Hindustan Zinc Still Has Upside Potential

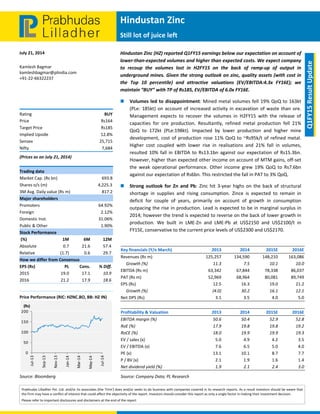

- 1. Hindustan Zinc Still lot of juice left July 21, 2014 Prabhudas Lilladher Pvt. Ltd. and/or its associates (the 'Firm') does and/or seeks to do business with companies covered in its research reports. As a result investors should be aware that the Firm may have a conflict of interest that could affect the objectivity of the report. Investors should consider this report as only a single factor in making their investment decision. Please refer to important disclosures and disclaimers at the end of the report Q1FY15 Result Update Kamlesh Bagmar kamleshbagmar@plindia.com +91‐22‐66322237 Rating BUY Price Rs164 Target Price Rs185 Implied Upside 12.8% Sensex 25,715 Nifty 7,684 (Prices as on July 21, 2014) Trading data Market Cap. (Rs bn) 693.8 Shares o/s (m) 4,225.3 3M Avg. Daily value (Rs m) 817.2 Major shareholders Promoters 64.92% Foreign 2.12% Domestic Inst. 31.06% Public & Other 1.90% Stock Performance (%) 1M 6M 12M Absolute 0.7 21.6 57.4 Relative (1.7) 0.6 29.7 How we differ from Consensus EPS (Rs) PL Cons. % Diff. 2015 19.0 17.1 10.9 2016 21.2 17.9 18.6 Price Performance (RIC: HZNC.BO, BB: HZ IN) Source: Bloomberg 0 50 100 150 200 Jul‐13 Sep‐13 Nov‐13 Jan‐14 Mar‐14 May‐14 Jul‐14 (Rs) Hindustan Zinc (HZ) reported Q1FY15 earnings below our expectation on account of lower‐than‐expected volumes and higher than expected costs. We expect company to recoup the volumes lost in H2FY15 on the back of ramp‐up of output in underground mines. Given the strong outlook on zinc, quality assets (with cost in the Top 10 percentile) and attractive valuations (EV/EBITDA:4.3x FY16E); we maintain “BUY” with TP of Rs185, EV/EBITDA of 6.0x FY16E. Volumes led to disappointment: Mined metal volumes fell 19% QoQ to 163kt (PLe: 185kt) on account of increased activity in excavation of waste than ore. Management expects to recover the volumes in H2FY15 with the release of capacities for ore production. Resultantly, refined metal production fell 21% QoQ to 172kt (PLe:198kt). Impacted by lower production and higher mine development, cost of production rose 11% QoQ to ~Rs95k/t of refined metal. Higher cost coupled with lower rise in realisations and 21% fall in volumes, resulted 10% fall in EBITDA to Rs13.1bn against our expectation of Rs15.3bn. However, higher than expected other income on account of MTM gains, off‐set the weak operational performance. Other income grew 19% QoQ to Rs7.6bn against our expectation of Rs6bn. This restricted the fall in PAT to 3% QoQ. Strong outlook for Zn and Pb: Zinc hit 3‐year highs on the back of structural shortage in supplies and rising consumption. Zince is expected to remain in deficit for couple of years, primarily on account of growth in consumption outpacing the rise in production. Lead is expected to be in marginal surplus in 2014; however the trend is expected to reverse on the