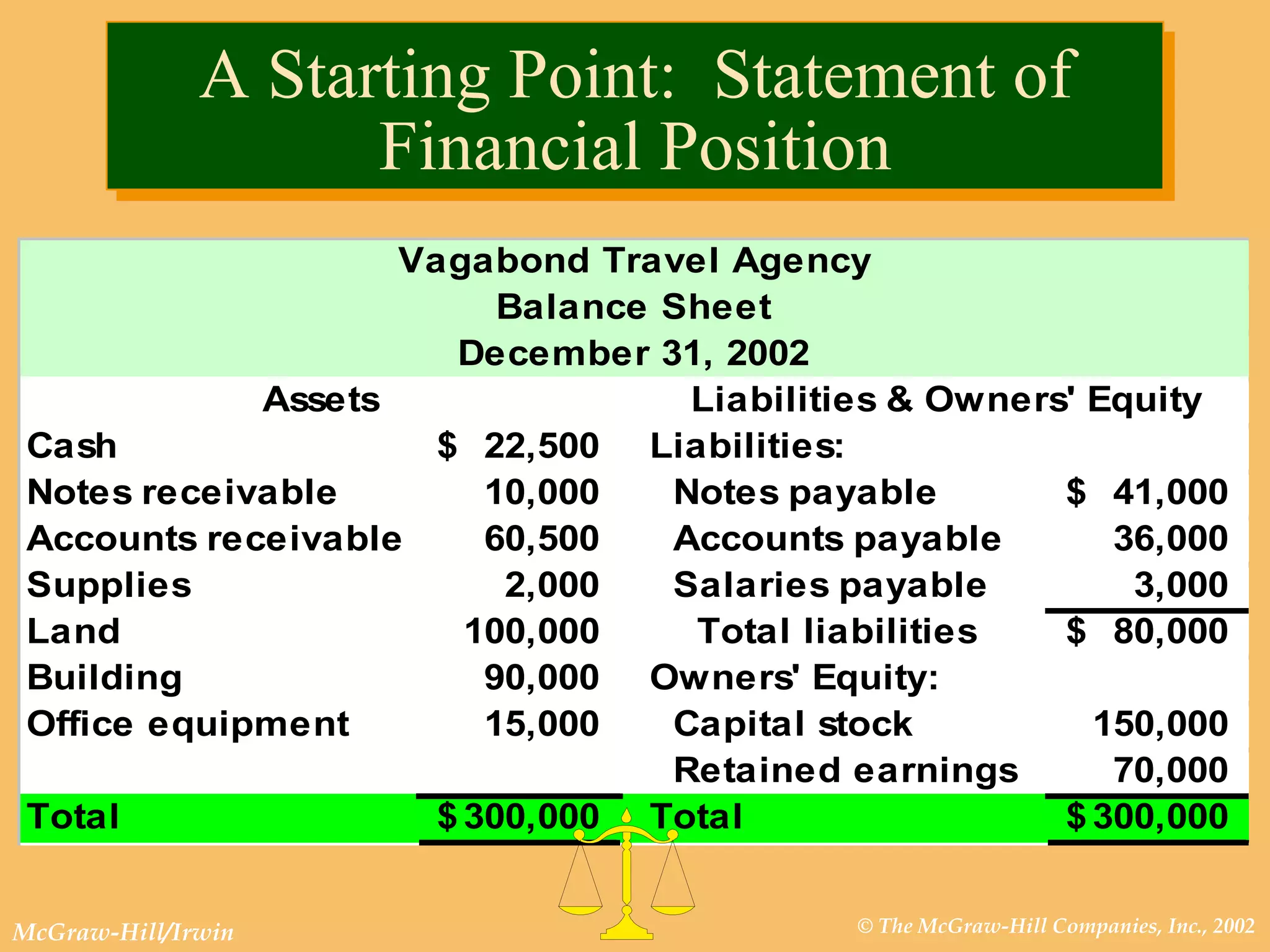

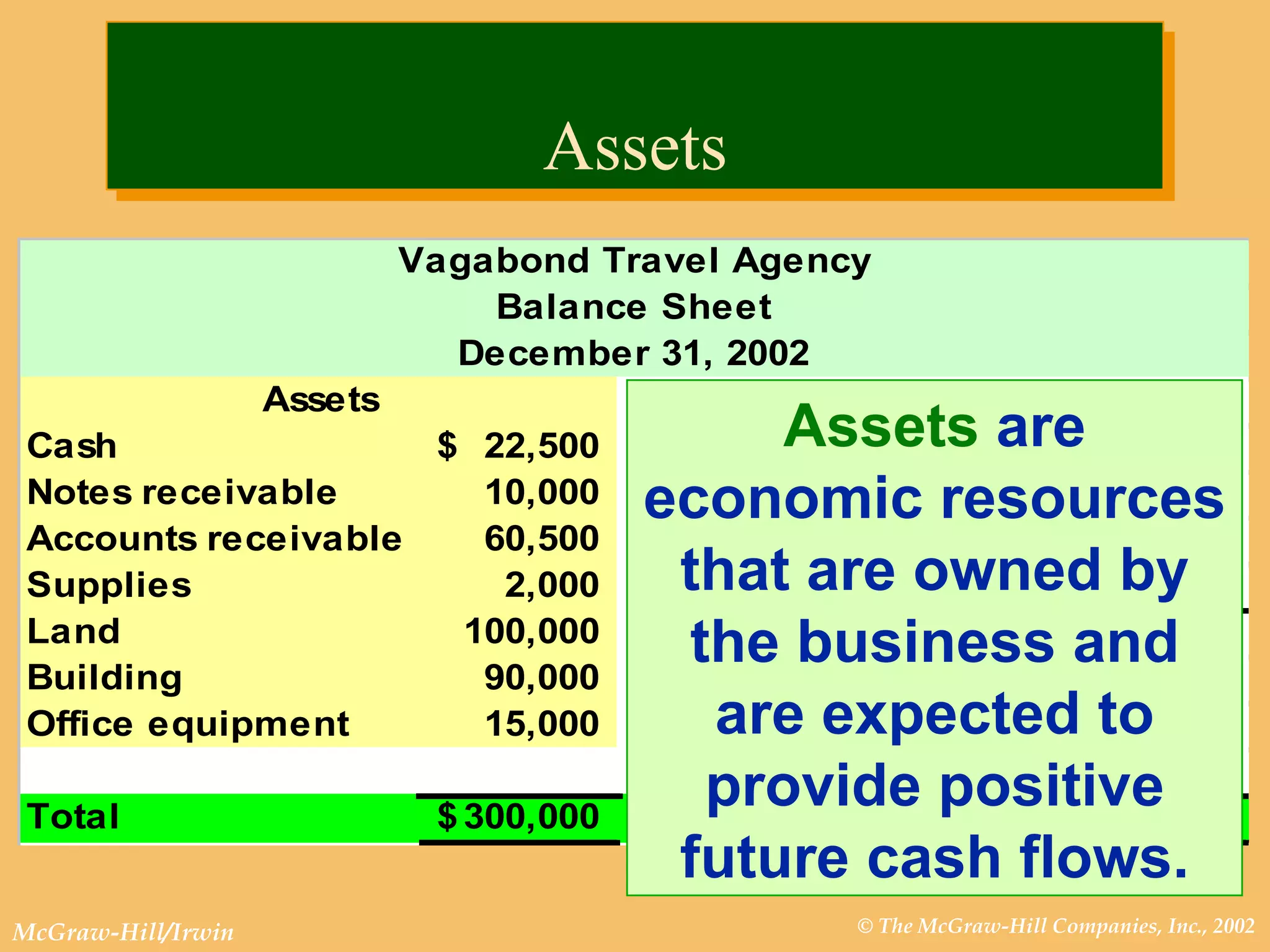

