Japara (JHC) equity research initiation report - riding the silver tsunami - finding shareholder value in aged care

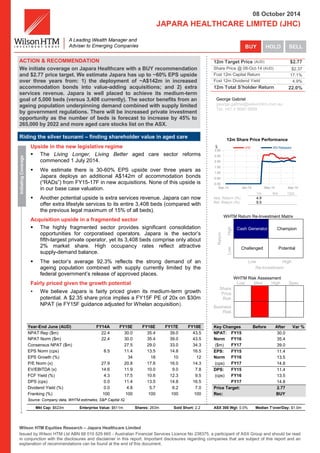

- 1. Wilson HTM Equities Research – Japara Healthcare Limited Issued by Wilson HTM Ltd ABN 68 010 529 665 - Australian Financial Services Licence No 238375, a participant of ASX Group and should be read in conjunction with the disclosures and disclaimer in this report. Important disclosures regarding companies that are subject of this report and an explanation of recommendations can be found at the end of this document. 08 October 2014 JAPARA HEALTHCARE LIMITED (JHC) ACTION & RECOMMENDATION We initiate coverage on Japara Healthcare with a BUY recommendation and $2.77 price target. We estimate Japara has up to ~60% EPS upside over three years from: 1) the deployment of ~A$142m in increased accommodation bonds into value-adding acquisitions; and 2) extra services revenue. Japara is well placed to achieve its medium-term goal of 5,000 beds (versus 3,408 currently). The sector benefits from an ageing population underpinning demand combined with supply limited by government regulations. There will be increased private investment opportunity as the number of beds is forecast to increase by 45% to 265,000 by 2022 and more aged care stocks list on the ASX. Riding the silver tsunami – finding shareholder value in aged care InitiatingCoverage Upside in the new legislative regime The Living Longer, Living Better aged care sector reforms commenced 1 July 2014. We estimate there is 30-60% EPS upside over three years as Japara deploys an additional A$142m of accommodation bonds (“RADs”) from FY15-17F in new acquisitions. None of this upside is in our base case valuation. Another potential upside is extra services revenue. Japara can now offer extra lifestyle services to its entire 3,408 beds (compared with the previous legal maximum of 15% of all beds). Acquisition upside in a fragmented sector The highly fragmented sector provides significant consolidation opportunities for corporatised operators. Japara is the sector’s fifth-largest private operator, yet its 3,408 beds comprise only about 2% market share. High occupancy rates reflect attractive supply-demand balance. The sector’s average 92.3% reflects the strong demand of an ageing population combined with supply currently limited by the federal government’s release of approved places. Fairly priced given the growth potential We believe Japara is fairly priced given its medium-term growth potential. A $2.35 share price implies a FY15F PE of 20x on $30m NPAT (ie FY15F guidance adjusted for Whelan acquisition). 12m Target Price (AUD) $2.77 Share Price @ 08-Oct-14 (AUD) $2.37 Fcst 12m Capital Return 17.1% Fcst 12m Dividend Yield 4.9% 12m Total S’holder Return 22.0% George Gabriel george.gabriel@wilsonhtm.com.au Tel. +61 3 9640 9999 12m Share Price Performance 1m 6m 12m Abs. Return (%) 4.9 Rel. Return (%) 9.5 WHTM Return Re-Investment Matrix Return High Cash Generator ChampionLow Challenged Potential Low High Re-Investment WHTM Risk Assessment Low Med High Spec Share Price Risk Business Risk Year-End June (AUD) FY14A FY15E FY16E FY17E FY18E NPAT Rep ($m) 22.4 30.0 35.4 39.0 43.5 NPAT Norm ($m) 22.4 30.0 35.4 39.0 43.5 Consensus NPAT ($m) 27.5 29.0 33.0 34.3 EPS Norm (cps) 8.5 11.4 13.5 14.8 16.5 EPS Growth (%) 34 18 10 12 P/E Norm (x) 27.9 20.8 17.6 16.0 14.3 EV/EBITDA (x) 14.6 11.9 10.0 9.0 7.8 FCF Yield (%) 4.3 17.5 10.6 12.3 9.5 DPS (cps) 0.0 11.4 13.5 14.8 16.5 Dividend Yield (%) 0.0 4.8 5.7 6.2 7.0 Franking (%) 100 100 100 100 100 Source: Company data, WHTM estimates, S&P Capital IQ Key Changes Before After Var % NPAT: FY15 30.0 Norm FY16 35.4 ($m) FY17 39.0 EPS: FY15 11.4 Norm FY16 13.5 (cps) FY17 14.8 DPS: FY15 11.4 (cps) FY16 13.5 FY17 14.8 Price Target: 2.77 Rec: BUY Mkt Cap: $623m Enterprise Value: $611m Shares: 263m Sold Short: 2.2 ASX 300 Wgt: 0.0% Median T’over/Day: $1.0m 0.00 0.50 1.00 1.50 2.00 2.50 3.00 Sep-13 Jan-14 May-14 Sep-14 $ JHC XSI Rebased