back of lower growth in production. We built in LME‐Zn and LME‐Pb at US$2150 and US$2100/t in FY15E, conservative to the current price levels of US$2300 and US$2170. Key financials (Y/e March) 2013 2014 2015E 2016E Revenues (Rs m) 125,257 134,590 148,210 163,086 Growth (%) 11.3 7.5 10.1 10.0 EBITDA (Rs m) 63,342 67,844 78,338 86,037 PAT (Rs m) 52,969 68,964 80,081 89,749 EPS (Rs) 12.5 16.3 19.0 21.2 Growth (%) (4.0) 30.2 16.1 12.1 Net DPS (Rs) 3.1 3.5 4.0 5.0 Profitability & Valuation 2013 2014 2015E 2016E EBITDA margin (%) 50.6 50.4 52.9 52.8 RoE (%) 17.9 19.8 19.8 19.2 RoCE (%) 18.0 19.9 19.9 19.3 EV / sales (x) 5.0 4.9 4.2 3.5 EV / EBITDA (x) 7.6 6.5 5.0 4.0 PE (x) 13.1 10.1 8.7 7.7 P / BV (x) 2.1 1.9 1.6 1.4 Net dividend yield (%) 1.9 2.1 2.4 3.0 Source: Company Data; PL Research

- 2. July 21, 2014 2 Hindustan Zinc Exhibit 1: Q1FY15 Result Overview (Rs m) Y/e March Q1FY15 Q1FY14 YoY gr. (%) Q4FY14 FY15E FY14 YoY gr. (%) Net Sales 29,627 29,394 0.8 35,887 148,210 134,590 10.1 Raw material consumed 2,752 (633) NA 2,508 2,238 3,461 (35.3) % of Net Sales 9.3 (2.2) 7.0 1.5 2.6 Stores and spares consumed 2,962 3,265 (9.3) 3,268 13,787 13,336 3.4 % of Net Sales 10.0 11.1 9.1 9.3 9.9 Power and fuel 2,276 2,649 (14.0) 2,914 11,423 11,551 (1.1) % of Net Sales 7.7 9.0 8.1 7.7 8.6 Mining Royalty Rates 1,987 2,530 (21.5) 2,498 12,013 10,273 16.9 % of Net Sales 6.7 8.6 7.0 8.1 7.6 Other manufacturing expenses 3,665 3,779 (3.0) 4,260 16,901 15,570 8.5 % of Net Sales 12.4 12.9 11.9 11.4 11.6 Employee Cost 1,617 1,781 (9.2) 1,663 7,481 6,801 10.0 % of Net Sales 5.5 6.1 4.6 5.0 5.1 Selling, general and administrative 1,288 1,484 (13.2) 1,763 6,029 5,754 4.8 % of Net Sales 4.3 5.0 4.9 4.1 4.3 Total Expenduture 16,548 14,854 11.4 18,875 69,872 66,745 4.7 EBITDA 13,079 14,540 (10.1) 17,012 78,338 67,844 15.5 Margin (%) 44.1 49.5 47.4 52.9 50.4 Depreciation 2,023 1,843 9.7 2,041 8,270 7,846 5.4 Other income 7,619 6,650 14.6 6,427 23,367 20,765 12.5 EBIT 18,675 19,347 (3.5) 21,398 93,435 80,763 15.7 Interest 76 67 14.1 203 318 449 (29.3) PBT 18,599 19,281 (3.5) 21,195 93,117 80,314 15.9 Extraordinary income/(expense) ‐ (5) ‐ ‐ (617) PBT (After EO) 18,599 19,275 (3.5) 21,195 93,117 79,697 16.8 Tax 2,422 2,671 (9.3) 2,383 13,036 10,651 22.4 % PBT 13.0 13.9 11.2 14.0 13.4 Reported PAT 16,177 16,605 (2.6) 18,812 80,081 69,046 16.0 Adjusted PAT 16,177 16,609 (2.6) 18,812 80,081 69,580 15.1 Source: Company Data, PL Research

- 3. July 21, 2014 3 Hindustan Zinc Exhibit 2: Key Operating metrics Y/e March Q1FY15 Q1FY14 YoY gr. (%) Q4FY14 FY15E FY14 YoY gr. (%) Production volume ‐ Mined metal (Zinc+Lead)‐tonnes 23,000 238,000 (90.3) 200,228 908,067 879,718 3.2 ‐ Refined metal (Zinc+Lead)‐tonnes 172,000 204,788 (16.0) 218,946 876,128 871,763 0.5 ‐ Silver (kgs) 82,000 96,000 (14.6) 91,000 407,157 349,684 16.4 Sales volume ‐ Refined Zinc 142,000 171,000 (17.0) 184,000 748,376 750,766 (0.3) ‐ Refined Lead 32,000 30,000 6.7 37,000 127,752 121,120 5.5 ‐ Sulphuric acid 245,000 294,000 (16.7) 330,000 1,335,162 1,328,510 0.5 ‐ Silver (kgs) 82,000 92,000 (10.9) 91,000 407,157 352,000 15.7 Realisation (Rs/unit) ‐ Refined Zinc 144,859 116,140 24.7 140,815 143,915 130,493 10.3 ‐ Refined Lead 141,250 134,000 5.4 144,865 139,940 143,907 (2.8) ‐ Silver (kgs) 38,780 44,348 (12.6) 41,209 42,000 42,699 (1.6) Source: Company Data, PL Research