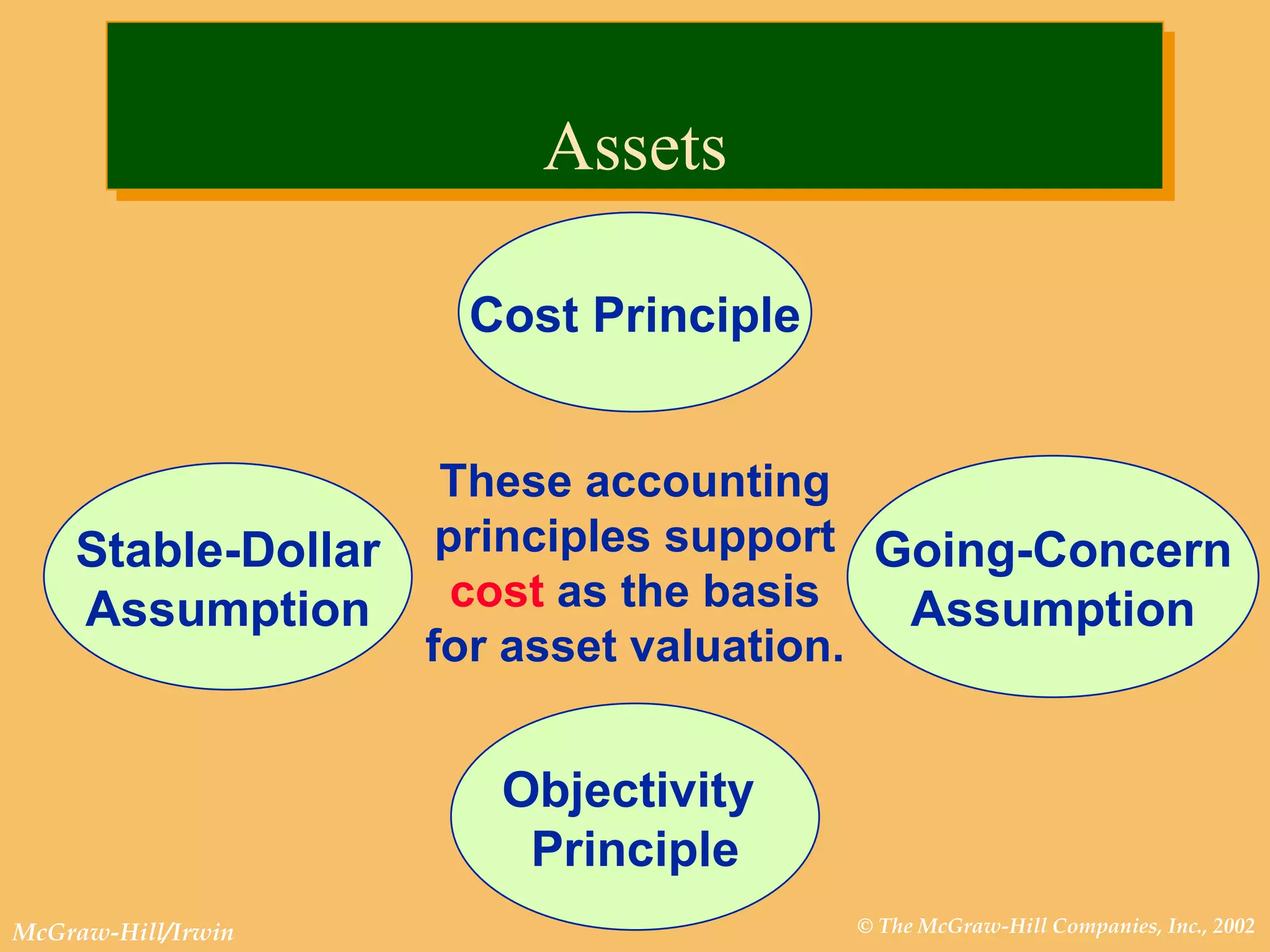

