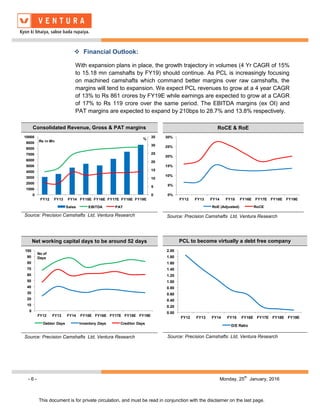

This document analyzes and recommends buying shares of Precision Camshafts Ltd. It summarizes that over FY12-FY15, PCL's revenues grew at a CAGR of 21% and are expected to continue growing at 13% to FY19. PCL's EBITDA and PAT margins are also expected to expand through FY19 due to increasing focus on value-added products and lower financing costs. PCL plans capacity expansions through FY18 to increase production, and aims to expand into Asia and Europe through strategic investments and partnerships. Based on this, the document initiates coverage on PCL with a buy recommendation and target price representing a 30% potential upside.