.S. inventories of natural gas will reach 3,592 billion cubic feet (Bcf) by November 1, the beginning of the winter heating season. This amount is 159 Bcf below its previous five-year average (2016–2020). Above-average withdrawals of natural gas from storage in the 2020–2021 winter heating season and below-average injections into storage this summer contributed to our forecast of below-average inventories of natural gas, along with relatively flat dry natural gas production and high natural gas exports. U.S. production of dry natural gas has remained relatively flat, averaging 91.5 billion cubic feet per day (Bcf/d) so far in 2021 (January–July), 0.4 Bcf/d below the same period in 2020. Production in January 2021 and July 2021 both averaged 92.5 Bcf/d. Production of natural gas declined in February 2021 by more than 6.5 Bcf/d because of extremely cold weather and well freeze-offs, but it increased to 92.0 Bcf/d the next month. U.S. exports of liquefied natural gas (LNG) have reached record-high levels so far in 2021 due to newly added LNG export capacity and increases in international natural gas and LNG prices. In 2020, U.S. LNG exports averaged 6.5 Bcf/d during a time of low global natural gas demand following the onset of the COVID-19 pandemic. In contrast, U.S. LNG exports have averaged 9.4 Bcf/d so far this year, and we forecast that LNG exports will average 9.5 Bcf/d for the year as a whole. Pipeline exports of natural gas have also increased in 2021 compared with 2020. U.S. pipeline exports of natural gas have averaged 8.5

- 10. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 Bcf/d so far in 2021, compared with 7.9 Bcf/d in 2020. We forecast that U.S. pipeline exports of natural gas will average 8.8 Bcf/d for all of 2021. Source: U.S. Energy Information Administration, Short-Term Energy Outlook (STEO) The high level of U.S. exports in 2021 combined with the relatively flat production has contributed to below-average injections of natural gas to storage this summer as we head into the winter heating season. So far this injection season (April 1–October 31), U.S. inventories of natural gas have grown by 960 Bcf, 14% less than the five-year average inventory build from April to July. In June 2021, the hottest June on record for the United States, natural gas inventories grew by 207 Bcf, 120 Bcf less than the five-year average inventory build for June. In May and June, U.S. consumption of natural gas increased 4.2 Bcf/d, or 6.2%, because of higher electric power sector consumption in response to the hot weather. NewBase August 12-2021 Khaled Al Awadi Oil price special coverage

- 11. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Oil prices slip as IEA warns of slowdown in demand recovery Reuters + NewBase Oil prices held a staple position ell on Thursday after the International Energy Agency (IEA) said the spread of the Delta variant of the coronavirus would slow the recovery of global oil demand. Brent crude recorded a price $71.50 a barrel by 05.070 pm BST Earlier, Brent hit a session high of $71.90. U.S. West Texas Intermediate (WTI) crude futures rose15 cents to $69.40 a barrel. The international energy watchdog’s monthly report said rising demand for oil reversed course in July and was set to proceed more slowly for the rest of the year after the latest wave of COVID-19 infections prompted countries to bring in restrictions again. “Growth for the second half of 2021 has been downgraded more sharply, as new COVID-19 restrictions imposed in several major oil consuming countries, particularly in Asia, look set to reduce mobility and oil use,” the Paris-based IEA said. “We now estimate that demand fell in July as the rapid spread of the COVID-19 Delta variant undermined deliveries in China, Indonesia and other parts of Asia.”

- 12. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 The IEA put the demand slump last month at 120,000 barrels per day (bpd) and predicted growth would be half a million bpd lower in the second half than it had estimated last month, noting some changes were due to revisions in data. “The IEA report seemed to suggest we’d see demand weaken a bit because of the COVID flare-up and because that will reduce the odds of a so-called super cycle in oil,” said Phil Flynn, a senior analyst at Price Futures Group in Chicago. In its monthly report that also came out on Thursday, the Organization of the Petroleum Exporting Countries (OPEC) stuck to its prediction of a strong recovery in world oil demand in 2021 and 2022, despite concerns about the spread of the virus. That came a day after the United States urged OPEC and its allies, known as OPEC+, to boost oil output to tackle rising gasoline prices, which it sees as a threat to the global economic recovery. OPEC agreed in July to boost output each month by 400,000 bpd versus the previous month, starting in August, until the rest of their record cuts of 10 million bpd, about 10% of world demand, made in 2020 are phased out. “The Biden Administration said that the recently agreed production increases will not fully offset previous production cuts imposed during the pandemic,” ANZ said in a note.

