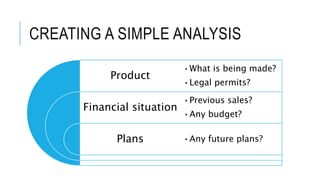

This document provides guidance on helping entrepreneurs start and manage businesses through microfinancing. It outlines four key steps: 1) conducting a business analysis, 2) developing a minimum viable product, 3) providing a loan to fund the business based on a created budget, and 4) ongoing financial tracking and business management. Emphasis is placed on understanding the entrepreneurs' situations, starting small with an MVP before full production, and conservative financial planning to help the businesses succeed.