OPEC output drops as Saudi cuts mount

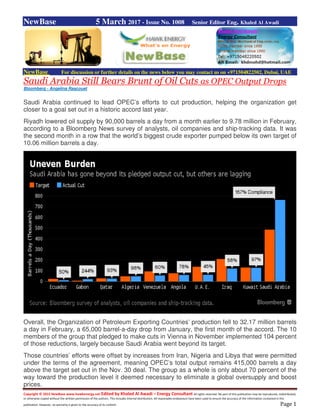

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase 5 March 2017 - Issue No. 1008 Senior Editor Eng. Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Saudi Arabia Still Bears Brunt of Oil Cuts as OPEC Output Drops Bloomberg - Angelina Rascouet Saudi Arabia continued to lead OPEC’s efforts to cut production, helping the organization get closer to a goal set out in a historic accord last year. Riyadh lowered oil supply by 90,000 barrels a day from a month earlier to 9.78 million in February, according to a Bloomberg News survey of analysts, oil companies and ship-tracking data. It was the second month in a row that the world’s biggest crude exporter pumped below its own target of 10.06 million barrels a day. Overall, the Organization of Petroleum Exporting Countries’ production fell to 32.17 million barrels a day in February, a 65,000 barrel-a-day drop from January, the first month of the accord. The 10 members of the group that pledged to make cuts in Vienna in November implemented 104 percent of those reductions, largely because Saudi Arabia went beyond its target. Those countries’ efforts were offset by increases from Iran, Nigeria and Libya that were permitted under the terms of the agreement, meaning OPEC’s total output remains 415,000 barrels a day above the target set out in the Nov. 30 deal. The group as a whole is only about 70 percent of the way toward the production level it deemed necessary to eliminate a global oversupply and boost prices.

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 Iraq’s production dropped by 50,000 barrels to 4.44 million barrels a day, the survey showed. A strike by oil workers in Gabon -- the tiniest member -- contributed to a decline of 15,000 barrels a day. Angola, among the most compliant members in January, failed to meet its target in February after the start-up of two oil projects. Output there ramped up 20,000 barrels to 1.69 million barrels a day. Iran’s output increased to 3.83 million barrels a day, slightly above its goal of 3.797 million barrels a day. As part of the deal, Iran was allowed to increase supply after years of sanctions that hurt its oil industry. Libya and Nigeria -- both exempt from the accord -- saw combined 50,000 barrel-a-day growth. Russian Cuts Investors are also paying close attention to Russia and 10 other oil-producing countries, which agreed in December to join OPEC in cutting output. A monitoring committee last week found the non-OPEC countries achieved 66 percent of their pledged cuts for January. In Russia, the largest non-OPEC participant in the deal, oil output was unchanged in February at about 11.1 million barrels a day after a cut of 117,000 barrels a day in January, according to Energy Ministry data. The nation pledged in December to gradually reduce supply by as much as 300,000 barrels a day from a post-Soviet high of 11.23 million in October. Benchmark Brent crude prices have rallied about 20 percent since the November pact amid optimism the market will re-balance following three years of glut. OPEC and its allies will decide at meetings in May whether to prolong the accord past June 30.

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 UK: Angus Energy to put the Kimmeridge into production at the Brockham oil field, onshore UK…Source: Angus Energy Angus Energy has announced that, following the extensive analysis of the BR-X4Z sidetrack well, the Company's intention is to bring the Kimmeridge into production at its existing Brockham production facility as soon as the necessary OGA approval is in place. The Brockham X4Z well, drilled to a total depth of 1,391m, was planned to evaluate the Portland, Corallian and Kimmeridge formations at Brockham including an evaluation of the Kimmeridge reservoir that had been demonstrated by the Horse Hill discovery 8 km to the South. The operator of the well at Horse Hill has announced cumulative production rates of over 1,500 barrels per day in short term testing. The Brockham X4Z well was intended to establish whether the evidence of a potential reservoir reported at Horse Hill extended further North into the Brockham Licence. The well was therefore intended to answer three main questions. Is the reservoir section in Brockham similar in thickness and reservoir properties to what had been reported at Horse Hill? Is there evidence of naturally occurring fractures to enable production of oil using conventional means? Is the content of oil in the Kimmeridge similar to Horse Hill where oil was tested at substantial rates? Angus Energy is pleased to announce that the preliminary results from Brockham X4Z confirm very similar thickness of reservoir and properties to those reported at Horse Hill. The gross thickness of Kimmeridge in Brockham X4Z is some 385m thick. The two limestone intervals (each

