Microsoft word new base 672 special 25 august 2015

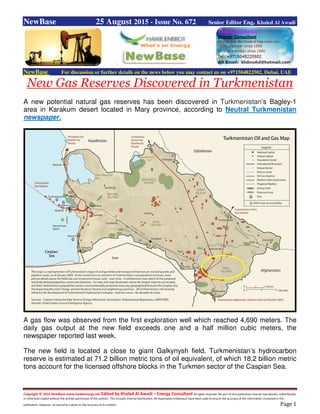

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase 25 August 2015 - Issue No. 672 Senior Editor Eng. Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE New Gas Reserves Discovered in Turkmenistan A new potential natural gas reserves has been discovered in Turkmenistan’s Bagley-1 area in Karakum desert located in Mary province, according to Neutral Turkmenistan newspaper. A gas flow was observed from the first exploration well which reached 4,690 meters. The daily gas output at the new field exceeds one and a half million cubic meters, the newspaper reported last week. The new field is located a close to giant Galkynysh field. Turkmenistan’s hydrocarbon reserve is estimated at 71.2 billion metric tons of oil equivalent, of which 18.2 billion metric tons account for the licensed offshore blocks in the Turkmen sector of the Caspian Sea.

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 UAE Mubadala in talks with Russia's Rosneft on east Siberian fields Reuters + NewBase Russia's Rosneft , the world's top listed oil company by output, is in talks with the UAE's Mubadala Petroleum to jointly develop two east Siberian projects, Tass Yuriakh and Verkhnechonskoye, the Kremlin said on Monday. The Kremlin did not give any further details in a statement ahead of President Vladimir Putin's meeting with Abu Dhabi Crown Prince Sheikh Mohammed bin Zayed al-Nahyan due on Tuesday. Combined production at both assets stood at around 9 million tonnes last year, according to the Russian Energy Ministry, compared to 205 million tonnes (4.1 million barrels per day) for Rosneft in total. Rosneft became the world's top listed oil firm by output after buying its peer TNK-BP for $55 billion in 2013. Rosneft has been in talks in recent years on selling stakes in some of its largest assets, including the Vankor field in east Siberia. In June, Rosneft agreed to sell a 20 percent stake in Tass Yuriakh to its shareholder BP . Putin and the crown prince, who is deputy chief commander of the United Arab Emirates armed forces, will also discuss Syria and Iraq, where Islamic State controls large swathes of land. The conflict in Syria and countering the radical jihadist group will also be on the agenda when Putin meets King Abdullah of Jordan on Tuesday, the Kremlin said in a separate statement.

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Libya oil production at 350,000 to 400,000 bpd Reuters + NewBase Libya is producing between 350,000 bpd and 400,000 bpd, roughly half the level it was a year ago, the chairman of a state oil firm loyal to the country’s internationally recognised government said yesterday. Naji al-Maraghi also told Reuters his management was working to lift the force majeure on the closed oil ports of Es Sider and Ras Lanuf, the country’s biggest, but no decision had made. Both ports have been shut since December when fighting broke out between factions allied to Libya’s rival administrations. The clashes have ended, but Islamic State has attacked oilfields linked to the ports, part of chaos in the Opec member four years after the ousting of Muammar Gaddafi. Mirroring the divide in the country, the state oil firm NOC has split into two managements. Foreign buyers of Libyan oil deal with the established state firm based in Tripoli which has processed oil exports for decades. But the recognised administration, which has been based in the east since losing the capital a year ago, has appointed al-Maragahi as its own NOC head, working out of a new eastern headquarters and challenging the Tripoli management. The eastern government said in March it wanted oil buyers to pay through a new bank account in Dubai, bypassing Tripoli. To hammer home its message of change, the eastern NOC is staging an oil conference in Dubai on September 2 to discuss existing oil deals with foreign oil buyers and service firms. Al-Maghrabi declined to elaborate on his planned discussions with oil firms in Dubai. Mohamed El- Harari, a spokesman for NOC Tripoli, also declined to comment on the conference. The UN has urged the warring parties not to touch the state oil firm or the central bank, which processes oil revenues, Libya’s lifeline. Al-Marghabi also said the eastern Zueitina port remained closed due to a pipeline blockage by locals demanding state jobs. Libya’s conflict has reduced output to less than a quarter of production before an uprising toppled Gaddafi in 2011. Most foreign oil companies have moved expatriate staff out of Libya or closed major fields due to insecurity or protests.

