New base energy news issue 841 dated 01 may 2016

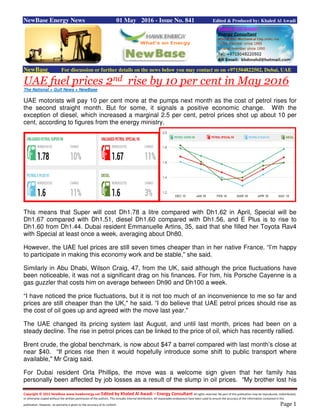

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 01 May 2016 - Issue No. 841 Edited & Produced by: Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE UAE fuel prices 2nd rise by 10 per cent in May 2016 The National + Gulf News + NewBase UAE motorists will pay 10 per cent more at the pumps next month as the cost of petrol rises for the second straight month. But for some, it signals a positive economic change. With the exception of diesel, which increased a marginal 2.5 per cent, petrol prices shot up about 10 per cent, according to figures from the energy ministry. This means that Super will cost Dh1.78 a litre compared with Dh1.62 in April, Special will be Dh1.67 compared with Dh1.51, diesel Dh1.60 compared with Dh1.56, and E Plus is to rise to Dh1.60 from Dh1.44. Dubai resident Emmanuelle Artins, 35, said that she filled her Toyota Rav4 with Special at least once a week, averaging about Dh80. However, the UAE fuel prices are still seven times cheaper than in her native France. “I’m happy to participate in making this economy work and be stable," she said. Similarly in Abu Dhabi, Wilson Craig, 47, from the UK, said although the price fluctuations have been noticeable, it was not a significant drag on his finances. For him, his Porsche Cayenne is a gas guzzler that costs him on average between Dh90 and Dh100 a week. “I have noticed the price fluctuations, but it is not too much of an inconvenience to me so far and prices are still cheaper than the UK," he said. “I do believe that UAE petrol prices should rise as the cost of oil goes up and agreed with the move last year." The UAE changed its pricing system last August, and until last month, prices had been on a steady decline. The rise in petrol prices can be linked to the price of oil, which has recently rallied. Brent crude, the global benchmark, is now about $47 a barrel compared with last month’s close at near $40. “If prices rise then it would hopefully introduce some shift to public transport where available," Mr Craig said. For Dubai resident Orla Phillips, the move was a welcome sign given that her family has personally been affected by job losses as a result of the slump in oil prices. “My brother lost his

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 job in Canada because of the drop in prices, so I’m happy it’s turning around," said the 34-year old Irish national. The global oil and gas industry had shed more than 250,000 jobs globally by the end of last year after prices dropped about 60 per cent from highs of $110 a barrel nearly two years ago. “This shows that the market is improving and all the regular people working in the industry who have been adversely affected by the drop in oil prices can breathe a small sign of relief at the increase," Ms Phillips said. The new prices were announced as global oil prices recover due to rising demand and drop in the US output. Brent, the global benchmark was trading at about $47 per barrel on Thursday, highest since November.Though the rise in oil prices is a good news for producers, but consumers will end up paying more as fuel prices are linked to global oil prices. In a land mark decision in July last year, the Ministry of Energy liberalized fuel prices and new pricing policy linked to global prices was implemented.Following the decision, diesel prices reduced by 24 per cent and petrol price have gone up by 29 per cent but dropped in the subsequent months. Fuel prices went up last month due to recovery in the global oil prices. Industry experts predict global oil prices to touch $50 in the coming months. “An average price of $50 per barrel is achievable in 2016,” Abdullah Salem Al Daheri, Director, Marketing and Refining, Adnoc said this week in Abu Dhabi. He expects oil markers to rebalance in the second half of this year. Ole Hansen, a commodity analyst from Saxo Bank said oil prices could go up due to positive momentum in the market. “As long positive momentum and investor interest remains as strong as seen this past month, traders could be taking aim at $50 per barrel,” said Hansen.