- 2. 08 October 2014 Health Care Equipment & Services Japara Healthcare Limited Wilson HTM Equities Research – Japara Healthcare Limited 2 PRICE TARGET Valuation Discounted Cash Flow 2.94 EV/EBITDA multiple 2.71 PE multiple 2.51 Weighted average 2.77 Price target 2.77 INTERIMS ($m) Half-yr (AUD) Dec 13 Jun 14 Dec 14 Jun 15 1HA 2HA 1HE 2HE Sales Revenue 132.7 108.6 146.2 119.6 EBITDA 23.1 18.9 28.3 23.1 EBIT 18.1 14.8 23.9 19.6 Net Profit 12.3 10.1 16.5 13.5 Norm. EPS 4.7 3.8 6.3 5.1 EBIT/Sales (%) 13.6 13.6 16.4 16.4 Dividend (c) 0.0 0.0 6.3 5.1 Franking (%) 0.0 0.0 0.0 0.0 FINANCIAL STABILITY Year-end June (AUD) FY14A FY15E FY16E Net Debt -12.3 -52.1 -82.9 Net Debt / Equity (%) <0 <0 <0 Net Debt / EV (%) <0 <0 <0 Current Ratio (x) 2.8 2.5 2.4 Interest Cover (x) 34.2 69.3 20.0 Adj. Cash Int. Cover (x) 38.8 >99 31.6 Debt / CashFlow (x) 0.0 0.1 0.2 Net Debt (cash) / share ($) <0 <0 <0 NTA / share ($) 2.0 2.0 2.0 Book Value / share ($) 2.0 2.0 2.0 Payout Ratio (%) 0 100 100 Adj. Payout Ratio (%) 0 28 53 EPS RECONCILIATION ($m) FY14A FY15E Rep. Norm . Rep. Norm .Sales Revenue 241 241 266 266 EBIT 32.9 32.9 43.5 43.5 Net Profit 22.4 22.4 30.0 30.0 Notional Earn. 0.0 0.0 0.0 0.0 Pref./Conv. Div. 0.0 0.0 0.0 0.0 Profit for EPS 22.4 22.4 30.0 30.0 Diluted Shrs(m) 263 263 263 263 Diluted EPS (c) 8.5 8.5 11.4 11.4 KEY ASSUMPTIONS Year-end June (AUD) FY14A FY15E FY16E FY17E FY18E Revenue Growth (%) 10.2 10.8 8.7 10.6 EBIT Growth (%) 32.2 22.3 12.6 17.0 NPAT Growth (%) 34.2 17.9 10.1 11.6 EPS Growth (%) 34.2 17.9 10.1 11.6 EBIT / Sales (%) 16.1 17.8 18.4 19.5 Tax Rate (%) 30.0 30.0 30.0 30.0 ROA (%) 5.0 5.9 6.4 7.3 ROE (%) 5.8 6.9 7.6 8.5 PROFIT & LOSS ($m) Year-end June (AUD) FY14A FY15E FY16E FY17E FY18E Sales Revenue 241.3 265.9 294.7 320.3 354.4 EBITDA 41.9 51.4 61.3 68.2 78.6 Depn & Amort 9.0 7.9 8.1 8.2 8.4 EBIT 32.9 43.5 53.2 59.9 70.1 Net Interest Expense 1.0 0.6 2.7 4.2 8.0 Tax 9.6 12.9 15.2 16.7 18.7 Minorities / pref divs 0.0 0.0 0.0 0.0 0.0 Equity accounted NPAT 0.0 0.0 0.0 0.0 0.0 Net Profit pre Sig. Items 22.4 30.0 35.4 39.0 43.5 Abn’s / Ext’s / Signif. 0.0 0.0 0.0 0.0 0.0 Reported Net Profit 22.4 30.0 35.4 39.0 43.5 CASH FLOW ($m) Year-end June (AUD) FY14A FY15E FY16E FY17E FY18E EBITDA 41.9 51.4 61.3 68.2 78.6 Interest & Tax -9.1 -12.0 -16.8 -20.9 -26.6 Working Cap / Other 8.3 76.6 29.2 37.7 16.4 Operating Cash Flow 41.2 116.1 73.7 84.9 68.3 Maintenance Capex -14.4 -6.8 -7.5 -8.1 -9.0 Free Cash Flow 26.8 109.3 66.3 76.8 59.3 Dividends Paid 0.0 -30.0 -35.4 -39.0 -43.5 Growth Capex 0.0 0.0 0.0 0.0 0.0 Invest. / Disposals 0.0 -39.5 0.0 0.0 0.0 Other Inv. Flows 0.0 0.0 0.0 0.0 0.0 Cash Flow Pre Financing 26.8 39.8 30.9 37.8 15.8 Funded by Equity 0.0 0.0 0.0 0.0 0.0 Funded by Debt 0.0 0.0 0.0 0.0 0.0 Funded by Cash -26.8 -39.8 -30.9 -37.8 -15.8 BALANCE SHEET SUMMARY ($m) Year-end June (AUD) FY14A FY15E FY16E FY17E FY18E Cash 28.1 67.9 98.7 136.6 152.4 Current Receivables 7.1 0.0 0.0 0.0 0.0 Current Inventories 0.0 0.0 0.0 0.0 0.0 Net PPE 340.8 379.1 378.5 378.4 379.0 Investments 23.3 23.3 23.3 23.3 23.3 Intangibles / Capitalised 393.2 393.2 393.2 393.2 393.2 Other 7.5 7.5 7.5 7.5 7.5 Total Assets 800.0 871.0 901.3 939.0 955.4 Current Payables 15.4 7.6 8.5 9.2 10.2 Total Debt 15.8 15.8 15.8 15.8 15.8 Other Liabilities 254.8 333.6 363.0 400.0 415.4 Total Liabilities 286.0 357.0 387.3 425.0 441.4 Minorities / Convertibles 0.0 0.0 0.0 0.0 0.0 Shareholder Equity 514.0 514.0 514.0 514.0 514.0 Total Funds Employed 529.8 529.8 529.8 529.8 529.8 RETURNS FY14A FY15E FY16E FY17E ROE (%) 8.5 5.8 6.9 7.6 ROIC (%) 9.0 6.3 8.3 10.2

- 3. 08 October 2014 Health Care Equipment & Services Japara Healthcare Limited Wilson HTM Equities Research – Japara Healthcare Limited 3 Table of contents Key investment considerations .................................................................................. 4 High growth, fragmented sector................................................................................. 6 Aged care is growing quickly.................................................................................. 6 High occupancy rates reflect supply-demand imbalance ...................................... 6 Fragmented sector ................................................................................................. 7 Revenue model .......................................................................................................... 8 ACFI revenues ...................................................................................................... 8 Resident contributions............................................................................................ 8 New revenue lines.................................................................................................. 9 Value-adding, top quartile operator.......................................................................... 10 Accommodation payments....................................................................................... 12 Overview .............................................................................................................. 12 Accounting............................................................................................................ 13 Valuation .................................................................................................................. 14 Blended valuation................................................................................................. 14 EV/EBITDA valuation ........................................................................................... 14 Comparable companies valuation........................................................................ 15 RAD valuation impact........................................................................................... 16 Earnings outlook ...................................................................................................... 17 Guidance.............................................................................................................. 17 ACFI revenue ....................................................................................................... 18 Occupancy ........................................................................................................... 18 Brownfields........................................................................................................... 19 Acquisitions .......................................................................................................... 19 Regulatory change ............................................................................................... 19 Margins................................................................................................................. 20 Japara business overview........................................................................................ 21 Business overview ............................................................................................... 21 Board and management........................................................................................... 22 Risks......................................................................................................................... 24 Downside risks ......................................................................................................24 Upside risks...........................................................................................................25

- 4. 08 October 2014 Health Care Equipment & Services Japara Healthcare Limited Wilson HTM Equities Research – Japara Healthcare Limited 4 Key investment considerations Upside from the new legislative regime. The new Living Longer, Living Better regulatory regime, applicable from 1 July 2014, creates multiple upsides for Japara Healthcare. Most of this upside is not currently in our base case valuation: Accommodation bond (“RAD”) upside – we estimate there is 30-60% EPS upside over three years as Japara invests an additional A$142m of refundable accommodation bonds (“RADs”) from FY15-17F in new acquisitions. None of this upside is in our base case valuation. The catalysts required to include this upside in our base case valuation are: good momentum in RAD inflows from 1 July 2014; and continuing acquisition value-add. Extra services fee upside – the extent of upside in extra services revenue will not be known for up to 12 months. Our base case currently assumes additional extra services revenue of ~$3.2m in FY15F, at a 10% bed penetration ratio and 40% gross margin. Previously, extra services could only be offered to a maximum of 15% of beds. Japara can now offer extra services to all beds. Japara is rolling out its “My Choices” extra services offering from October 2014 to the remaining ~2,800 beds. Daily accommodation payment (DAP) upside – there is upside to our base case numbers if the DAP/RAD mix exceeds the forecast 38/62% mix (Japara’s prospectus forecasts). From 1 July 2014, residents have the choice of paying a DAP instead of a RAD. Our base case assumes Japara will generate an additional DAP revenue of ~$3.4m in FY15F. DAPs are expected to average ~$51 per resident, per day in FY15F. JHC has significant upside potential from the new legislative regime, applicable from 1 July We estimate up to 50% EPS upside over 3 years from deployment of increased refundable accommodation deposits (RADs) into acquisitions It is too early to tell how much upside there will be from provision of “My Choices” extra services Acquisition upside – Japara’s strategy is to increase its number of beds to 5,000 in the medium term through a combination of acquisitions and brownfield expansion. Japara has a track record of adding value by acquiring smaller operators and applying Japara’s established systems and processes (in facilities, human resources, cost management and corporate governance). The sector is ripe for consolidation given: - it is highly fragmented; - large variability in profit between operators (not-for-profit operators generate an average EBITDA per resident of A$8,176 versus a for-profit industry average of $13,121 and Japara’s $21,408 (FY13)); - scalability of systems; and - emergence of corporatised business models to replace “cottage industry” operators. JHC’s strategy is to grow to 5,000 beds over the medium term through acquisitions and brownfield development Brownfield development upside – brownfield developments (ie an extension of existing facilities) are expected to add another 500 beds over the next four years. Our base case valuation currently includes brownfields projects as per prospectus forecasts. Brownfields are a key growth strategy Valuing RADs – in our enterprise value (EV) calculation, we do not include RADs as debt because we assume that RADs remain a perpetual component of the capital structure. In our discounted cash flow (DCF) valuation, we include the change in RAD as a change in working capital which flows through to free cash flow to equity (similar to a “working capital release”) because an increase in RAD balances would in fact replace working expenditure. RADs are not included as debt in EV calculations. In the DCF valuation, change in RAD is included as a change in working capital which impacts FCFE