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 around 30m) tested in Horse Hill are also seen in the Brockham well. The reservoir properties appear to be very similar to Horse Hill, based on electrical logging evidence. Angus took the search for natural fractures a stage further by using the Weatherford Ultra Wave Acoustic borehole imaging tool. This is its first use in Europe. Technical papers are to be presented on this at DEVEX shortly. The tool made it possible to see fractures in the borehole directly, unlike the need to infer fractures from logs. The information confirmed not only evidence of natural fractures in the two main limestones intervals previously tested at Horse Hill, but also confirmed abundant natural fractures in sections of interbedded shales and limestones between and below the two main limestones. Around 200m of the reservoir has this potential. Angus took many samples during the drilling to use for geochemical analysis. The initial results of this work show total organic content through the Kimmerdige section between 2-12%, exceeding Horse Hill in places. Furthermore, evidence shows that the highest organic content corresponds to the limestones and, in particular, the intervals in between the limestones which have natural fracturing. Whilst organic content is not the same as oil content, it is indicative of those sections where oil content will be highest. This supports the potential for some 200m of reservoir of interest. Actual oil content depends on the extent to which burial has resulted in pressures and temperatures sufficient to generate oil. Initial Tmax and Hydrogen Index readings correspond with Horse Hill data. Since oil was produced briefly at Horse Hill and as it is most likely that the oil in the Portland Sandstone in Brockham is sourced from the Kimmeridge, the evidence backs a similar oil content to Horse Hill. Therefore, based on the evidence so far, Angus has confidence that the well will be similar to Horse Hill and perhaps given that the reservoir is potentially much thicker in zones not previously tested the results could be even better. These results achieve everything short of production to prove the potential from this zone. In line with Angus's measured approach to field development, operations are in hand to install new production facilities for the well and to prepare for the production as soon as necessary OGA approval is in place. Targeted completion for production is in spring/summer 2017. Our professional team will shortly be meeting Surrey County Council to discuss the position in relation to the sidetrack and also to agree what further planning permissions are necessary in order to regularise the existing site cabins, fencing and associated structures. In addition, additional oil shows were observed in the Portland and Corallian formations. Currently, the Brockham number 2 well is a temporarily suspended producer from the Portland reservoir and the Company is confident of additional production from the Portland from Brockham X4Z in due course. The Corallian formation with good indications of both gas and oil is still being evaluated.

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Libya's Es Sider Oil Port Seized in Blow to Production Surge by Ghaith Shennib and Hatem Mohareb Libya’s biggest oil port was seized by an armed group, dealing a blow to the North African country as it seeks to revive production of its most important commodity. Brent crude futures climbed. The Benghazi Defense Brigades, a militia that’s not allied to the United Nations-backed government in Tripoli, took control of the Es on Friday afternoon, according to people with knowledge of matter who asked not to be Sider terminal identified because they aren’t authorized to speak to the media. The facility had previously been under the control of eastern-based military commander Khalifa Haftar. “That is a considerable blow to Haftar,” said Mattia Toaldo, senior policy fellow at the European Council on Foreign Relations. “We have to see if there is an immediate impact on exports. But for confidence in Libya’s production it’s a blow.”

