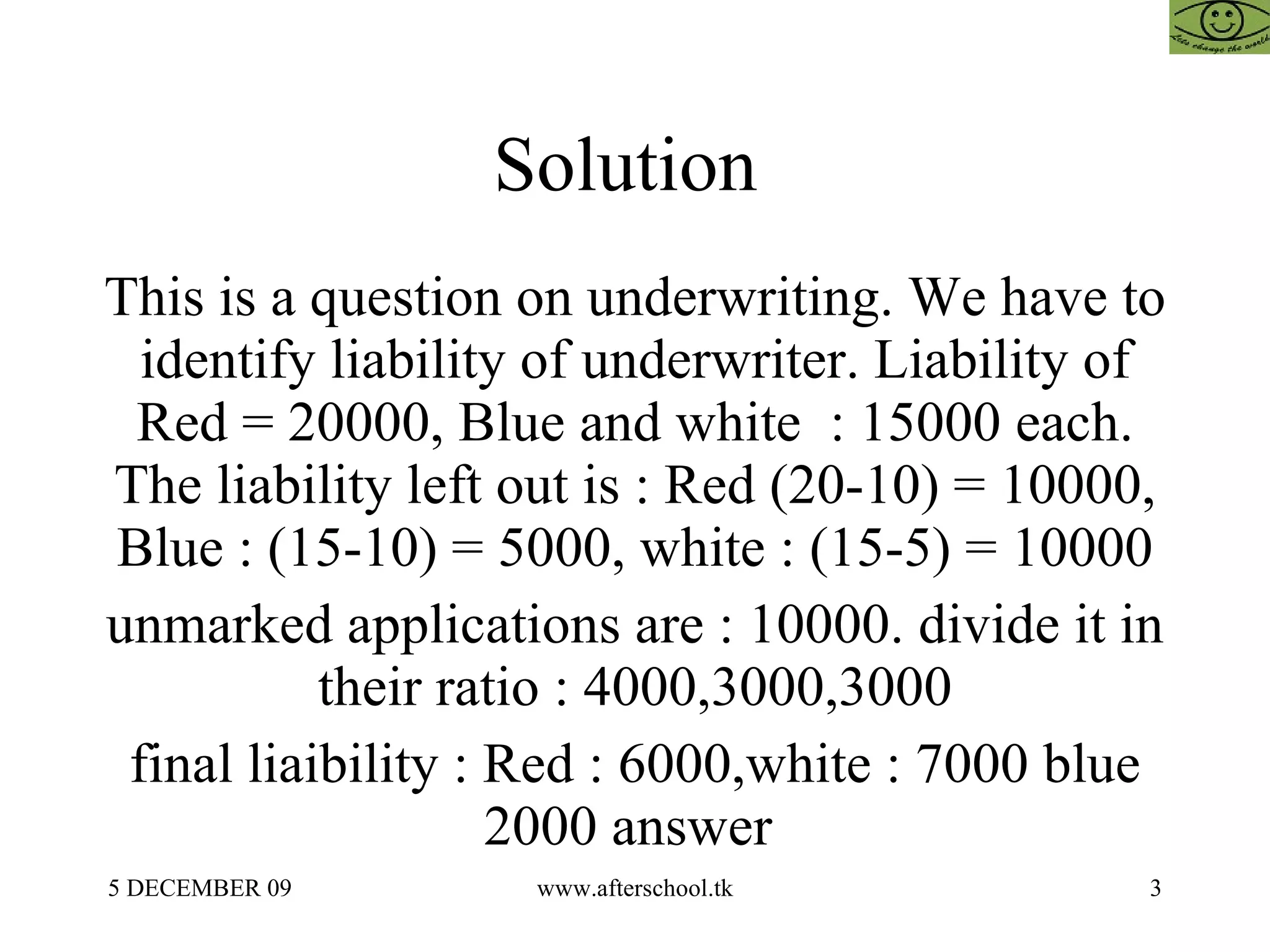

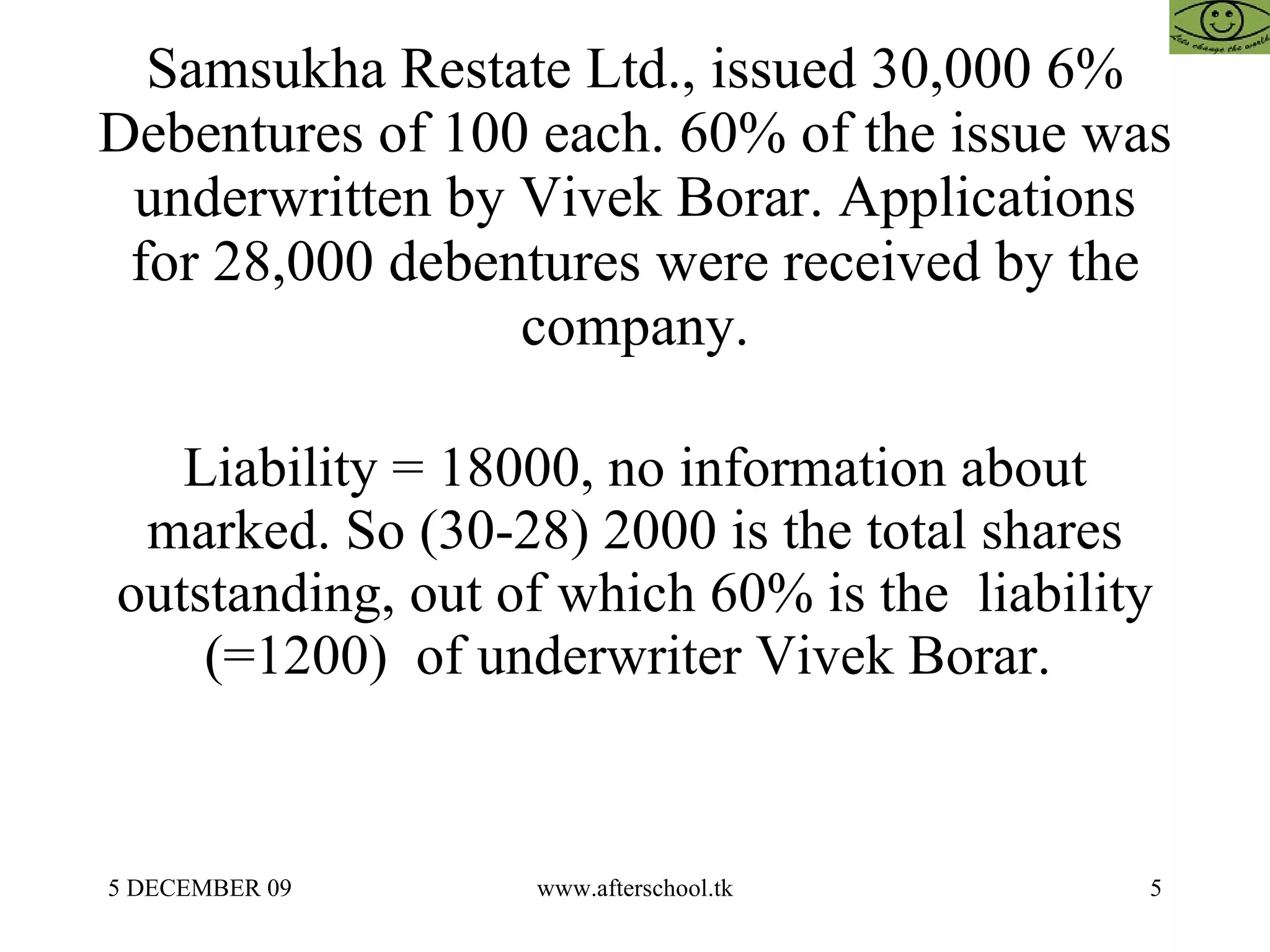

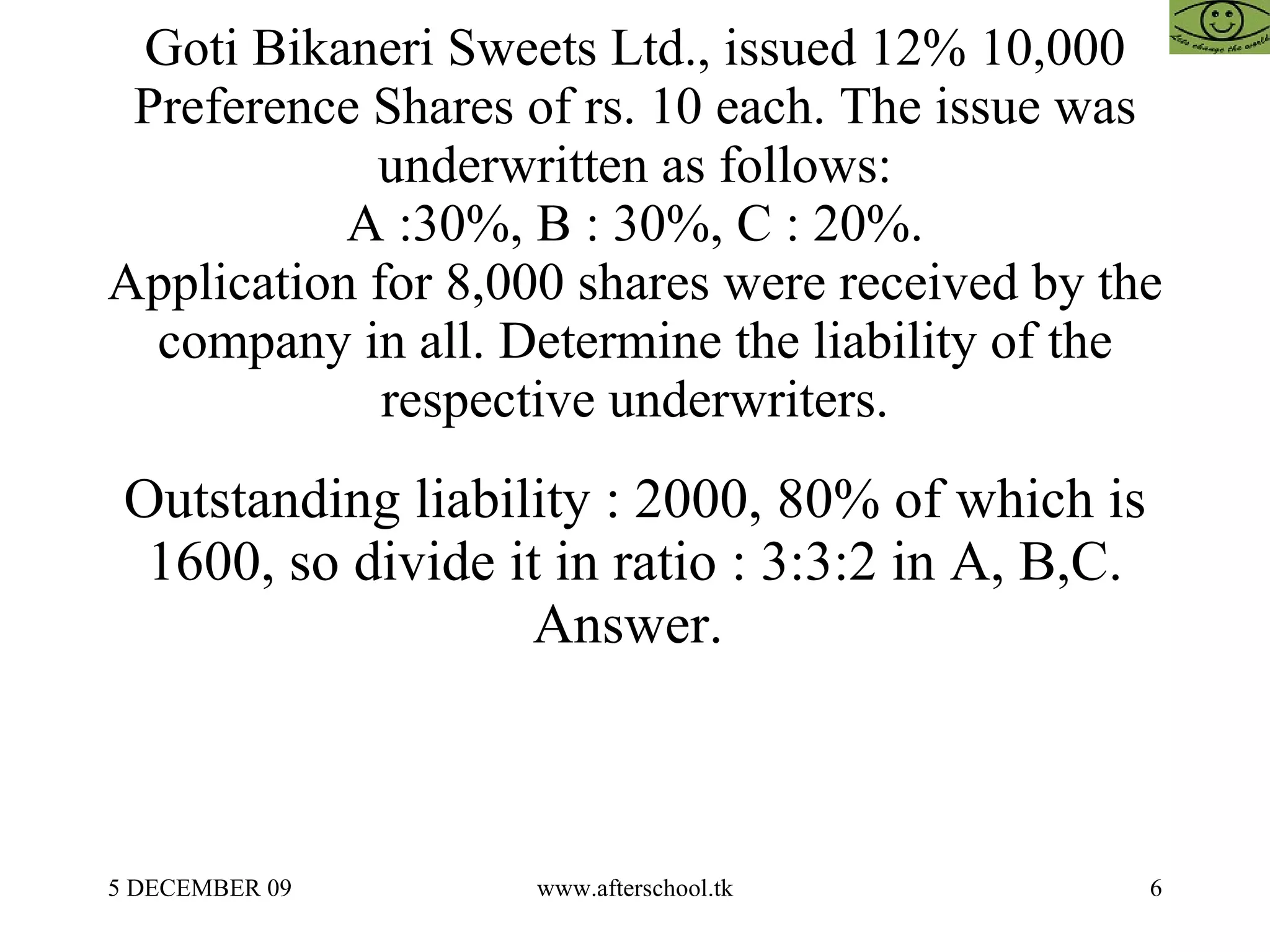

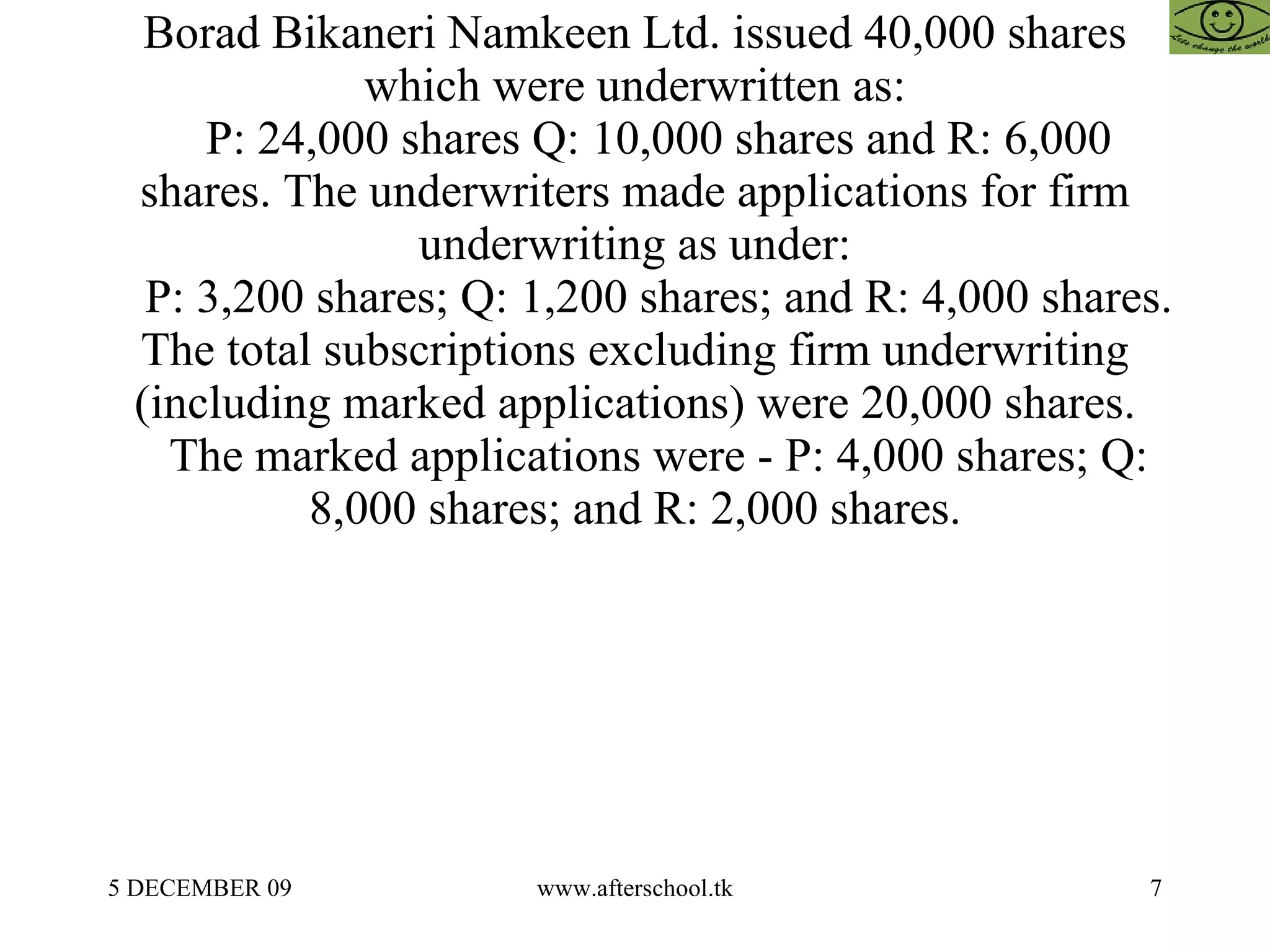

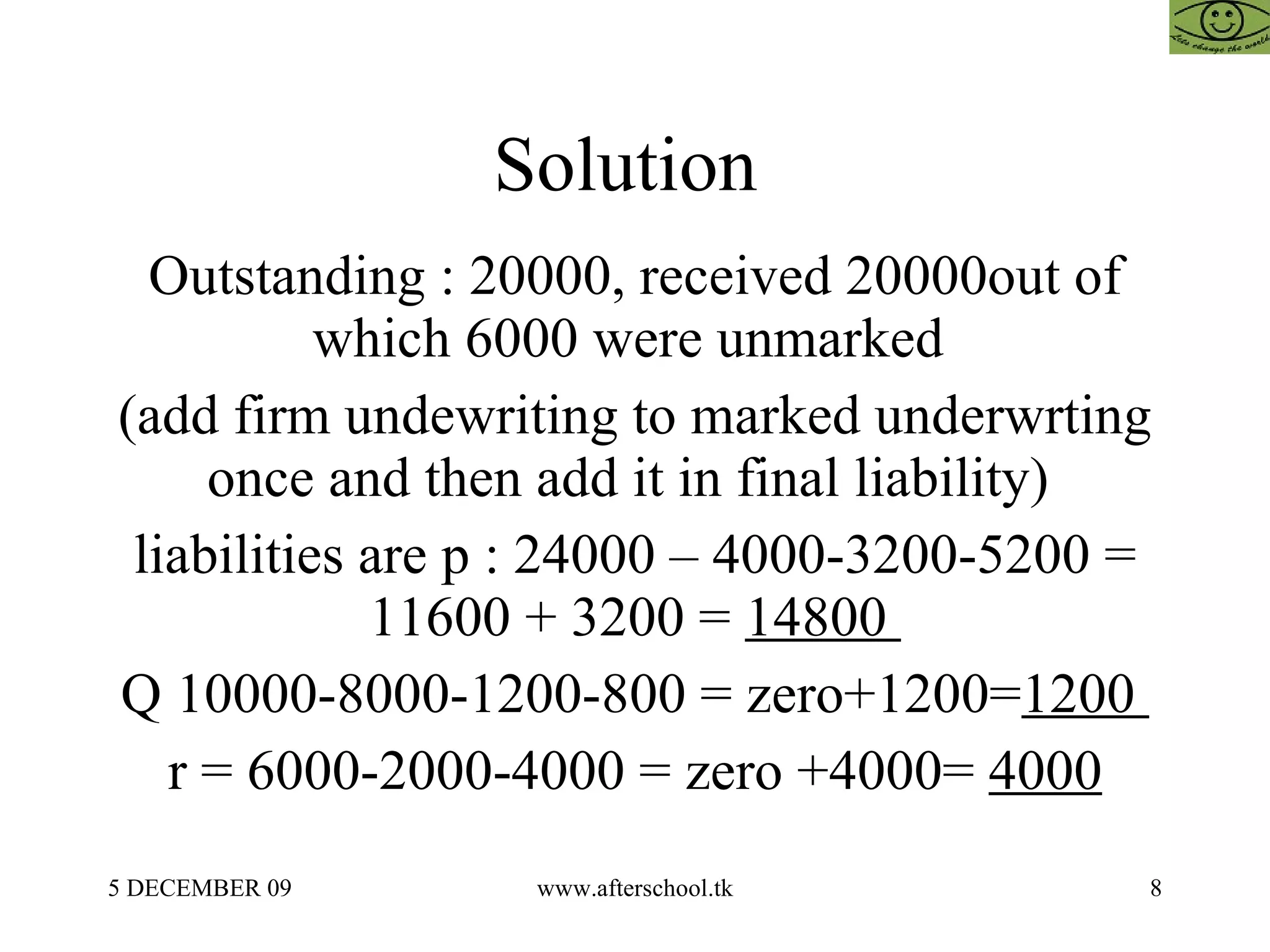