- 5. 08 October 2014 Health Care Equipment & Services Japara Healthcare Limited Wilson HTM Equities Research – Japara Healthcare Limited 5 Highly fragmented sector – the sector is highly fragmented, with 65% of operators being single-facility operators and the top 10 operators accounting for ~17% of the sector’s 180,000 total beds. Japara is sector’s fifth largest, with 3,408 beds comprising ~2% market share. About 58% of places are managed by not-for-profit operators. JHC is the sector’s 5th-largest operator, and yet only has 2% market share FY15F guidance has been reaffirmed – Japara has reaffirmed guidance of A$48.9m EBITDA and A$27.7m NPAT. Adjusting for the Whelan acquisition on August 2014 implies a FY15F PE of 20x on $30m NPAT (share price of $2.35, FY15F EBITDA guidance of $50.3m and NPAT of $30.0m). 20x FY15F PE multiple is implied by adjusted FY15F NPAT guidance 100% dividend payout ratio – Japara’s 100% of NPAT dividend payout ratio is supported by accommodation bond funding. Japara’s FY15F dividend forecast implies a 4.8% dividend yield. 100% dividend payout ratio is supported by accommodation bond funding Good return on tangible equity (ROTE) – nominal FY14 return on equity appears low, at ~4%. However, nominal ROE is depressed due to high acquisition goodwill ($384.5m on $800m total assets in FY14) resulting from Japara’s acquisitions over eight years. Removing acquisition goodwill results in FY14 ROTE of ~17%. Nominal ROE is depressed by acquisition goodwill. FY14 ROTE is ~17%

- 6. 08 October 2014 Health Care Equipment & Services Japara Healthcare Limited Wilson HTM Equities Research – Japara Healthcare Limited 6 High growth, fragmented sector Japara is a value-adding consolidator in a high growth, fragmented sector. AGED CARE IS GROWING QUICKLY The residential aged care sector comprises ~186,000 beds/places, more than double the size of the hospital sector’s (public and private combined) 87,000 places. The government expects the number of beds to increase to ~265,000 by 2022, at a compound annual growth rate (CAGR) of 4.2% per annum (source: The Future of Aged Care Nursing in Australia, October 2013). The Productivity Commission expects that: the number of Australians aged over 85 years will double within 20 years; and by 2050 more than 3.5m Australians will use aged care services each year. Total sector revenue CAGR from 2009-14 is about 9%. The number of aged care beds is expected to increase by ~45% to 265,000 by 2022 CHART 1: TOTAL SECTOR REVENUE GROWTH 2009-14 Source: Report on Government Services 2013 – Steering Committee Report, 2012-13 Report on the Operation of the Aged Care Act 1997 Total sector revenue CAGR is ~9% from 2009-14 HIGH OCCUPANCY RATES REFLECT SUPPLY-DEMAND IMBALANCE High demand outlook: - Demand is underpinned by an ageing population. - The government forecasts demand growth of 4.2% per annum through to 2022. Supply side constraints exist: - Aged care places increased by ~1.9% per annum from 2006-13. It is uncertain how many places will be confirmed going forwards. We expect continuing supply-side constraints given: the government funds ~70% operating revenues; continuing cost inflation to the government on a per bed basis; federal government budget constraints; and barriers to entry, including government limits on new bed numbers and continuing regulatory compliance. High occupancy rates reflect the supply-demand imbalance: - Occupancy rates have averaged 92.3% over the past five years. Demand is underpinned by an ageing population We expect continuing supply side constraints 6.5 7.1 8 8.7 9.2 0 1 2 3 4 5 6 7 8 9 10 FY09 FY10 FY11 FY12 FY13 GovernmentFunding($bn)

- 7. 08 October 2014 Health Care Equipment & Services Japara Healthcare Limited Wilson HTM Equities Research – Japara Healthcare Limited 7 CHART 2: AGED CARE OCCUPANCY RATES Source: Australian Institute of Health and Welfare, “Australia’s Health”, 2012 High occupancy rates reflect the supply-demand imbalance FRAGMENTED SECTOR The aged care sector is highly fragmented. Japara’s 3,408 beds comprise ~2% market share, making it the fifth-largest player (after Bupa, Opal, Regis and Estia). The key sector statistics (as at 30 June 2013) are: 2,716 homes; around 186,000 beds; 65% are single-facility operators; 38% are private for-profit operators; the majority are not-for-profit; more than 90% operators have less than 10 facilities (source: Inaugural Report, ACFA 2013). CHART 3: BEDS PER OPERATOR Source: WHTM Research, company accounts JHC’s 3,408 beds is ~2% market share JHC is the sector’s 5th-largest operator by number of beds 92.9% 92.4% 93.1% 92.8% 92.7% 92.0% 92.2% 92.4% 92.6% 92.8% 93.0% 93.2% FY09 FY10 FY11 FY12 FY13 OccupancyRate - 1,000 2,000 3,000 4,000 5,000 6,000 Bupa Opal Aged Care Regis Estia Japara Allity Aegis Arcare Tricare Hall & Prior Blue Cross Beds

- 8. 08 October 2014 Health Care Equipment & Services Japara Healthcare Limited Wilson HTM Equities Research – Japara Healthcare Limited 8 Revenue model Aged care operators source their revenue from two sources: federal government revenue, called “ACFI” (~70% Japara’s revenue); and resident payments (~30% revenue). AGED CARE FUNDING INSTRUMENT (ACFI) REVENUES There are four types of payments made by the federal government to aged care operators: Basic residential care subsidy (“ACFI”) – ACFI revenues are driven by a resident’s dependency (ie level of care needs) and income. Payments are provided in accordance with the payment schedules of the Aged Care Funding Instrument (ACFI). The process of claiming revenue from the government is rather technical and often requires dedicated ACFI teams to maximise revenue. Japara achieved average ACFI funding of $146 per day per place, which is 17% above the industry average of $125 per day in FY14. Primary supplements – primary supplements are payable to operators that can demonstrate they supply specific higher-care services to eligible residents, as approved by a Government Aged Care Assessment Team (ACAT). The types of services include: - enteral feeding; and - administration of oxygen to an eligible resident. Other supplements – Other supplements are provided to operators that supply more than 40% of their residential services to supported, concessional or assisted residents, as defined in the Residential Care Subsidy Principles 1997. Conditional adjustment payments (CAPs) – CAPs are available to operators that satisfy improved management practice criteria. The subsidy is designed to improve the overall performance and accessibility of the sector. JHC’s operating revenue comprises ~70% government and ~30% resident payments There are 4 types of payments made by the government to aged care operators JHC received average ACFI funding of $146 per place per day RESIDENT CONTRIBUTIONS Residents contribute around 30% of operating funding through two categories, regulated by the government: Basic daily care fee – this contributes to living expenses (eg meals, laundry, heating/cooling, nursing and personal care). The maximum basic daily fee is currently 85% of the annual single basic age pension for all permanent residents, which is currently ~$17k per annum. Income-tested fee – if a resident’s income is above a specified limit, the additional fee paid by the resident replaces the government’s proportion of funding (ie there is no impact to the aged care operator). The maximum basic daily fee is 85% of the annual single basic age pension, currently ~$17k pa