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Xcite looking to cut price for Bentley development Xcite Energy Ltd, the operator of an oilfield dubbed one of the largest undeveloped resources in the UK North Sea, the Bentley field, is looking to benefit from the lack of work in shipyards, while also trying to secure funding for the development. The company which operates the Bentley heavy oil field with a 100% stake said Monday that it was continuing technical due diligence with its potential development partners. The company said that its management acknowledged that the progress was slow, but it required a detailed analysis due to the fields unique nature. It also said it was pursuing a range of potential funding solutions to secure the development capital required for the Bentley first phase development. The funding options could include a joint venture, farm down deal , public financing, asset financing or “other means”. The company took over the licence in 2003, and has been working to bring Bentley oil into steady production ever since. The Bentley field is located on the East Shetland Platform in the UK Northern North Sea. Xcite in 2012 completed pre-production phase, producing 147,000 barrels of Bentley crude oil in the process. According to the company’s updates released over the past years, the plan for the development of the Bentley field should include a self-elevating ACE production platform, a bridge-linked Floating, Storage and Offloading (FSO) unit, and a jack-up drilling rig.

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 In its Monday’s statement, Xcite Energy said it was continuing to work with a number of parties in order to develop an asset funding package for the construction and delivery of the mobile offshore production unit (“MOPU”) and the floating storage and offloading vessel (“FSO”). Xcite is hoping to benefit from the lack of work and increasing competitiveness among the shipyards for large projects. “The current industry environment has freed up capacity in shipyards and we are actively pursuing and evaluating potential opportunities as a result of increasing competitiveness for major projects in order to deliver the best value and most secure project execution strategy. Management believes this process is complementary with the potential field development partner discussions and will create greater clarity for the overall Bentley First Phase Development funding requirements,” the company said, The company also said that the construction of the N Plus class drilling rig continues to make good progress in Singapore. $35 per barrel Xcite Energy said that the current full field development life-cycle cost estimate is around $35 per barrel, representing a relatively low cost per barrel for a UK North Sea development. “The Company has worked closely with third parties to validate the economic and commercial viability of the Bentley project. The collaborative work with the development group has also resulted in material operational efficiencies, such as the utilisation of a bridge-linked FSO into the development plan, which offers significant operational cost savings potential throughout the life of the field. The Company believes this is a good example of how contractor group collaboration can contribute towards maximising economic recovery in the UK North Sea,” Xcite said. It added: “The Company has an active dialogue with the Oil and Gas Authority (“OGA”) and has recently begun detailed discussions to review the technical approach to the Bentley field development in order to ensure that it will be compliant with government policy. Xcite Energy is fully committed to maximising economic recovery from the Bentley field, maintaining a collaborative approach with its development group and remaining consistent with the aims of the OGA.”

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Angola: Cobalt International sells offshore Angola blocks to Sonangol for US$1.75 billion . Source: Cobalt International Energy Sonangol and Cobalt International Energyhave announced the signing of a Sale and Purchase Agreement for Sonangol to acquire all of Cobalt’s 40% participating interest in Blocks 21/09 and 20/11 offshore Angola for $1.75 billion with an effective date of January 1, 2015. This transaction is subject to customary Angolan government approvals which are expected prior to the end of the year. The Sale and Purchase Agreement provides for a smooth transition to a new operator and underscores the parties’ commitment to attain the final investment decision for the Cameia development in Block 21/09 by year end 2015 in order to deliver first oil from Cameia in 2018. Notwithstanding Cobalt’s continuing as operator for an interim period, all costs going forward will be borne by Sonangol. Commenting on the transaction, Mr. Francisco Lemos José Maria, Chairman and Chief Executive Officer of Sonangol said, 'Over the past seven years, Cobalt International Energy has had outstanding exploration success in Angola’s pre- salt, which will accrue considerable prosperity to the Angolan people over coming generations. We are thankful and appreciative of their efforts and dedication to the task and wish them well in their future endeavors in the global industry.' 'We are proud of the tremendous success that our partnership with Sonangol has achieved in opening the pre-salt play in the Kwanza Basin with five significant discoveries and a deep portfolio of exploration prospects,' said Joseph H. Bryant, Cobalt’s Chairman and Chief Executive Officer. 'We remain committed to continuing our joint efforts with Sonangol to move the Cameia development project to sanction by year end.'