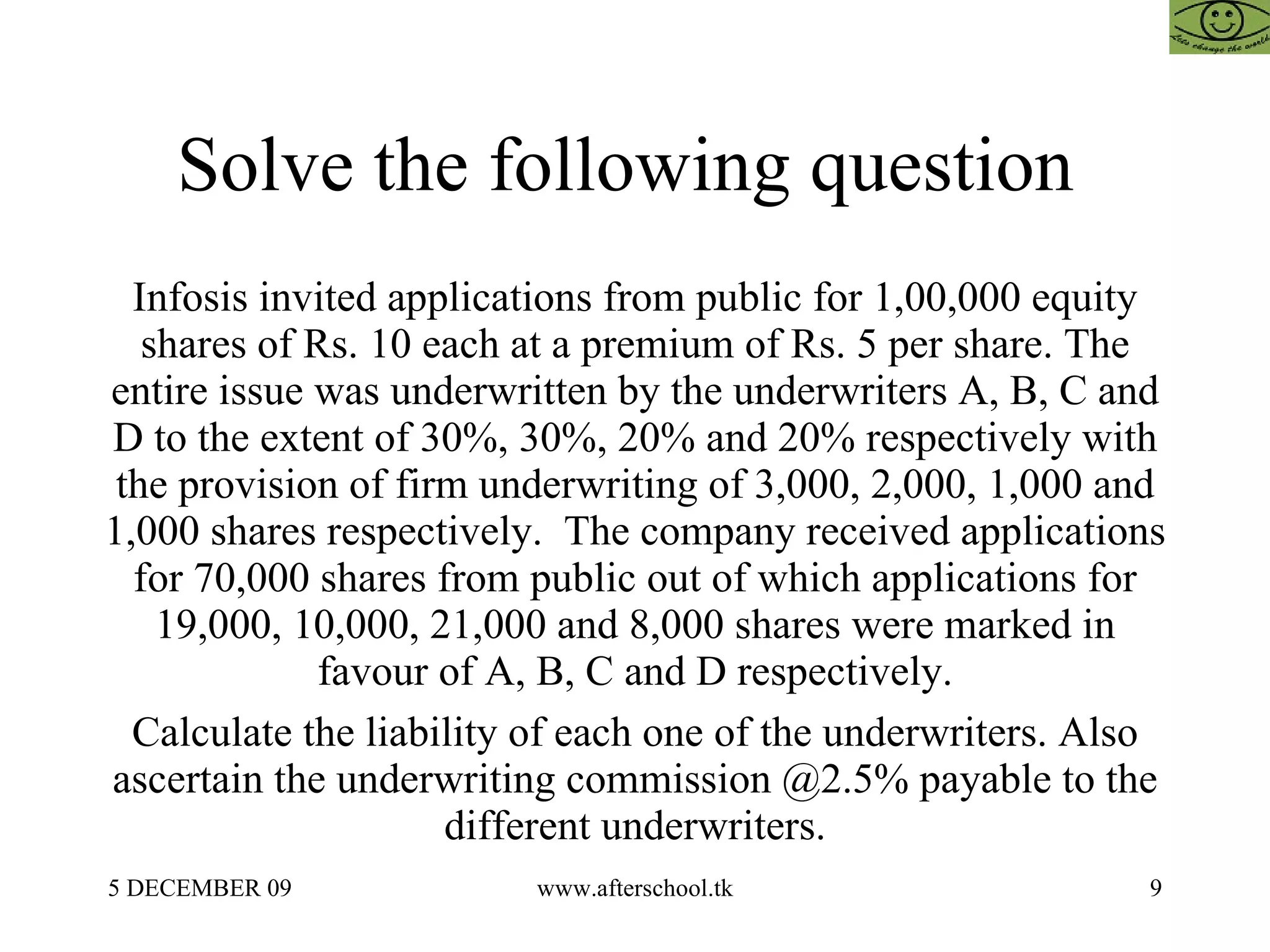

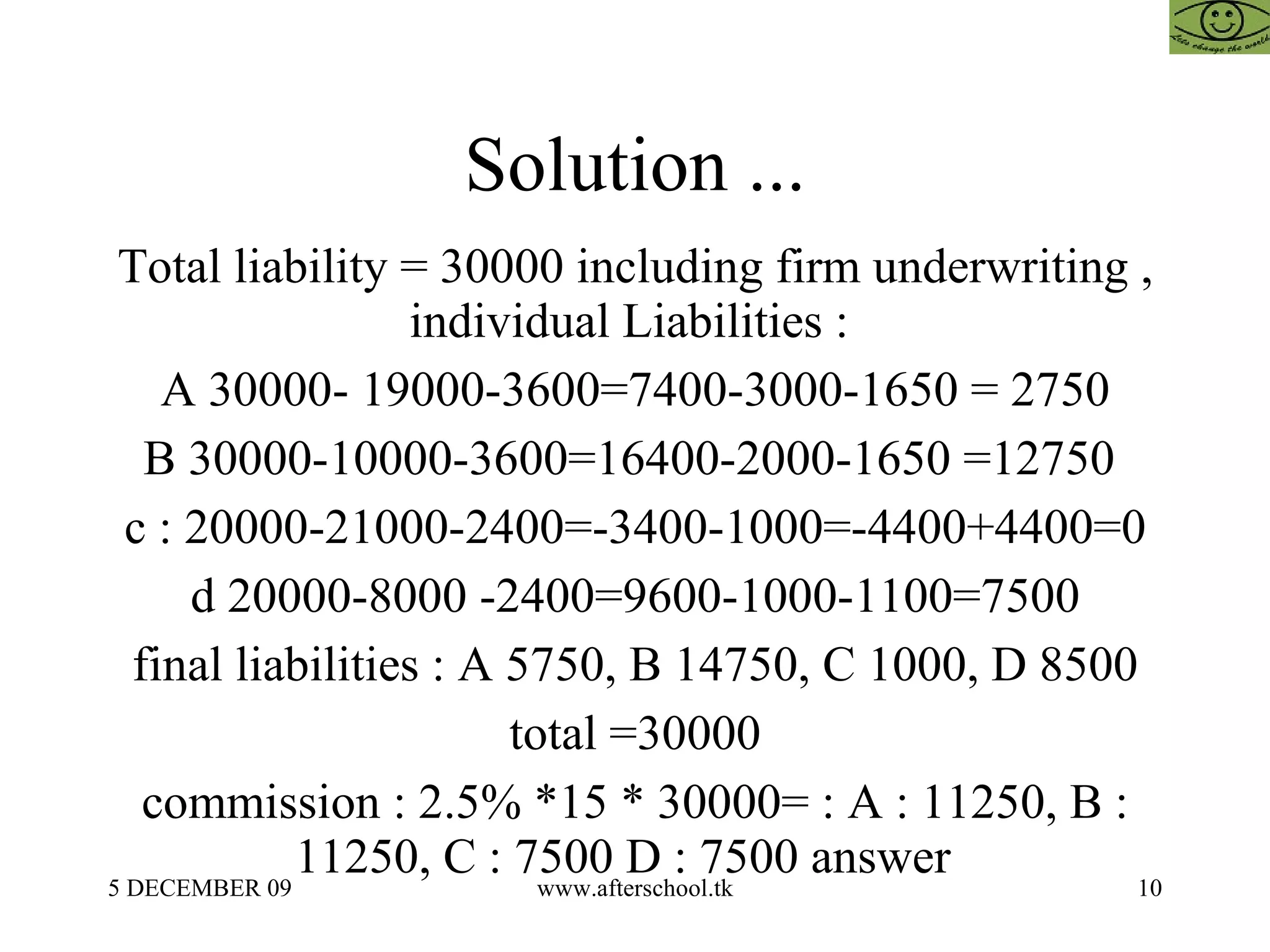

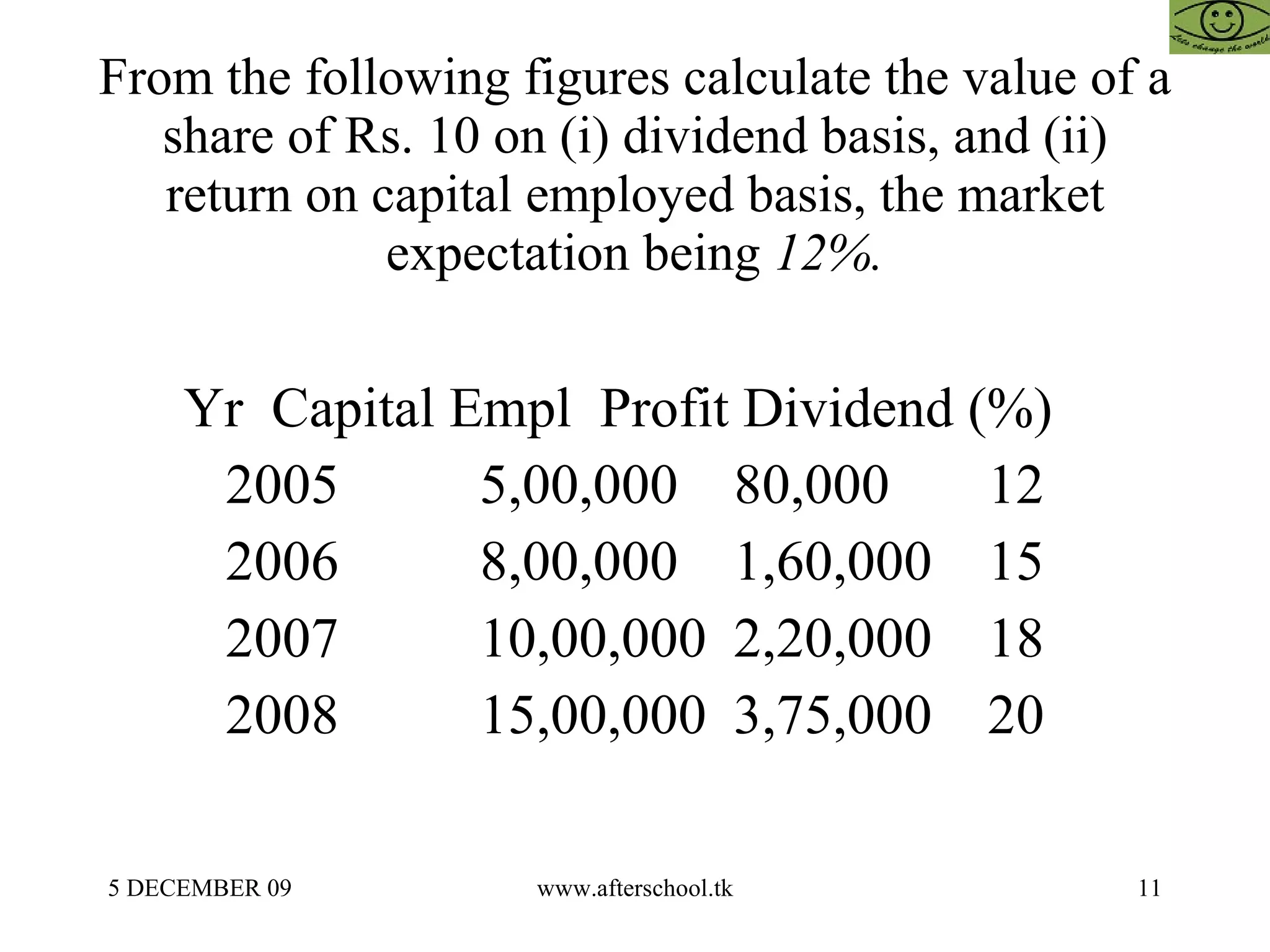

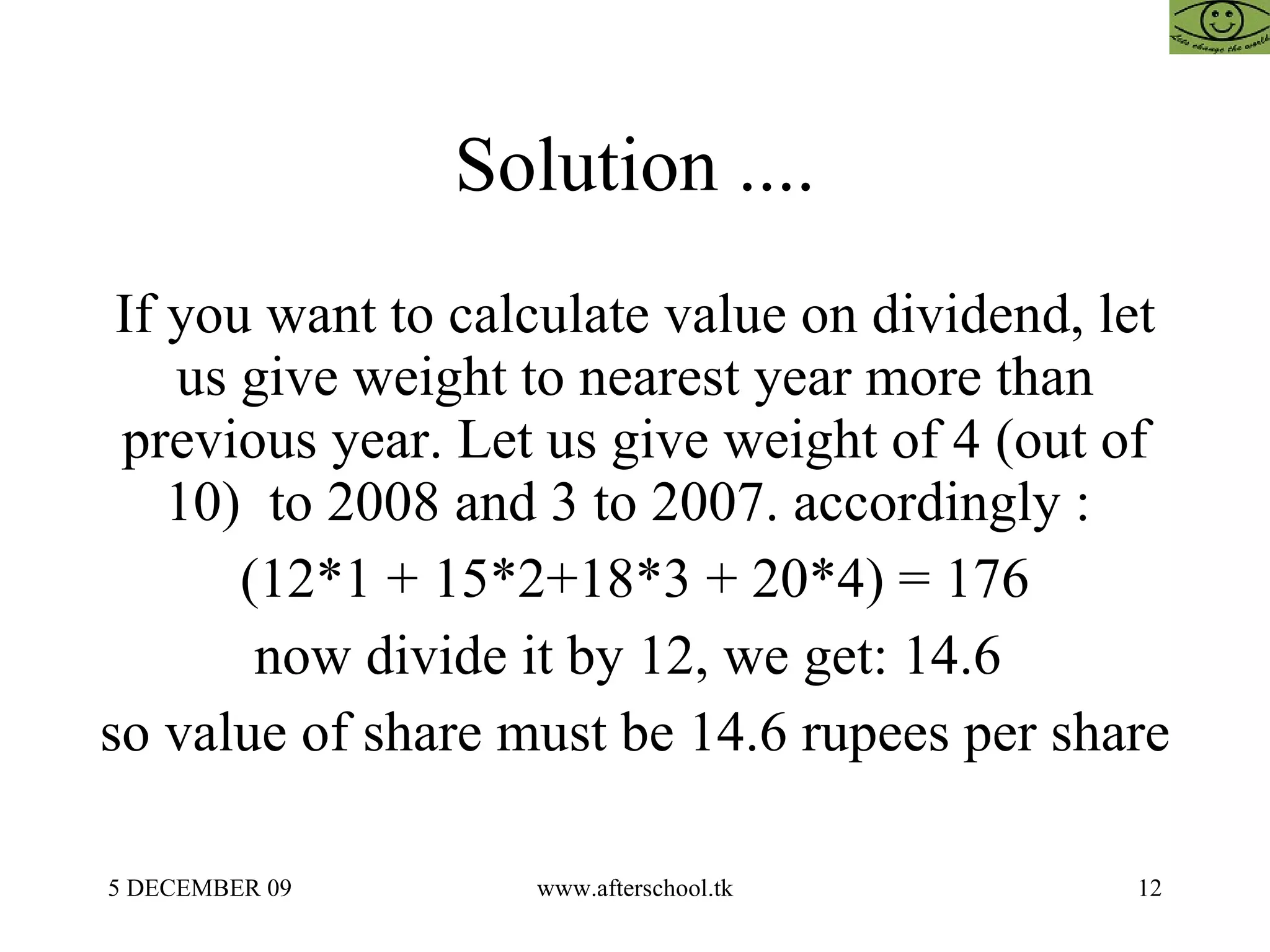

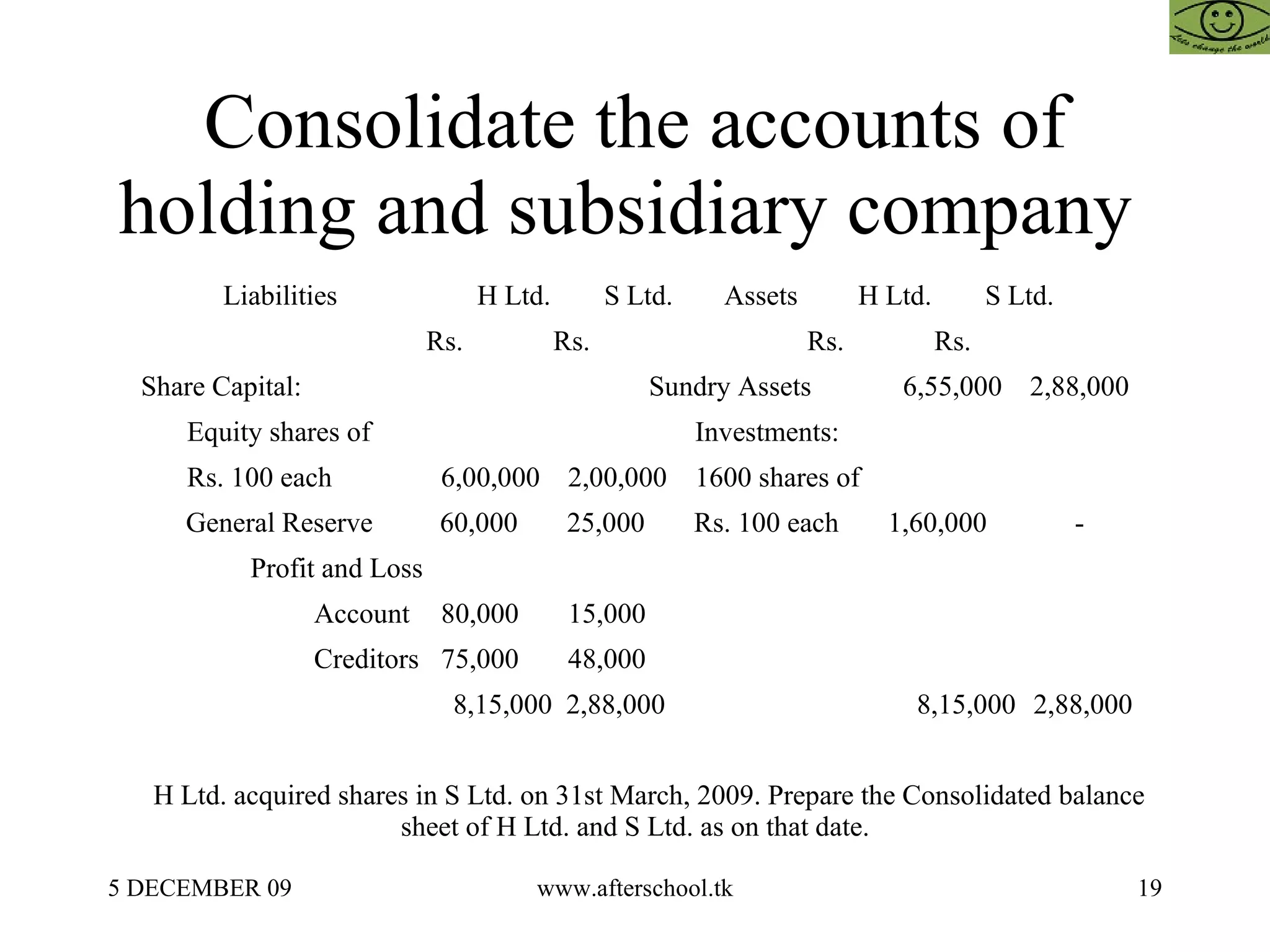

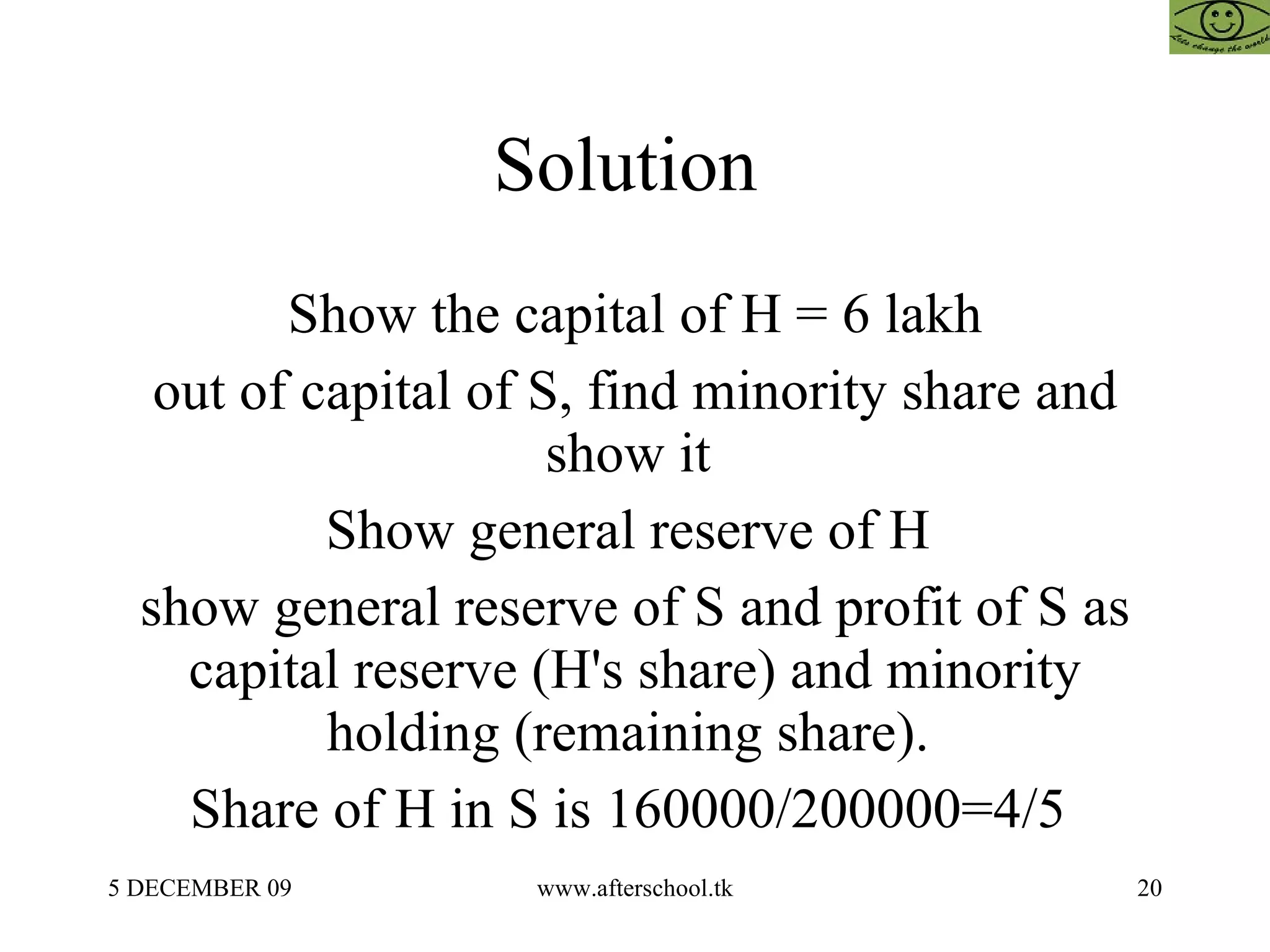

