The document discusses various topics related to money and banking in the United States, including the following key points:

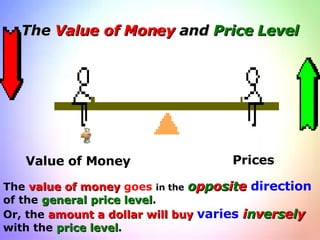

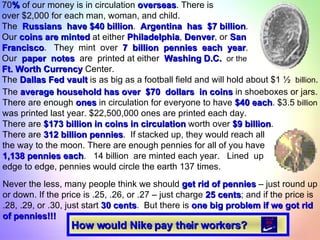

- There is over $2 trillion in U.S. currency in circulation globally, enough to provide over $2000 for each person.

- The Federal Reserve is responsible for printing paper currency and regulating the money supply and interest rates to influence economic conditions.

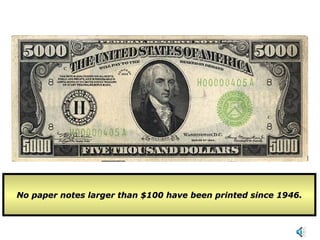

- U.S. coins are minted in Philadelphia, Denver, and San Francisco, with over 7 billion pennies minted each year. Paper currency is printed in Washington D.C. and Fort Worth.

- The Bureau of Engraving and Printing replaces damaged bills if over 51% of the bill is received, including recovering $850 after

![Money, Banking, the Fed, Money Creation, and Monetary Policy There is $665 billion in currency [notes & coins]. $37 million in notes is printed each day.](https://image.slidesharecdn.com/money-and-banking-1198090566674326-3/75/Money-And-Banking-1-2048.jpg)

![Dollar Decoded Fed bank that issued the bill [Chi.] Bills are crowded with numbers and letters that help the U.S. Treasury track printing errors & authenticate currency. Here’s what many of them mean: Number corresponds to letter in circle indicating issuing Fed bank. First letter corresponds to issuing Fed bank Last letter tells how many times serial number has run 25 Branches](https://image.slidesharecdn.com/money-and-banking-1198090566674326-3/85/Money-And-Banking-2-320.jpg)

![[Jackson’s portrait is larger, free from the oval] New $20 colors are peach , blue , and green . This is the 20’ s 20 th new look . New background colors add an extra layer of complexity for counterfeiters Ink appears either copper or green , depending upon the angle at which the bill is viewed. The first $20 bill was introduced in 1861 . Back then, $20 was about the monthly wage for manual laborers. The average $20 bill lasts 3 years . There are 5 billion twenties in circulation, enough to circle the earth 19 times. An ATM can hold up to 7,500 bills, or $150,000 in twenties. The $20 bill is the most counterfeited in the U. S. , while the $100 is most counterfeited abroad .](https://image.slidesharecdn.com/money-and-banking-1198090566674326-3/85/Money-And-Banking-3-320.jpg)

![Donald Stokes, in 2005, pleaded guilty to stealing $700,000 since 1998 from the Ft Worth Currency C enter . His job was making sure flawed currency was shipped off to destruction. He was stopped for a routine traffic stop, then took off on a high-speed chase. When stopped, he had $79,000 in flawed currency in his car, which he said he won in Reno]. Stokes faces 10 years in prison and a $250,000 in fine. Shredding of U.S. Money $500 million is shredded at the 12 Feds each day. That is over $100 billion each year . A typical dollar last about 18 months. Higher denominations last longer. Despite a camera on those whose job it is to shred money – can you get out of the shredding room with some of the notes? Yes!!! An employee in Washington took $1.7 million in $100 bills [ he sneaked 1,700 $100 bills past his security]. He was caught when his bank teller reported his frequent large deposits in his bank. A woman at the Atlanta Fed made off with $277,000 over a 3 year period. She was observed “concealing bills on her person”. At the Boston Fed, an employee made off with $23,000 when he stuffed money into his pockets after obstructing the view of his coworkers. He was caught when his employer viewed the video.](https://image.slidesharecdn.com/money-and-banking-1198090566674326-3/85/Money-And-Banking-4-320.jpg)