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 The clashes show just how vulnerable Libya’s recent oil-production surge is to conflict that escalated in late 2014 but that had shown signs of calming in the past few months. The nation pumped about 700,000 barrels a day in February, almost doubling from a year ago, according to information compiled by Bloomberg. Brent crude futures climbed as high as $55.95 a barrel following the port’s seizure. They were at $55.88 at 7:25 p.m. in London. Oil Crescent After sweeping through the oil crescent in September and taking control of the ports in the region, Haftar had allowed Libya’s National Oil Corp., part of the Tripoli-backed government that he opposes, to use Es Sider for oil exports. But production remains vulnerable without a lasting peace between the east and west of the country. International efforts to break the political stalemate have so far failed. Haftar is supported in his standoff with the government of Prime Minister Fayez al-Serraj in the west by Russia, the United Arab Emirates and Egypt. His allies contend that he alone has the military might and control of oil needed to govern the country. Others inside Libya also support him, though he’s opposed by powerful militias mostly across central and western Libya, where 70 percent of the population lives. Military Bluff “If they can hold on to the positions, they’re calling Haftar’s military bluff,” Toaldo said of the Benghazi Defense Brigades. “He had conquered the oil terminals with relatively few military resources. His ground troops are quite thin. He has prevailed until now thanks to a mix of the air- power and political skills.” “If his troops were overrun in two such areas in 24 hours, people inside Libya and outside will start to question his military force,” Toaldo added. Earlier, workers at the terminal had fled to nearby Ras Lanuf as Haftar’s forces sought to repel the attack, Saad Dinar, head of the oil workers’ union in eastern Libya, said by phone. Bushra, the Benghazi Defense Brigades’ news website, published photos showing their fighters at the airport in Ras Lanuf, another key city for Libyan oil exports. The Benghazi Defense Brigades’ stronghold is in Jufra, on the western edge of the nation’s oil crescent, rather than the city of Benghazi, which is in the east. The group was formed in 2016 with a goal of wresting Benghazi back from Haftar. There have been skirmishes in the area between the two sides before. Friday’s fighting marks an escalation and highlights threats to the North African country’s efforts to restore its crude production following two years of conflict. Libyan oil production has been rising, with shipments from key ports resuming after many months of conflict. The more it pumps, the greater the pressure on other members of the Organization of Petroleum Exporting Countries to curb supply in order to eliminate a global oil glut. “It’s still very early to judge the situation, and it depends on the ability of each side to sustain their control over the area,” said Zeid Ragas, a Libyan political commentator.

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Iraqi Kirkuk Oil Exports at Risk as Kurds Seize Pump Station by Khalid Al Ansary , Kadhim Ajrash , and Sam Wilkin Iraqi oil shipments of about 105,000 barrels a day were halted briefly on Thursday after Kurdish troops seized control of a pumping station in disputed Kirkuk province and demanded that crude shipments to the country’s central government be stopped. Oil from Kirkuk stopped flowing into a Kurdish-built export pipeline to Turkey after fighters loyal to the Patriotic Union of Kurdistan political party took control of the province’s main pumping station, Najat Hussein, a member of Kirkuk’s oil, energy and industry committee, said by phone. The shipments resumed several hours later, he said. The PUK, one of two parties in the Kurdistan Regional Government, has controlled much of Kirkuk since sending forces to protect oil facilities there after Islamic State militants captured swathes of northern Iraq in 2014. Kirkuk lies outside the KRG-run Kurdish region and is a potential flashpoint between Kurds and Iraqi Arabs. The KRG struck a deal with the federal government in Baghdad last August to share revenue from Kirkuk oil exported through the Kurdish- operated pipeline. By seizing the station that controls oil flowing into the export pipeline, the PUK was trying to pressure the federal government to allocate money to Kirkuk from sales of the province’s oil, Hussein said. The PUK will cut exports again if no agreement is reached within one week, he said. “Today’s storming of the North Oil Co. in Kirkuk was provocative and irresponsible local behavior,” Safeen Dizayee, a KRG spokesman, told the Kurdish Rudaw news agency late Thursday. “It was not necessary to take this irresponsible step.” Iraq, the second-biggest member of the Organization of Petroleum Exporting Countries, pumps most if its crude at fields in the south and exports it by sea from the southern port of Basra. Total exports increased to 3.85 million barrels a day last month, about 39,000 barrels a day more than in January, according to port-agent reports and ship-tracking data compiled by Bloomberg.

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 U.S. Shale Industry Challenges OPEC Once Again by Javier Blas When the who’s who of the oil industry met a year ago in Houston, Saudi Arabia’s energy minister had harsh words for U.S. shale drillers struggling with the worst price crash in a generation. "Lower costs, borrow cash or liquidate," said Ali Naimi, who managed the world’s largest oil- exporting business for more than two decades. In the year since, the drillers have largely taken Naimi’s advice. While more than 100 have gone bankrupt since the start of 2015, the companies that survived have reshaped themselves into fitter, leaner and faster versions that can thrive with oil at $50 a barrel. Now, it’s OPEC that’s seeking solutions, desperate to drive prices up even further in a push to repair the economies of the countries it serves. "The shale business is rejuvenated because of the difficulties it has been through," Ben van Beurden, the chief executive officer of Royal Dutch Shell Plc., said in comments last month. After a two-year downturn spurred by oil’s plunge to $26 from $100, U.S. production is on the rise once again, opening the door for another showdown with the Organization of Petroleum Exporting Countries. The number of U.S. drilling rigs has grown 91 percent to 602 in just over nine months. Meanwhile, production has gained more than 550,000 barrels a day since the summer, rising above 9 million barrels a day for the first time since April. And as shale returns with a vengeance, it’s not just the pioneer cowboys that dominated the first phase of the revolution in the Bakken of North Dakota. This time, Exxon Mobil Corp. and other major oil groups are joining the rush. It’s a new reality that OPEC and Russia -- the main forces behind the production cuts approved last year as a solution to re-balance the global market -- are starting to acknowledge.