- 13. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 NewBase Special Coverage The Energy world – August - 12- -2021 Shale’s Prudence Wins Over Debt Market With $42 Billion of Bonds Bloomberg - David Wethe Shale drillers -- some of them just emerging from bankruptcy -- racked up a staggering $42 billion in new debt in the first half of the year. It’s not what you think. America’s oil explorers aren’t repeating the costly mistakes that landed them in hot water with investors, left them almost entirely shut out of debt markets and forced hundreds of them into insolvency over the course of five years. They’re holding the line on production, boosting investor returns and are now attracting the lowest bond yields they’ve ever seen. And instead of using their newly found cheap credit to boom once again, they’re using it to retire costlier debt. It’s true enough that borrowing costs have plunged across all industries as central banks inject liquidity into their economies. But arguably no sector has benefited from the bonanza of cheap debt more than shale, which about a year ago was on the brink of total collapse -- facing a pandemic that sent fuel demand plunging and investors and creditors who, even before Covid-19, had grown weary of waiting for profits. “We came into this year with too much debt, and we plan to pay debt down,” shale explorer APA Corp.’s Chief Executive Officer John Christmann told analysts and investors last week. “The first priority has been the debt, and clearly we’re on a much faster pace there than we would have envisioned at the start of the year.” It’s what investors want to hear, and it was repeatedly emphasized by other top producers such as EOG Resources Inc., Pioneer Natural Resources Co. and Continental Resources Inc. in the latest round of earnings calls.

- 14. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 Average yields on non-investment grade energy bonds plunged to an all-time low of less than 5% last month, from almost 24% in March of last year. The shale patch has gone from 230 bonds trading at distressed levels in April of last year to less than 15 today, according to Bloomberg Intelligence. The industry is also poised to generate more than $30 billion of cash this year, another record, thanks to a surge in crude prices. As they push maturities back with newer bonds, energy companies face a much smaller wall of debt between now and the middle of next year, at less than $4 billion, Spencer Cutter, an analyst at Bloomberg Intelligence, said. The last time the shale patch had credit metrics this good, with debt roughly 2.5 times earnings, oil was selling for $100 a barrel in 2014. West Texas Intermediate is trading at about $66 a barrel. Paying It Down Oil explorers are chipping away at debt levels that hit a record in 2019 Now energy bonds may be better positioned to weather the next bust. And that’s just where temptation may also lurk. America’s second-largest drilling-rig contractor, Patterson-UTI Energy Inc., is boosting its own spending this year by 22% from earlier guidance based on conversations it’s having with customers for higher activity ahead. Normally, the Houston company and other hired hands of the oil patch get

- 15. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 a break in activity during the final three months of the year after customers blew their drilling budgets and are forced to wait for the new year before growing again. “You can take fourth-quarter decline and throw it out the window this year,” CEO Andy Hendricks told analysts and investors on July 29. “If you look at where commodity prices are trading -- oil above $65 a barrel and natural gas above $3 -- we’re not considering a fourth-quarter decline.” But while the hired hands of the oilfield are talking about higher activity ahead, the explorers themselves are not indicating that just yet. In fact, Tudor Pickering Holt & Co. has warned it will probably reduce its 2022 outlook for onshore U.S. crude-output growth given the signals from executives on second-quarter earnings conference calls. “Previously, in an improving price environment, the call for growth would have sent the capital to drill better or to acquisitions, as opposed to shareholders,” said Dane Whitehead, CFO of Marathon Oil Corp., which chopped $1.4 billion of its debt faster than anticipated. “We’re kind of in a new paradigm.”

- 16. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 NewBase Energy News 12 August 2021 - Issue No. 1448 call on +971504822502, UAE The Editor:” Khaled Al Awadi” Your partner in Energy Services NewBase energy news is produced Twice a week and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscriptions, please email us. About: Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 www.linkedin.com/in/khaled-al-awadi-38b995b Mobile: +971504822502 khdmohd@hawkenergy.net or khdmohd@hotmail.com Khaled Al Awadi is a UAE National with over 30 years of experience in the Oil & Gas sector. Has Mechanical Engineering BSc. & MSc. Degrees from leading U.S. Universities. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat “with external voluntary Energy consultation for the GCC area via Hawk Energy Service, as the UAE operations base. Khaled is the Founder of NewBase Energy news articles issues, an international consultant, advisor, ecopreneur and journalist with expertise in Gas & Oil pipeline Networks, waste management, waste-to-energy, renewable energy, environment protection and sustainable development. His geographical areas of focus include Middle East, Africa and Asia. Khaled has successfully accomplished a wide range of projects in the areas of Gas & Oil with extensive works on Gas Pipeline Network Facilities & gas compressor stations. Executed projects in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of gas/oil supply routes. Has drafted & finalized many contracts/agreements in products sale, transportation, operation & maintenance agreements. Along with many MOUs & JVs for organizations & governments authorities. Currently dealing for biomass energy, biogas, waste-to-energy, recycling and waste management. He has participated in numerous conferences and workshops as chairman, session chair, keynote speaker and panelist. Khaled is the Editor- in-Chief of NewBase Energy News and is a professional environmental writer with more than 1400 popular articles to his credit. He is proactively engaged in creating mass awareness on renewable energy, waste management and environmental sustainability in different parts of the world. Khaled has become a reference for many of the Oil & Gas Conferences and for many Energy program broadcasted internationally, via GCC leading satellite Channels. Khaled can be reached at any time, see contact details above.

- 17. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17

- 18. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18

- 19. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19

- 20. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20 For Your Recruitments needs and Top Talents, please seek our approved agents below