- 9. 08 October 2014 Health Care Equipment & Services Japara Healthcare Limited Wilson HTM Equities Research – Japara Healthcare Limited 9 NEW REVENUE LINES Other revenue lines include: Daily accommodation payments (DAP) – from 1 July 2014, new rules apply which give residents the option of paying a DAP instead of an accommodation bond (known as a “refundable accommodation deposit” or RAD). If a resident chooses to pay a DAP (instead of a RAD), then the DAP is received as revenue by the aged care operator. Japara forecasts that the DAP/RAD mix for new residents will be 37.9% and 62.2%, the average DAP for FY15 is $51 per resident per day, and the average RAD per resident in FY15 is $283,000. Extra services fees – it is too early to estimate how much upside Japara can capture in increased extra services revenue. Extra services fees are for upgraded standards of accommodation, food and other services (eg entertainment). From 1 July 2014, aged care operators can offer Extra Services to all beds (previously it was limited to a maximum of 15% of beds). Japara is rolling out its My Choices extra services offering from October 2014, charging $45 per day for extra services. The full level of customer take-up will be known in about 2.4 years (ie the average length of stay for a resident). It is too early to estimate how much upside JHC can capture in increased Extra Services revenue JHC is rolling out its My Choices extra services offering from October 2014

- 10. 08 October 2014 Health Care Equipment & Services Japara Healthcare Limited Wilson HTM Equities Research – Japara Healthcare Limited 10 Value-adding, top quartile operator Japara has a track record of applying its established systems and processes to add value to acquisitions. Value-adding methods include: improving occupancy; improved ACFI billing – ACFI calculations are quite complex and given residents’ care needs change over time, and Japara has a full-time ACFI-billing team focused on revenue maximisation; reducing catering, cleaning and laundry costs through in-house service provision; reduced temporary labour hire – efficient rostering reduces the need to hire expensive agency staff; procurement savings through scale; and focus on best-practice technologies and methods – Japara seeks continuous operational improvement through the use of new technologies and systems. Japara’s $21,540 EBITDA per resident is in the sector’s top quartile (Chart 4). This is driven by its systems and processes as well as operating scale. JHC has a track record of adding value to acquisitions through its established systems & processes and operating scale CHART 4: EBITDA PER RESIDENT PER ANNUM 2011-12 Source: “Inaugural Report on the funding and financing of the Aged Care Sector”, Aged Care Financing Authority, 2013 JHC is a top quartile operator ($15,000) ($10,000) ($5,000) $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 Not-for profit For-profit Government Total 1st Quartile 2nd Quartile 3rd Quartile 4th Quartile

- 11. 08 October 2014 Health Care Equipment & Services Japara Healthcare Limited Wilson HTM Equities Research – Japara Healthcare Limited 11 CHART 5: EBITDA PER RESIDENT PER ANNUM 2006-12 “Report on the residential aged care sector”, KPMG, 2013

- 12. 08 October 2014 Health Care Equipment & Services Japara Healthcare Limited Wilson HTM Equities Research – Japara Healthcare Limited 12 Accommodation payments OVERVIEW Accommodation bonds (also known as refundable accommodation deposits or “RADs”) are a unique feature of the aged care sector. RADs are interest-free funding which aged care operators can use for working capital and development, but not for capital management. The key impact is that RADs can fund both brownfield expansion and acquisitions, as well as a 100% dividend payout ratio. Table 1 describes the key features of RADs. We analyse the valuation implications of RADs in the “Valuation” section below. Accommodation bonds are also known as refundable accommodation deposits (“RADs”). RADs are effectively interest-free finance which can be used to finance working capital and development TABLE 1: OVERVIEW OF RADS Source: WHTM Research Living Longer, Living Better – the new legislative framework From 1 July 2014, the Living Longer, Living Better aged care reforms apply. Table 2 summarises the key changes, which include: 100% of beds are now “bondable”. Previously, bonds were not permitted on high care beds, so ~45% of Japara’s beds were potentially “bondable”. The final level of Japara’s RAD base will be known in ~2.4 years, as it accepts new residents over that time. As at 30 June 2014, Japara has $220.9m of RADs, which we estimate will increase by $142m through to FY17. 100% of beds can now choose to purchase extra services (previously capped at 15%). 100% of JHC’s beds are now “bondable”. Previously, high care beds (~54% JHC’s total) could not be “bonded” beds. Extra services can now be offered to 100% of beds Feature Description Paid by: Aged care residents upon admission to an aged care facility. Amount Set by the operator. Averaged ~$274k across the sector in 2013. Ministerial Approval is required if >$550k. Duration: Held for the duration of residents’ stay. Repayment date: Refunded immediately if the resident moves to another facility or w ithin 14 days of the grant of probate. Repayment amount: Face value (ie. zero price inflation or deflation; zero interest paid). Applicable to: From 1 July 2014, operators are able to charge bonds to all classifications of residents. Previously, less than half of JHC’s beds w ere “bondable”. Use of funds: Can be used by the operator to fund developments, acquisitions or repay debt but not to pay dividends. Capital gains: Bond capital gains accrue to the operator. Bonds are generally correlated w ith residential property prices. Bond capital gains have been ~9.9% CAGR over the last 7 years, broadly in line w ith residential property market grow th. Guarantee: Bond repayments are guaranteed by the Government.

- 13. 08 October 2014 Health Care Equipment & Services Japara Healthcare Limited Wilson HTM Equities Research – Japara Healthcare Limited 13 TABLE 2: OVERVIEW OF LEGISLATIVE CHANGES Source: WHTM Research ACCOUNTING Refundable accommodation deposits (RADs) have both a balance sheet and cash flow impact: On the balance sheet, RADs are current “other financial liabilities”. Even though 100% of RADs are classified as current, typically only around 40% of RADs are repayable each year as residents depart the aged care facilities. On the cash flow statement, RADs are financing cash flows. In FY14, Japara reported a $25.6m cash inflow in “proceeds from accommodation bonds” and an $11.2m cash outflow in “repayment of accommodation bonds”. It is important to note that RADs are not considered as debt for the purposes of bank credit analysis because typically RADs are repaid to a departing aged care resident from the RAD deposit of an incoming resident. Daily accommodation payments (DAPs) are recognised as revenue in the profit and loss statements and as operating cash flow. RADs are classified as current “other financial liabilities” and are reported in cash flow from financing activities Feature Pre 30 June 2014 Post 1 July 2014 Accommodation bonds Bonds on high care beds not permitted. Operators can charge ABs to all classifications of residents AB prices set at operator discretion. The distinction betw een Low Care, High Care and Extra Services residents w ill be removed Maximum set at $550k (w ith any excess requiring ministerial approval). Payment options Only ABs w ere paid. Residents can choose betw een payment of a lump sum (RAD) or regular cashflow (DAP), or a cominbation of both. Resident fees (DAP) $33 fixed fee. Average DAPw ill likely increase from $33 fixed to ~$51 per day, w hich is 6.59% of the bond w hich the residents w ould otherw ise be paying. Extra services Only 15% of beds could purchase extra services. 100% of beds can choose to purchase extra services for higher end lifestyle services (e.g. food, entertainment) and superior accommodation (e.g. Hotel services). Means testing Changed. Significant refurbishment Did not apply. Operators w ho have completed a new construction or a significant refurbishment receive an additional $20 a day accommodation supplement.