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 "With $55 a barrel, we see everyone very happy in the U.S.," said Didier Casimiro, a senior executive at Moscow-based Rosneft PJSC. Long a world leader in multi-billion dollar oil developments that take years to build and even longer to profit, Exxon is diverting about one-third of its drilling budget this year to shale fields that will deliver cash flow in as little as three years, Chief Executive Officer Darren Woods said this week. In January, Exxon agreed to pay as much as $6.6 billion in an acquisition designed to more than double the company’s footprint in the Permian basin of west Texas and New Mexico, the most fertile U.S. shale field. Add to the mix the election of President Donald Trump, carrying the promise of fewer regulations, added pipelines and energy independence, and you see why the mood at CERAWeek, the conference that every year gathers oil executives, bankers and investors in Houston, will be far brighter next week than in 2016. "North American oil companies are going to increase their spending by 25 percent in 2017 compared to last year," said Daniel Yergin, the oil historian-cum-consultant who hosts the CERAWeek. "The increase reflects the magnetism of U.S. shale." U.S. benchmark West Texas Intermediate traded at $52.65 a barrel on Friday. Futures bounced between $51.22 and $54.94 in February. So far this year, U.S. energy companies have raised $10.5 billion in fresh equity, with shale and oil service groups drawing the most investment, the best start of the year since at least 1999 and equal to a third of what the sector raised in the whole of 2015. In Midland, the Texas city at the center of the Permian basin, the activity rush is palpable, as is the threat of higher costs for shale companies. The county’s active-rig total ranks second in the U.S., behind only Reeves County further to the west. "You could see the town’s energy is back," said Alan Means, founder of Cambrian Management Ltd., a Midland-based firm that operates more than 200 oil wells in the Permian across Texas and New Mexico. "The rigs are up again, the fracking crews are busier and the highway traffic is increasing." As activity rises, the man-camps in the town outskirts are flush again, with workers arriving from the Bakken in Montana and North Dakota, and from as far way as Canada. The 1,000-bed Permian Lodging camp is now 100 percent full, up from 65 percent in July, according to camp owner Ralph McIngvale. More Efficient It’s not just more activity. The growth is also the result of far more efficient ways to drill than existed only two years earlier. With oil companies benefiting from lower service costs, Shell reckons it can drill a well today for about $5.5 million, down a whopping 56 percent from 2013. And the new wells, thanks to more powerful fracking techniques, are yielding more barrels than ever. The average Permian well now gushes 668 barrels per day, compared to just 98 barrels four years ago, according to government data.

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 Shale companies such as EOG Resources Inc. and RSP Permian Inc. are telling investors they will expand oil output by as much as 30 percent in the next two or three years, more than they did in the heydays of the shale boom between 2010 and 2014. "The bottom line is we think they can produce as much oil out of the Permian as they want to," Greg Armstrong, the boss of Plains All American Pipeline LP, told investors in February. "It’s a matter of rigs, just a manufacturing operation." And the revival isn’t confined to the Permian, which stretches from Texas into New Mexico. Drilling is also increasing in other shale basins, such as the Scoop and Stack in Oklahoma, and in the Gulf of Mexico’s deep-water oilfields. Production Budgets At the same time, some of the industry’s most influential voices say they are keeping a tight hold on production budgets, vowing not to repeat the mistakes of the first phase of the shale revolution from 2010 to 2015, when companies spent well above the cash they generated. Marathon Oil Corp., for example, told investors last month it expects to boost output by about 20 percent a year from 2017 to 2021 even if oil prices stay at around $55. "We plan to achieve these impressive growth rates within cash flow, inclusive of the dividend," Marathon CEO Lee Tillman said in February. For a U.S. industry that once seemed ever-dependent on $100 oil, the return to profit with lower prices was a big surprise. And producers returned to profit using the very playbook offered by one- time market rival Naimi, who was replaced as Saudi Arabia’s energy minister in May. "Today, almost every single shale basin is economic in the $35-$50 a barrel price range," said Regina Mayor, head of energy at KPMG LLP in Houston.