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Saudi Arabia needs billions in investment to meet renewable energy targets … The National - LeAnne Graves Saudi Arabia will need US$20 billion of investment to meet its renewable energy targets as it looks to diversify its economy away from its dependence on oil by 2020, according to industry experts. Prince Mohammed bin Salman set an “initial target" for the installation of 9.5 gigawatts of renewable energy when he announced Saudi’s National Transformation Plan on Monday. In his speech, the deputy crown prince said that while oil and gas remained essential to the economy, Saudi Arabia was laying the groundwork to expand investments into additional sectors. “We will also seek to localise a significant portion of the renewable energy value chain in the Saudi economy, including research and development, and manufacturing, among other stages," he said. The country’s renewable energy heavyweight, Acwa Power, believes that the 9.5GW target will include a blend of solar and wind. “The plan is likely to be a mixture of solar photovoltaic [PV], concentrated solar power [CSP] and wind," said Paddy Padmanathan, chief executive of Acwa. “And the 9.5GW would require an investment of around $20bn." However, the government’s target is modest compared to Saudi Arabia’s potential, which has an average of 3,000 hours of sunlight annually, almost double Berlin’s 1,700 hours – Germany has been a leader in renewables. Yet as the deputy crown prince said, the kingdom remains somewhat in the dark without a competitive renewable energy sector at present. As the country’s energy consumption is anticipated to increase threefold by 2030, renewables present the best option to help the electricity sector, which is almost exclusively powered via crude oil. But while some may consider the 9.5GW an underwhelming target, Saudi Arabia currently only has a negligible 25 megawatts currently installed. There is also no timeline mentioned which could allude to even greater amounts of renewable energy sources being added to the national grid. “The reality will be that as the delivered tariffs show how competitive renewables are, Saudi Arabia will very likely roll out much faster," said Mr Padmanathan. The German cleantech advisory firm Apricum agrees that the country could easily support a much larger rate of solar and wind installations. “If the political will is there, we expect multiple gigawatts per year to be possible," said Moritz Borgmann, a partner at Apricum. The deputy crown prince wants to link the goal of renewable energy with the manufacturing sector and announced that more opportunities would emerge to localise the “renewable energy and industrial sectors". Apricum said that a strong renewed interest in local manufacturing would be driven by Saudi’s industrial conglomerates. “Depending on the level of expected demand for renewables and the capabilities available in the country, activities may evolve from light assembly to more complex and capital-intensive activities such as polysilicon and PV wafer manufacturing," said Mr Borgmann. Further details of the kingdom’s new strategy are expected in the next few weeks, including more information on the King Salman Renewable Energy Initiative, but others are hesitant as to Saudi Arabia’s commitment to going green after the unsuccessful attempt to incorporate renewable energy as part of the King Abdullah City for Atomic and Renewable Energy (KA Care). “It will be interesting to see if Saudi Arabia is able to implement the King Salman Renewable Energy Initiative after the failed establishment of KA Care in 2010 and the following white paper in 2013 that never moved beyond paper," said Browning Rockwell, founder of the Saudi Arabia Solar Industry Association (Sasia). “I think the motivations for success are very different this time."

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Saudi to push its oil output higher but ‘not to flood market’ Reuters + NewBase Saudi Arabia’s oil output will edge up close to record highs in coming weeks to meet summer demand for power but is unlikely to be pushed to the limit and flood global markets, Saudi-based industry sources said. Production may rise to around 10.5mn bpd during summer, the sources said. Supply in April has held steady to slightly lower at about 10.15mn bpd, said three industry sources who monitor Saudi output. The predictions may help ease market fears that Saudi Arabia could steeply add to a global glut after production-freeze talks in Qatar last month collapsed following Riyadh’s refusal to sign the deal without participation by Iran. Days before the meeting, Saudi Arabia’s top oil official, Deputy Crown Prince Mohammed bin Salman, said the kingdom could boost output immediately to 11.5mn bpd and go to 12.5mn in six to nine months “if we wanted to”. Some analysts said the comments signalled a new phase in a battle for market share with Iran, which is ramping up its own exports after the lifting of international sanctions. But Saudi-based industry sources told Reuters that Riyadh does not plan to dump more oil into the market if there is no demand. They said the comments by Prince Mohammed were made to highlight the theoretical ability of the kingdom to raise output rather than its immediate plans. “Eleven million bpd? No, I don’t see it,” one source said.

