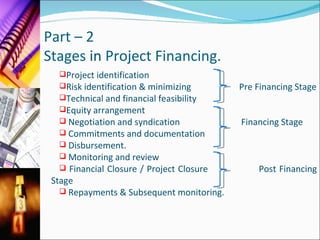

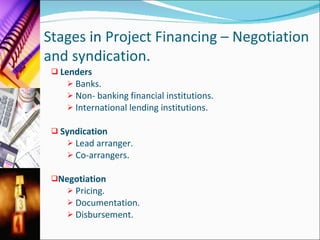

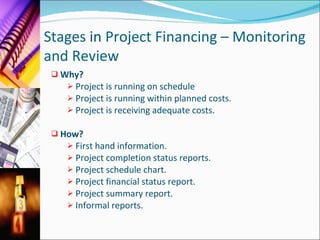

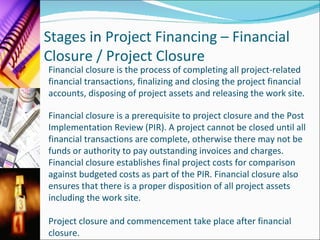

This document provides an overview of project financing, including what it is, the key parties and stages involved, and its advantages and disadvantages. Project financing refers to financing long-term infrastructure or industrial projects based on the future cash flows generated by the project rather than the balance sheets of its sponsors. The stages discussed include project identification, risk assessment, feasibility analysis, equity and debt arrangement, documentation, disbursement, monitoring, and closure. Advantages include off-balance sheet treatment for sponsors, while disadvantages include higher costs and complexity.