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 U.S. Oil Drilling Collapse—and Rise Again Sources: Data compiled by Bloomberg, EIA, Baker Hughes - Tom Randall and Blacki Migliozzi The boom looks like it’s back. The number of oil and gas rigs drilling in the U.S. has almost doubled since bottoming out at the lowest level in more than 75 years of records. The animation below shows the collapse of America’s energy boom beginning in 2015—and its subsequent resurrection beginning last May. While two dozen nations are coordinating to cut oil production and rein in the global supply glut, U.S. producers are moving in the opposite direction. Over the last four months, output increased by half a million barrels a day. If that rate of expansion continues, the shale boom will break new production records by summer. This decade saw the fastest expansion of oil and gas production in American history. New technology drove the boom—particularly deployment of horizontal drilling through shale rock. Major shale regions include the Permian and Eagle Ford basins in Texas, the Scoop and Stack plays in Oklahoma and the Bakken formation in North Dakota. After the global plunge in oil prices began in late 2014, producers began shutting drilling operations at an unprecedented rate. The number of active oil and gas rigs plummeted 80 percent to the fewest since Baker Hughes started tracking them in 1940. The industry that's returned has been transformed. It employs fewer workers per rig and is even more tightly focused on the rich shale formations that drove America’s oil and gas boom before

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 the crash. Almost 90 percent of the rigs added during the rebound have been of the horizontal variety. Raw rig counts are losing their predictive power. The drilling industry is increasingly automated, and wells are pumping oil faster. Gone are the abundant high-paying jobs in pop-up oil towns filled with roughnecks. The U.S. now produces 9 million barrels a day; when the shale boom first crossed that threshold in 2014, more than twice as many rigs were actively drilling.

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 NewBase 05 March 2017 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil settles at $53.33 and $ 55.87, rebounding from recent weakness Reuters = NewBase Oil prices surged on Friday, as a weaker dollar encouraged buying but investors remained cautious after Russian production figures showed weak compliance with a global deal to cut output. Global benchmark Brent rose 79 cents to $55.87 a barrel at 2:30 p.m. ET (1930 GMT), recovering some of Thursday's losses. WTI futures settled at 72 cents to $53.33 a barrel, a 1 percent gain. "There is nothing surprising in seeing fresh buying after a big sell-off and of course the slightly weaker dollar is also helping oil recover," said Tamas Varga, senior analyst at London brokerage Both benchmarks have traded in a tight range all year. U.S. crude's peak this year was $55.24 on the first trading day of 2017; its low was $50.71 later in January. Oil barely budged after a speech by U.S. Federal Reserve Chair Janet Yellen. The dollar was down 0.3 percent on Friday, barely changed from prior to her statement which suggested a rate increase would come at the close of its two-day meeting on March 15. U.S. drillers added rigs for the seventh straight week, Baker Hughes said on Friday. Rig counts rose by seven rigs to bring the total to 609, most since October 2015, the energy services company said. "For the large part an interest-rate hike in the near-term is probably already valued into the dollar," said Sarp Ozkan, DrillingInfo's manager of energy analytics. Oil price special coverage

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 Dollar strength tends to pressure oil prices, as global trade in petroleum is conducted in dollars. Oil's gains were capped by lingering concerns over compliance, by producers outside the Organization of the Petroleum Exporting Countries, with a global deal to rein in oversupply. Russia's February oil output was unchanged from January at 11.11 million barrels per day (bpd), energy ministry data showed, with cuts from October 2016 levels remaining at 100,00 bpd, or a third of what Moscow pledged in its agreement with OPEC. Official U.S. data also showed crude inventories in the world's biggest oil consumer rose for an eighth straight week to a record 520.2 million barrels. Still, OPEC boosted already strong compliance with the group's six-month deal to 94 percent, cutting output for a second month in February, a Reuters survey found. In a bid to maintain demand for its oil, world top exporter Saudi Arabia has cut the price for its April light crude deliveries to Asia, trade sources told Reuters.