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 The sources said production would likely stay at 10.2mn-10.3mn bpd and could rise by some 200,000 bpd-00,000 bpd in the hot summer months to around 10.5mn. Production often rises briefly in summer, when the kingdom burns more than 800,000 bpd to generate power as demand for air conditioning surges. State oil giant Saudi Aramco has a stated production capacity of 12mn bpd and maintains 1.5mn- 2.0mn bpd as a cushion in case of any global supply disruption. But production has never reached 11mn bpd. The kingdom pumped 10.56mn bpd, a record, in June last year. It kept output in March steady at 10.22mn bpd and has yet to disclose figures for April. Earlier this month, Aramco sold 730,000 barrels for June loading to Chinese refinery Shandong Chambroad Petrochemicals, one of about 20 independent refineries nicknamed “teapots”. This was Aramco’s first spot sale to a teapot plant, but Saudi-based industry sources said such a deal should not be viewed as an escalation of any battle for market share. “It’s not unusual to sell spot,” one of the industry sources said. “It’s basically pure demand-driven.”

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Equatorial Guinea: Ophir Energy, Fortuna FLNG update Source: Ophir Energy Ophir Energy has provided an update on the project workstreams leading to Final Investment Decision ('FID') on the Fortuna FLNG Project: 1. Since the 26 January 2016 announcement of a non-binding Heads of Terms Agreement with Schlumberger for upstream participation, Schlumberger has satisfactorily completed its technical due diligence. However, Ophir and Schlumberger have been unable to complete the transaction on the terms agreed in the Heads of Terms. As such, discussions between the parties have terminated. 2. Notwithstanding this the project still represents a technically and financially attractive project for Ophir and its shareholders. The Schlumberger agreement was one of several options being reviewed as a basis for development of the project and delivery of value to shareholders. 3. Ophir continues to progress the project. After completion of the upstream FEED studies, and EPCIC bids having been received as planned earlier this month, the forward upstream capex requirement from FID to first gas has been further reduced from $600mm (gross) to between $450-500mm (gross). 4. Ophir has remained in active discussions with a number of other parties with regards to participation in and funding of the Fortuna FLNG Project. These discussions include upstream equity participation, vendor financing and pre-sales of gas. 5. Offtake selection has progressed to a decision between three alternative solutions. Fully- termed LNG sales agreements are nearing completion. 6. Negotiation of the mid-stream chartering agreement with Golar is near complete. 7. The Development and Production plan was submitted to MMIE on schedule and in accordance with the PSC in March 2016 In light of the additional time required to fully develop these options to reach binding agreements, we now expect to make FID during 4Q 2016 with first gas now forecast for early 2020. Nick Cooper, Chief Executive Officer of Ophir, commented: 'The Fortuna project workstreams are progressing towards FID. We have been reviewing a number of options and our discussions continue with other quality counterparties that can offer an attractive source of funding. In addition, the reduction in the capex to first gas has lowered the project breakeven oil price to approximately $40 per bbl. We continue to work closely with Golar, the prospective offtakers and the other potential partners and remain confident that we will take the FID in 2016.'