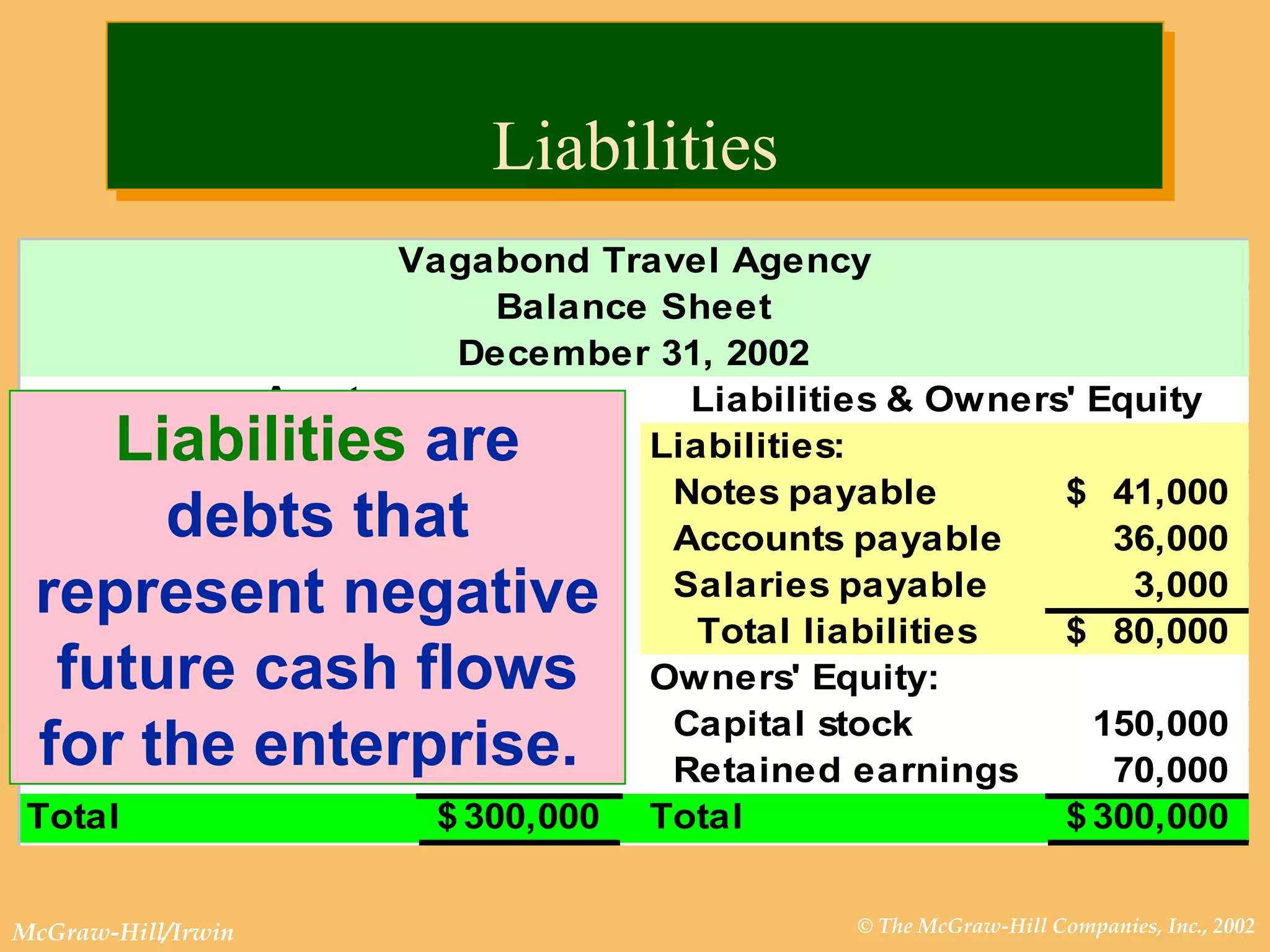

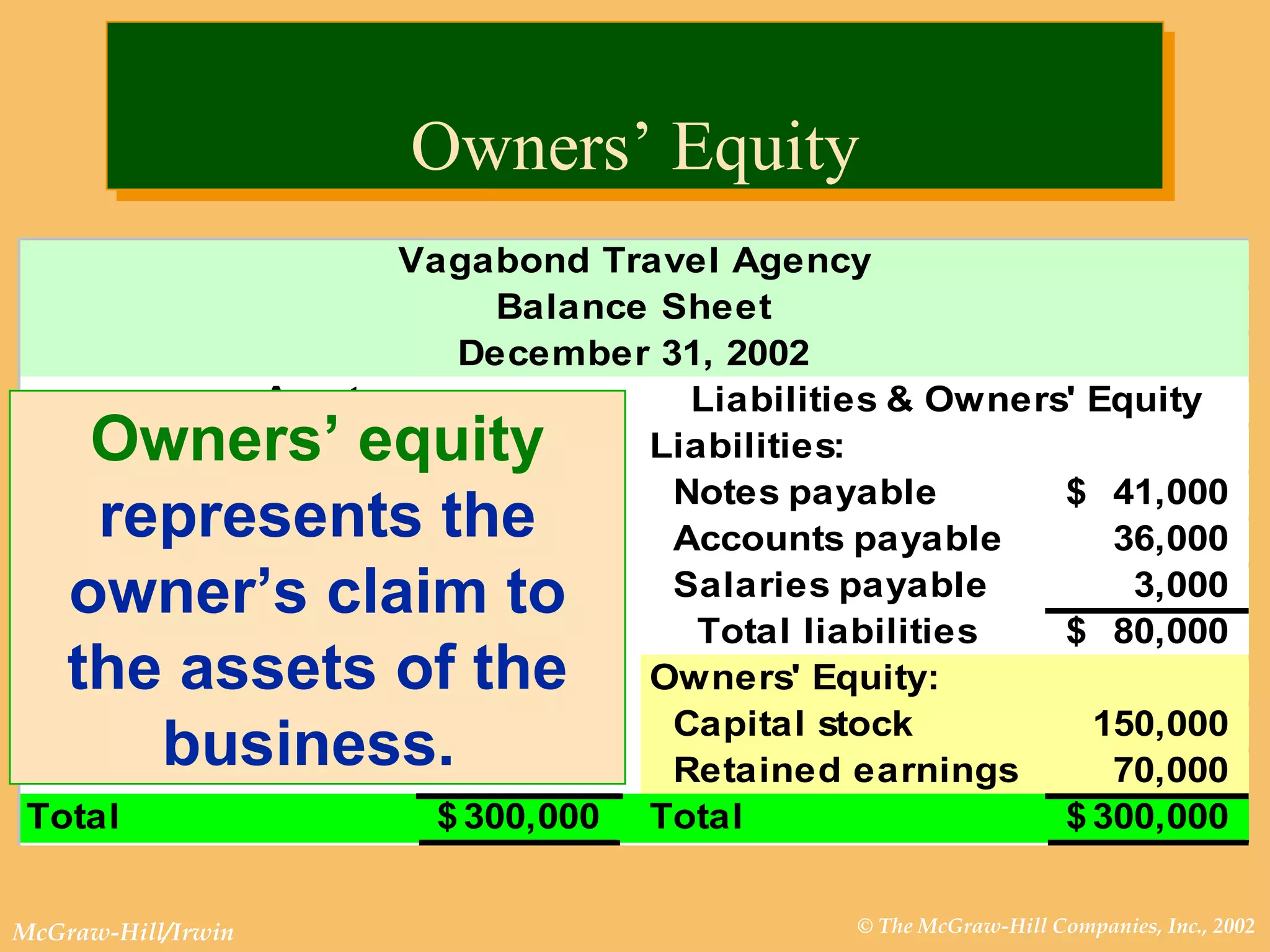