- 4. July 21, 2014 4 Hindustan Zinc Income Statement (Rs m) Y/e March 2013 2014 2015E 2016E Net Revenue 125,257 134,590 148,210 163,086 Raw Material Expenses — — — — Gross Profit 125,257 134,590 148,210 163,086 Employee Cost 6,499 6,801 7,481 8,229 Other Expenses 55,416 59,945 62,391 68,821 EBITDA 63,342 67,844 78,338 86,037 Depr. & Amortization 6,470 7,846 8,270 8,510 Net Interest 269 449 318 350 Other Income 21,598 20,148 23,367 27,183 Profit before Tax 78,201 79,697 93,117 104,360 Total Tax 25,176 10,651 13,036 14,610 Profit after Tax 53,025 69,046 80,081 89,749 Ex‐Od items / Min. Int. (294) (1,151) — — Adj. PAT 52,969 68,964 80,081 89,749 Avg. Shares O/S (m) 4,225.3 4,225.3 4,225.3 4,225.3 EPS (Rs.) 12.5 16.3 19.0 21.2 Cash Flow Abstract (Rs m) Y/e March 2013 2014 2015E 2016E C/F from Operations 47,850 55,365 61,918 66,413 C/F from Investing (12,150) (10,450) (19) 3,648 C/F from Financing (12,546) (15,774) (17,125) (20,123) Inc. / Dec. in Cash 23,154 29,141 44,773 49,938 Opening Cash 52,553 69,421 30,314 75,088 Closing Cash 55,165 68,804 75,088 125,026 FCFF 41,002 60,913 79,254 89,024 FCFE 40,998 60,913 79,254 89,024 Key Financial Metrics Y/e March 2013 2014 2015E 2016E Growth Revenue (%) 11.3 7.5 10.1 10.0 EBITDA (%) 7.0 7.1 15.5 9.8 PAT (%) (4.0) 30.2 16.1 12.1 EPS (%) (4.0) 30.2 16.1 12.1 Profitability EBITDA Margin (%) 50.6 50.4 52.9 52.8 PAT Margin (%) 42.3 51.2 54.0 55.0 RoCE (%) 18.0 19.9 19.9 19.3 RoE (%) 17.9 19.8 19.8 19.2 Balance Sheet Net Debt : Equity (0.2) (0.1) (0.2) (0.3) Net Wrkng Cap. (days) — — — — Valuation PER (x) 13.1 10.1 8.7 7.7 P / B (x) 2.1 1.9 1.6 1.4 EV / EBITDA (x) 7.6 6.5 5.0 4.0 EV / Sales (x) 5.0 4.9 4.2 3.5 Earnings Quality Eff. Tax Rate 32.2 13.4 14.0 14.0 Other Inc / PBT 27.8 25.9 25.1 26.0 Eff. Depr. Rate (%) 5.3 5.8 5.9 5.9 FCFE / PAT 77.4 88.3 99.0 99.2 Source: Company Data, PL Research. Balance Sheet Abstract (Rs m) Y/e March 2013 2014 2015E 2016E Shareholder's Funds 322,757 374,176 434,483 499,516 Total Debt — — — — Other Liabilities 12,799 16,581 19,375 22,505 Total Liabilities 335,556 390,757 453,858 522,021 Net Fixed Assets 99,143 111,083 124,312 137,302 Goodwill — — — — Investments 145,399 225,064 225,064 225,064 Net Current Assets 91,015 54,611 104,482 159,655 Cash & Equivalents 69,421 30,314 75,088 125,026 Other Current Assets 40,692 50,306 59,945 72,039 Current Liabilities 19,098 26,010 30,550 37,410 Other Assets — — — — Total Assets 335,556 390,757 453,858 522,021 Quarterly Financials (Rs m) Y/e March