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Canada expects lower natural gas exports to U.S., higher LNG exports to other countriesSource: U.S. EIA, based on Canada's National Energy Board, In its recent publication, Canada's Energy Future (CEF), Canada's National Energy Board (NEB) projects that both Canada's natural gas production and its domestic natural gas consumption will increase through the next decade. Exports of natural gas by pipeline to the United States are expected to continue to decline. The planned construction of liquefied natural gas (LNG) export terminals on Canada's western coast, which would send LNG exports to Asian markets by 2019, plays a key role in maintaining Canada's overall natural gas exports. Highlights from Canada's outlook include: Net natural gas exports to the United States. The NEB expects that Canadian natural gas net exports to the United States will fall to 2.5 billion cubic feet per day (Bcf/d) by 2025, shrinking to a negligible volume by 2040. Net exports to the United States have already decreased from a high of 10.6 Bcf/d in 2007 to 7.4 Bcf/d in 2014. With the continued development of U.S. shale resources, such as the Marcellus, the United States now relies less on Canadian imports to meet demand. By 2040, CEF projects that U.S. natural gas exports to eastern Canada will largely offset Canadian natural gas exports to the United States. Liquefied natural gas exports to other destinations. With the decline of natural gas exports to the United States, LNG exports are expected to be the primary driver of Canadian natural gas production growth, with production growing from 15 Bcf/d in 2015 to nearly 18 Bcf/d in 2025. The NEB analyzes two additional cases in CEF to explore the impact of LNG exports on production. In

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 a low-LNG case, where no liquefaction facilities are constructed, production remains at the 2015 level of 15 Bcf/d through 2040. In a high-LNG case, where LNG exports reach 4.0 Bcf/d by 2023 and 6.0 Bcf/d by 2030, production increases to 22 Bcf/d by 2040. Based on these results, CEF anticipates that future Canadian natural gas production growth will rely on the construction of LNG export capacity. Natural gas production. Recent technological advances in horizontal drilling and hydraulic fracturing have led to increased development of tight gas and shale gas resources in the Western Canadian Sedimentary Basin. CEF expects this development to continue as Canada's domestic natural gas production grows to nearly 18 Bcf/d by 2025. Tight natural gas accounts for 70% of projected production in 2025, and most of this natural gas is from theMontney formation in British Columbia and Alberta, where production is projected to triple from 3.0 Bcf/d to 9.6 Bcf/d between 2014 and 2040. Production growth also occurs in the Alberta Deep Basin (tight) and the Horn River Basin (shale). These increases offset the decline in production from other resources. Domestic natural gas consumption. Canadian natural gas consumption is also projected to rise, reaching 16.4 Bcf/d by 2025 and 18.6 Bcf/d by 2040. The industrial sector, which includes refining and oil exploration, is the primary driver of this growth, as well as the largest consumer of natural gas. Oil sands operations alone currently account for 20% of Canadian natural gas consumption. By 2040, CEF expects oil sands production to more than double to 4.8 million barrels per day, consuming 3.4 Bcf/d of natural gas. Another source of natural gas demand growth is electricity generation, whose consumption rises to more than 3.2 Bcf/d by the end of the projection period.

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 Natural gas net imports in 2015 at lowest level since 1986 Source: U.S. Energy Information Administration, Natural Gas Monthly U.S natural gas net imports fell to 2.6 billion cubic feet per day (Bcf/d) in 2015, continuing a decline that began in 2007, when net imports of natural gas exceeded 10 Bcf/d. While both U.S. natural gas consumption and production have increased in recent years, natural gas production has grown slightly faster, resulting in a decline in net imports. Increasing domestic production of natural gas has reduced U.S. reliance on imported natural gas and kept U.S. natural gas prices relatively low. Most U.S. imports of natural gas come by pipeline from Canada. A small and declining amount of imported liquefied natural gas (LNG) comes mainly from Trinidad. Most U.S. exports of natural gas are sent by pipeline to Mexico and Canada. The United States also exported LNG and compressed natural gas to several countries, but these volumes were relatively minimal in 2015. EIA's Short-Term Energy Outlook expects that the United States will become a net exporter of natural gas by mid-2017. In recent years, increasing production from shale plays in the United States has resulted in an increase in U.S. natural gas exports. Since 2012, the natural gas pipeline industry has added 3.4 Bcf/d and 0.2 Bcf/d of export capacity to Mexico and Canada, respectively. As a result, U.S. natural gas exports to Mexico grew from 1.3 Bcf/d in 2011 to 2.9 Bcf/d in 2015. U.S. natural gas net imports from Canada have remained relatively stable since 2011. The natural gas industry plans to build 5.4 Bcf/d and 3.4 Bcf/d of additional export capacity to Canada and Mexico by 2019, respectively. Demand for additional export capacity from the United States to Canada and Mexico is driven by production growth in the United States and increasing demand in northern Mexico from power generators that use natural gas.