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Philippines’ coal-power plans unsettle investors Reuters/ Plans to boost the Philippines’ coal-fired power capacity by more than 25% in just three years will be a cheap solution to the country’s precarious power supply but bad news to investors in clean energy. A total of 25 coal-fired power stations are in the pipeline with capacity totaling 12,200 megawatts, according to an updated list of power projects published by the Philippine Department of Energy last month. Twelve of them with a total capacity of 3,400 MW are under construction, and are slated to be completed by 2018. Those plants require at least 10mn tonnes of coal a year, industry estimates show. About a third of the country’s power capacity of nearly 18,500 megawatts uses coal as fuel, but supply from local mines mainly owned by Semirara Mining and Power Corp is not enough. Coal imports soared to a record 15.2mn tonnes last year. While minuscule compared to purchases by China and India, growing Philippine imports will be welcomed by Indonesia, its traditional main supplier, at a time prices are falling. The Philippines also buys coal from Australia, Vietnam and China. “A significant portion of our electricity market is dependent on imported coal from Indonesia. I’m worried about our energy security being put in the hands of another country,” said Vincent Perez, a former Philippine energy secretary who is now the CEO of wind power developer Alternergy Partners. Promoting solar, wind, hydro and geothermal energy has become a challenge for investors as the government remains biased towards low-cost power from coal. Investors have been grappling with high initial expenses and red tape. But Theresa Cruz-Capellan, chief executive of SunAsia Energy Inc and president of the industry group Philippine Solar Power Alliance, says the additional coal-fired power plants should not be seen as lost opportunity for renewable-energy investors. “By the time they have built those coal- fired plants, we believe there will be additional demand and we can install additional capacity in just six months.”

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 Growing global liquids inventories reflect lower crude oil prices Source: U.S. Energy Information Administration, Short-Term Energy Outlook, August 2015 Continued growth in global production of petroleum and other liquids has outpaced consumption growth since August 2014, resulting in rising global liquids stocks. Total global liquids inventories are estimated to have grown by 2.3 million barrels per day (b/d) through the first seven months of 2015, the highest level of inventory builds through July of any year since 1998. These strong inventory builds have put significant downward pressure on near-term crude oil prices: North Sea Brent crude oil spot prices have averaged $58/barrel through July of this year compared to $109/b over the same period in 2014, responding to growth in global inventories. EIA estimates global consumption of petroleum and other liquids grew by 1.1 million b/d in 2014, averaging 92.4 million b/d for the year. Through July 2015, global liquids consumption has grown by an additional 1.2 million b/d. Global production of petroleum and other liquids has been higher, growing by 2.3 million b/d in 2014, averaging 93.3 million b/d for the year, and increasing by an estimated additional 2.9 million b/d through July 2015. Although the annual increases in global crude oil and liquids production have been similar, the sources of supply have been different. In 2014, most global liquids production growth was from countries outside of the Organization of the Petroleum Exporting Countries (OPEC), particularly the United States, while production from OPEC actually fell. In contrast, growth thus far in 2015 has come from both OPEC and non-OPEC countries. Through the first seven months, EIA estimates that non-OPEC petroleum and other liquids production has grown by an average of 2.0 million b/d, while OPEC liquids production is estimated to have grown by 0.9 million b/d over the same period.