Q2FY14 Q3FY14 Q4FY14 Q1FY15 Net Revenue 35,205 34,104 35,887 29,627 EBITDA 18,447 17,841 17,012 13,079 % of revenue 52.4 52.3 47.4 44.1 Depr. & Amortization 1,865 2,097 2,041 2,023 Net Interest 80 100 203 76 Other Income 3,056 4,636 6,427 7,619 Profit before Tax 18,946 20,280 21,195 18,599 Total Tax 2,544 3,053 2,383 2,422 Profit after Tax 16,403 17,227 18,812 16,177 Adj. PAT 16,932 17,227 18,812 16,177 Key Operating Metrics Y/e March 2013 2014 2015E 2016E Mined Zinc metal prod‐MIC tns 764,671 769,897 787,764 865,692 Mined Lead metal prod‐MIC tns 105,529 109,821 120,303 133,616 Total Mines metal‐MIC tns 870,200 879,718 908,067 999,308 Refined Zinc Vol. (tonnes) 674,958 750,766 748,376 798,310 Refined Lead Vol. (tonnes) 117,445 121,120 127,752 132,843 Total Refined metal‐tns 792,403 871,886 876,128 931,153 Concentrate sales vol (MIC tns) 61,097 — — 25,366 Silver Sales Vol. (kg) 374,000 352,000 407,157 423,054 Zinc (US$)‐LME / tonne 1,948 1,909 2,150 2,200 Lead(US$)‐LME / tonne 2,113 2,093 2,100 2,150 Silver (Rs / Kg) 56,193 44,142 42,000 43,200 Cost per tonne of Mined metal (Zn+Pb) 78,135 76,553 79,750 82,746 Source: Company Data, PL Research.

- 5. July 21, 2014 5 Hindustan Zinc Prabhudas Lilladher Pvt. Ltd. 3rd Floor, Sadhana House, 570, P. B. Marg, Worli, Mumbai‐400 018, India Tel: (91 22) 6632 2222 Fax: (91 22) 6632 2209 Rating Distribution of Research Coverage 29.0% 51.4% 19.6% 0.0% 0% 10% 20% 30% 40% 50% 60% BUY Accumulate Reduce Sell % of Total Coverage PL’s Recommendation Nomenclature BUY : Over 15% Outperformance to Sensex over 12‐months Accumulate : Outperformance to Sensex over 12‐months Reduce : Underperformance to Sensex over 12‐months Sell : Over 15% underperformance to Sensex over 12‐months Trading Buy : Over 10% absolute upside in 1‐month Trading Sell : Over 10% absolute decline in 1‐month Not Rated (NR) : No specific call on the stock Under Review (UR) : Rating likely to change shortly This document has been prepared by the Research Division of Prabhudas Lilladher Pvt. Ltd. Mumbai, India (PL) and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of PL. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, PL has not independently verified the accuracy or completeness of the same. Neither PL nor any of its affiliates, its directors or its employees accept any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient's particular circumstances and, in case of doubt, advice should be sought from an independent expert/advisor. Either PL or its affiliates or its directors or its employees or its representatives or its clients or their relatives may have position(s), make market, act as principal or engage in transactions of securities of companies referred to in this report and they may have used the research material prior to publication. We may from time to time solicit or perform investment banking or other services for any company mentioned in this document.