- 14. 08 October 2014 Health Care Equipment & Services Japara Healthcare Limited Wilson HTM Equities Research – Japara Healthcare Limited 14 Valuation BLENDED VALUATION Our blended valuation is $2.77 per share, summarised in Table 3. Note that: Upside risk exists from increased RAD-funded acquisitions. We forecast an additional ~$142m in increased RAD balance over the next three years. Based on Japara’s expected returns from its August 2014 Whelan acquisition, an additional $142m in acquisitions can generate from 30-60% EPS upside (not in our base case valuation). It is too early to estimate extra services penetration, given Japara’s My Choices extra services offering is being rolled out from October 2014. Risks to our base case valuation include: acquisitions and extra services TABLE 3: BLENDED VALUATION Source: WHTM estimates EV/EBITDA VALUATION Our EV/EBITDA multiple of 12x is a discount to Japara’s recent 13.9x acquisition of Whelan. TABLE 4: WHELAN ACQUISITION METRICS Source: JHC. Upside case reflects further growth in EBITDA anticipated in line with JHC portfolio average over time and as the Trevu facility is completed and operational Methodology Key Inputs Weighting Value ($ps) Discounted Cash Flow 11.0% WACC 50% $2.94 EV/EBITDA multiple 14x FY15E EV/EBITDA 25% $2.71 PE multiple 22x FYF PE 25% $2.51 Weighted average $2.77 Source: WHTM estimates Methodology Base Upside Net purchase price 39.5 39.5 EBITDA 2.85 4 EV/EBITDA (x) 13.9x 9.9x Source: JHC. Upside case reflects further growth in EBITDA anticipated in line with JHC portfolio average over time and as Trevu facility is completed and operational.

- 15. 08 October 2014 Health Care Equipment & Services Japara Healthcare Limited Wilson HTM Equities Research – Japara Healthcare Limited 15 COMPARABLE COMPANIES VALUATION The only directly comparable listed stock is Regis Healthcare Ltd (REG), which listed on the ASX on 7 October (issue price $3.65 per share, closed at $4.02 on first day of trading). Ryman (RYM) and Summerset (SNZ) are dual NZ-ASX listed integrated health care-retirement village operators. The key conclusions are: Japara’s FY15F PE of 22.4x is broadly in line with sector average of 22.7x. Japara’s FY15F EV/EBITDA of 12.4x is at a discount to Regis’ 13.4x. Both Japara and REG trade at a discount to New Zealand’s integrated aged care-retirement village business models (RYM and SNZ). We believe that the higher valuation rating reflects the diversified earnings base and longer-stay residents (a “one-stop shop” providing independent retirement living to supported aged care services). The higher valuation of integrated retirement village-aged care operators represents a potential upside for Japara and REG if their business models evolve over time. The listed retirement villages sector (including INA, LIC and AVO) trades at a 27% FY15F PE discount and 16% EV/EBITDA discount to the aged care sector. We believe this is due to the increased capital intensity and relative lack of annuity revenues compared with the aged care sector. JHC’s FY15F PE of ~22x is in line with the sector average JHC and REG could re-rate if their business models evolve into integrated retirement village-aged care models The retirement village sector trades at a discount to aged care due to higher capital intensity and lack of annuity revenues

- 16. 08 October 2014 Health Care Equipment & Services Japara Healthcare Limited Wilson HTM Equities Research – Japara Healthcare Limited 16 TABLE 5: COMPARABLE COMPANIES VALUATION Source: Wilson HTM Research RAD VALUATION IMPACT RADs effectively provide an interest-free source of funding for brownfields and acquisitions. In our discounted cash flow (DCF) valuation, we include the capital appreciation of RADs as free cash flow to equity. Our rationale is that: departing residents only receive the face value of the RAD upon departure, and any capital uplift (or decline) is received (or incurred) by the aged care operator; and historically, the value of RADs has increased ~9% per annum, broadly in line with residential property market growth. RADs provide free optionality on acquisition value-add. Aged care operators with a track record of value-adding acquisitions are well placed to benefit from the Living Longer, Living Better reforms, which increase the number of potentially bondable beds. We do not consider RADs to form a part of debt for the purposes of enterprise value calculation, consistent with the treatment of commercial banks (which do not include RADs in bank debt covenants). Our rationale is that in a going concern aged care operator in a stable sector, RADs will not have any claim over the assets of the aged care operator and will instead be repaid by incoming residents. In our DCF valuation, the capital appreciation of RADs over time are included as in free cash flow to equity RADs provide a free call option on acquisition value-add We do not consider RADs to be debt, consistent with the treatment of commercial banks Comparable companies Ticker Mkt cap (A$M) PE PE PE PE EV/EBITDA EV/EBITDA EV/EBITDA EV/EBITDA 2014 2015 2016 2017 2014 2015 2016 2017 Comparable Companies Aged care Japara Healthcare Ltd JHC 623.4 27.6x 22.4x 21.5x 17.8x 14.8x 12.4x 12.0x 10.4x Regis Healthcare Ltd REG 1,207.2 25.2x 13.9x 13.4x - - Ryman Healthcare Ltd RYM 3,815.0 32.3x 25.5x 22.5x 19.2x 23.3x 22.5x 19.6x 16.2x Summerset Group Holdings Ltd SNZ 554.8 22.0x 18.0x 14.0x 13.2x 20.6x 17.4x 14.2x 13.5x Average - aged care 27.3x 22.7x 19.4x 16.7x 18.2x 16.4x 15.3x 13.4x Private hospitals Ramsay Health Care Ltd RHC 10,001.0 30.3x 25.5x 22.3x 19.8x 15.9x 13.1x 10.9x 9.8x Healthscope Ltd HSO 4,295.6 21.2x 25.6x 23.8x 20.7x 19.7x 13.6x 12.6x 11.2x Average - private hospitals 25.8x 25.5x 23.1x 20.2x 17.8x 13.4x 11.8x 10.5x Health services Sonic Healthcare Ltd SHL 6,976.4 17.8x 16.7x 15.3x 14.0x 11.9x 11.0x 10.1x 9.2x Primary Health Care Ltd PRY 2,138.9 14.1x 12.0x 11.1x 10.3x 8.0x 7.6x 7.2x 6.7x Invocare Ltd IVC 1,202.6 25.6x 23.2x 20.9x 19.6x 14.2x 13.1x 12.1x 11.4x Virtus Health Ltd VRT 623.6 19.3x 17.1x 14.8x 13.4x 12.0x 10.5x 9.3x 8.3x Average - health services 22.4x 20.1x 17.8x 16.5x 13.1x 11.8x 10.7x 9.9x Retirement villages Ingenia Communities Group INA 313.2 25.6x 15.9x 11.0x 8.2x 30.4x 15.5x 11.8x 10.7x Lifestyle Communities Ltd LIC 178.9 16.6x 13.8x 12.6x 11.2x 9.6x 8.1x 7.4x 6.5x Aveo Group AVO 1,025.2 21.4x 19.9x 14.1x 12.6x 22.0x 17.8x 13.1x 12.3x Average - retirement villages 21.2x 16.5x 12.6x 10.7x 20.7x 13.8x 10.8x 9.8x Average - total 23.7x 20.8x 17.7x 15.6x 16.8x 13.6x 11.8x 10.6x

