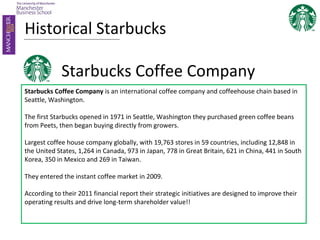

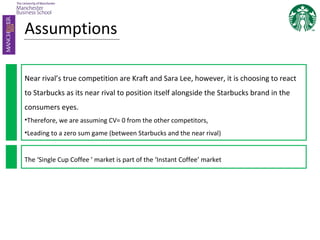

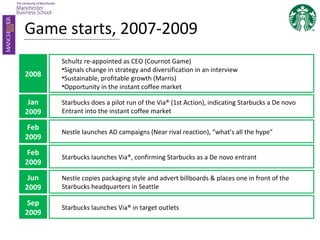

Starbucks entered the instant coffee market in 2009 with the launch of Via, positioning itself as a de novo entrant and signaling a change in strategy under the new CEO Howard Schultz. Nestle, the near rival, reacted aggressively through advertising campaigns and copying Starbucks' packaging. From 2010 to 2012, the two companies engaged in competitive moves like expanding operations and launching new products, with Nestle signaling a cost leadership approach. Starbucks indicated it would introduce a new coffee machine, while still seeking a non-Green Mountain partnership for single-cup options. The document analyzes the economic interaction between Starbucks and Nestle as they compete in the growing single-cup coffee market.