Embed presentation

Download as PDF, PPTX

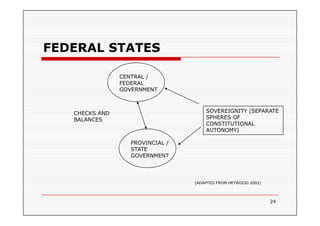

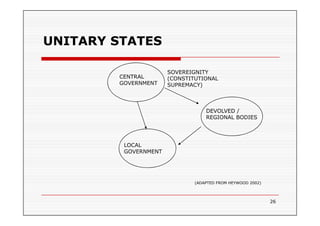

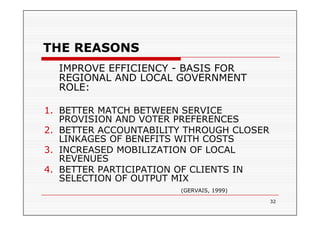

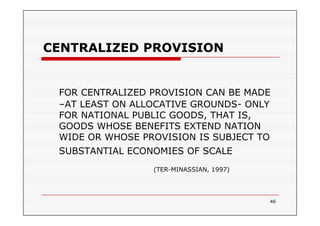

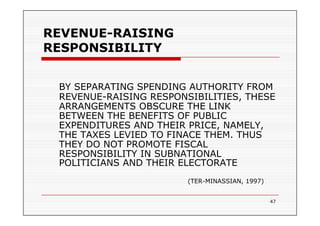

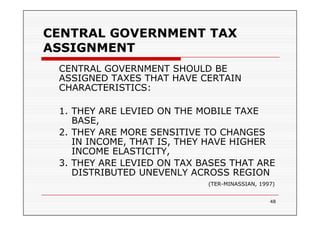

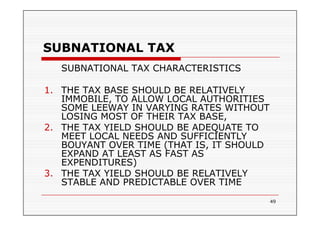

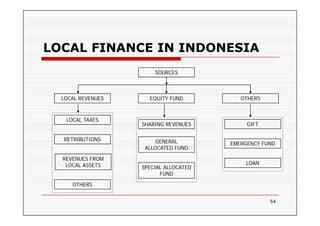

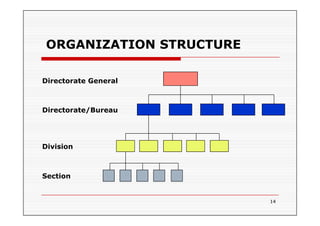

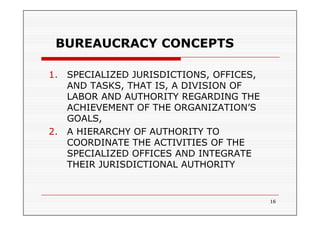

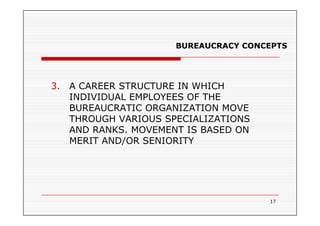

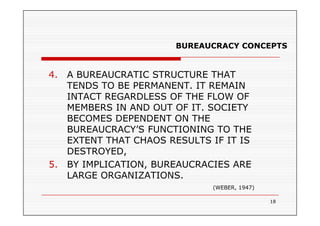

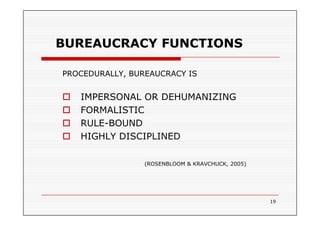

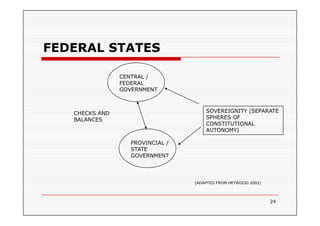

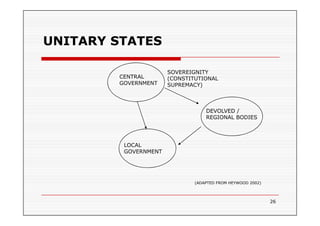

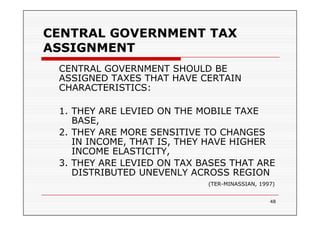

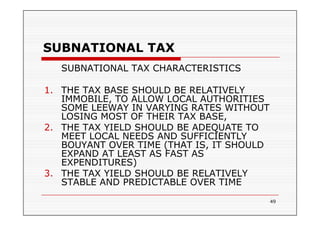

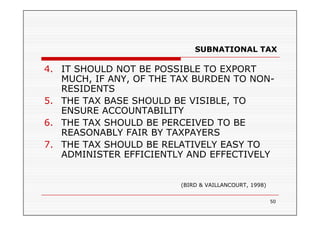

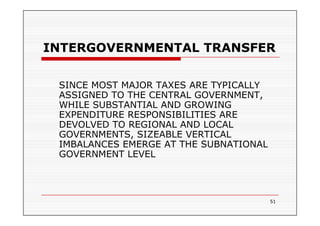

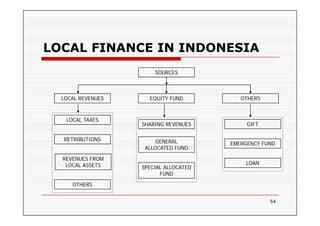

This document discusses theories of public administration and organization. It defines key concepts like institutions, organizations, and bureaucracy. It also discusses different models of government, including federalism and unitary systems. A major focus is on decentralization and local autonomy. Decentralization involves transferring authority and responsibilities from central governments to lower levels like regional or local governments. This can take different forms such as deconcentration, delegation, or devolution. The document also examines fiscal decentralization and assigning tax responsibilities between central and subnational governments.