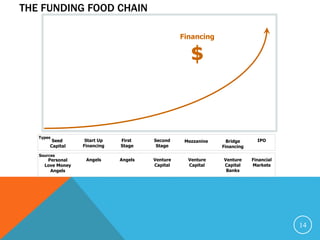

Entrepreneurs obtain funding from four main sources:

1. Their own money through personal contributions as owners' equity or loans.

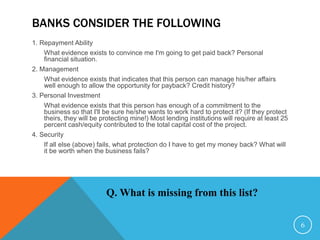

2. Debt financing such as bank loans that provide cash upfront in exchange for later repayment with interest.

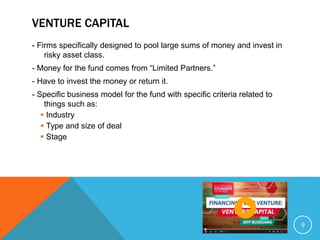

3. Equity financing whereby investors provide cash in exchange for ownership of the business, including angel investors, venture capital, or public stock offerings.

4. Bootstrapping, which involves piecing together financing from numerous small sources without outside investment, such as leveraging personal savings, customer payments, and strategic partnerships.