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 Growing oil inventories typically put downward pressure on near-term prices and increase contango in the futures market, meaning contracts for delivery in the future show higher prices than contracts in the near term. Since global liquids inventories began to consistently grow in the third quarter of last year, the difference between futures prices and near-term contracts has increased from nearly zero to $5/b- $10/b over the past year, reflecting the increased supply of crude oil and the associated costs of growing storage needs in the near term as well as the expectation of reduced oil supply growth in future months. Over the same period, Brent crude oil spot prices have fallen from an average of $102/b in August 2014 to a range between $55/b and $65/b for six consecutive months between February and July in 2015. In the August Short-Term Energy Outlook (STEO), EIA forecasts that falling crude oil production in the United States in response to lower oil prices will help moderate oil inventory builds in the coming months, leading to slightly higher expected prices. The pace of inventory accumulation is expected to slow from more than 2.0 million b/d currently to 1.5 million b/d in the fourth quarter of 2015, and to drop below a 1.0 million b/d build in 2016. Expectations for a continuation in this trend should be reflected in increasing Brent crude oil spot prices, which are forecast in STEO to increase from an average of $51/b in the fourth quarter of this year to an average of $59/b in 2016.

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 NewBase 25 August- 2015 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil rebounds after sharp losses, but China worries weigh Reuters + NewBase Crude oil markets recovered more than a percent on Tuesday after a sharp drop in the prior session, although prices held near 6-1/2-year lows as continued weakness in Chinese equities triggered fears of an economic tailspin in the region. While global markets showed signs of a respite from the recent blood-letting, Chinese shares lost another 5 percent with investors fearing a hard landing of the world's second-biggest economy and top commodity consumer. "The recent turmoil has left even the most hardened trader gasping for air. And there's probably more to come," said Frederic Neumann, HSBC's co-head of Asian Economics Research, in a note to clients. "China's economy continues to slow and the (U.S.) Fed may still hike rates before the end of the year. That puts further cracks into the two main growth pillars for the world economy of recent years: Chinese demand (including commodities) and easy money," he said, but added that a re- run of Asia's financial crisis in the late 1990s was unlikely. U.S. crude CLc1 was up 65 cents at $38.89 per barrel at 0443 GMT (0043 EDT), while Brent LCOc1 was up 56 cents at $43.25. The benchmarks were not far from Monday's lows of $37.75 and $42.23, respectively, weakest since early 2009, suggesting worries over China's economic outlook are now as big as concerns of surplus that have plagued the market for over a year. Oil price special coverage

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 Shipping sources said that a potential slowdown in demand was becoming visible in tanker traffic, where the number of very large crude carriers (VLCC) fixed to arrive in Asia fell from 105 in June, to 94 in July and to 83 this month. West African VLCC-fixtures to Asia halved in August to 18, compared with 36 in July. Goldman Sachs said that while China's turmoil would not lead to a global recession, it did expect the trouble to result in weak commodities. Beyond Asia's turmoil, oil markets have been suffering from oversupply that started pulling down prices in June 2014. The Organization of the Petroleum Exporting Countries is producing record volumes to squeeze out competition especially from U.S. shale producers which, however, have so far been resilient to the resulting price plunges and kept pumping oil.

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 NewBase Special Coverage NewBase News Release 25 Aug 2015 Refiners face decade long global gasoline glut http://www.woodmac.com/public/media-centre/12528994 Wood Mackenzie says the global oil product market could experience a surplus of gasoline supply as early as 2017 which, combined with a deficit of middle distillate and fuel oil, would put significant pressure on refiners by the end of the decade. According to Wood Mackenzie, this is in contrast to the current picture, with refiners benefitting from low oil prices, unplanned refinery outages and slower than expected ramp-up of new facilities which have helped keep oil product markets tight. However, Wood Mackenzie cautions that oil demand growth will eventually slow in the long- term thanks to increasing efficiency and alternative fuel sources. By 2019 Wood Mackenzie expects margins to fall to the minimum sustainable level for some refiners and identifies key market indicators that could see gasoline cracks bottom out at low levels last seen in 2013. According to Wood Mackenzie's latest long-term oil product market forecast, a surplus of gasoline is expected to flood the market as early as 2017 - in contrast with what's happening right now, where refiners are struggling to meet gasoline demand growth of approximately 420 thousand barrels per day (kb/d). Jonathan Leitch, a Research Director for oil product markets research at Wood Mackenzie explains: "Although gasoline cracks have been very strong this year, we could see a complete reversal in the market in just two years. The outlook for 2016 remains similar and in many ways stable, but in 2020 start we start to see a glut of gasoline supply developing – in excess of 30 million tonnes - which doesn't go away for a decade." The latest oil product analysis from Wood Mackenzie - which tracks 745 operational refineries globally - shows that gasoline yields are expected to increase by 1% over the next 15 years. This means even if there aren't any new refineries built beyond 2020, there will still be an oversupply of gasoline globally for several years. Wood Mackenzie says this is the result of falling demand in the key market of North America, combined with continued declines in Europe and Asia, which offsets most of the demand growth seen in the emerging Asian economies, Latin America, Middle East and Africa. Wood Mackenzie asserts that at present refiners are enjoying healthy margins due to several factors: low oil prices have reduced costs, while refinery outages in Latin America and slower than expected ramp-up of new facilities in the Middle East have all caused global refining capacity, and therefore supply, to lag compared to demand. However, Wood Mackenzie cautions that global oil demand growth will eventually slow in the longer term due to increasing efficiency and alternative fuel sources - lowering global gasoline demand. In addition the