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 Before 2010, the United States was expanding its LNG import infrastructure. The natural gas industry built eight new LNG import terminals between 2005 and 2011: two in New England and six in the Gulf of Mexico. Net LNG imports accounted for 19% of total U.S. net imports of all natural gas in 2007, but LNG's share of imports fell to 7% in 2015. Certain parts of the United States, such as New England, continue to rely on LNG imports because of limited access to domestically produced natural gas. Other LNG terminals are adding liquefaction plants to provide LNG for exports. The Sabine Pass LNG liquefaction facility was completed earlier this year and made its first shipment (to Brazil) on February 24. According to : http://www.forbes.com/sites/arthurberman/2016/02/21/natural-gas-price-increase-inevitable-in-2016/#2edecaf81a76 Today, the oil and gas industry is in financial shambles with both oil and gas prices at very low levels, and it is unlikely that companies can raise the capital necessary to ramp up gas drilling quickly if at all. Export plans of at least 7 bcfd by 2020 are not helpful considering the challenges of meeting domestic supply in coming years (Figure 6).The prospect of exports increasing to 13 bcfd by 2030 is even more troubling absent some new shale gas play that we don’t know about yet.

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 OPEC Oil Output Surges as Iran Looks to Regain Market Share Bloomberg - Mark Shenk OPEC crude production surged in April, led by Iran, which is seeking to regain market share after sanctions were lifted early this year. The Organization of Petroleum Exporting Countries increased production by 484,000 barrels to 33.217 million a day in April, the most in monthly data compiled by Bloomberg going back to 1989, according to a survey of oil companies, producers and analysts. Negotiations between OPEC members and other producers on April 17 in Doha ended without a deal to limit output after Saudi Arabia and other Gulf nations wouldn’t agree to any accord unless all members of the oil-exporter group joined, including Iran. OPEC set aside its output target of 30 million barrels a day at its Dec. 4 meeting in Vienna. Iranian output rose by 300,000 barrels a day to 3.5 million, the most since December 2011. Sanctions against the nation, which were strengthened in July 2012, were lifted in January. The Islamic republic is boosting production after sanctions were removed upon completion of an agreement limiting its nuclear program.

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 "The most significant number is Iran’s," said Mike Wittner, head of oil markets at Societe Generale SA in New York. "Iran continues to increase output at a fairly healthy clip, which has been the case since January." Iraqi Barrels Iraqi production rose by 160,000 barrels a day to 4.31 million in April, according to the survey. OPEC’s second-biggest producer pumped a record 4.51 million barrels a day in January. Saudi Arabia, OPEC’s top producer, increased output by 80,000 barrels a day to 10.27 million, the highest level since November. "Saudi Arabia and Iraq are very strong and Iran is coming back quickly," Wittner said. Kuwaiti production slipped 100,000 barrels a day to 2.9 million, the biggest decline in April. Kuwait plans to boost oil production to more than 3 million barrels a day within months, doubling output from where it stood during last week’s oil-worker strike. OPEC ministers are scheduled to gather on June 2 in Vienna.

