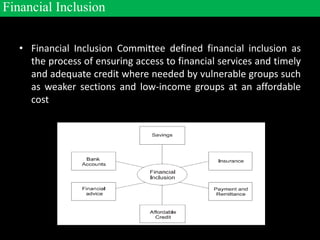

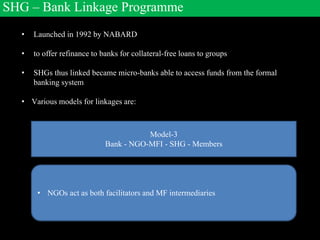

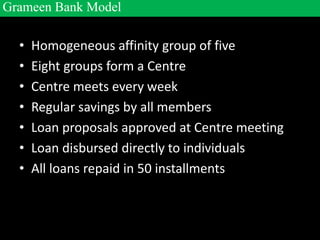

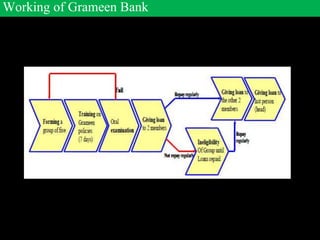

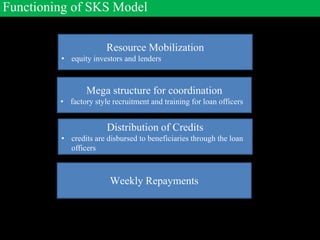

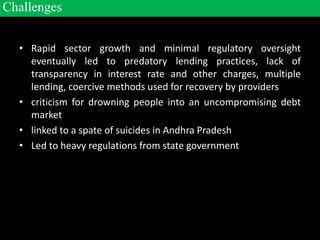

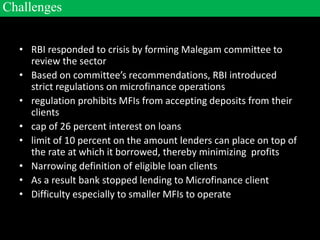

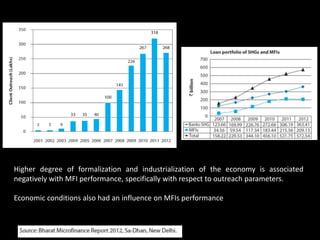

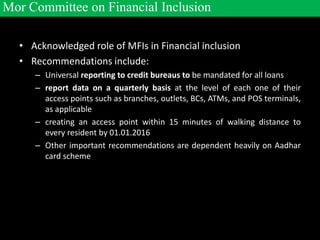

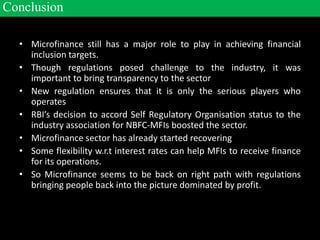

The document discusses the role of microfinance in promoting financial inclusion, particularly for vulnerable groups in India who lack access to formal banking services. It outlines various microfinance models, challenges faced by the sector including predatory lending practices and regulatory responses, and highlights the importance of transparency and regulation in restoring trust in microfinance institutions. The document concludes that, despite challenges, microfinance remains crucial for achieving financial inclusion and has started to recover under new regulations.