![$100 Dollar Bill – Red Polymer Thread $50 – Yellow $20 – Green $10 – Orange $5 – Blue [This $5 will be hard to counterfeit]](https://image.slidesharecdn.com/money-and-banking-1198090566674326-3/85/Money-And-Banking-5-320.jpg)

![Bogus Bills – fined up to $5,000 [5,000 arrested in 2002] - imprisoned up to 15 years . The so-called supernote – a counterfeit $100 bill of extremely high quality began showing up around 1990 . 40% of world’s bogus bills come from Columbia . They border Ecuador , which converted to the U.S. dollar in 2000. The $20 bill is the most popular domestic counterfeit bill , while the $100 bill is most popular among foreign counterfeiters . Of the fake bills found in the U.S. in 2002, half were produced with computers, copiers, and printers , up from just 1% in 1996 . Only about 3/100ths of 1% is counterfeited . $44 in 02](https://image.slidesharecdn.com/money-and-banking-1198090566674326-3/85/Money-And-Banking-11-320.jpg)

![It cost 3.5 cents to print a dollar which last 1.5 years. It cost 12 cents to mint a sacagawea [“bird woman ”] but they last 30 years. [500 million were minted but you seldom see them.] The government could save $400 million if people would use more sacagaweas.](https://image.slidesharecdn.com/money-and-banking-1198090566674326-3/85/Money-And-Banking-13-320.jpg)

![“ Show me the Wampum!!!” History of U.S. Money [A Panorama of Legal Tender] From Wampum to Credit Cards](https://image.slidesharecdn.com/money-and-banking-1198090566674326-3/85/Money-And-Banking-17-320.jpg)

![Continental Currency [1775-1781] [$1/6;$1/2;$1/3;$2/3;$1;$2;$3;$4;$5;$6;$8;$30;$40;$45 ;$60;&$80]](https://image.slidesharecdn.com/money-and-banking-1198090566674326-3/85/Money-And-Banking-18-320.jpg)

![Great Seal of The U.S. The Great Seal (on the $1) was adopted in 1783. The American Bald Eagle holds an olive branch -symbolizing peace-with 13 berries & 13 leaves . In the left talon, the eagle holds 13 arrows-symbolizing war . The 13 units represent the original 13 colonies . The eagle’s head is turned toward the olive branch showing a desire for peace . E Pluribus Unum – “Out of Many, One” The pyramid stands for permanence and strength . The pyramid is unfinished signifying future growth of the U.S. and the goal of perfection. A sunburst and an eye are above the pyramid standing for the Deity . The All-Seeing Eye is a Masonic symbol [Franklin & Washington were Masons]. The eye represents the eternal eye of God and the virtue of “putting the spiritual above the material.”](https://image.slidesharecdn.com/money-and-banking-1198090566674326-3/85/Money-And-Banking-22-320.jpg)

![Three FUNCTIONS OF MONEY 3. Store of Value [from one point in time to another ] [ doesn’t wear out easily and holds up to inflation ] Greek Coin 2,500 years old](https://image.slidesharecdn.com/money-and-banking-1198090566674326-3/85/Money-And-Banking-29-320.jpg)

![M1 M2 M3 $1,287 $6,076 $8,595 billions plus savings deposits, MMA’s, and small Time Deposits under $100,000 equal M2 plus large time deposits over $100,000equal M3 Currency + DD equal M1 [Spendable Money] “ V” – how many times a dollar turns over in a year A lso included here would be Travelers checks, Checklike deposits Money In The American Economy 2% 50% 48% M 1 Completely Liquid](https://image.slidesharecdn.com/money-and-banking-1198090566674326-3/85/Money-And-Banking-33-320.jpg)

![WHAT ABOUT CREDIT CARDS? What About Debit Cards ? Debit cards are money . They serve as a medium of exchange ; they serve as a store of value (not an extension of credit); and debit card statements serve as a unit of account . [ no store of value ]](https://image.slidesharecdn.com/money-and-banking-1198090566674326-3/85/Money-And-Banking-34-320.jpg)