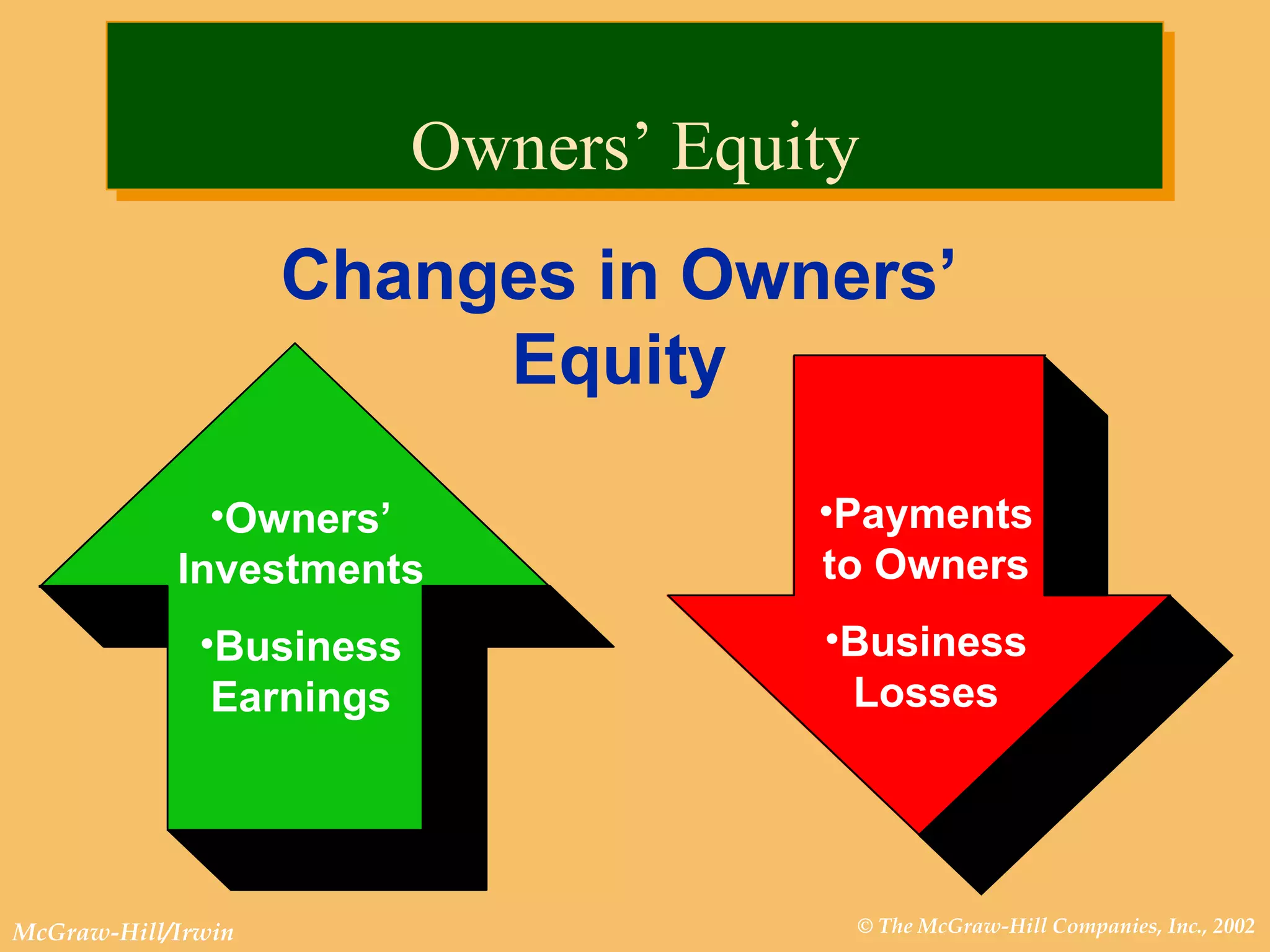

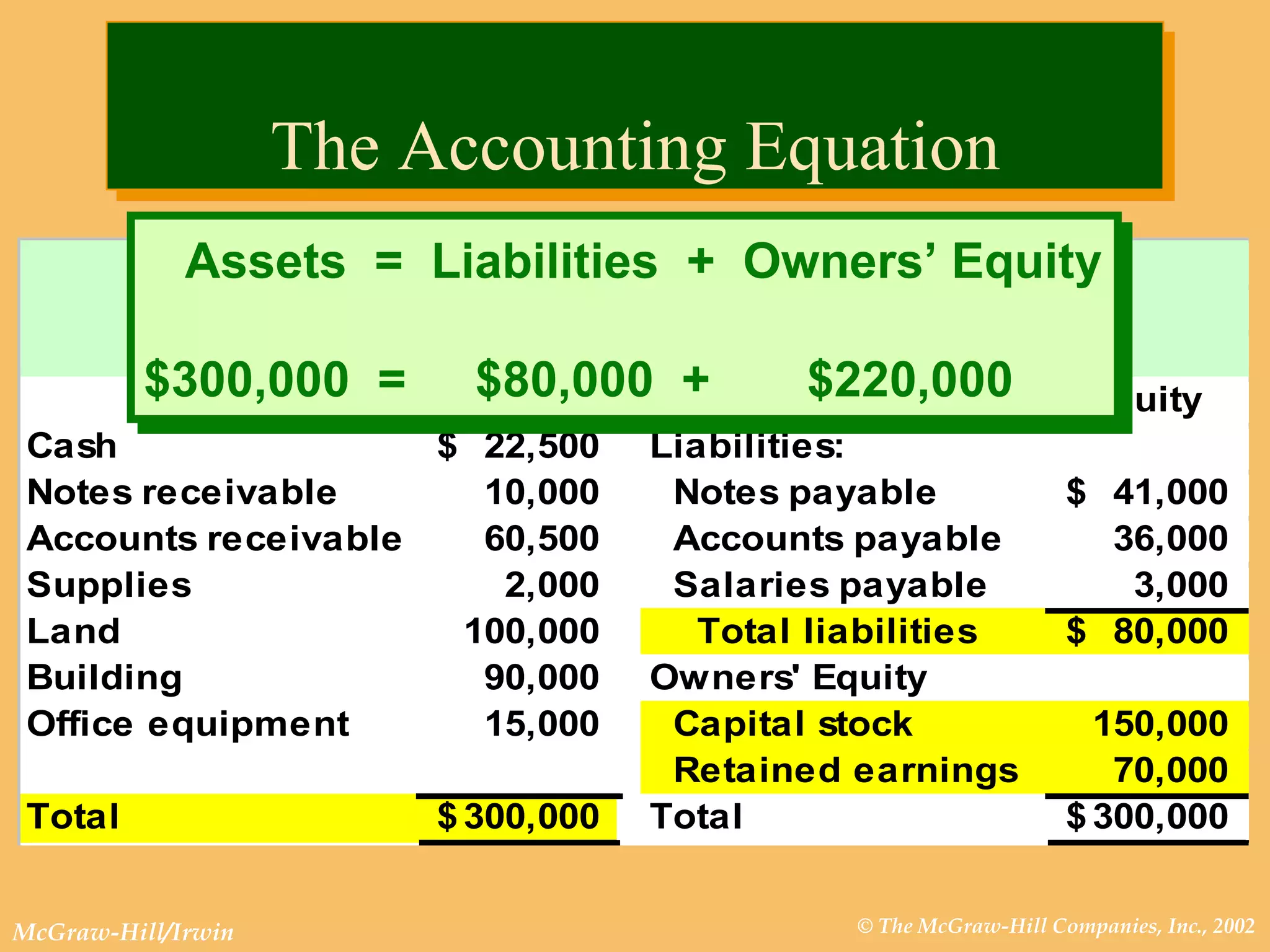

