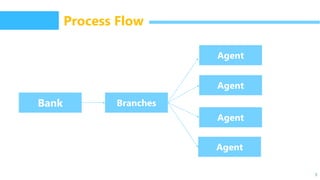

Agent banking allows banks to provide limited banking services to underserved populations through engaged agents under an agency agreement. It involves agents providing services like cash deposits, withdrawals, utility bill payments, and local fund transfers on behalf of banks. The process involves branches contracting with agents who then provide services to customers. Benefits include increased access through more locations and flexible hours, while limitations are that agents cannot perform tasks like approving loans or dealing in foreign currency. In Bangladesh, 12 banks are licensed for agent banking and four have active operations, helping expand access to formal banking for the 62% of the population currently underserved.