White label ATMs are those without bank logos, operated by non-bank entities licensed by the RBI to enhance financial inclusion in India. They offer convenience to customers and help banks reduce operational costs, but face challenges such as low transaction volumes and high operating expenses. Despite the potential for financial inclusion, many white label ATMs struggle to be profitable due to competition and operational difficulties.

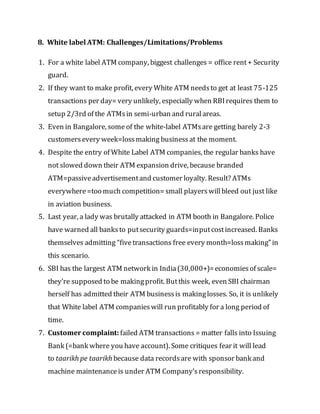

![5. Howdoes White Label ATM help in financial inclusion?

RBIrequires White label-ATM companiesto install machines in the ratio of

Two ATMsin (tier 3 to 6 place) : One ATM in (tier 1-2 place).

Center city census

definition:population is

White Label ATM

Metropolitan Tier 1 10 lakh and above if company wantsto Setup

ONE ATM here,

Urban 1 lakh and above

Semi-Urban Tier 2 50,000 to 99,999

Tier 3 20,000 to 49,999 Then, company mustinstall

TWO ATMshere.

Tier 4 10,000 to 19,999

Rural Tier 5 5,000 to 9,999

Tier 6 Less than 5,000.

For example, RBIhas permitted Tata to deploy 15000Whitelabel ATMs.

Meaning[2/(2+1)] x15000 = 10,000 ATMswillbesetup in the ruraland

semi-urban areas. = more access to ATM= financialinclusion

6. Facilities at white label ATM

1. Any customer from belonging to any bank, can useit.

2. Every month, Five transactions are free.](https://image.slidesharecdn.com/whitelabelatm-150930024736-lva1-app6892/85/Whitelabel-atm-5-320.jpg)