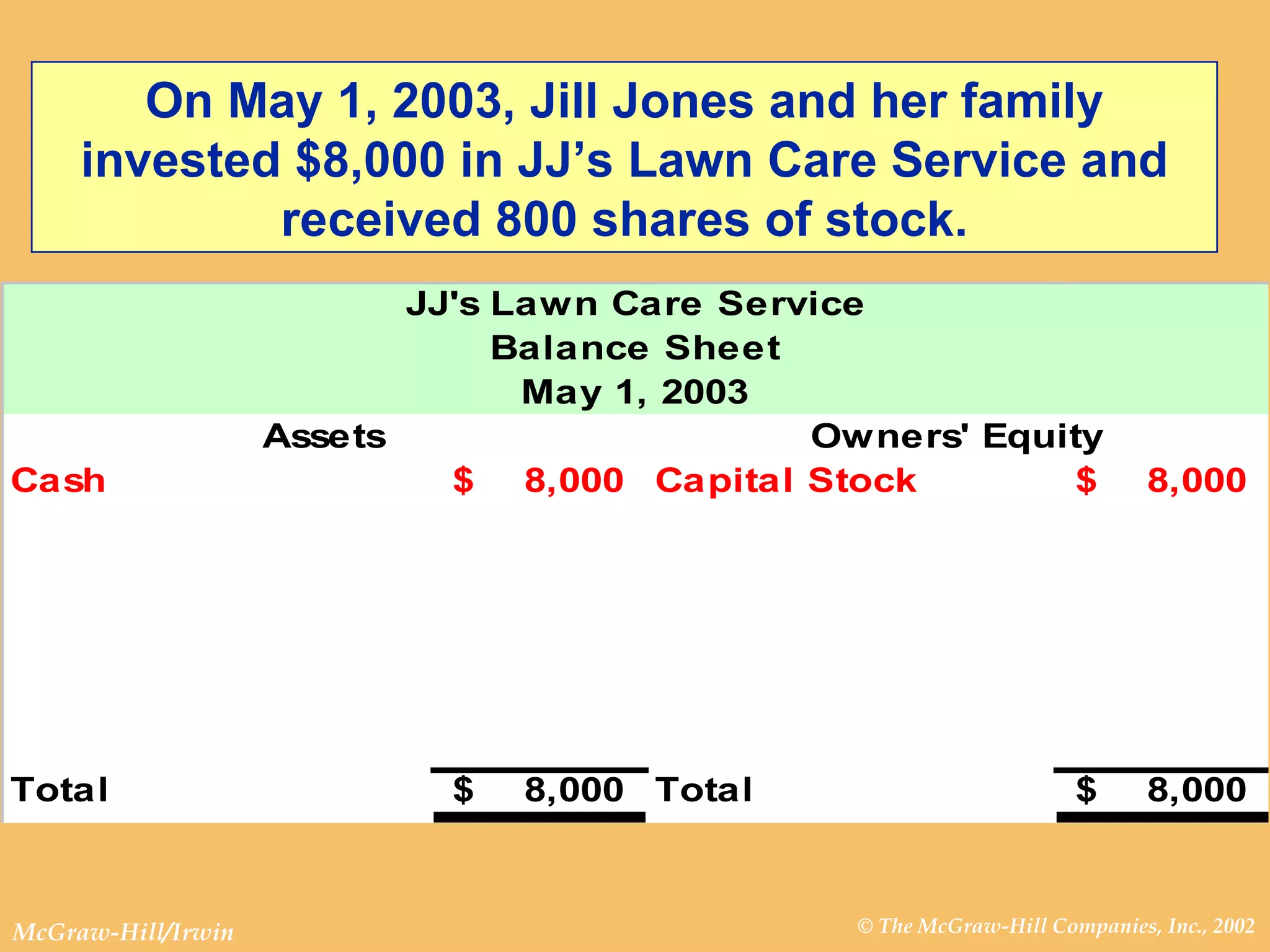