- 17. 08 October 2014 Health Care Equipment & Services Japara Healthcare Limited Wilson HTM Equities Research – Japara Healthcare Limited 17 Earnings outlook GUIDANCE Japara has confirmed its FY15F prospectus EBITDA forecast of A$48.9m and A$27.7m NPAT. Adjusting for August 2014’s Whelan acquisition (settling December 2015) implies FY15F EBITDA guidance of $50.3m and NPAT of $30.0m. Chart 6 illustrates Japara’s EBITDA bridge from FY14 to FY15F. Below, we discuss the key earnings drivers: organic revenue growth (ie ACFI revenue); occupancy rates; brownfields expansion; acquisitions; regulatory change; and margins. CHART 6: EBITDA BRIDGE TO FY15F Source: JHC FY14 results presentation

- 18. 08 October 2014 Health Care Equipment & Services Japara Healthcare Limited Wilson HTM Equities Research – Japara Healthcare Limited 18 ACFI REVENUE Our forecast organic revenue growth of 6-8% cross-cycle comprises: ACFI organic growth of 4-5% per annum; and Acuity creep of 2-3% per annum. However, organic revenue growth is variable from year to year. Relevant historical data points include the following: The CAGR in government fees paid per resident from FY09 to FY13 was ~7.1% per annum: - Total government spending per resident has increased in line with the increasing care needs of residents (called “acuity creep”). Acuity creep adds ~2-3% per annum. - The government tends to increase the ACFI fee schedule by ~1.6-2% per resident per annum as part of its Commonwealth Own Purpose Expense (COPE) schedule, but will reduce this to 0% after a period of above-average revenue growth. In FY13, the government set the COPE at 0%. - COPE grew by an average 8.7% between 2009 and 2012. The government believes the overall cost per patient will settle at 2-3% above inflation. We forecast organic revenue growth of 6-8% p.a. Acuity creep adds 2-3% revenue p.a. COPE adds up to 2% p.a. OCCUPANCY Occupancy is an important revenue driver. Occupancy rates tend to be seasonal, with lower occupancy during weather extremes. Chart 7 illustrates Japara’s occupancy rates: occupancy increased to 95.2% during the FY14 reporting period (from 22 April to 30 June 2014); and Japara’s average 95% occupancy level is above the sector average of 92.7% (Chart 8). CHART 7: JHC OCCUPANCY RATES Source: JHC FY14 investor presentation

- 19. 08 October 2014 Health Care Equipment & Services Japara Healthcare Limited Wilson HTM Equities Research – Japara Healthcare Limited 19 CHART 8: INDUSTRY OCCUPANCY RATES Source: JHC prospectus BROWNFIELDS We estimate Japara will increase its bed portfolio by 405 beds from FY15-17F through brownfields developments. We view brownfields favourably because: they do not involve new land acquisition or town planning risk; the expansions are typically covered by existing allocations for new beds from the government; they are self-funding from RAD inflows. Current brownfield development estimates are $222k per place, compared to average new bond values of ~$274k in 2013. We estimate JHC will add 405 beds through brownfield developments from FY15-17F ACQUISITIONS Acquisitions are a core component of Japara’s strategy to grow to 5,000 beds in the medium term. The growth profile from Japara’s current 3,408 portfolio is: 405 brownfield beds; and 1,187 bed acquisitions. We will only factor acquisitions into our base case valuation once they have been announced. JHC needs to acquire 1,204 beds to achieve its medium term goal of 5,000 beds REGULATORY CHANGE Regulatory change remains a key risk for aged care operators, given around 70% revenues are from the government and continuing compliance requirements. However, we believe that even though there may be short-term changes to revenue composition, the government has accepted a certain level of cost inflation in the aged care sector is necessary to service the ageing population (refer “ACFI revenue” above). During FY14, regulatory changes with a downside revenue impact were: removal of the payroll tax supplement for for-profit aged care operators, costing Japara a ~$4.0m annual EBITDA benefit in FY15F; and removal of the dementia supplement, costing Japara about $3.0m. Japara has advised that it is quite unusual for the sector to have experienced two rounds of regulatory change in FY14. In the short term, we believe that regulatory risk is cyclical, peaking with the federal election cycle. Hence, we believe the prospect of further material regulatory change in the next two years is limited. In the long term, we believe that while there may be changes to the composition of ACFI revenues over time the government recognises the need for a well-funded and profitable aged care sector and hence is unlikely to dramatically alter the industry’s economics. FY14 was unusual in that there were two changes to the ACFI revenue model in a short period In the short term, regulatory risk is cyclical, in line with the political cycle In the long term, we believe the government is unlikely to dramatically alter the industry’s economics

- 20. 08 October 2014 Health Care Equipment & Services Japara Healthcare Limited Wilson HTM Equities Research – Japara Healthcare Limited 20 MARGINS Japara is forecasting EBITDA margins to improve back up to 18.5% in FY15 (16.3% FY14). Margins have been somewhat volatile, driven by: the government’s downwards revision of its price growth per resident (called “COPE”) from 2.0% to 0% in FY13; and above-trend wage inflation with the Victorian enterprise bargaining agreement increasing twice in the space of six months; 3.0% in October 2012 and a further 2.0% in April 2013. Labour costs were around 80% of total costs in FY13. Margins have been somewhat volatile

- 21. 08 October 2014 Health Care Equipment & Services Japara Healthcare Limited Wilson HTM Equities Research – Japara Healthcare Limited 21 Japara business overview BUSINESS OVERVIEW Japara has grown from inception nine years ago become the sector’s fifth-largest aged care operator, with 3,408 beds (3,346 operational beds, after the closure of 45 beds at Launceston), comprising ~2% share of the 186,000 beds in Australia. Japara’s portfolio is overweight Victoria. It has 39 aged care facilities (including Whelan), of which 3 are leased and the remainder owned freehold. The geographic spread is: Victoria (31 facilities); New South Wales (2 facilities); Tasmania (1 facility); and South Australia (5 facilities, including 4 from Whelan in Adelaide). We expect that NSW will provide attractive acquisition opportunities for Japara as NSW’s facility ownership transitions away from not-for-profit (NFP) operators. NSW is unique in its high concentration of NFP operators, with 2 of the state’s top 10 operators being “for profit”. NFPs such as Baptist Care, Freemasons and Uniting Church have large portfolios. JHC has 3,408 beds across 39 facilities across Australia NSW presents an attractive expansion opportunity as facility ownerships transitions away from not-for-profit sector Japara’s business model is to provide for “ageing in-place” by servicing Low Care, High Care, Extra Services and dementia-specific residents. This allows residents to stay in the one place, and Japara to capture revenue through the resident’s personal aged care journey. Japara has high leverage to new RAD inflow given ~54% of its portfolio comprises high care beds, which were previously not “bondable” beds. JHC’s business model is to provide “ageing place”, which brings it one step closer to RYM and SNZ’s integrated retirement village/aged care models. CHART 9: CLASSIFICATION OF BEDS CHART 10: BEDS BY LOCATION Source: WHTM estimates Source: Japara, WHTM 2,713 163 134 76 VIC NSW TAS SA Bed Type Number % total Low Care 370 11% High Care 1,917 57% High Care Extra Services 942 28% Independent Living Units 135 4% Total 3,363 100% Source: WHTM estimates

