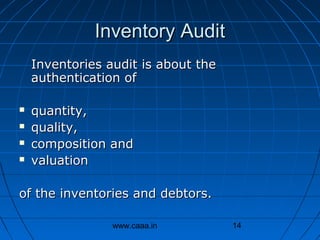

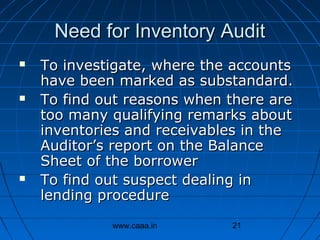

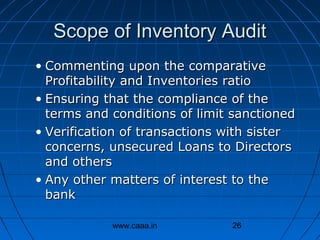

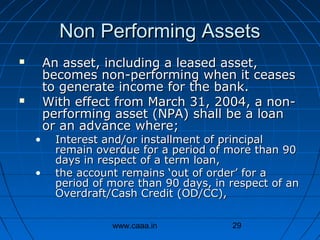

The document discusses the meaning, purpose and process of conducting a stock audit for banks. It defines stock/inventory according to accounting standards and explains the different types of inventory that should be included in an audit. Key points covered include methods for valuing different inventory types, reasons to perform stock audits, the scope of an audit, and relevant RBI notifications regarding non-performing assets. The document emphasizes verifying physical quantities, quality and valuation of inventory that has been pledged as loan security.

![Special Points on Stock Audit

•

•

If the stock statement as shown in the

hypothecation statement does not tally with

the stocks as in the balance sheet , then

appropriate action should be taken to find

reasons for the differences

It should be seen that the stocks have been

properly valued, after considering the

relevant accounting principles, Accounting

standards (AS) and Engagement Standards

[ earlier Known as Auditing and Assurance

standards (AAS)]

www.caaa.in

31](https://image.slidesharecdn.com/6asvstockaudit1112-140206060258-phpapp02/85/08-Stock-Audit-31-320.jpg)