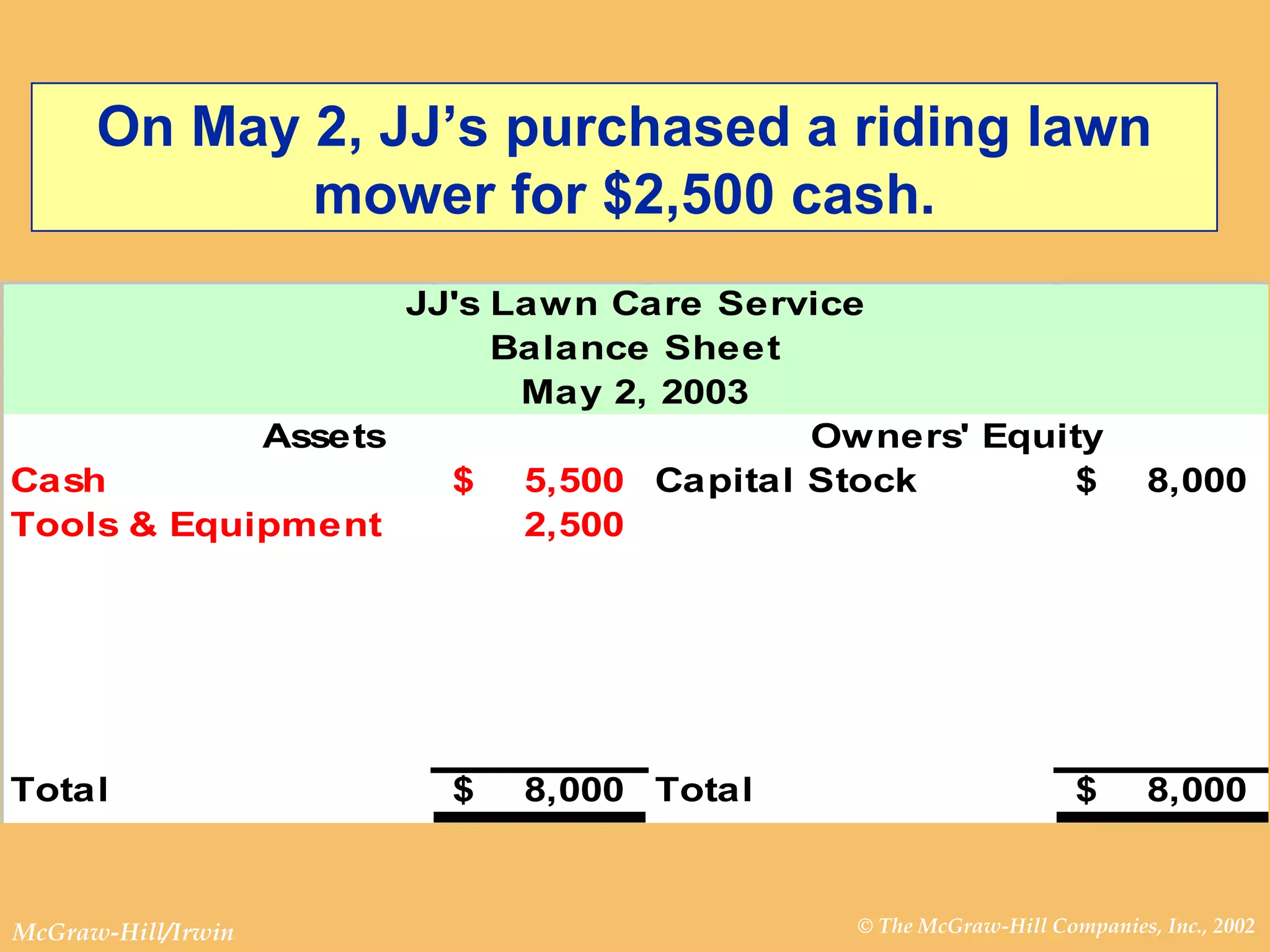

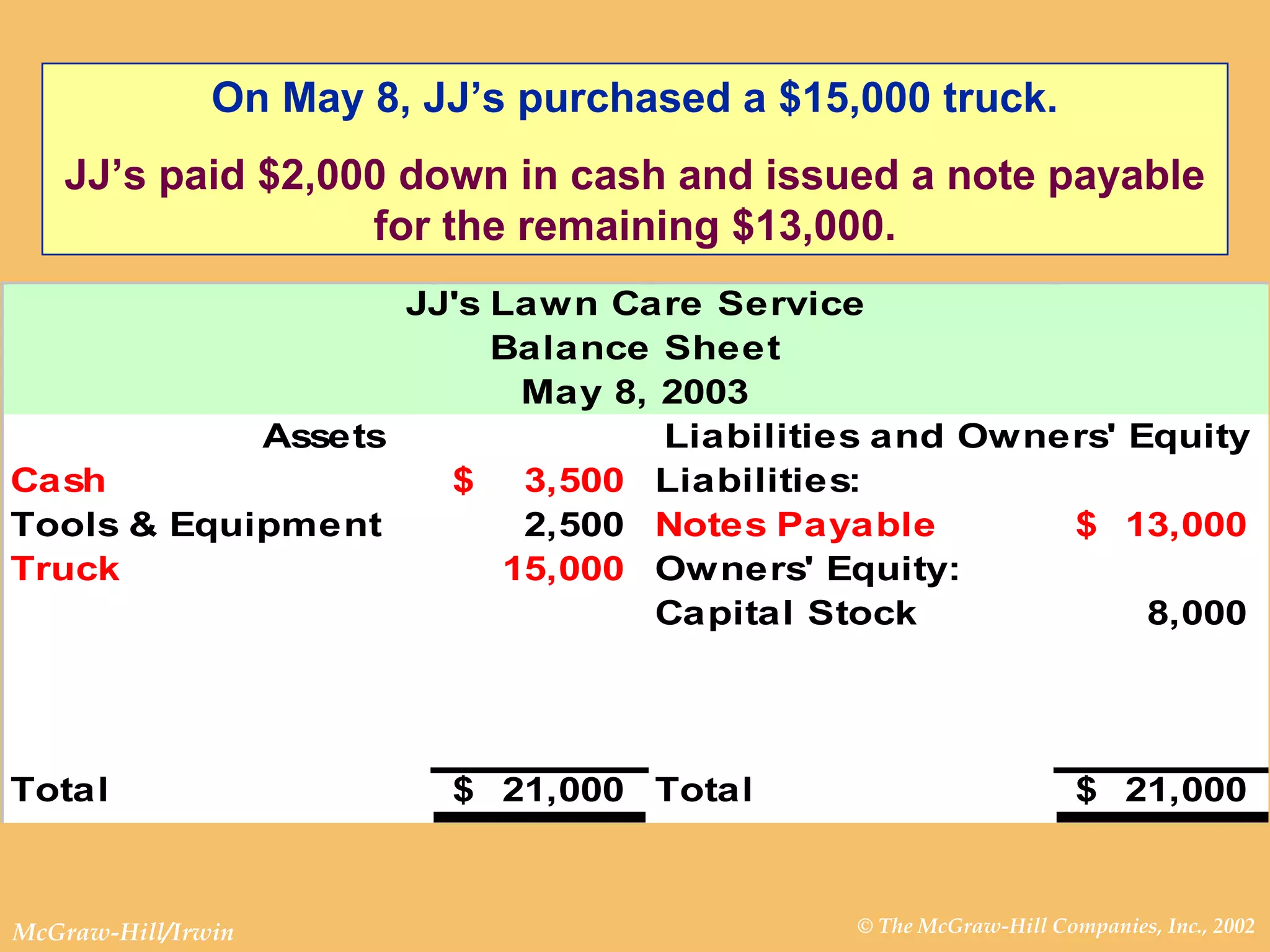