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 ramp up for three new refineries in the Middle East, which combined add 1.2 million barrels per day (mb/d) in capacity plus the stabilisation of operations in Venezuela could be key indicators of the prolonged period of oversupply. Mr Leitch says: "Surplus supplies coupled with the continued growth of alternative fuel products from outside the refining system – increasing by 1.8 million barrels per day (mb/d) between 2014 and 2020 from products such as biofuels and gas and coal to liquid products by 2020 - means that there will be increasing pressure on refinery margins. We expect to see particularly strong growth in liquefied petroleum gas (LPG) supply from natural gas liquids (NGLs) in North America and the Middle East, and by 2019 margins could bottom out at minimum sustainable levels for Europe and Asia. We expect to see gasoline cracks come down and margins weakening again - taking us back to levels where we were last year and in 2013." "Refiners will continue to invest in refining operations to meet global demand and increasing stringent product specifications to comply with environmental legislation, which could see an additional 5.5 mb/d in net refining capacity by 2020. This would put significant pressure on Europe and Asia for further capacity consolidation and the US refining sector could also start to suffer, particularly in areas without access to export markets," Mr Leitch adds.

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 Water management key to achieving sustainable development goals Reuters + NewBase As demand for water grows, the world must focus on how the precious resource will be shared among farmers, the energy sector and cities if it is to achieve the United Nations’ new development agenda, a World Bank expert said. The world faces a 40 percent shortfall in water supplies in 15 years due to urbanization, population growth and growing demand for water for food production, energy and industry, according to a United Nations report published in March. The UN Millennium Development Goals (MDGs), which had focused attention on the needs of poor nations for the past 15 years, included boosting access to clean water and sanitation. The Sustainable Development Goals, due to be adopted at a UN summit in September to replace the MDGs, broadens water from a narrow access issue to a fundamental rethink of how it is managed, said Junaid Ahmad, director at the World Bank’s water global practice. We’re headed into a perfect storm in which over the next 20 years we will see the demand for water growing significantly, driven by thirsty agriculture, thirsty energy and thirsty cities, Ahmad said on Sunday on the sidelines of a global water conference in Stockholm. If we are to achieve these goals of food and energy security, sustainable urbanization, and ensure service delivery of water and sanitation to citizens, we now need to figure out how water is going to be allocated across sectors. Some 2.6 billion people have gained access to clean water since 1990, but more than 660 million still live without access, say UNICEF and the World Health Organization. Ahmad said achieving the new water goal and scaling up access means not only building pipes, but also fixing institutions and improving governance. Another challenge, he said, is putting a price on water. We are in a world in which we are trying to price carbon, but we do not know how to value water, he said, adding that because water is a human right, there is an assumption that it should be free. Free water is probably the most expensive water for poor people, because whenever you give out free water it’s captured by the politically powerful, not by the poor. Other challenges include climate change, which has made the water supply patchy, and the management of groundwater. Groundwater is the biggest source of stored water that we have, and yet it has been progressively abused , extracted at a faster rate than it is being recharged, he said. More than 2 billion people still lack access to toilets, but Ahmad is optimistic that the new goal of universal sanitation coverage by 2030 can be achieved. It took developed countries many years to achieve universal access, he said, noting that a World Bank simulation showed countries such as France took 25 to 30 years to provide toilets for everybody. If we look at history and the pace in which developed countries have changed, then what developing countries are doing today is pretty historic. They are catching up at a very fast rate.