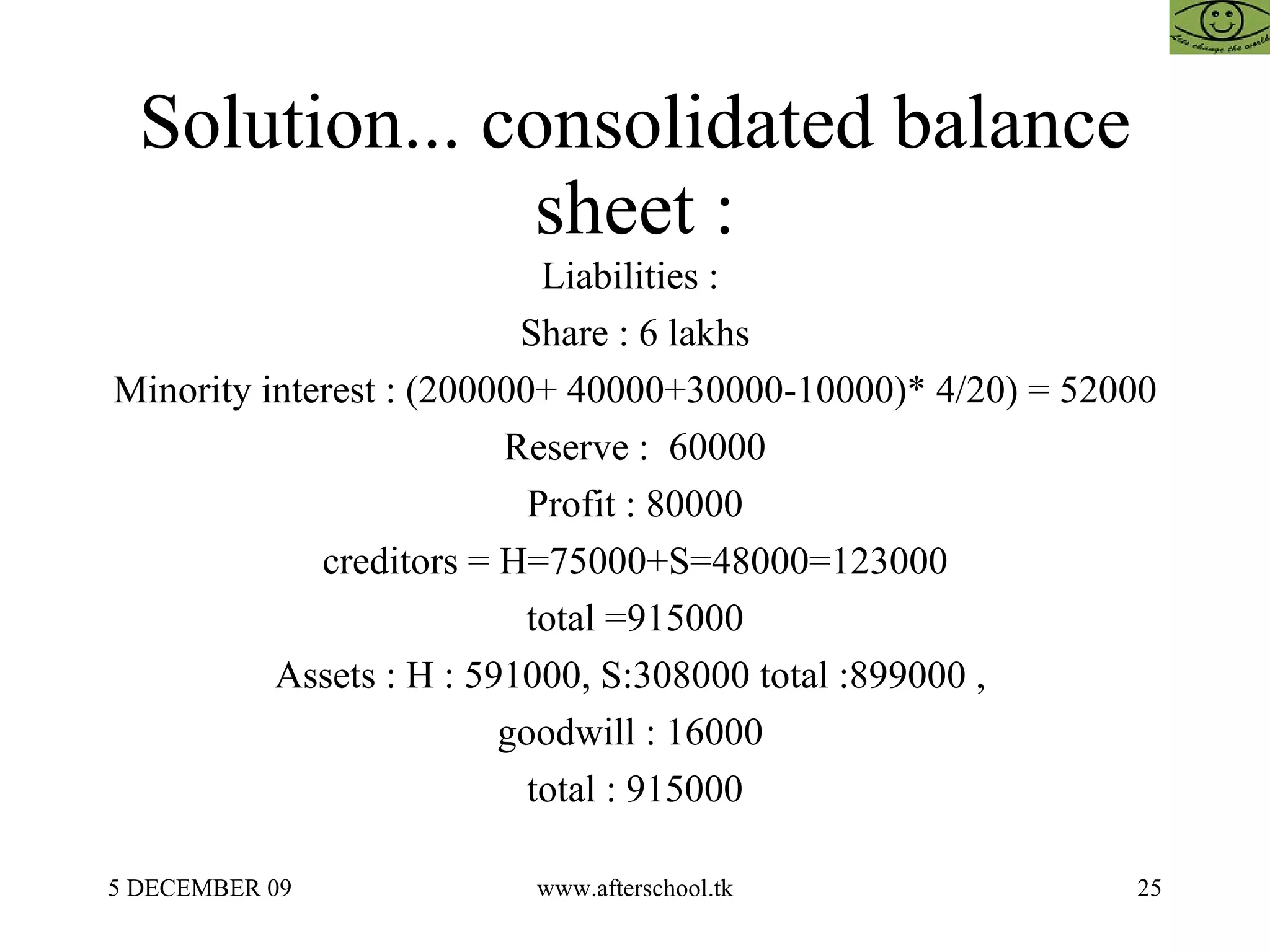

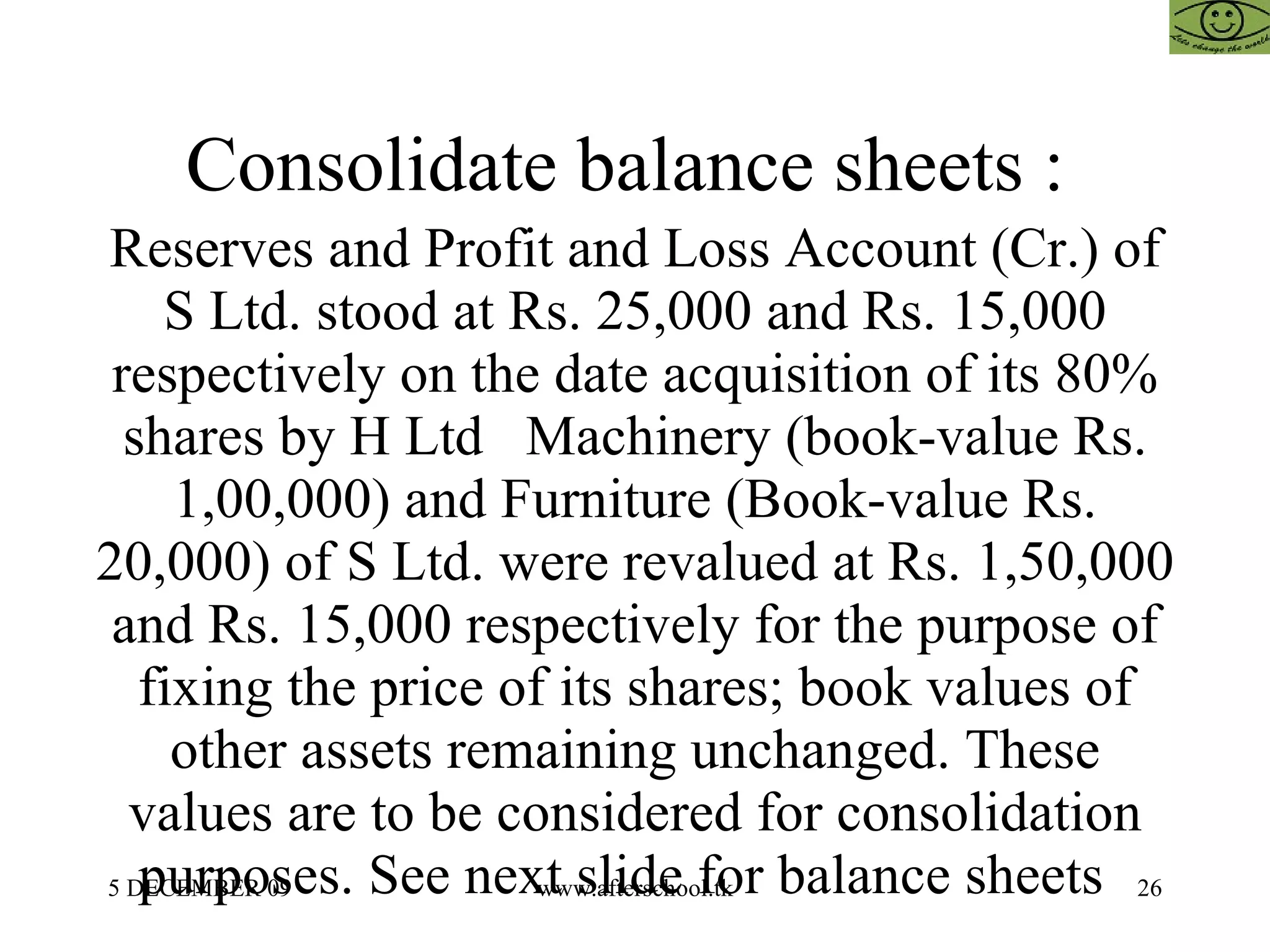

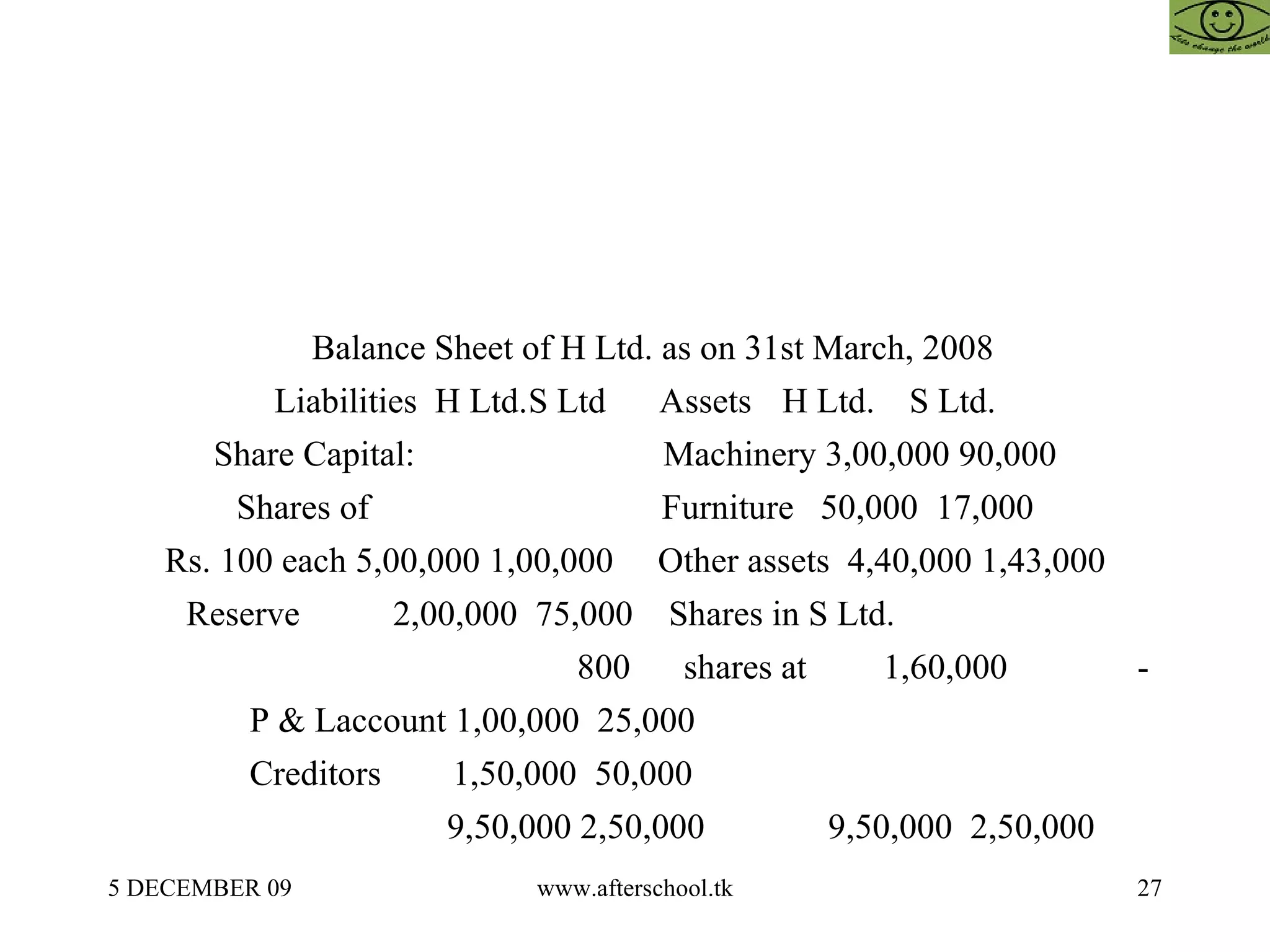

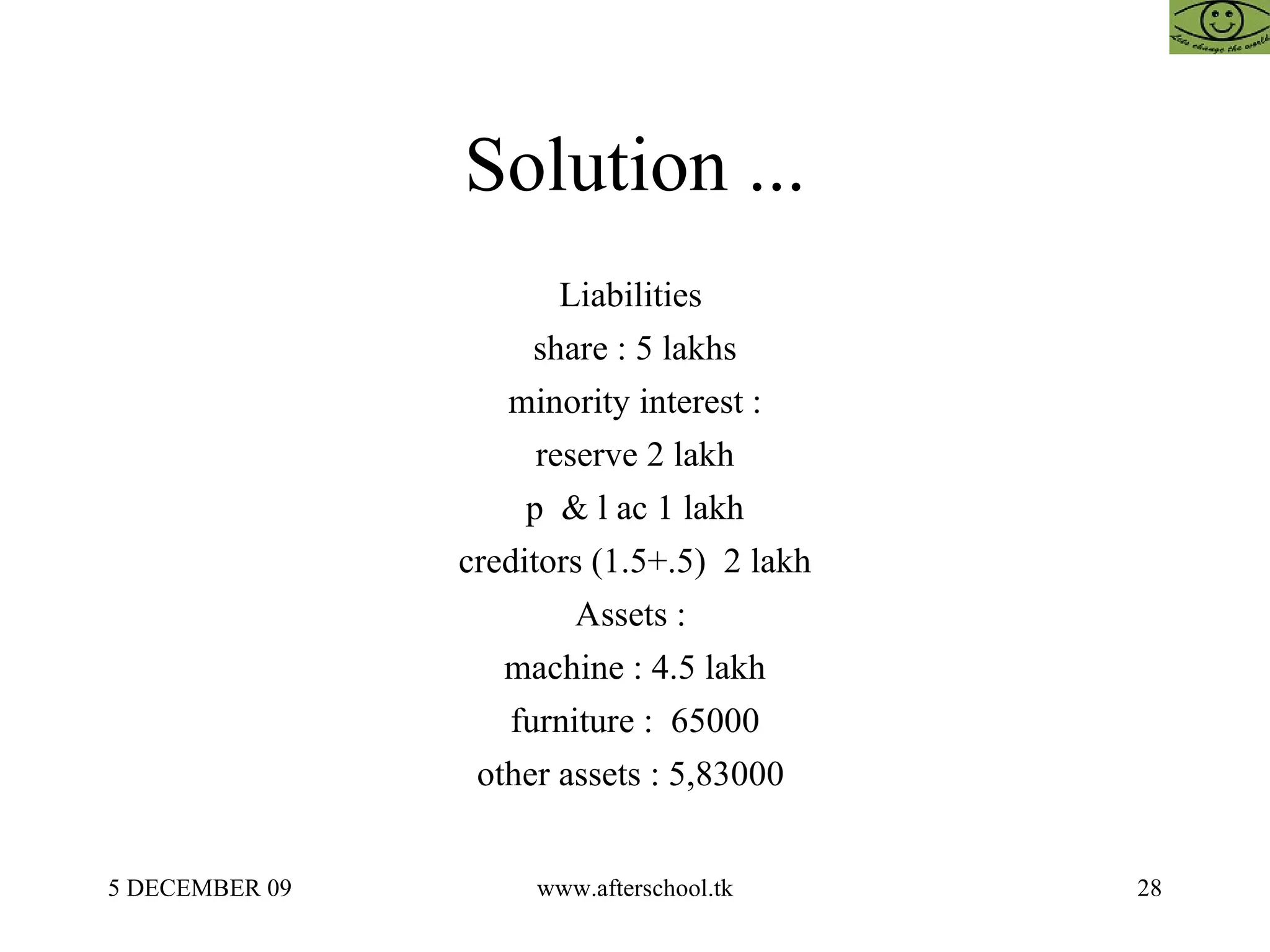

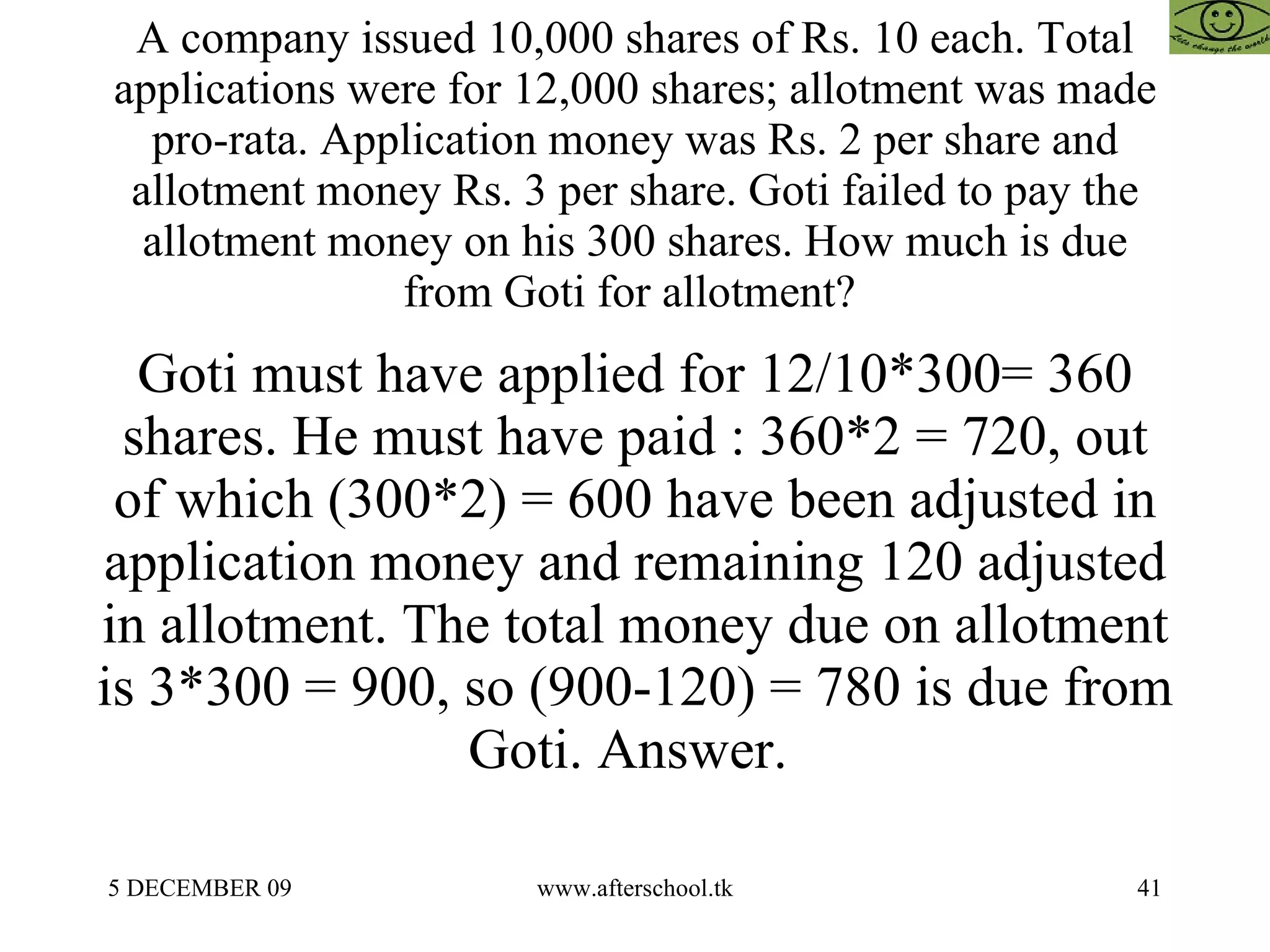

