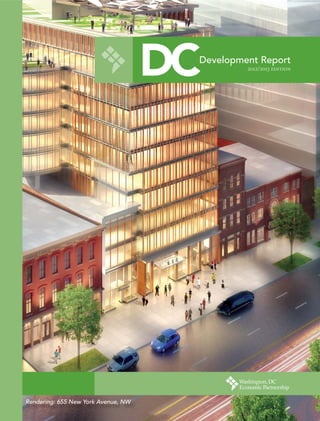

The DC Development Report 2012/2013 provides a comprehensive overview of major development and construction projects in Washington, D.C., highlighting significant growth in residential, office, retail, and education sectors. It notes a thriving economy with job growth and an increase in urban living, driving demand for new development, with projections estimating over 7.8 million square feet of construction by the end of 2012. The report also emphasizes the importance of sustainable development, with numerous LEED-certified projects contributing to the city's evolving real estate landscape.