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 UK economy vulnerable to China market fallout, Osborne says Bloomberg Chancellor of the Exchequer George Osborne said the UK economy is vulnerable to international shocks as concerns about a slowdown in China caused stock markets across the world to tumble. “Everyone is concerned about the situation on the Asian financial markets,” Osborne told reporters in Helsinki on Monday after meeting with Finnish Finance Minister Alexander Stubb. “I would take it as a reminder that we are not immune from what happens in the world.” Osborne’s comments underline a growing unease among investors and policy makers as a sell-off in China’s stock market spreads globally, sparking concern about the potential impact on the world economy. Chinese shares tumbled the most since 2007, commodities fell to a 16-year low and emerging- market currencies weakened to a record. Speaking at a joint press conference with Swedish Finance Minister Magdalena Andersson in Stockholm later the same day, Osborne said that while there was “a real concern” about the volatility in Europe caused by China, its effects wouldn’t be immediate. “I am reasonably confident, although I don’t think that we can be unaffected by what goes on in China, I don’t think it’s going to cause immediate sharp problems in Europe,” said Osborne. “The issue is the growth in China’s economy” and “that’s the area we should focus on.” ‘Next Crisis’ The UK’s benchmark FTSE 100 Index followed Asian stocks lower, and was down 5.3 per cent as of 2:18 pm in London. In Helsinki, Osborne said the Chinese authorities were doing “all they can to stabilise those markets.” Osborne, who is on a tour of Scandinavia to seek support for the UK’s push to reform the European Union ahead of a planned referendum on Britain’s membership of the bloc by end-2017, said the situation highlighted the importance of other countries “keeping their own house in order.” “You don’t know where the next crisis is coming from, where the next shock is going to come from in the world,” he said. “Britain is a very open economy, probably the most open of the largest

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 economies, and we are affected by what happens, whether it is problems in the Eurozone, problems in Asian financial markets.” Oil Explorers Tumble as Commodities Bloodbath Sinks MarketsShare on FacebookShare on Twitter Oil and gas producers dropped to their lowest level in almost four years as collapsing markets in China heightened concern that demand will falter in the world’s second-largest destination for crude, aggravating a glut from North American shale and the Persian Gulf. An index of 40 energy explorers declined 3.7 percent at 10:30 a.m. in New York trading, after earlier tumbling as much as 5.5 percent to the lowest since October 2011. Exxon Mobil Corp. and Chevron Corp., the biggest U.S. oil companies, racked up losses of as much as 8 percent shortly after domestic equity markets opened on Monday. Stocks around the world plunged as a rout that began with the Aug. 11 devaluation of China’s yuan rippled through European and U.S. markets. Commodities fell to a 16-year low, Treasury yields dipped and U.S. crude fell below $38 a barrel for the first time since February 2009. “It’s a bloodbath,” said Mark Hanson, an analyst who follows U.S. crude explorers at Morningstar Inc. in Chicago. “We’re at an intersection of a lot of bad news.” Market Turbulence Some of the biggest losers in the Standard & Poor’s 500 Energy Index included shale oil pioneer Continental Resources Inc., which plunged as much as 25 percent, and Anadarko Petroleum Corp., which dropped as much as 16 percent. Crude futures for October delivery declined 4.2 percent to $38.76 a barrel at 11:18 a.m. in New York after earlier dipping to $37.75. Deal activity among energy-focused investment bankers and project financiers screeched to a halt as potential investors eyed the market turbulence and sat on the sidelines, said Christopher Geier, partner-in-charge at Sikich Investment Banking in Chicago. “The guys who are looking to invest money get really nervous when they see the markets turn like this,” Geier said. “Sitting on cash and doing nothing seems to make them feel better.”

- 17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17

- 18. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 25 August 2015 K. Al Awadi

- 19. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 6th – 8th Oct.