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 NewBase Special Coverage News Agencies News Release 05 March 2017 Due to oil some countries Economies Are Getting More Miserable This Year, Venezuela tops the list once again, but it's the moves in the middle that matter by Catarina Saraiva and Michelle Jamrisko If 2016 was the year of political shocks, this year could be when we find how they'll impact the global economy. Bloomberg's Misery Index, which combines countries' 2017 inflation and unemployment outlooks, aims to show us just that. For the third year in a row, Venezuela's economic and political problems make it the most miserable in the ranking. The least miserable country is once again Thailand — in large part due to its unique way of calculating employment — and the rest of the ladder features noteworthy moves by the U.K., Poland and Mexico, to name a few. Economic woes have plagued Venezuela for years. Sluggish oil prices, the country's only significant export, have fueled a crisis that has left grocery store shelves empty, hospitals without basic medication and violent crime rampant as desperation leads to anger. While the country has not reported economic data since 2015, Bloomberg's Cafe Con Leche Index, which aims to track inflation via the cost of a cup of coffee, shows a price surge of 1,419 percent since mid- August. Economists estimate that prices will rise almost six-fold this year, according to the median estimate in a Bloomberg survey.

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 A turn for the worse Moving closer to Venezuela territory — though no country even comes close to its score of nearly 500 — are a handful of central and eastern European countries. Poland, which experienced the biggest negative move in the rankings, clocks in at No. 28 among this year's 65 economies, from a rank of 45 in last year's index of actual performance. The higher the ranking, the more miserable the economy. Though it's seen a steady decline in its unemployment rate since the financial crisis, inflation rose to 1.8 percent in January after Poland's longest period of deflation on record. Similar price increases in Romania, Estonia, Latvia and Slovakia drove large jumps in the countries' Misery Index rankings. The misery also has deepened in Mexico, according to the index. After finishing 2016 at No. 38, it's slated to rise to 31st place as inflation balloons to a forecast of 5 percent in 2017 from an average 2.8 percent last year. A combination of the end of government fuel subsidies and the peso's 11 percent decline against the dollar since the U.S. presidential election in November is pressuring prices. The U.K.'s move by two notches toward more misery comes on the heels of the Brexit vote. The popular referendum that cemented the start of the country's move out of the European Union has driven the pound to a more than 30-year low, pushing up the cost of imports and, along with it, inflation. Price growth has been sluggish in the U.K. since oil prices fell at the end of 2014.

- 17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 Looking Up Making strides to become less miserable is a diverse cast of characters: Norway, Peru and even China. Norway's economic woes could at least lower prices for consumers this year, allowing the country some room to improve on last year's mediocre performance and become less miserable by 18 spots. Economists see oil spending slipping in 2017 while unemployment holds at around 4.8 percent — the latter perhaps a credit to the government's spending spree. Peru also is poised to impress with a noteworthy 13-position move toward a happier economy this year. Again, this is good news for bad reasons: Peru was more miserable than expected in 2016 as a drought sparked food-price inflation and weak domestic demand weighed on the labor market. Economists appear to agree with Peru's central bank, which sees improvement in investment and trade on the horizon. Rounding out the most-improved in the rankings this year should be Hong Kong, Taiwan, the Netherlands, China, Ecuador and Russia — each set to move down nine spots or more. A rosier outlook in China, the world's second-biggest economy, is a boon for global prospects. The U.S. remained among the 20 least miserable countries (at No. 49), though now a few spots worse than China, with which it tied in 2016. For full rankings, please see the table. Bloomberg's misery index comprises 65 countries and is calculated by adding together the forecasts for a country's rate of inflation and unemployment. A higher score indicates more 'misery.'

- 18. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18

- 19. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19

- 20. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20

- 21. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 21

- 22. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 22 With assistance from Andre Tartar, Cynthia Li, Sarina Yoo and Harumi Ichikura.

- 23. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 23 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase February 2017 K. Al Awadi

- 24. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 24 Hilton hotel 1B AZADLIG AVENUE, BAKU, AZ1000, AZERBAIJAN Please send your request by email at info@oil-gas.org, or call +994 55 5993345 About Summit Azerbaijan Oil and Gas Summit will host by FA Events. Summit will cover main oil and gas topics and latest trends. The Summit will gather main market key players and experts around globe. Social Networking Contact • Address: Jafar Jabbarli str., 44. Caspian Plaza. Baku, Azerbaijan. AZ1065 Baku Azerbaijan • Contact Us: +994 55 599 33 45 • Email: info@oil-gas.org The Oil and Gas Summit