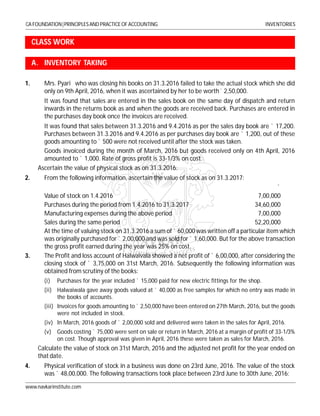

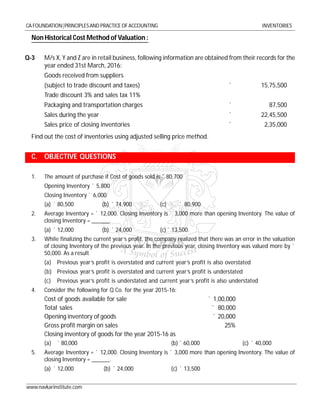

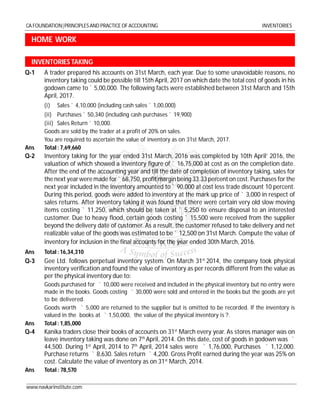

The document discusses inventory in accounting, defining it as assets held for sale or production, and differentiating between inventories in trading and manufacturing concerns. It emphasizes the significance of inventory valuation for determining income, financial position, and liquidity analysis, as well as compliance with statutory requirements. The document also details inventory record systems, methods of inventory valuation, and examples for calculating inventory values.