- 22. 08 October 2014 Health Care Equipment & Services Japara Healthcare Limited Wilson HTM Equities Research – Japara Healthcare Limited 22 Board and management Linda Nicholls AO, Non-Executive Chairman Linda is a senior executive and company director with more than 30 years’ experience across Australia, New Zealand and the United States. Linda is the chairman of Yarra Trams and a Director of Fairfax Media, Pacific Brands Group, Sigma Pharmaceutical Group, Low Carbon Australia and the Walter and Eliza Hall Institute of Medical Research. Previously, she was chairman of Healthscope and Australia Post, and was a Director of St George Bank. Linda holds a Masters of Business Administration from Harvard Business School and a Bachelor of Arts in Economics from Cornell University. Andrew Sudholz, CEO and Executive Director Andrew is a founding shareholder and executive director of Japara. He has more than 30 years’ experience in the real estate, healthcare and professional services industries. Before establishing Japara, Andrew was a global partner of the Arthur Andersen Group, a national partner of Ernst & Young’s Real Estate Advisory Services Group and the state general manager of the Triden Corporation. He is also a fellow of the Australian Property Institute, a former president of the Victorian division and national board member of the Property Council of Australia and is currently a member of the Australian Institute of Company Directors. Andrew holds an Associate Diploma of Valuations from the Royal Melbourne Institution of Technology. Richard England (Non-Executive Director) Richard has more than 18 years’ experience as a non-executive director and Chairman. He is currently chairman of Chandler Macleod Group and of Ruralco Holdings and is a non-executive director of Allianz Australia, Nanosonics and Macquarie Atlas Roads. He was a Chartered Accountant in Public Practice and a partner at Ernst & Young, where he was the national director of Corporate Recovery and Insolvency. He is a councillor of the Royal Sydney Botanic Gardens Foundation and is deputy chairman of Indigenous Art Code, the company administering the Indigenous Australian Art Commercial Code of Conduct. Richard is a fellow of the Institute of Chartered Accountants in Australia, is a qualified Chartered Accountant and a member of the Australian Institute of Company Directors. Tim Poole, (Non-Executive Director) Tim has more than 15 years’ experience as a director and chairman. He is currently a Director of Newcrest Mining, chairman of Westbourne Credit Management and a director of AustralianSuper, Continuity Capital and Lifestyle Communities and is a member of the LEK Consulting Advisory Board. He has formerly held the position of managing director of Hastings Funds Management and was the former chairman of Asciano. Tim holds a Bachelor of Commerce from the University of Melbourne and is a Chartered Accountant.

- 23. 08 October 2014 Health Care Equipment & Services Japara Healthcare Limited Wilson HTM Equities Research – Japara Healthcare Limited 23 David Blight, Non-Executive Director David has more than 30 years’ experience in the real estate sector and has held several senior positions with well-known Australian companies. Previously, he was managing director and chief executive officer of APN Property Group. He has held various positions concurrently with ING, including vice chairman of ING Real Estate, chairman and chief executive officer of ING Real Estate Investment Management and was on the management, diversity and leadership councils of the ING Group. David also has experience as a property valuer and general manager in Australia and New Zealand having previously worked for many property valuation companies including Mirvac Funds and Armstrong Jones. David holds a Bachelor of Applied Science in Property Resource Management (Valuation) from the University of South Australia. John McKenna, Chief Financial Officer and Company Secretary John McKenna is the Chief Financial Officer, with more than 30 years’ experience in financial services and related sectors. Prior to joining Japara, John was an executive director and chief operating officer of Burdett Buckeridge Young, a stockbroking and corporate advisory company, where he headed their finance and compliance divisions. He formerly held senior finance roles with the National Australia Bank Group including head of finance and financial controller of the UK branch. John has a Bachelor of Commerce degree from the University of Melbourne, is a qualified Chartered Accountant and has a Post Graduate Diploma in Applied Finance with the Securities Institute of Australia. Jerome Jordan, Executive Director of Operations Jerome is the Executive Director of Operations and has more than 20 years’ experience in the aged care sector. Prior to Japara, Jerome was the executive director at Glenvoir Holdings, where he managed the aged care and nursing facilities. Jerome has a Master in Business Management and a Post Graduate Diploma in Business Management from Monash University, a Post Graduate Diploma in Gerontology and a Bachelor of Health Science (Nursing) from Victoria University and multiple Certificates in Aged Care, Occupation Health and Safety and Front Line Management. Julie Reed, Executive Director of Aged Care Services Julie is the Executive Director of Aged Care Services. She has more than 30 years’ industry experience in the sector. Prior to Japara, she held positions as a registered nurse at Sandringham Hospital Acute Care, a RCS coordinator at Australian Residential Care and the director of nursing at the Rosehill Aged Care Facility, Coogee Private Nursing Home and Pembridge Private Nursing Home. Julie was a founding member of NURSAC Victoria and has held multiple positions including chairman and treasurer, and was the Victorian representative for both NURSAC and the Royal College of Nursing – Aged Care Liaison Committee for many years. Julie has worked as a sessional teacher for private registered training organisations and higher education facilities, teaching about the aged care sector. Julie is a graduate from the Alfred Hospital, School of Nursing.

- 24. 08 October 2014 Health Care Equipment & Services Japara Healthcare Limited Wilson HTM Equities Research – Japara Healthcare Limited 24 Risks DOWNSIDE RISKS Liquidity risk – the DAP/RAD mix and accommodation bond values There is a risk that there will be a liquidity event driven by RAD redemptions not being offset by incoming RADs. From 1 July 2014, residents can choose whether to make a lump sum (RAD) or a periodic payment (DAP) to aged care operators. This may reduce overall RAD inflows. In our view, a liquidity event driven by the DAP/RAD mix is unlikely given: Japara’s prospectus forecasts; current experience (July to Oct 2014); and upside of Japara being able to receive RADs on high care beds (~54% Japara portfolio) for the first time from 1 July 2014. We also believe that a liquidity event driven by accommodation bond (AB) value decline is unlikely given: ABs would have to decline by ~18% before operators’ cash balances would be adversely impacted, given ~18% growth in AB values over the past three years (the average resident stay is ~2.5 years) (source: “Inaugural report on the funding and financing of the aged care sector”, 30 June 2013). AB values are less than 50% of median property prices, indicating a large property market downturn is required before residential home vendors will be unable to fund ABs. Japara’s RAD LVR ratios sit below industry averages. Operators with high- priced bonds would be affected first. An acquisition-driven liquidity event is more likely, in our view. Regulatory risk Regulatory change remains a key risk for aged care operators, given approximately 70% revenues are from the government and continuing compliance requirements. In the short term, we believe that regulatory risk is cyclical, peaking with the federal election cycle. Hence, we believe the prospect of further material regulatory change in the next two years is limited. In the long term, we believe that while there may be changes to the composition of ACFI revenues over time, the government recognises the need for a well-funded and profitable aged care sector and hence is unlikely to dramatically alter the industry’s economics. Acquisition risk Japara needs to acquire 1,204 beds in the medium term to achieve its stated goal of a 5,000 bed portfolio. However, acquisitions are subject to pricing, availability, funding and execution risk. These risks are mitigated by Japara’s strong acquisition track record and ~54% high care beds in its portfolio (which increase the prospect of high RAD inflows). The outlook and impact of rising sector valuation multiples is unclear. On the one hand, Japara may be unable to identify value-adding acquisitions. On the other hand. Japara’s valuation may increase in line with the sector, or in an extreme scenario it may even consider a trade sale to a larger operator (Regis, BUPA, Opal or a superannuation fund).