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 NewBase 01 May 2016 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Crudes prices end week with WTI 45.96 & Brent 48.14 Reuters + NewBase U.S. oil prices dipped on Friday after an early rise to 2016 peaks, but posted a gain of about 20 percent for April, the largest monthly gain in a year. Futures held losses after oilfield services firm Baker Hughes reported its weekly U.S. oil rig count fell by 11 to 332. At this time last year, drillers were operating 679 oil rigs. A weaker dollar and optimism that a global oil glut will ease have boosted crude futures about $20 a barrel or more since they plumbed 12-year lows below $30 in the first quarter. With prices less than $5 away from $50 a barrel, investment bank Jefferies said the market "is coming into better balance" and would flip into undersupply in the second half of the year. But others warned that the rally was driven by investors holding large speculative positions, while oil stockpiles were still high, with a Reuters survey showing OPEC output in April rising to its most in recent history. "The issue is that we haven't seen price rallies ... correlate with fundamentals," said Hamza Khan, senior commodity strategist at ING. "The fundamentals - high stocks, high production - haven't changed." Technical analysts said crude could cruise to $50 a barrel but stiffer resistance before $55 could spark profit-taking on the market's biggest rebound in two years. Brent crude futures was flat at $48.14 a barrel, after setting a 2016 high of $48.50. U.S. crude fell 11 cents, or 0.2 percent, to settle at $45.96 after hitting a year-to-date peak at $46.78. Oil price special coverage

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 The discount in spot U.S. crude to the next trading month meanwhile whittled to its smallest since January, reducing the advantages of storing oil in the United States for later delivery. Analysts polled by Reuters raised their average forecast for Brent in 2016 to $42.30 per barrel, the second consecutive month of increases. Supply from the Organization of the Petroleum Exporting Countries rose to 32.64 million barrels per day (bpd) this month, from 32.47 million bpd in March, according to the survey, based on shipping data and information from sources at oil companies, OPEC and consultants. The OPEC survey aside, Saudi oil output was expected to edge up by 350,000 barrels to around 10.5 million barrels per day, sources told Reuters, as tankers filled with unsold oil floated at sea seeking buyers. Also on Friday, Libyan officials said the country's National Oil Corporation has ambitious plans to restore output to pre-2011 levels after years of violence and disruption. Oil output is now less than a quarter of the 1.6 million barrels per day Libya pumped before Muammar Gaddafi fell in 2011, and the National Oil Corporation (NOC) in Tripoli hopes to ramp it up swiftly with the backing of a new unity government. Bank of America Merrill Lynch said in a note that "non-OPEC oil supply is indeed hanging off a cliff", and estimated that global output would contract year on year in April or May for the first time since 2013. There are also growing risks that production in OPEC member Venezuela could decline. Risk consultancy Eurasia Group said the state was running out of cash to keep its oil pumps running. "Mounting problems will probably lead to a decline of 100,000-150,000 bpd this year," Eurasia Group said.

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 NewBase Special Coverage News Agencies News Release 01 May 2016 Saudi Arabia isn’t the only country looking to kick its crude addiction CNBC - Katy Barnato | Saudi Arabia's plan to diversify its economy away from oil grabbed the headlines this week, but other crude exporters have similar plans. Saudi Arabia's "Vision 2030," which includes plans to create the world's biggest sovereign wealth fund, privatize state-owned companies and attract more tourists, joins a host of similarly named programs from other Gulf states. Oman hatched its "Vision 2020" in 1996, while the United Arab Emirates (UAE) has "Vision 2021" and there is "Vision 2030" in Bahrain and the "Qatar National Vision 2030" — all aimed at diversifying economies away from oil. This is an urgent move as Brent and WTI crude oil prices remain far below the above-$100 per barrel levels reached before the collapse in oil prices began in June 2014. "We think the Gulf is acting in a much more vigorous and far-reaching way than was the case the last time oil prices collapsed in the 1980s," Charles Robertson and Vikram Lopez of boutique investment bank, Renaissance Capital, said in a report on Thursday. "Reform then was modest and late, and by the 1990s their economies remained too dependent on the state, over-subsidized and with excessively rigid labor markets," the strategists added. The UAE and Bahrain are already making the subsidy cuts promised by Saudi Arabia and have previous embarked on privatization drives that Robertson and Lopez said delivered good results in the 1990s. Slightly less of UAE's gross domestic product is based on oil and gas output — 40 percent — than in Saudi Arabia, where half of the economy is directly based on energy. That is according to OPEC, to which both countries belong. Some oil-producing countries, including Venezuela, Ecuador, Nigeria and Angola, defaulted on their sovereign debt in the 1980s when crude prices entered a six-year slump. However, there is hope that at least some countries will cope better this time. "We are encouraged by reforms that should help oil exporters manage in a $45 oil price world, with potential upside surprise if oil does not continue to follow the 1980s template," Robertson and Lopez said. Oxford Economics said on Tuesday that sovereign distress was less than in the 1980s, due to far lower interest rates and greater ease of refinancing debt.

