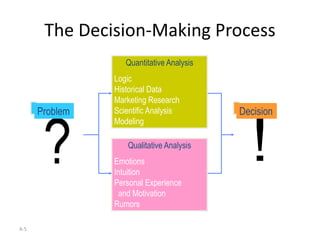

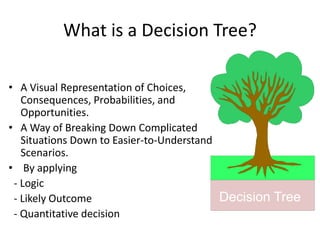

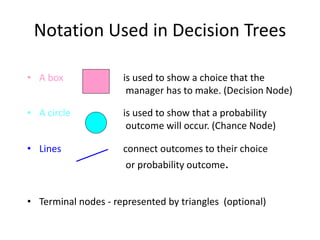

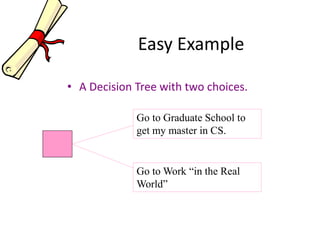

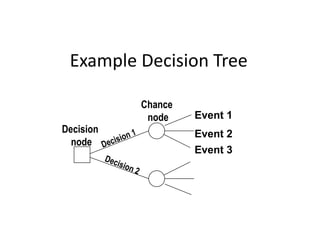

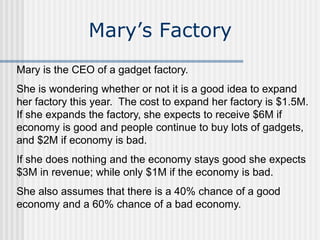

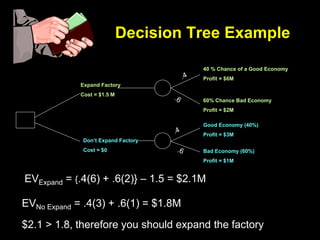

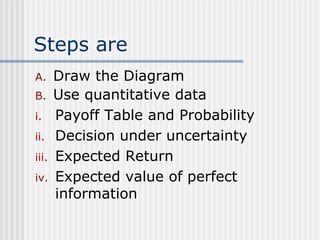

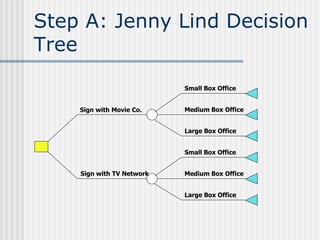

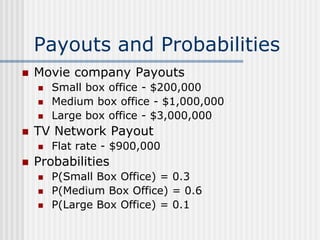

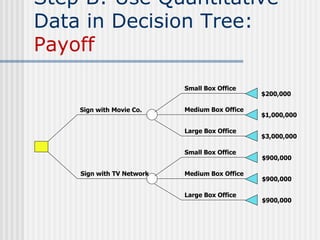

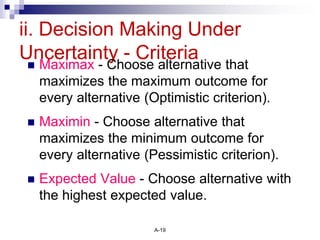

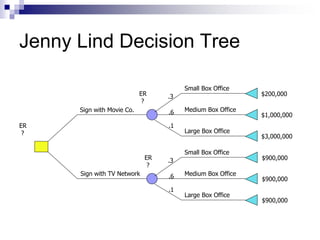

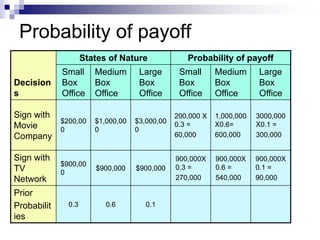

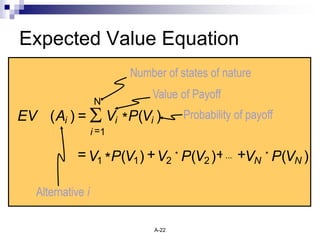

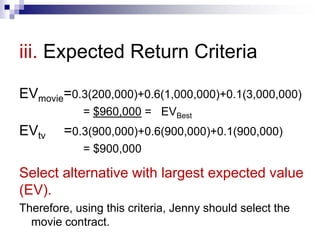

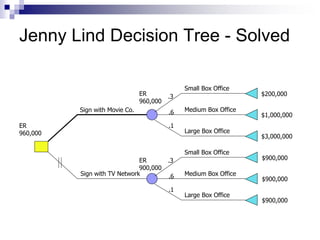

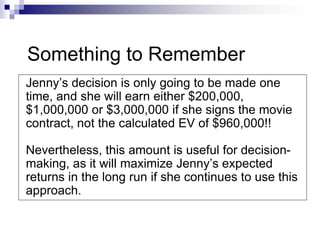

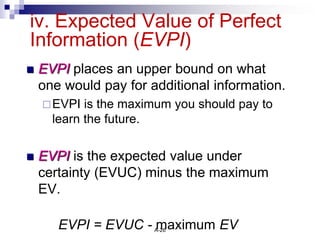

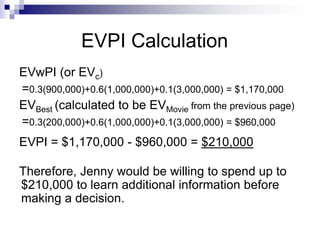

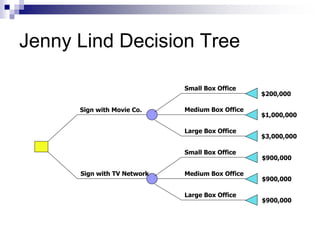

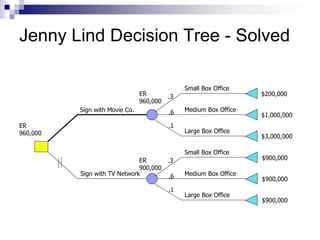

The document introduces decision trees as a quantitative tool for making decisions, detailing their structure, advantages, limitations, and practical applications. It provides examples, including scenarios involving expansion decisions in a factory and a writer considering contract options, illustrating how to calculate expected values for different outcomes. The document also touches on concepts like decision-making under uncertainty and the value of perfect information in optimizing decisions.