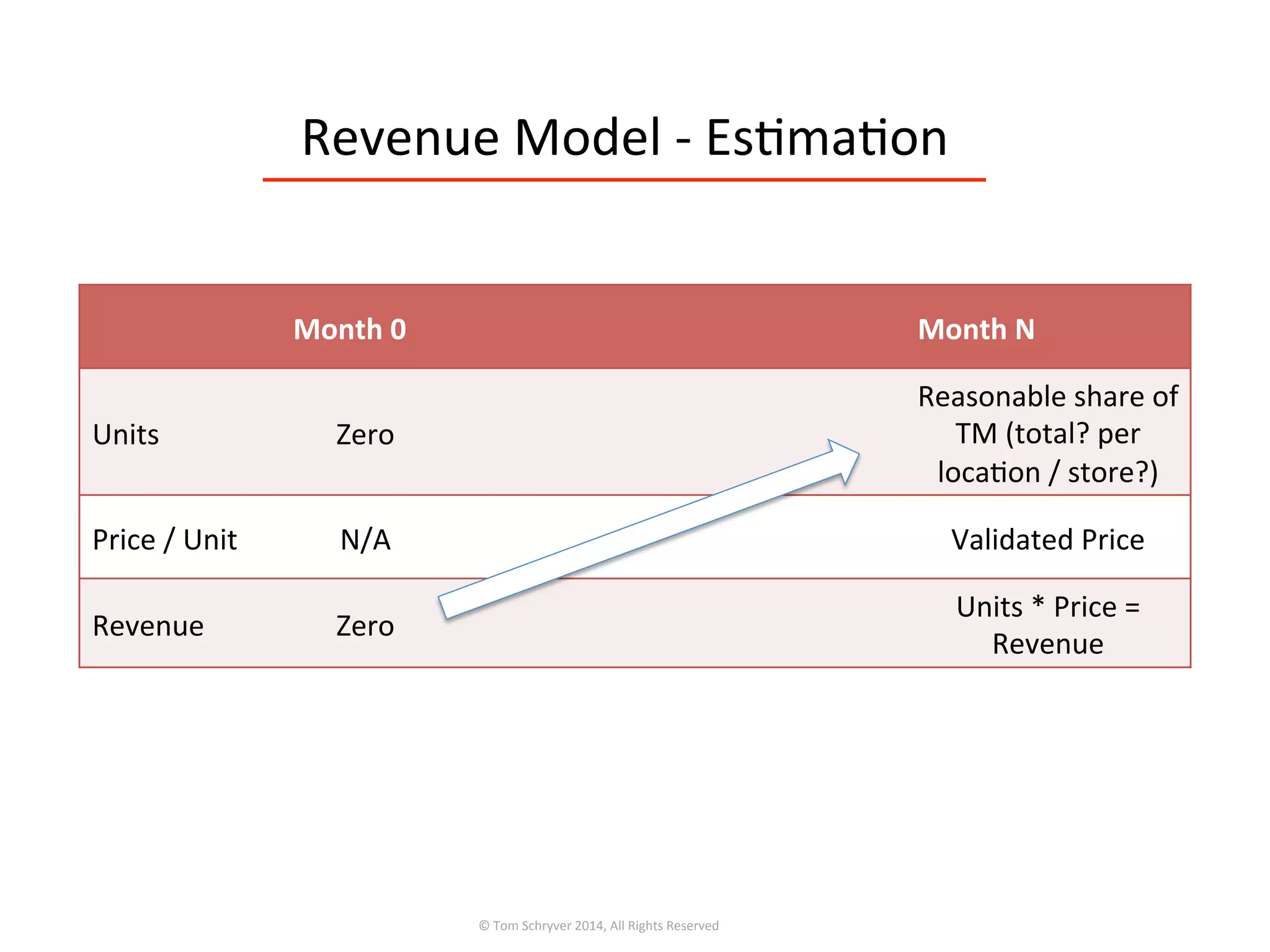

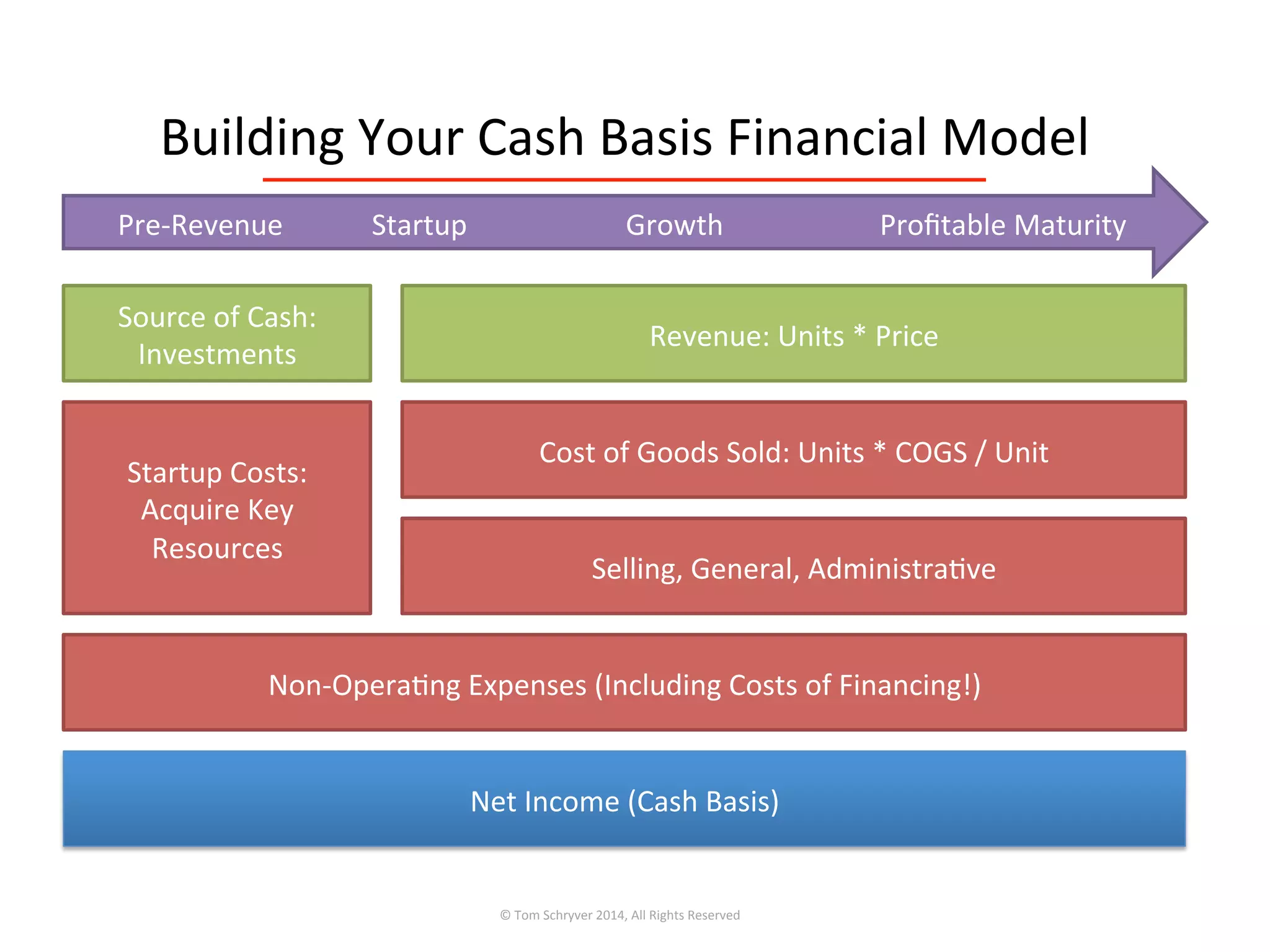

The document discusses financial planning and pitching for startups. It provides guidance on creating a financial plan to understand funding needs and describe the vision to partners and investors. It also explains that the purpose of pitching is to generate interest for follow up conversations, as investors rarely provide funding solely based on a pitch. The document then gives suggestions on what financial information to include in a pitch, such as market size, costs, funding requirements, and profitability projections. It also warns against unrealistic assumptions and provides too much detail.