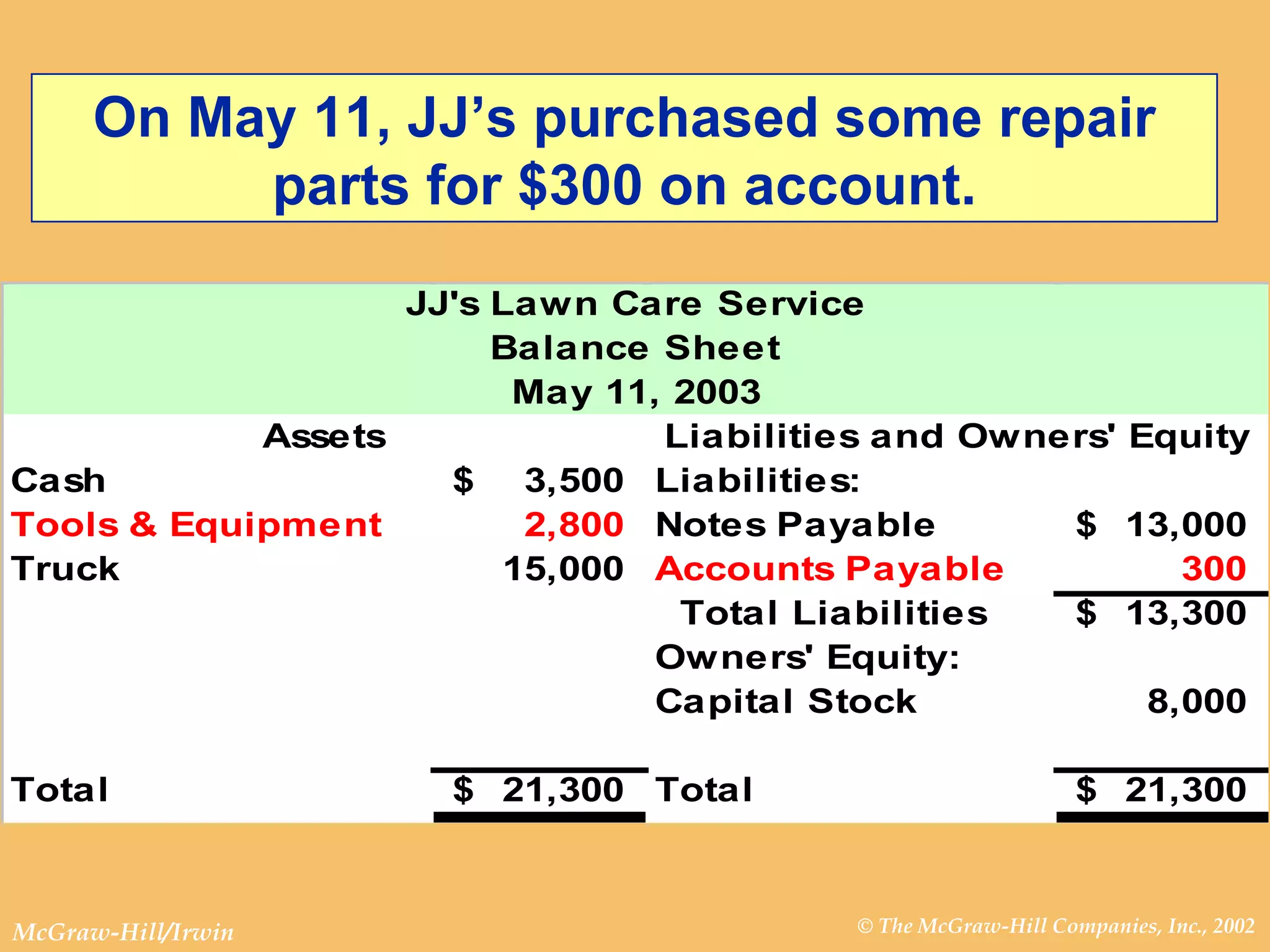