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 "A long grind lies ahead, but history suggests those adhering to fiscal and real exchange rate adjustment can restore growth," the economic-forecasting firm said in a report. Several oil-producing countries have opted to float their currencies recently, including Russia, Kazakhstan and Azerbaijan. This has led currencies to devalue, making their exports more competitive and serving as an economic "shock absorber." Oxford Economics saw sovereign default as "imminent" in Venezuela, however. "An IMF program (in Venezuela) would probably be the best solution to the current crisis, but the government has always had a strong anti-IMF anti-imperialist rhetoric," it noted. Follow CNBC International on Twitter and Facebook. Katy BarnatoReporter and Copy Editor, CNBC.com C R E D I T : R E Z A / C O N T R I B U T O R Oil Market Deja Vu Triggers Predictions of a Return to $30 Bloomberg - Grant Smith Oil’s climb above $45 a barrel is reassuring influential figures from BP Plc to the International Energy Agency that the industry is finally recovering from the worst slump in a generation. Others say the market is about to fall into the same trap as last year. There’s a sense of deja vu at Commerzbank AG, BNP Paribas SA and UBS Group AG, who say crude’s gain of about 70 percent from a 12-year low in January resembles the recovery that took hold this time last year -- only to sputter out by May as the supply glut endured. Prices will sink back towards $30 a barrel in the coming weeks, BNP and UBS warn. “There are dangerous parallels to 2015,” said Eugen Weinberg, head of commodities research at Commerzbank in Frankfurt. “The market already appears overheated and a correction is overdue.” Last year, Brent crude rose 45 percent from January to almost $68 in May as traders anticipated a rapid decrease in U.S. output as drilling rigs were idled. The rally reversed when production kept rising, peaking at 9.61 million barrels a day in June 2015, a year after the price slump began. While drilling cutbacks eventually took their toll and the nation’s output slipped to 8.9 million barrels a day last week, the current recovery could boost industry activity and slow the decline. Gathering Pace The price increase has been reinforced by unplanned disruptions in producers such as Nigeria, Iraq and Kuwait. Even the failure of talks between OPEC and other major producers in Doha to freeze production couldn’t dent this month’s rally, which for Brent is on track to be the biggest in almost seven years.

- 17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 As the recovery gathered pace, the conviction has grown that the worst is over. The IEA, which as recently as February raised its estimate of the global surplus and warned of further price losses, said this month that markets will “move close to balance” in the second half. BP Chief Executive Officer Bob Dudley, who joked in February that swimming pools would be needed to hold the world’s excess crude, echoed that view last week. But for now supply still exceeds demand, and will continue to do so if prices don’t stay low for long enough to strangle investment in the U.S. shale industry, according to BNP Paribas. Thin Ice “The recent rally in oil prices may be self-defeating as it throws a life-line to U.S. shale producers,” said Harry Tchilinguirian, head of commodity markets strategy at BNP Paribas in London. The current recovery has stark parallels to the “false rally” of last year that “stifled the recovery” by sustaining high-cost production, Helima Croft, head of commodity strategy at RBC Capital Markets LLC, said in a report. A collection of wells that have been drilled, but not brought into production -- known as the fracklog -- could return 500,000 barrels a day of production back to the market if they are activated, according to Richard Westerdale, a director at the U.S. State Department’s Bureau of Energy Resources. That’s about equal to the decline in the nation’s production the IEA forecasts for this year. Prices need to revert into the low $30s and hold there for high-cost production to retreat sufficiently, BNP Paribas estimates. “The price strength in crude oil is on very thin ice,” said Giovanni Staunovo, an analyst at UBS in Zurich.

- 18. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 01 May 2016 K. Al Awadi

- 19. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19