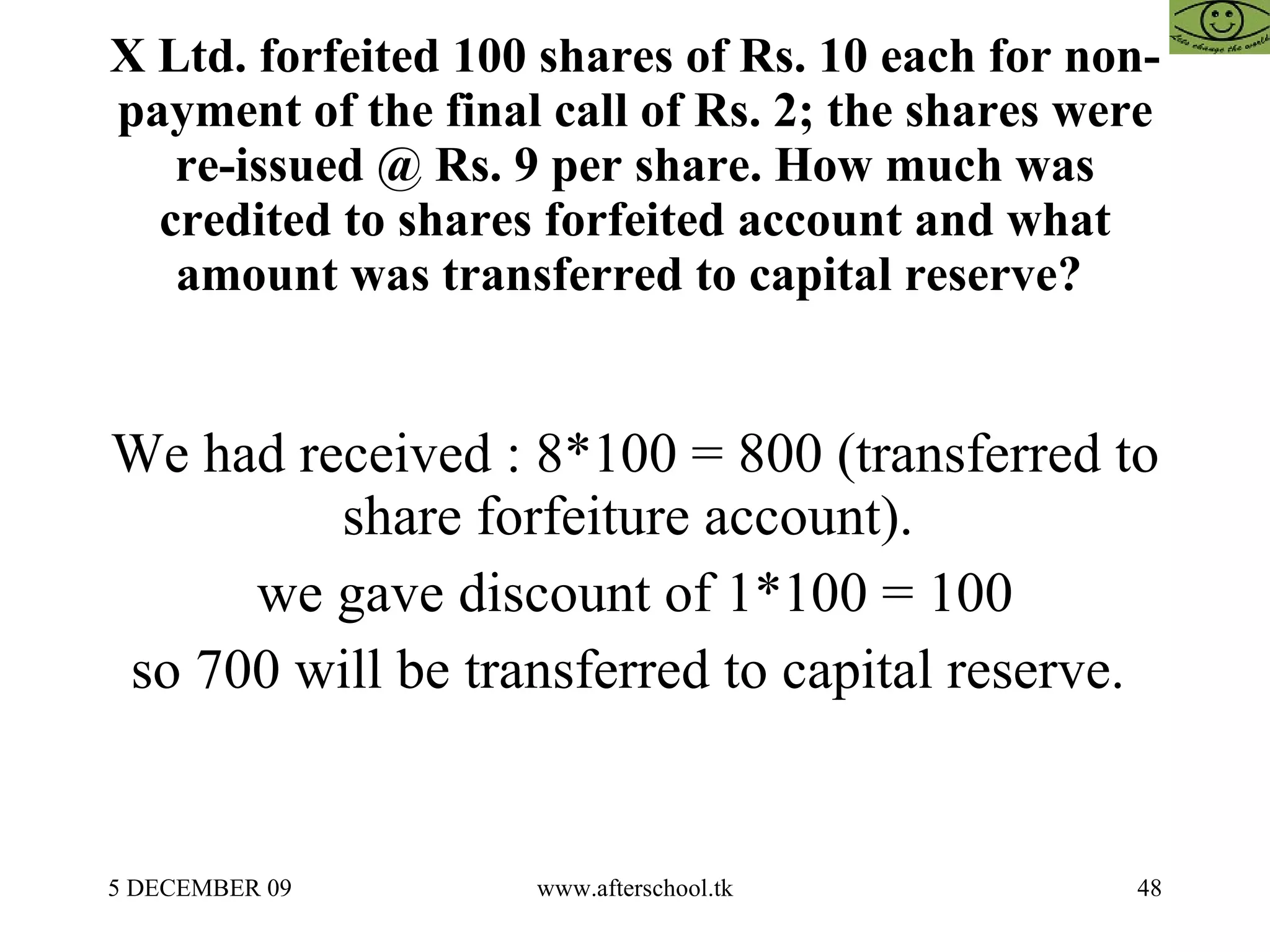

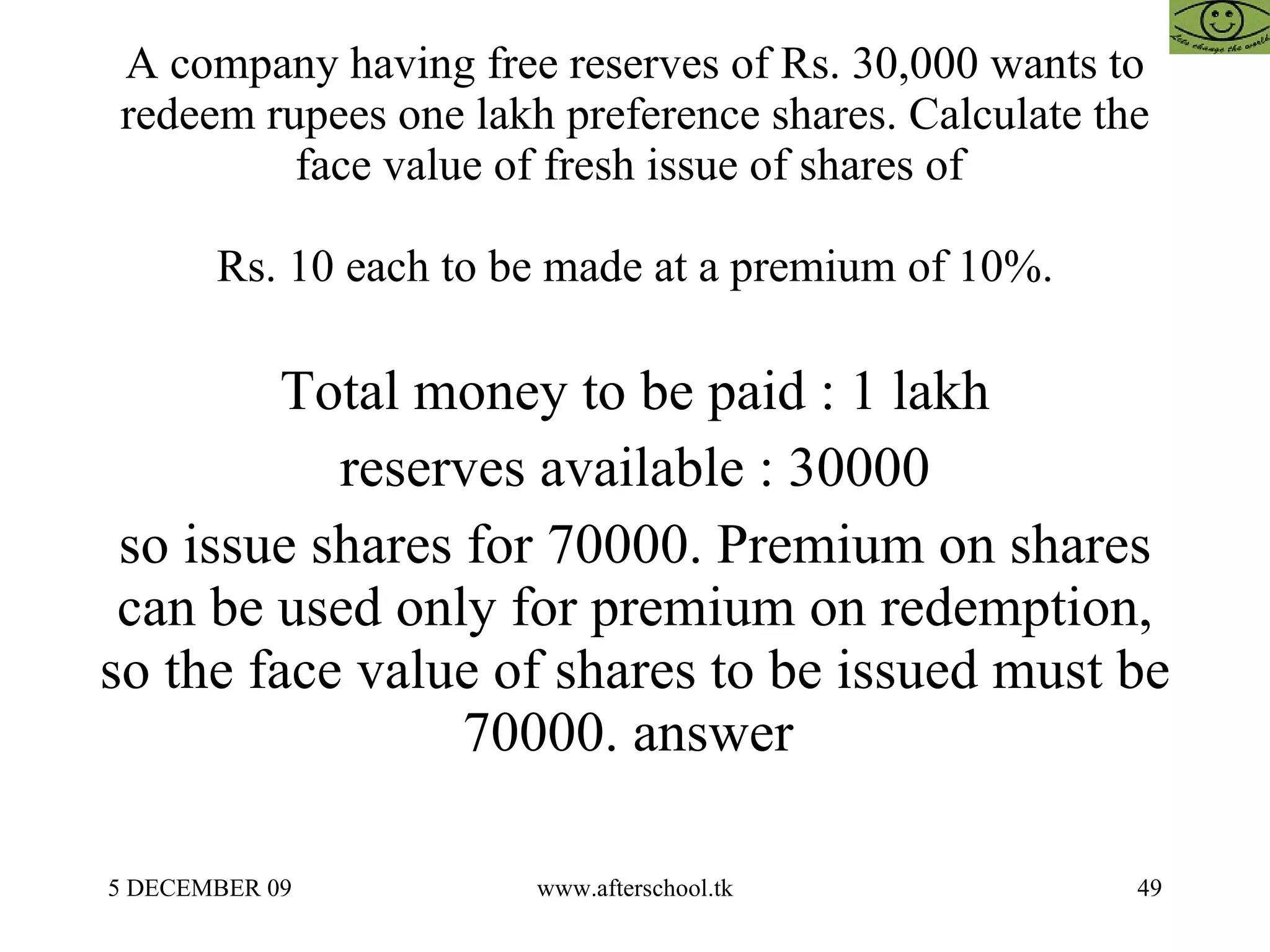

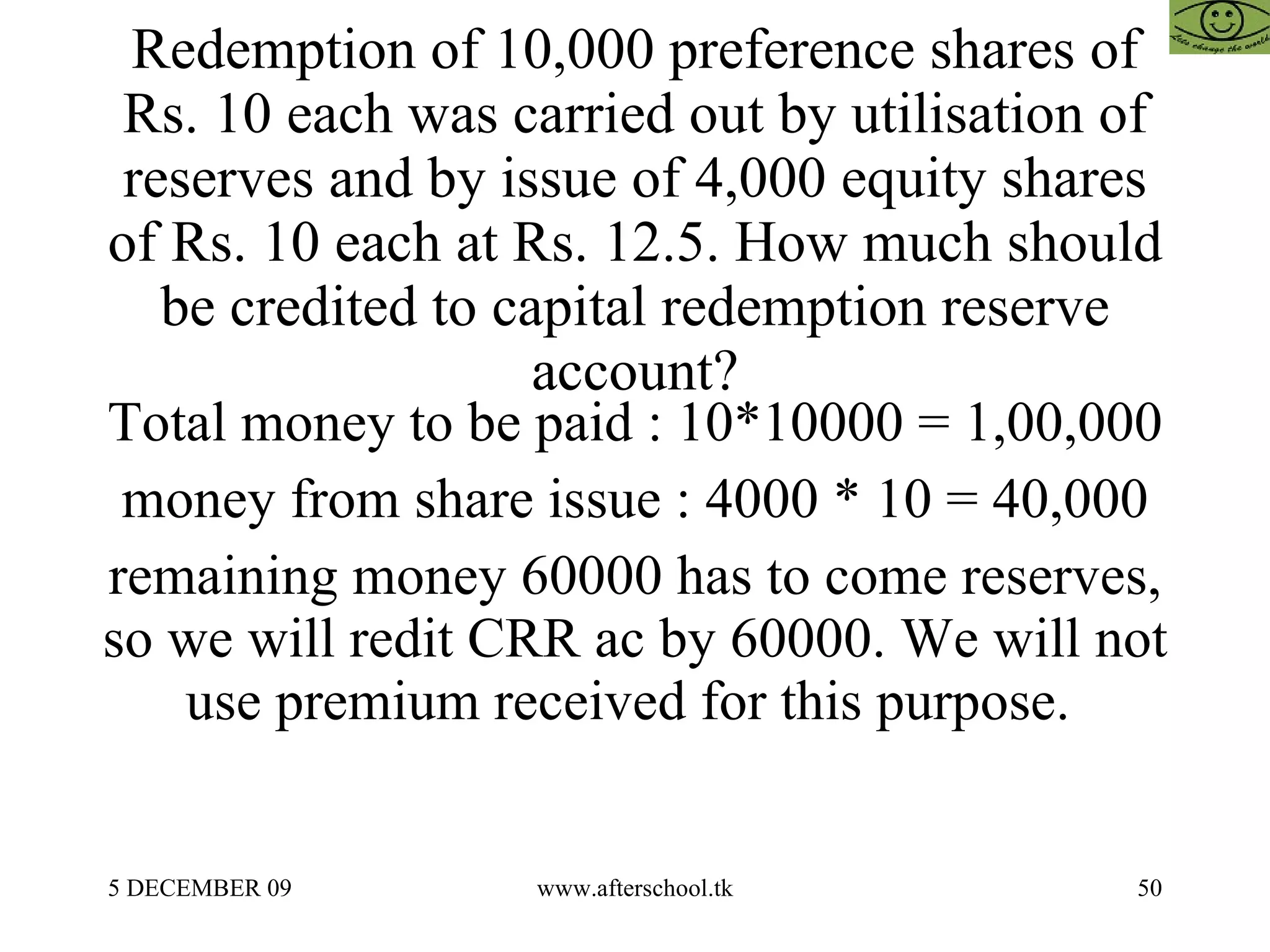

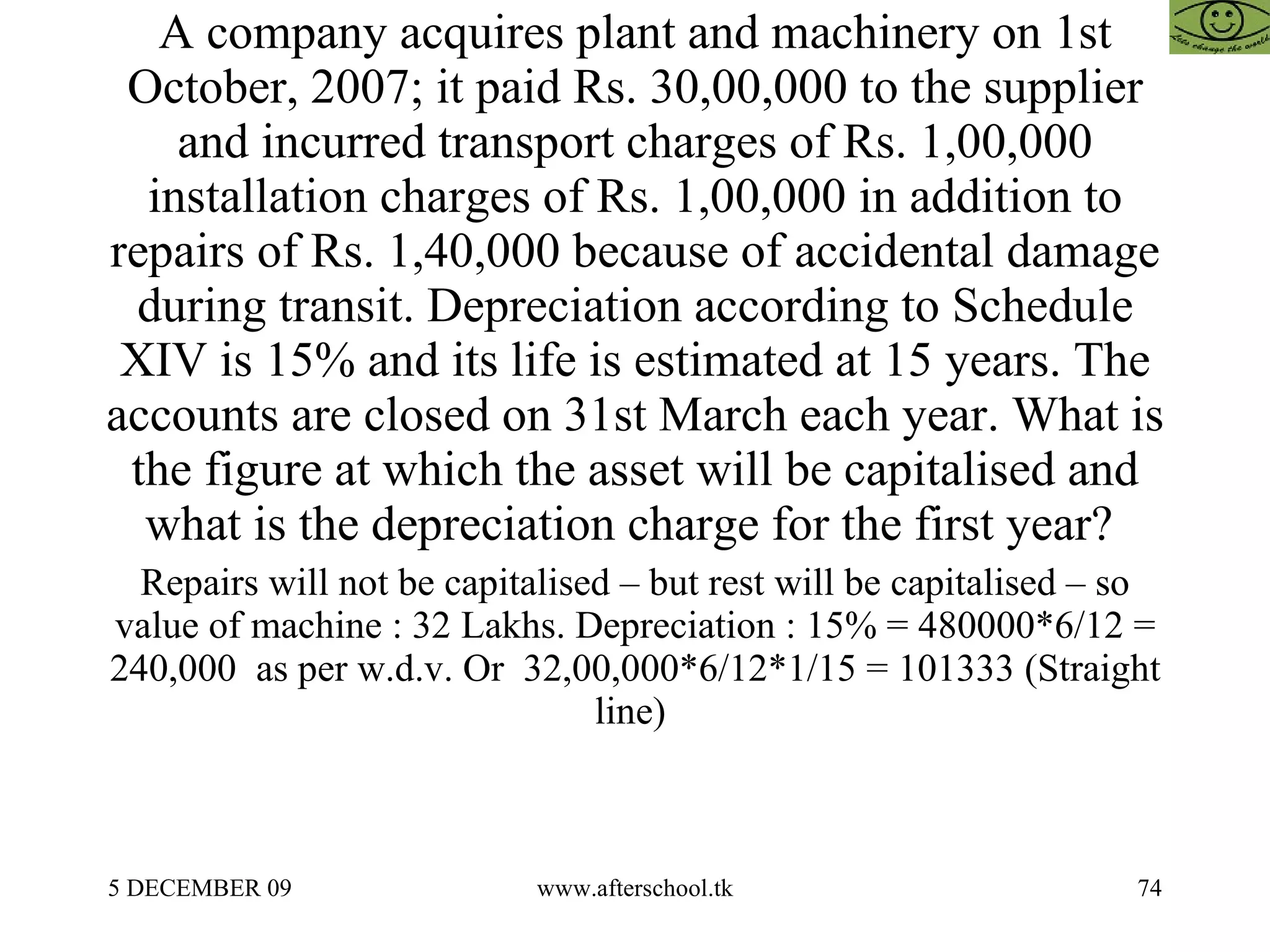

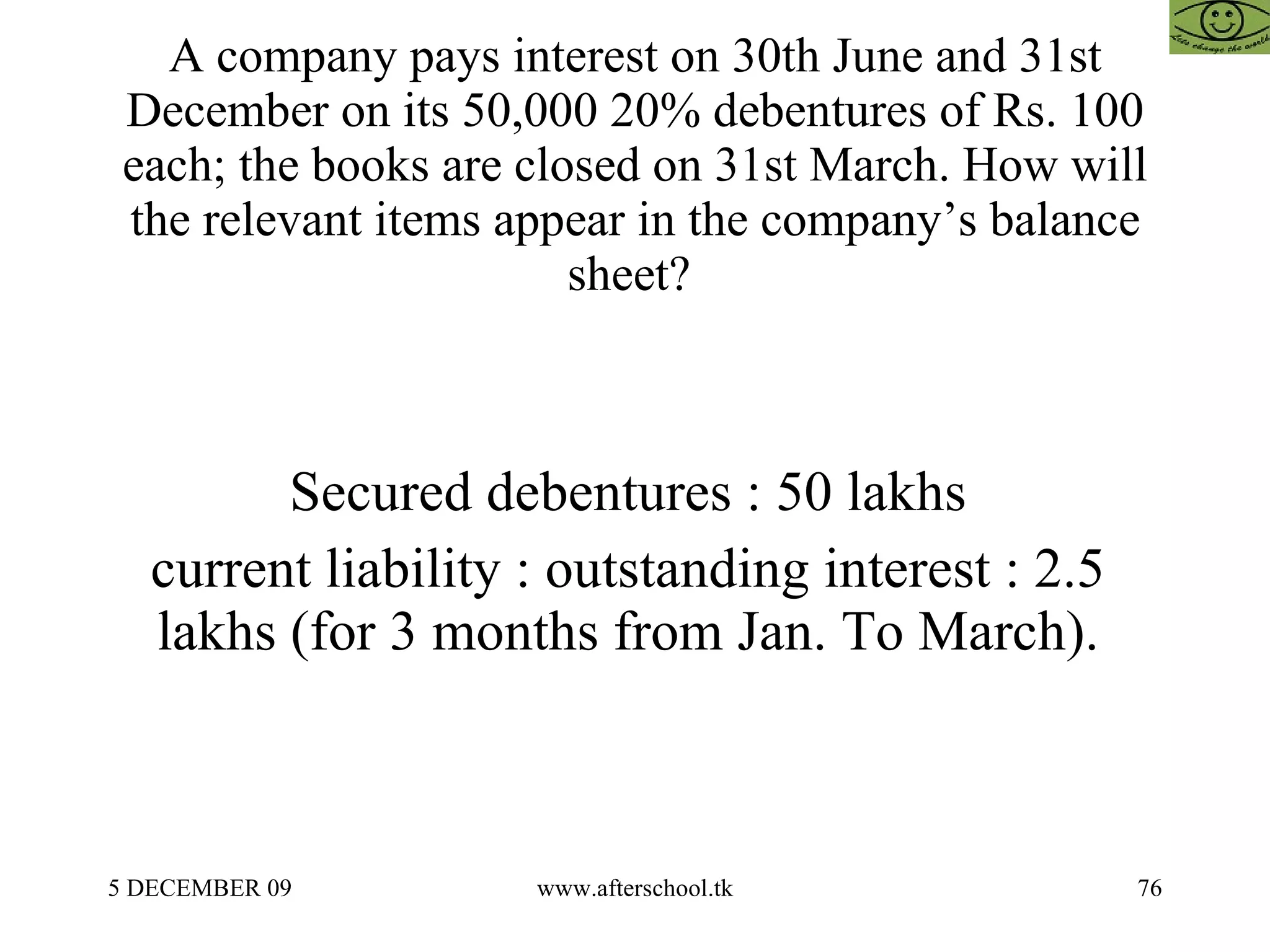