- 25. 08 October 2014 Health Care Equipment & Services Japara Healthcare Limited Wilson HTM Equities Research – Japara Healthcare Limited 25 UPSIDE RISKS RAD inflows We assume that RAD inflows will be 62.2% of all incoming residents, in line with Japara’s forecasts. Given Japara prices it bonds below industry levels and rising sector competition, there is a possibility that Japara may receive higher RAD inflows. RAD inflows can add shareholder value if deployed into value-adding acquisitions. Extra services revenue The extent of upside in extra services revenue will not be known for up to 12 months. Japara can now offer extra services to all beds. Previously, extra services could only be offered to a maximum of 15% of beds. Japara is rolling out its “My Choices” extra services offering from October 2014 to all beds. The penetration of My Choices will be mature across the bed portfolio in 2.4 years as new residents fully replace the existing residents.

- 26. 08 October 2014 Health Care Equipment & Services Japara Healthcare Limited Wilson HTM Equities Research – Japara Healthcare Limited 26 RETURN RE-INVESTMENT MATRIX RISK MEASURES Return High Cash Generator Champion Low Challenged Potential Low High Re-investment Japara has a 100% dividend payout ratio, with accommodation bonds funding growth and working capital. Low Med High Spec Share Price Risk Business Risk Key risks are acquisition and liquidity risk. BUSINESS DESCRIPTION Japara Healthcare Limited (JHC) is an operator of residential aged care facilities in Australia. Japara has grown from inception 9 years ago to 3,408 beds, comprising ~2% market share. Its portfolio is overweight Victoria (81% total beds), with a presence in SA (10% total) and NSW (5%) and Tasmania (4%). Japara has high leverage to new RAD inflow given ~54% of its portfolio comprises (what were previously classified as) high care beds. INVESTMENT THESIS We estimate Japara can generate up to ~50% EPS upside as it deploys up to $142m in increased refundable accommodation deposits (RADs) in value-adding acquisitions. REVENUE DRIVERS BALANCE SHEET Occupancy rates Brownfields expansion Acquisitions Nil debt on the balance sheet RADs are a form of interest-free funding available to aged care operators MARGIN DRIVERS BOARD Organic revenue growth (ie. ACFI revenue) Regulatory change Linda Nicholls, Chairman Richard England, NED Tim Poole, NED David Blight, NED KEY ISSUES/CATALYSTS MANAGEMENT The key catalysts required to re-rate Japara are: 1) continuing RAD inflows in line with prospectus expectations; 2) continuing value-adding acquisitions; and 3) realisation of brownfield development opportunities Andrew Sudholz, CEO John McKenna, CFO Jerome Jordan, Executive Director Operations Julie Reed, Executive Director, Aged Care Services RISK TO VIEW CONTACT DETAILS Liquidity risk Acquisition risk Accommodation bond risk Address: Q1 Building, L4, 1 Southbank Boulevard, Southbank, VIC 3006 Phone: 03 9649 2100 Website: www.japarahealthcare.com.au

- 27. 08 October 2014 Health Care Equipment & Services Japara Healthcare Limited Wilson HTM Equities Research – Japara Healthcare Limited 27 Head of Research Head of Institutional Sales Shane Storey (07) 3212 1351 Richard Moulder (02) 8247 6603 Industrials Sydney James Ferrier (03) 9640 3827 Jonathan Scales (02) 8247 6613 Stewart Oldfield (03) 9640 3818 Duncan Gamble (02) 8247 6629 George Gabriel (03) 9640 3864 Michael Pegum (02) 8247 6602 Andrew Dalziel (07) 3212 1946 Anthony Wilson (02) 8247 3113 Healthcare and Biotechnology Peter Tebbutt (02) 8247 6682 Shane Storey (07) 3212 1351 Melbourne Joseph Michael (02) 8247 3101 David Permezel (03) 9640 3885 Resources Adam Dellaway (03) 9640 3824 Phillip Chippindale (02) 8247 3149 James Redfern (02) 8247 6609 Wealth Management Research Liam Schofield (02) 8247 3173 Peter McManus (02) 8247 3186 Quantitative John Lockton (02) 8247 3118 Nathan Szeitli (03) 9640 3806 Email: firstname.lastname@wilsonhtm.com.au National Offices Brisbane Ph: (07) 3212 1333 Sydney Ph: (02) 8247 6600 Melbourne Ph: (03) 9640 3888 Gold Coast Ph: (07) 5509 5500 Dalby Ph: (07) 4660 8000 Hervey Bay Ph: (07) 4197 1600 Our website: www.wilsonhtm.com.au Return Reinvestment Matrix and Risk Measures Definitions at http://www.wilsonhtm.com.au/Disclosures Recommendation Structure and Other Definitions Definitions at http://www.wilsonhtm.com.au/Disclosures Disclaimer Whilst Wilson HTM Ltd believes the information contained in this communication is based on reliable information, no warranty is given as to its accuracy and persons relying on this information do so at their own risk. To the extent permitted by law Wilson HTM Ltd disclaims all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage) however caused, which may be suffered or arise directly or indirectly in respect of such information. Any projections contained in this communication are estimates only. Such projections are subject to market influences and contingent upon matters outside the control of Wilson HTM Ltd and therefore may not be realised in the future. The advice contained in this document is general advice. It has been prepared without taking account of any person’s objectives, financial situation or needs and because of that, any person should, before acting on the advice, consider the appropriateness of the advice, having regard to the client’s objectives, financial situation and needs. Those acting upon such information without first consulting one of Wilson HTM Ltd investment advisors do so entirely at their own risk. This report does not constitute an offer or invitation to purchase any securities and should not be relied upon in connection with any contract or commitment whatsoever. If the advice relates to the acquisition, or possible acquisition, of a particular financial product – the client should obtain a Product Disclosure Statement relating to the product and consider the Statement before making any decision about whether to acquire the product. This communication is not to be disclosed in whole or part or used by any other party without Wilson HTM Ltd’s prior written consent. Disclosure of Interest. Japara Healthcare Limited The Directors of Wilson HTM Ltd advise that at the date of this report they and their associates have relevant interests in Japara Healthcare Ltd. They also advise that Wilson HTM Ltd and Wilson HTM Corporate Finance Ltd A.B.N. 65 057 547 323 and their associates have received and may receive commissions or fees from Japara Healthcare Ltd in relation to advice or dealings in securities. Some or all of Wilson HTM Ltd authorised representatives may be remunerated wholly or partly by way of commission. In producing research reports, members of Wilson HTM Ltd Research may attend site visits and other meetings hosted by the issuers the subject of its research reports. In some instances the costs of such site visits or meetings may be met in part or in whole by the issuers concerned if Wilson HTM Ltd considers it is appropriate and reasonable in the specific circumstances relating to the site visit or meeting. Please see disclosures at http://www.wilsonhtm.com.au/Disclosures. Disclosures applicable to companies included in this report can be found in the latest relevant published research.