Tata Steel: Sale of Long products Europe, a positive move - Prabhudas Lilladher

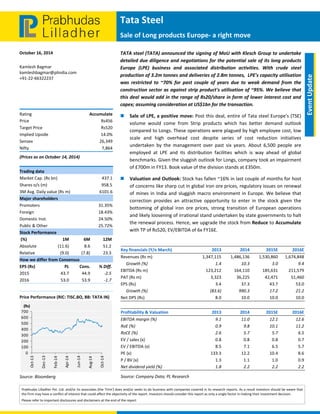

- 1. Tata Steel Sale of Long products Europe‐ a right move October 16, 2014 700 600 500 400 300 200 100 0 Oct‐13 Dec‐13 Feb‐14 Prabhudas Lilladher Pvt. Ltd. and/or its associates (the 'Firm') does and/or seeks to do business with companies covered in its research reports. As a result investors should be aware that the Firm may have a conflict of interest that could affect the objectivity of the report. Investors should consider this report as only a single factor in making their investment decision. Please refer to important disclosures and disclaimers at the end of the report Event Update Kamlesh Bagmar kamleshbagmar@plindia.com +91‐22‐66322237 Rating Accumulate Price Rs456 Target Price Rs520 Implied Upside 14.0% Sensex 26,349 Nifty 7,864 (Prices as on October 14, 2014) Trading data Market Cap. (Rs bn) 437.1 Shares o/s (m) 958.5 3M Avg. Daily value (Rs m) 6101.6 Major shareholders Promoters 31.35% Foreign 18.43% Domestic Inst. 24.50% Public & Other 25.72% Stock Performance (%) 1M 6M 12M Absolute (11.6) 8.6 51.2 Relative (9.0) (7.8) 23.3 How we differ from Consensus EPS (Rs) PL Cons. % Diff. 2015 43.7 44.9 ‐2.5 2016 53.0 53.9 ‐1.7 Price Performance (RIC: TISC.BO, BB: TATA IN) Source: Bloomberg Apr‐14 Jun‐14 Aug‐14 Oct‐14 (Rs) TATA steel (TATA) announced the signing of MoU with Klesch Group to undertake detailed due diligence and negotiations for the potential sale of its long products Europe (LPE) business and associated distribution activities. With crude steel production of 3.2m tonnes and deliveries of 2.8m tonnes, LPE's capacity utilisation was restricted to ~70% for past couple of years due to weak demand from the construction sector as against strip product's utilisation of ~95%. We believe that this deal would add in the range of Rs20/share in form of lower interest cost and capex; assuming consideration at US$1bn for the transaction. Sale of LPE, a positive move: Post this deal, entire of Tata steel Europe's (TSE) volume would come from Strip products which has better demand outlook compared to Longs. These operations were plagued by high employee cost, low scale and high overhead cost despite series of cost reduction initiatives undertaken by the management over past six years. About 6,500 people are employed at LPE and its distribution facilities which is way ahead of global benchmarks. Given the sluggish outlook for Longs, company took an impairment of £700m in FY13. Book value of the division stands at £350m. Valuation and Outlook: Stock has fallen ~16% in last couple of months for host of concerns like sharp cut in global iron ore prices, regulatory issues on renewal of mines in India and sluggish macro environment in Europe. We believe that correction provides an attractive opportunity to enter in the stock given the bottoming of global iron ore prices, strong transition of European operations and likely loosening of irrational stand undertaken by state governments to halt the renewal process. Hence, we upgrade the stock from Reduce to Accumulate with TP of Rs520, EV/EBITDA of 6x FY16E. Key financials (Y/e March) 2013 2014 2015E 2016E Revenues (Rs m) 1,347,115 1,486,136 1,530,860 1,674,848 Growth (%) 1.4 10.3 3.0 9.4 EBITDA (Rs m) 123,212 164,110 185,631 211,579 PAT (Rs m) 3,323 36,225 42,471 51,460 EPS (Rs) 3.4 37.3 43.7 53.0 Growth (%) (83.6) 990.3 17.2 21.2 Net DPS (Rs) 8.0 10.0 10.0 10.0 Profitability & Valuation 2013 2014 2015E 2016E EBITDA margin (%) 9.1 11.0 12.1 12.6 RoE (%) 0.9 9.8 10.1 11.2 RoCE (%) 2.6 5.7 5.7 6.5 EV / sales (x) 0.8 0.8 0.8 0.7 EV / EBITDA (x) 8.5 7.1 6.5 5.7 PE (x) 133.3 12.2 10.4 8.6 P / BV (x) 1.3 1.1 1.0 0.9 Net dividend yield (%) 1.8 2.2 2.2 2.2 Source: Company Data; PL Research

