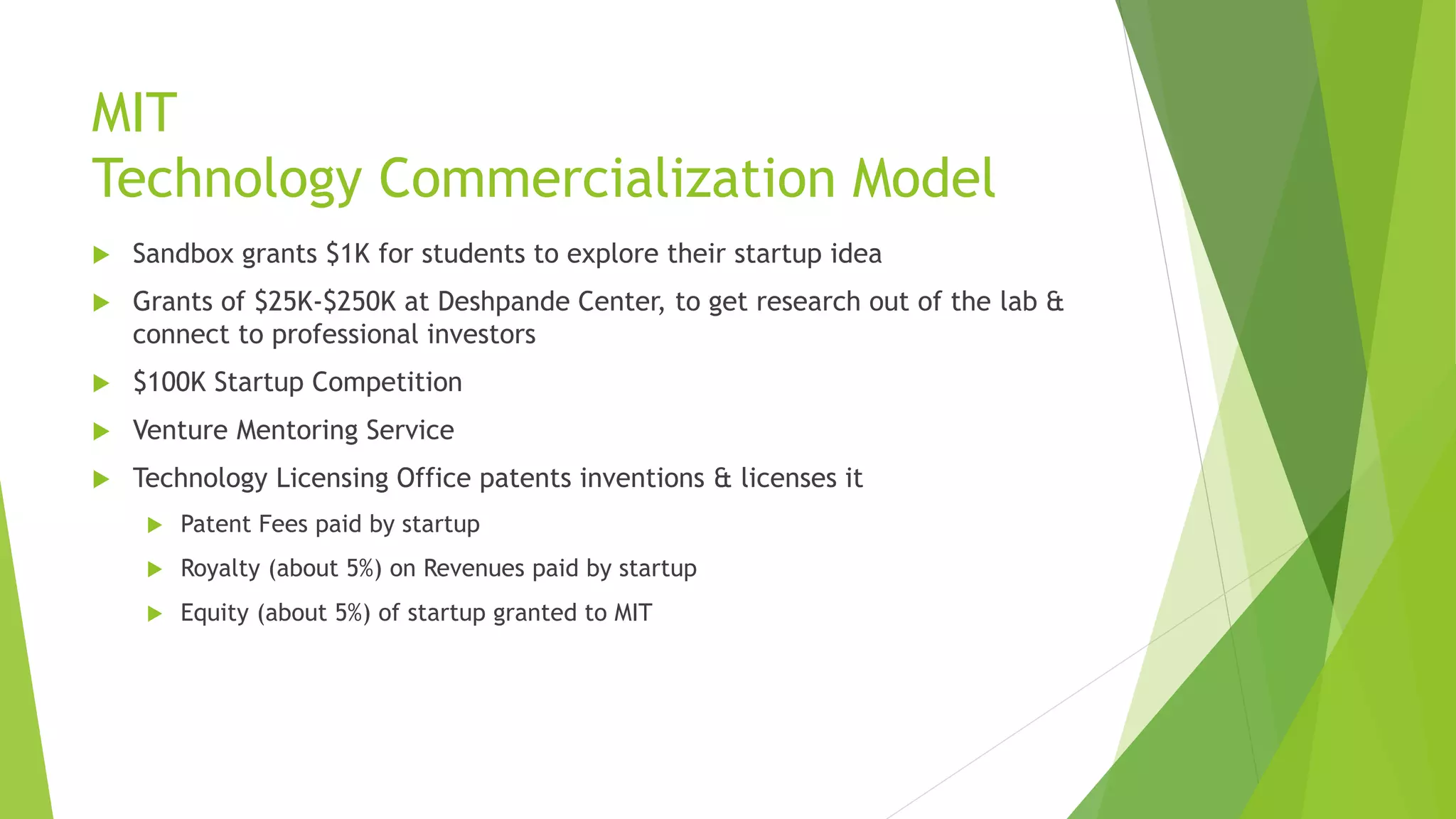

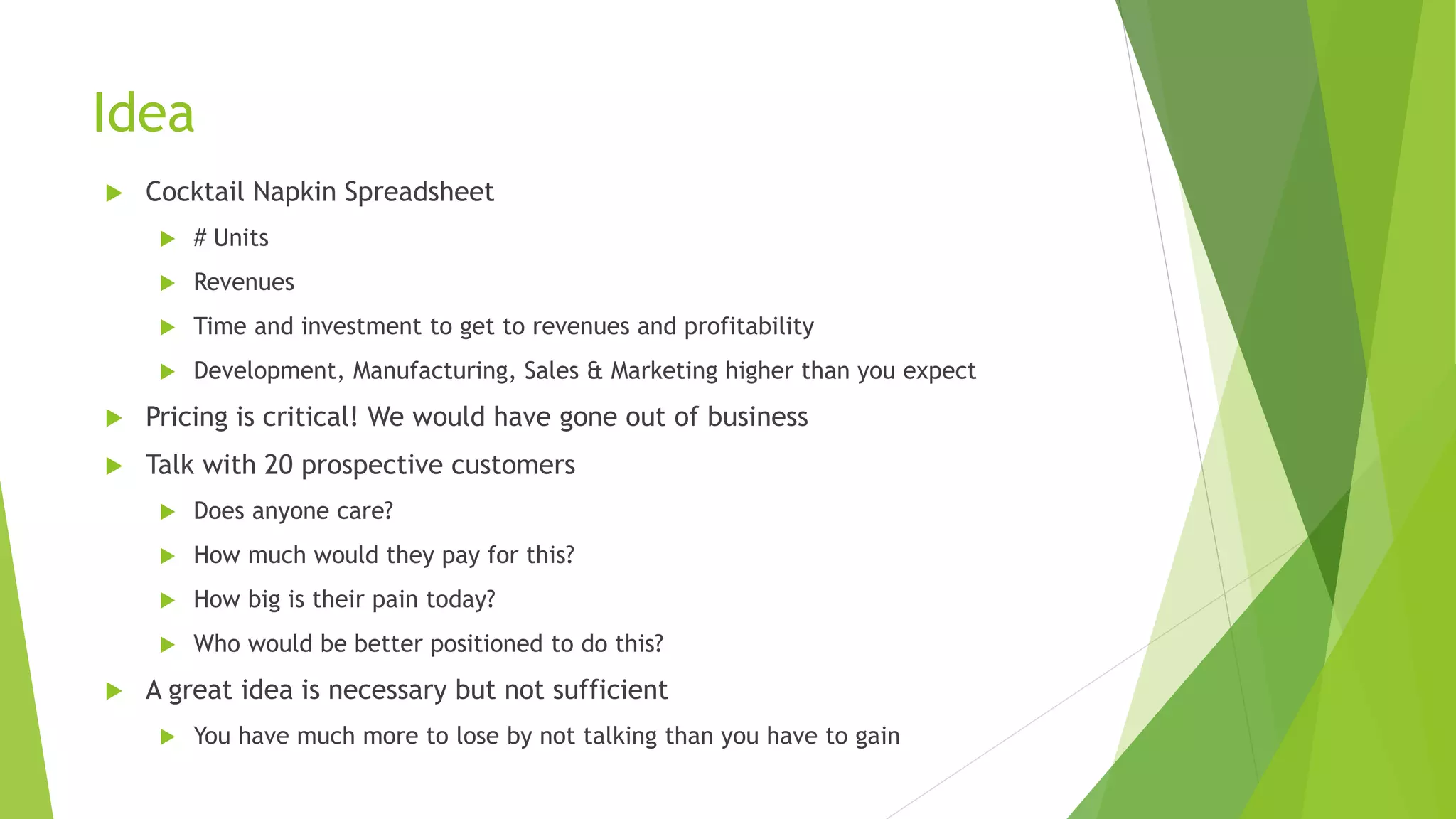

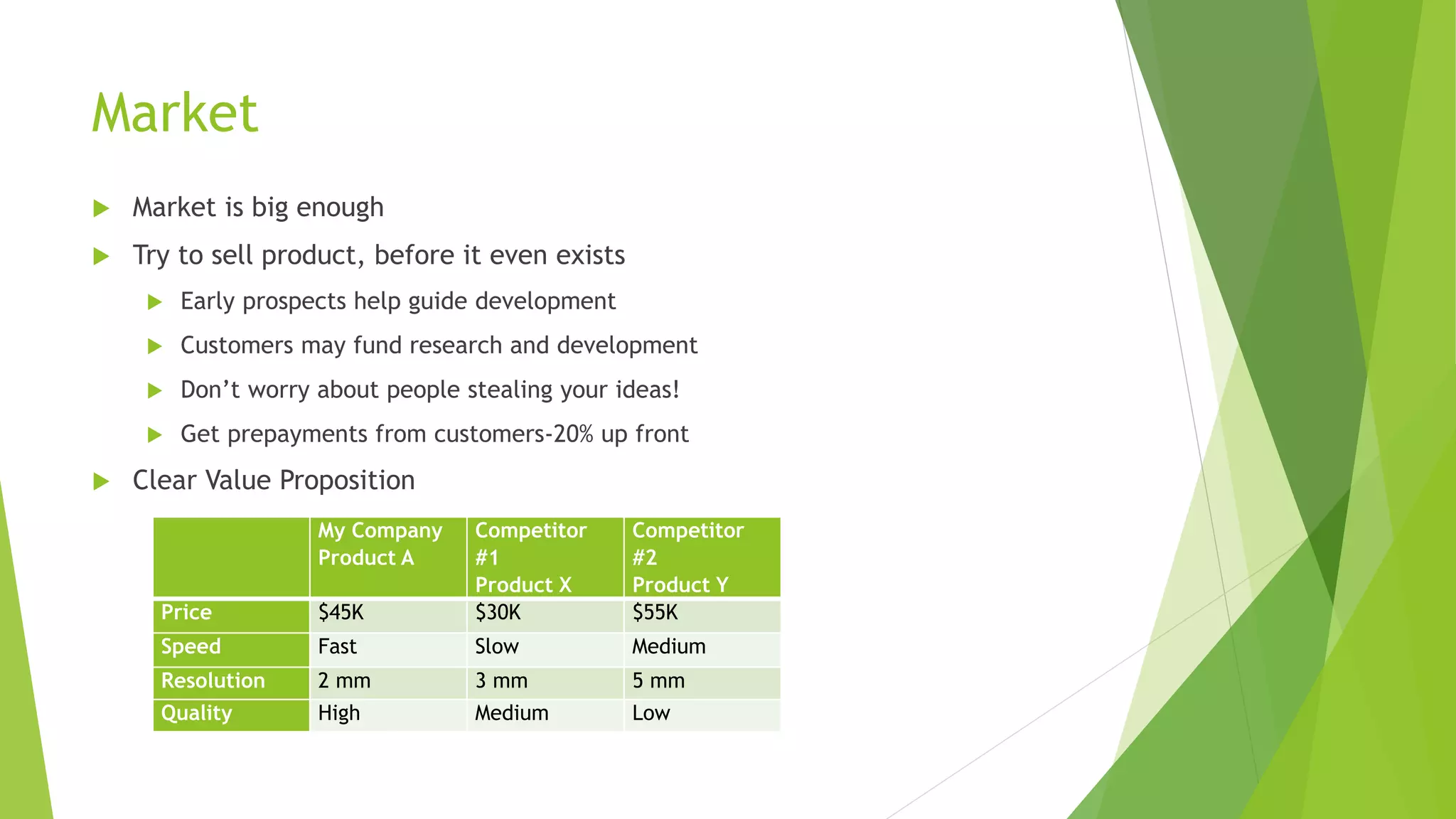

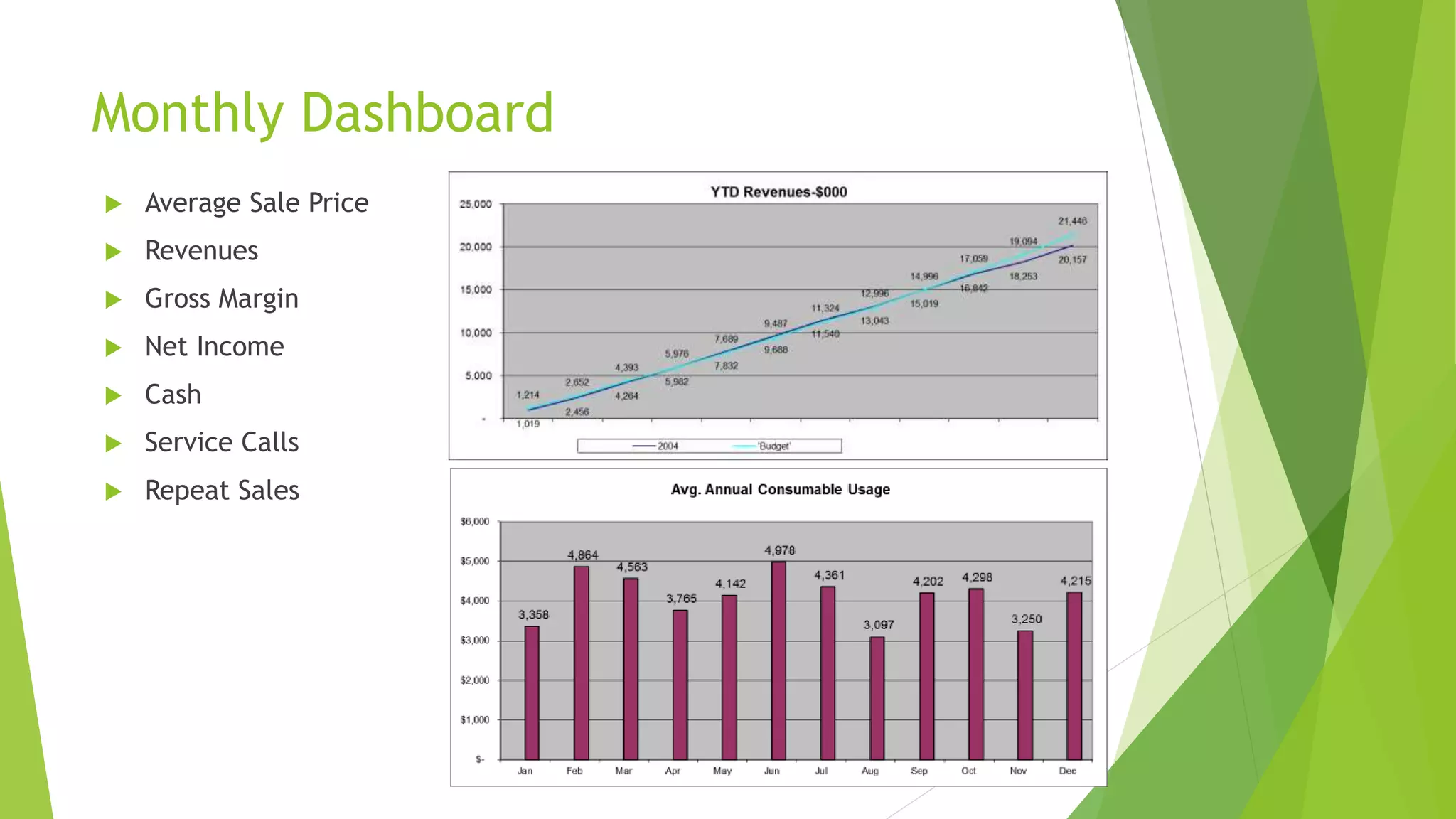

Marina Hatsopoulos emphasizes the key elements for startup success, including importance of entrepreneurship, market understanding, competition, and team dynamics. She shares her experiences, insights into financing options, and highlights the significance of intellectual property and mentorship for startups, particularly in the context of Greece. The document also provides guidance on creating a strong business foundation, networking, and achieving growth.