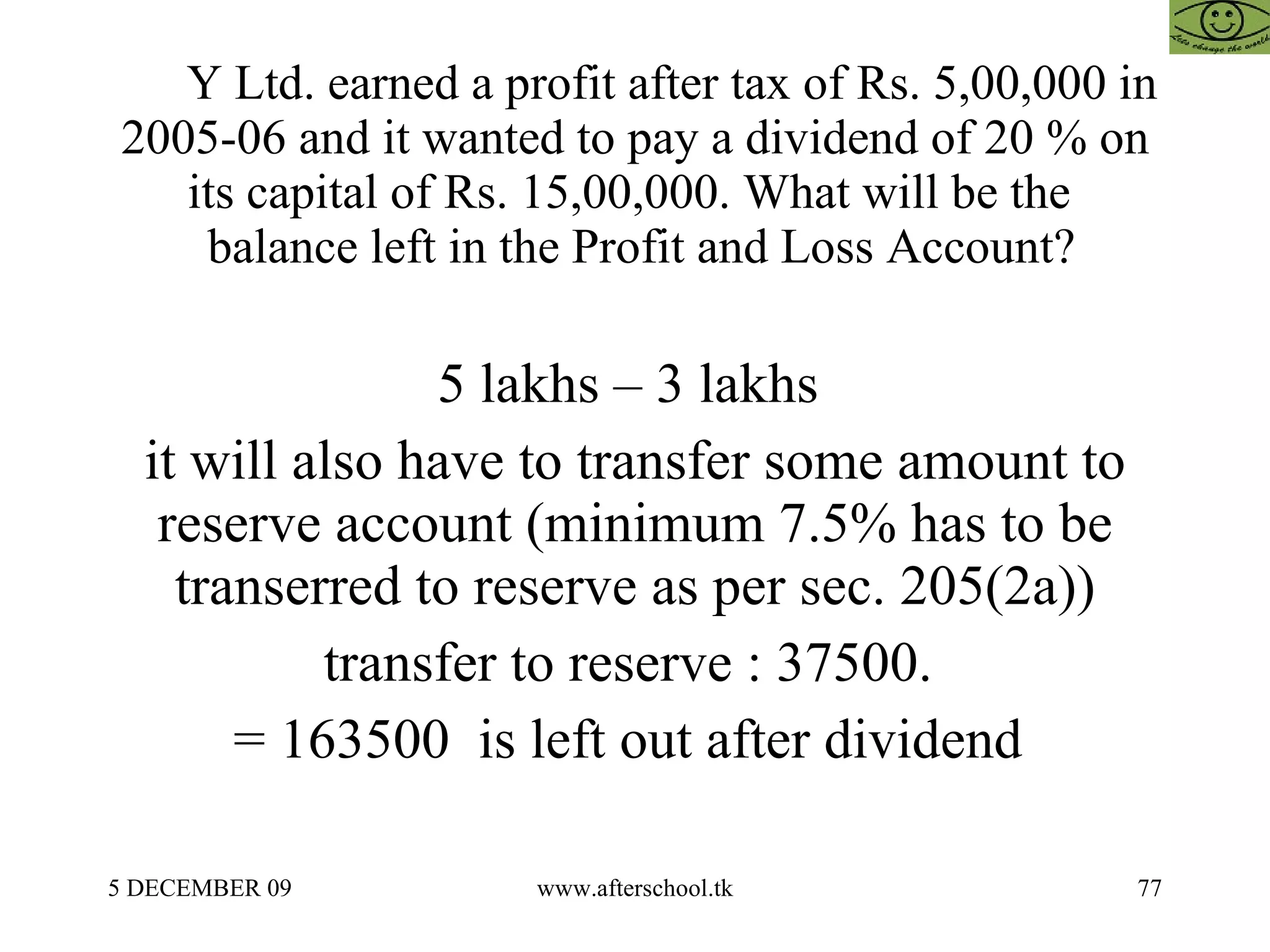

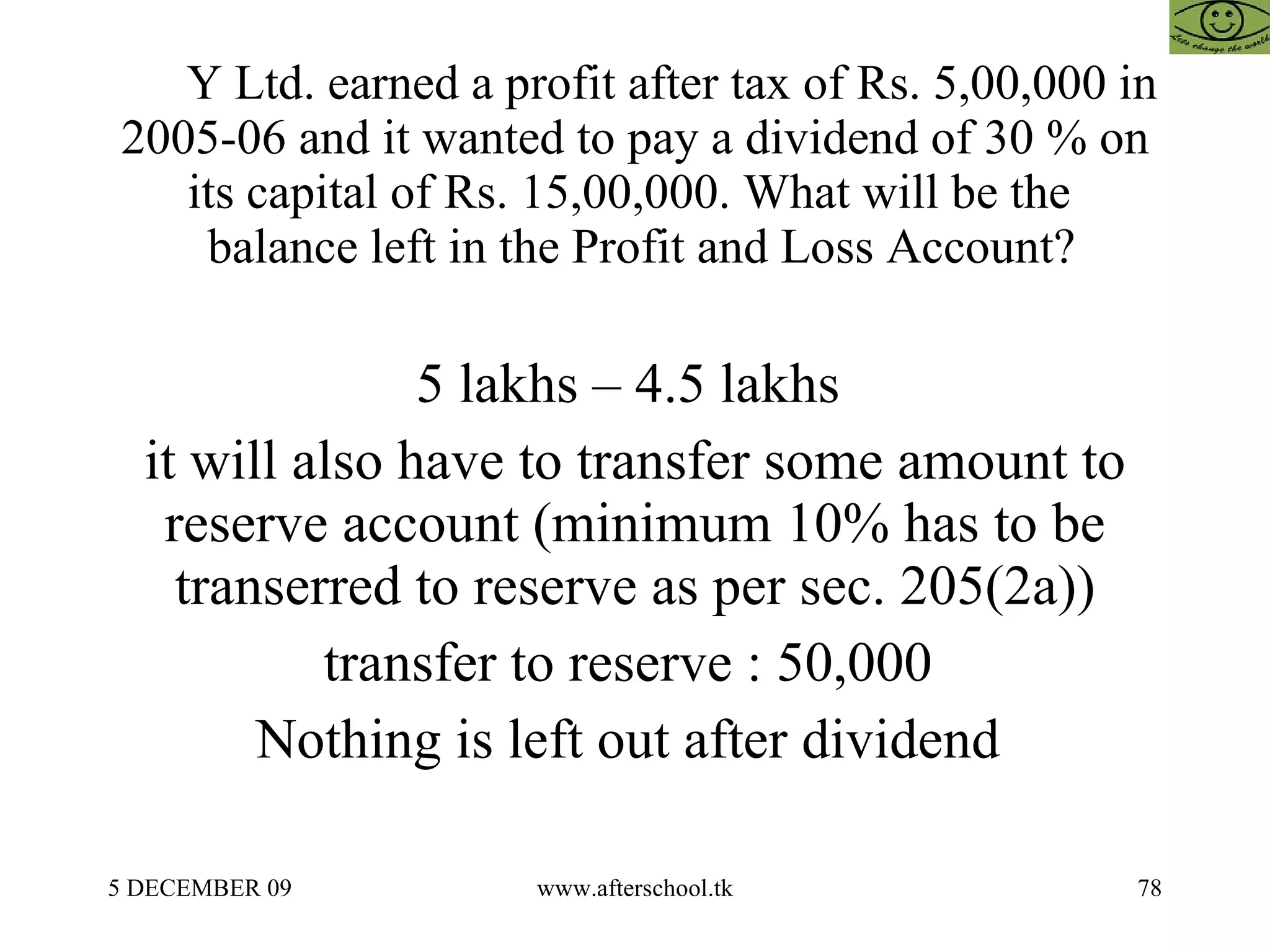

This document provides information and examples about accounting for public companies and underwriting. It discusses concepts like underwriting liability, applications received, marked applications, outstanding shares, and underwriter ratios and liabilities. Multiple examples are provided of calculating underwriter liability given information about shares issued, underwriting percentages, applications received, and marked applications.

![THANKS.... GIVE YOUR SUGGESTIONS AND JOIN AFTERSCHOOOL NETWORK / START AFTERSCHOOOL SOCIAL ENTREPRENEURSHIP NETWORK IN YOUR CITY [email_address] PGPSE – WORLD'S MOST COMPREHENSIVE PROGRAMME IN SOCIAL ENTREPRENEURSHIP](https://image.slidesharecdn.com/accountingforpubliccompanies-100319081028-phpapp02/75/All-About-Shares-How-To-Issue-And-Buy-Back-Them-93-2048.jpg)