- 2. Tata Steel Exhibit 1: Value accretion due to transaction assuming consideration at US$1bn Consideration (US$ m) 1000 Volumes (mn tonnes) 3.0 EBITDA/t (US$) 50 EBITDA (US$ m) 150 EV based on 5.5x EBITDA 825 Value in excess of factored by market 175 Savings in interest 50 Maintenance capex 80 Total accretion to share holder's value (US$ m) 305 In Rs 18,300 Per share basis 18.8 Source: Company Data, PL Research Exhibit 2: Tata Steel’s Long Products Europe include Scunthorpe integrated steelworks Immingham Bulk Terminal (port terminal) Teesside Beam Mill, Lackenby Hayange Rail Mill, north east France Special Profiles, Skinningrove & Darlington Engineering workshop, Workington Dalzell Plate Mill, Scotland Rail consultancy, York Clydebridge, Scotland Source: Company Data, PL Research Exhibit 3: The associated distributed sites include: Teesside Newton Abbot Scunthorpe (two locations) Stoke Newcastle Lisburn, Northern Ireland Edinburgh, Scotland Dublin, Ireland Dundee Cork, Ireland Mosstodloch, Scotland Mülheim, Germany Hull Zwickau, Germany Wolverhampton Hamburg, Germany Dartford Stuttgart, Germany Brandon Source: Company Data, PL Research October 16, 2014 2

- 3. Tata Steel Income Statement (Rs m) Y/e March 2013 2014 2015E 2016E Net Revenue 1,347,115 1,486,136 1,530,860 1,674,848 Raw Material Expenses 605,363 627,365 659,163 717,002 Gross Profit 741,753 858,770 871,698 957,847 Employee Cost 189,183 203,034 215,237 234,123 Other Expenses 429,358 491,626 470,830 512,144 EBITDA 123,212 164,110 185,631 211,579 Depr. & Amortization 55,753 58,412 65,678 75,402 Net Interest 39,681 43,368 49,434 53,412 Other Income (69,107) 4,892 14,913 7,568 Profit before Tax (41,330) 67,221 85,432 90,333 Total Tax 32,294 30,582 37,424 41,971 Profit after Tax (73,624) 36,640 48,008 48,361 Ex‐Od items / Min. Int. (75,140) 431 8,457 (173) Adj. PAT 3,323 36,225 42,471 51,460 Avg. Shares O/S (m) 971.4 971.4 971.4 971.4 EPS (Rs.) 3.4 37.3 43.7 53.0 Cash Flow Abstract (Rs m) Y/e March 2013 2014 2015E 2016E C/F from Operations 140,353 131,458 167,529 167,220 C/F from Investing (132,969) (164,511) (144,941) (113,092) C/F from Financing (20,254) 10,091 (37,611) (87,361) Inc. / Dec. in Cash (12,870) (22,961) (15,023) (33,234) Opening Cash 108,410 98,922 87,045 72,022 Closing Cash 98,922 87,045 72,022 38,788 FCFF (153,024) (112,833) 63,779 (213,099) FCFE (66,918) 18,180 79,421 (233,099) Key Financial Metrics Y/e March 2013 2014 2015E 2016E Growth Revenue (%) 1.4 10.3 3.0 9.4 EBITDA (%) (0.8) 33.2 13.1 14.0 PAT (%) (83.6) 990.3 17.2 21.2 EPS (%) (83.6) 990.3 17.2 21.2 Profitability EBITDA Margin (%) 9.1 11.0 12.1 12.6 PAT Margin (%) 0.2 2.4 2.8 3.1 RoCE (%) 2.6 5.7 5.7 6.5 RoE (%) 0.9 9.8 10.1 11.2 Balance Sheet Net Debt : Equity 1.8 1.8 1.7 1.6 Net Wrkng Cap. (days) 9 1 (5) — Valuation PER (x) 133.3 12.2 10.4 8.6 P / B (x) 1.3 1.1 1.0 0.9 EV / EBITDA (x) 8.5 7.1 6.5 5.7 EV / Sales (x) 0.8 0.8 0.8 0.7 Earnings Quality Eff. Tax Rate (78.1) 45.5 43.8 46.5 Other Inc / PBT 14.7 7.7 7.8 8.4 Eff. Depr. Rate (%) 4.2 3.8 4.1 3.9 FCFE / PAT (2,014.0) 50.2 187.0 (453.0) Source: Company Data, PL Research. Balance Sheet Abstract (Rs m) Y/e March 2013 2014 2015E 2016E Shareholder's Funds 338,139 402,000 440,310 478,685 Total Debt 707,823 838,837 854,478 834,478 Other Liabilities 48,456 43,535 44,633 56,706 Total Liabilities 1,094,418 1,284,372 1,339,422 1,369,869 Net Fixed Assets 720,082 876,314 974,898 1,018,156 Goodwill 130,650 157,488 157,488 157,488 Investments 24,974 24,251 9,944 11,406 Net Current Assets 221,931 229,230 200,004 185,731 Cash & Equivalents 106,524 113,729 98,706 65,472 Other Current Assets 486,534 544,255 529,636 575,991 Current Liabilities 371,127 428,754 428,339 455,733 Other Assets (3,219) (2,912) (2,912) (2,912) Total Assets 1,094,418 1,284,372 1,339,422 1,369,869 Quarterly Financials (Rs m) Y/e March Q3FY14 Q4FY14 Q1FY15 Q2FY15E Net Revenue 367,358 424,281 364,272 373,582 EBITDA 40,065 50,111 42,726 40,299 % of revenue 10.9 11.8 11.7 10.8 Depr. & Amortization 15,221 14,719 15,503 16,000 Net Interest 11,084 11,694 12,524 12,000 Other Income 181 1,117 2,161 2,200 Profit before Tax 13,946 24,357 14,236 14,499 Total Tax 8,951 13,645 10,804 8,760 Profit after Tax 5,032 10,359 3,373 5,619 Adj. PAT 5,028 10,817 5,998 5,619 Key Operating Metrics Y/e March 2013 2014 2015E 2016E Rev. Indian Op. (US$ m) 7,022 6,898 7,244 8,610 Rev.Corus (US$ m) 14,503 14,066 13,580 14,400 Rev. South East (US$ m) 2,543 2,810 3,150 3,285 EBITDA‐India (US$ m) 2,045 2,120 2,219 2,590 EBITDA‐Corus (US$ m) 142 500 700 720 EBITDA‐South East (US$ m) 88.4 72.4 99.0 99.0 Volume (mt)‐India 7.5 8.5 8.7 10.4 Real./ Tonne‐ India (Rs) 37,784 35,157 36,645 37,167 EBITDA/Tonne‐ India (Rs) 14,869 15,050 15,237 14,920 SalesVol.‐Corus (mt) 13.1 13.9 14.0 14.4 Real./Tonne‐Corus (US$) 1,109.6 1,014.9 970.0 1,000.0 EBITDA/Tonne‐Corus (US$) 10.8 36.1 50.0 50.0 Sales Vol.‐South East (mt) 3.0 4.0 4.5 4.5 Real./Tonne‐SEAN (US$) 836.4 706.0 700.0 730.0 EBITDA/Tonne‐SEAN (US$) 29.1 18.2 22.0 22.0 Source: Company Data, PL Research. October 16, 2014 3

