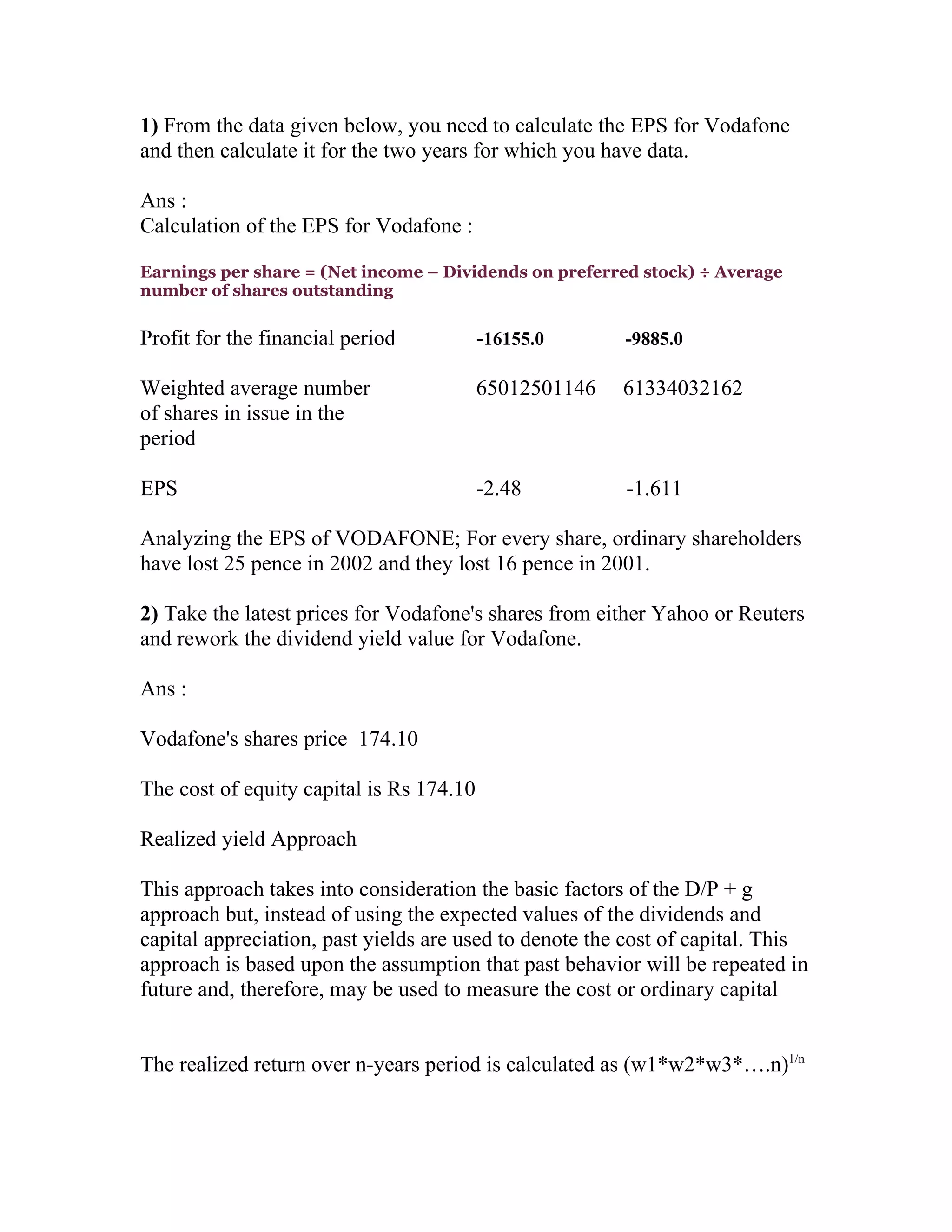

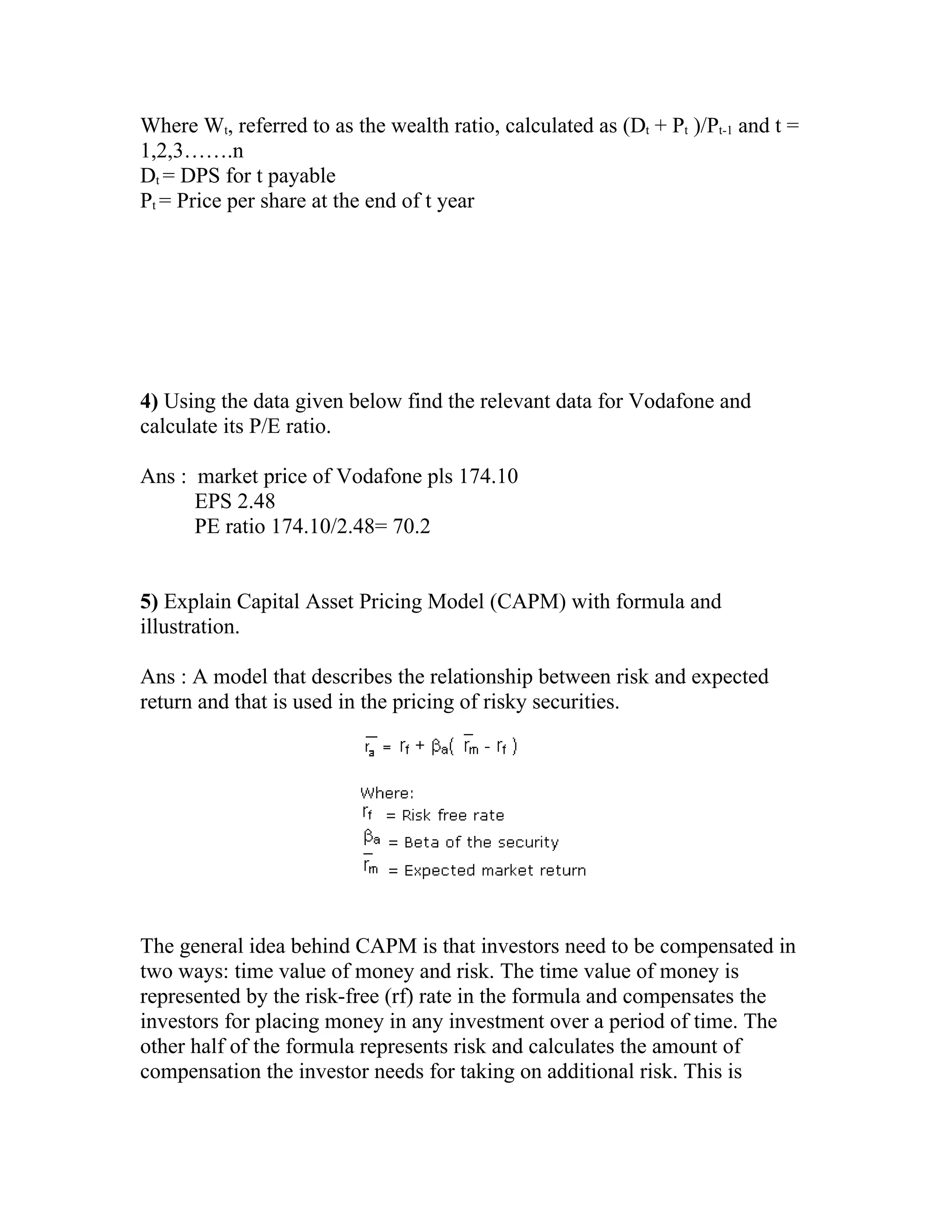

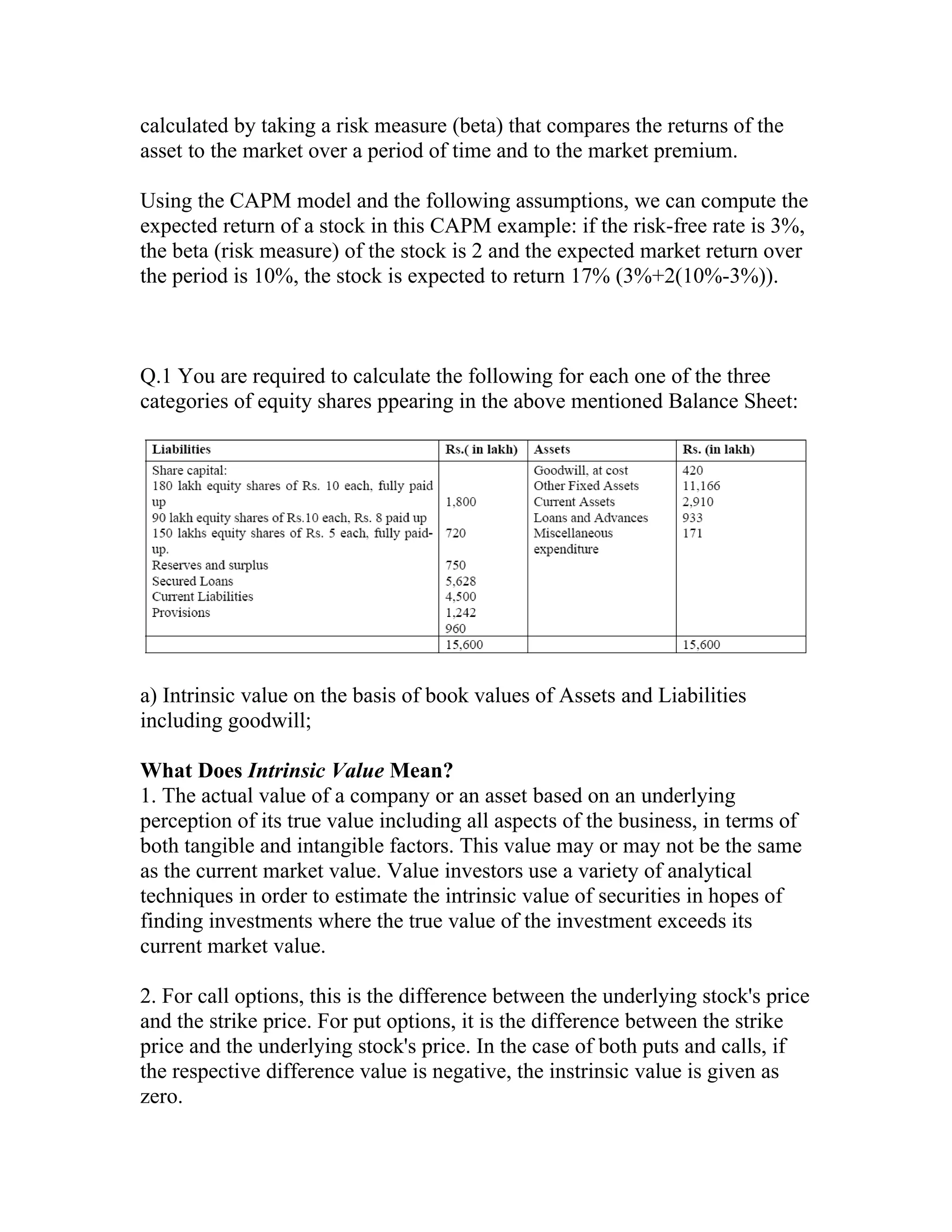

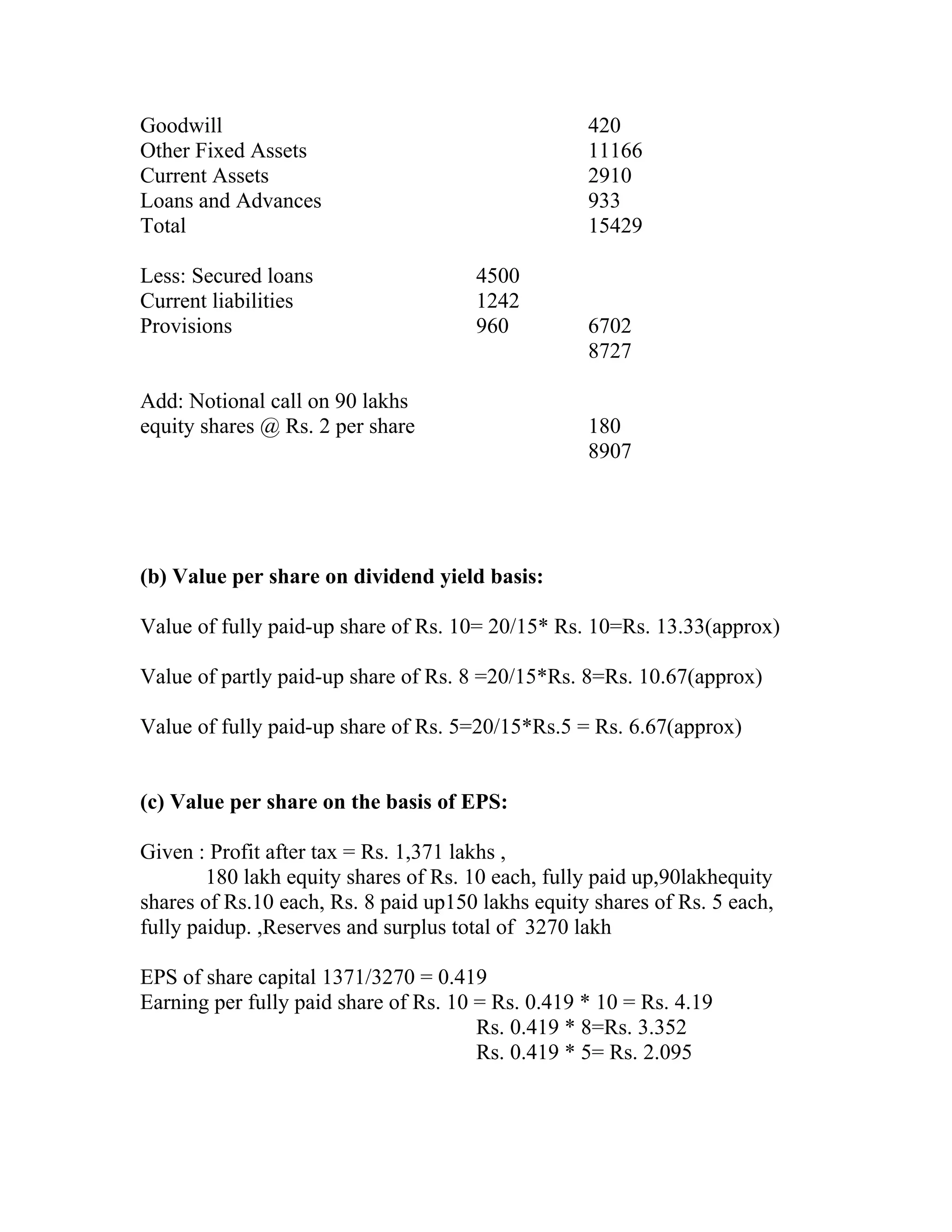

The document provides information to calculate earnings per share (EPS), dividend yield, price-to-earnings (P/E) ratio, and explains the Capital Asset Pricing Model (CAPM) for Vodafone for different years. It also provides a question asking to calculate intrinsic value, value per share on dividend yield basis, and value per share on EPS basis for different categories of equity shares in a company using data given.