- 4. Tata Steel Prabhudas Lilladher Pvt. Ltd. 3rd Floor, Sadhana House, 570, P. B. Marg, Worli, Mumbai‐400 018, India Tel: (91 22) 6632 2222 Fax: (91 22) 6632 2209 Rating Distribution of Research Coverage 31.3% 51.8% 17.0% 0.0% 60% 50% 40% 30% 20% 10% 0% BUY Accumulate Reduce Sell % of Total Coverage PL’s Recommendation Nomenclature BUY : Over 15% Outperformance to Sensex over 12‐months Accumulate : Outperformance to Sensex over 12‐months Reduce : Underperformance to Sensex over 12‐months Sell : Over 15% underperformance to Sensex over 12‐months Trading Buy : Over 10% absolute upside in 1‐month Trading Sell : Over 10% absolute decline in 1‐month Not Rated (NR) : No specific call on the stock Under Review (UR) : Rating likely to change shortly This document has been prepared by the Research Division of Prabhudas Lilladher Pvt. Ltd. Mumbai, India (PL) and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of PL. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, PL has not independently verified the accuracy or completeness of the same. Neither PL nor any of its affiliates, its directors or its employees accept any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient's particular circumstances and, in case of doubt, advice should be sought from an independent expert/advisor. Either PL or its affiliates or its directors or its employees or its representatives or its clients or their relatives may have position(s), make market, act as principal or engage in transactions of securities of companies referred to in this report and they may have used the research material prior to publication. We may from time to time solicit or perform investment banking or other services for any company mentioned in this document. October 16, 2014 4