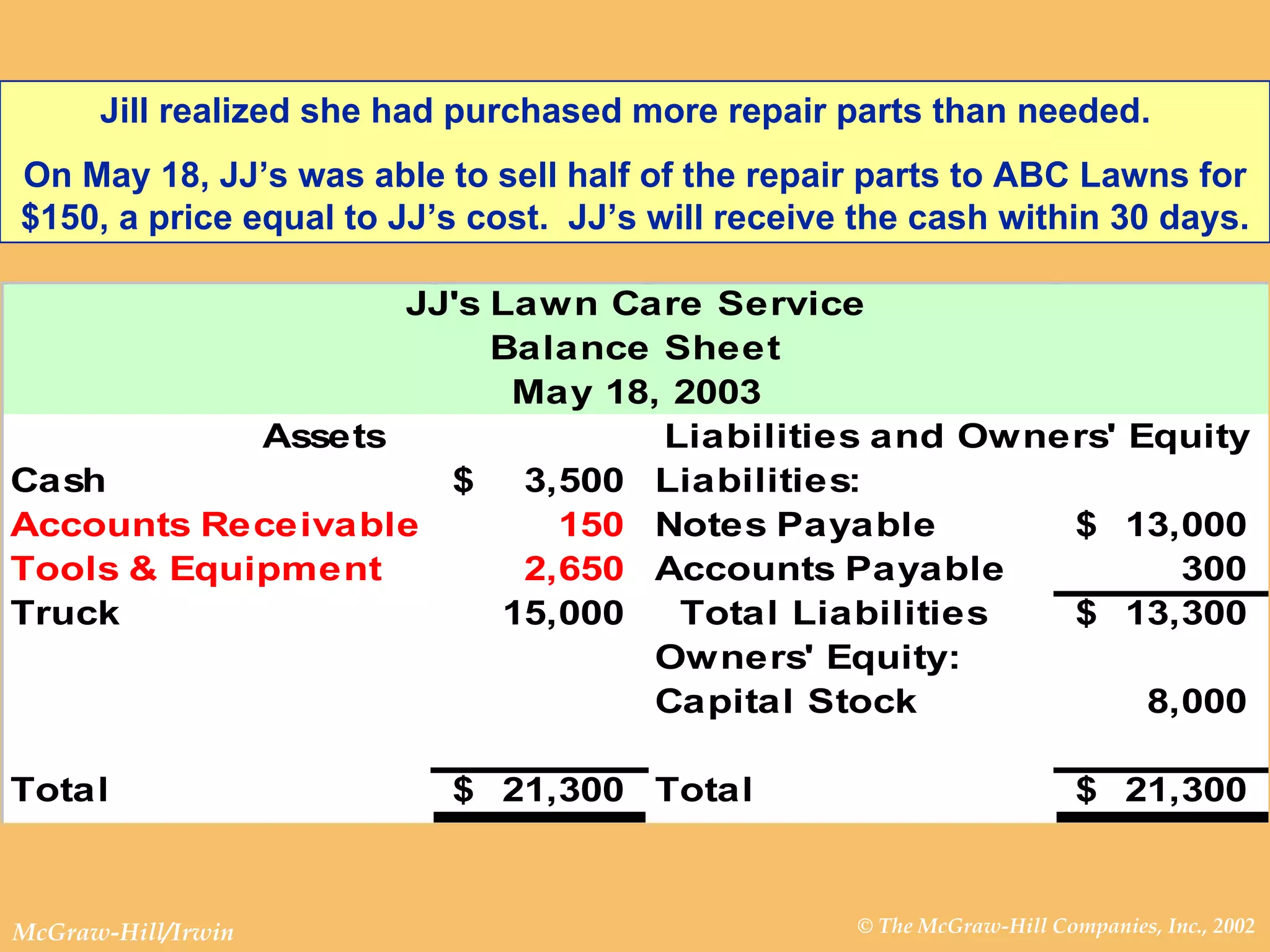

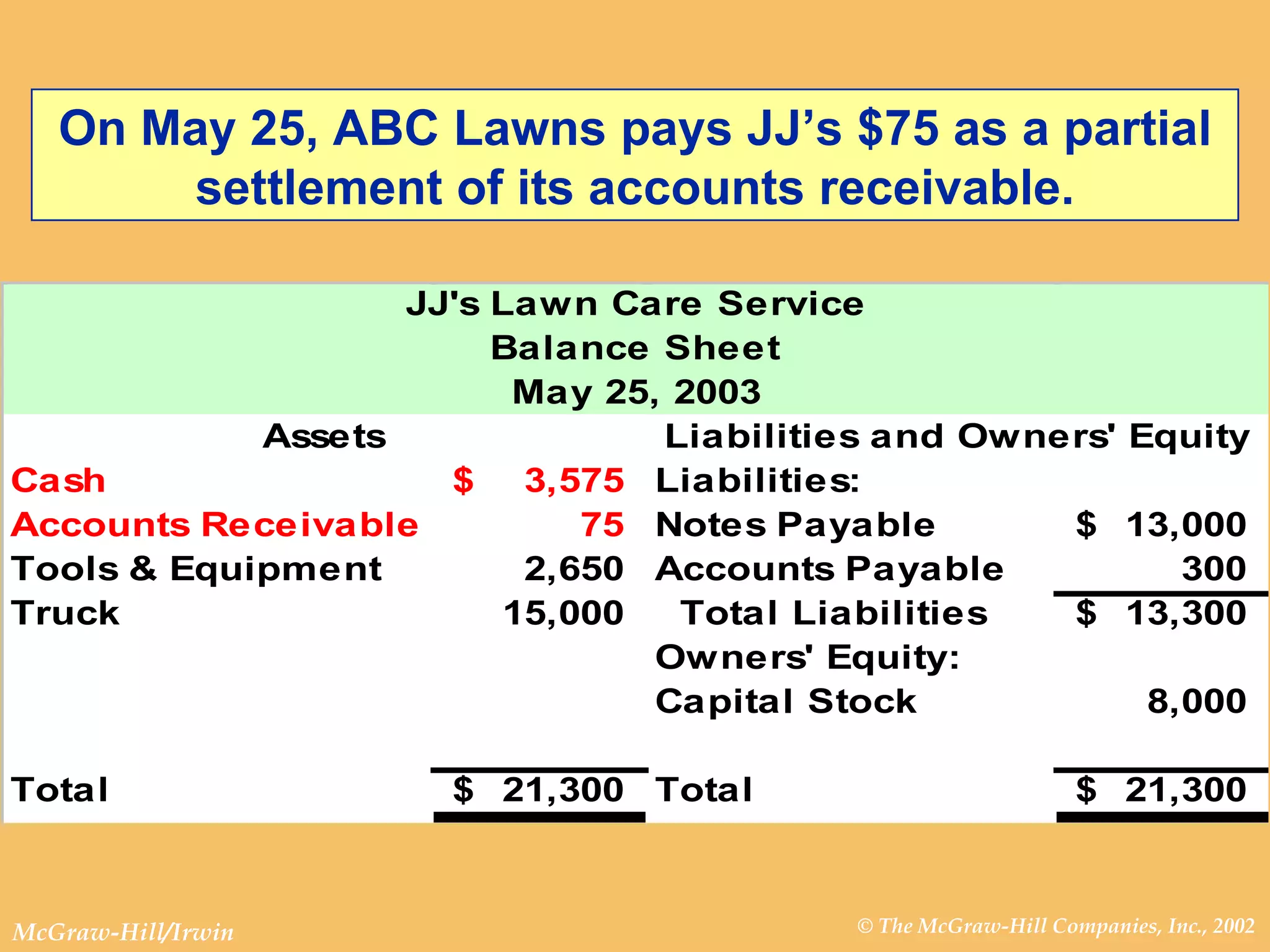

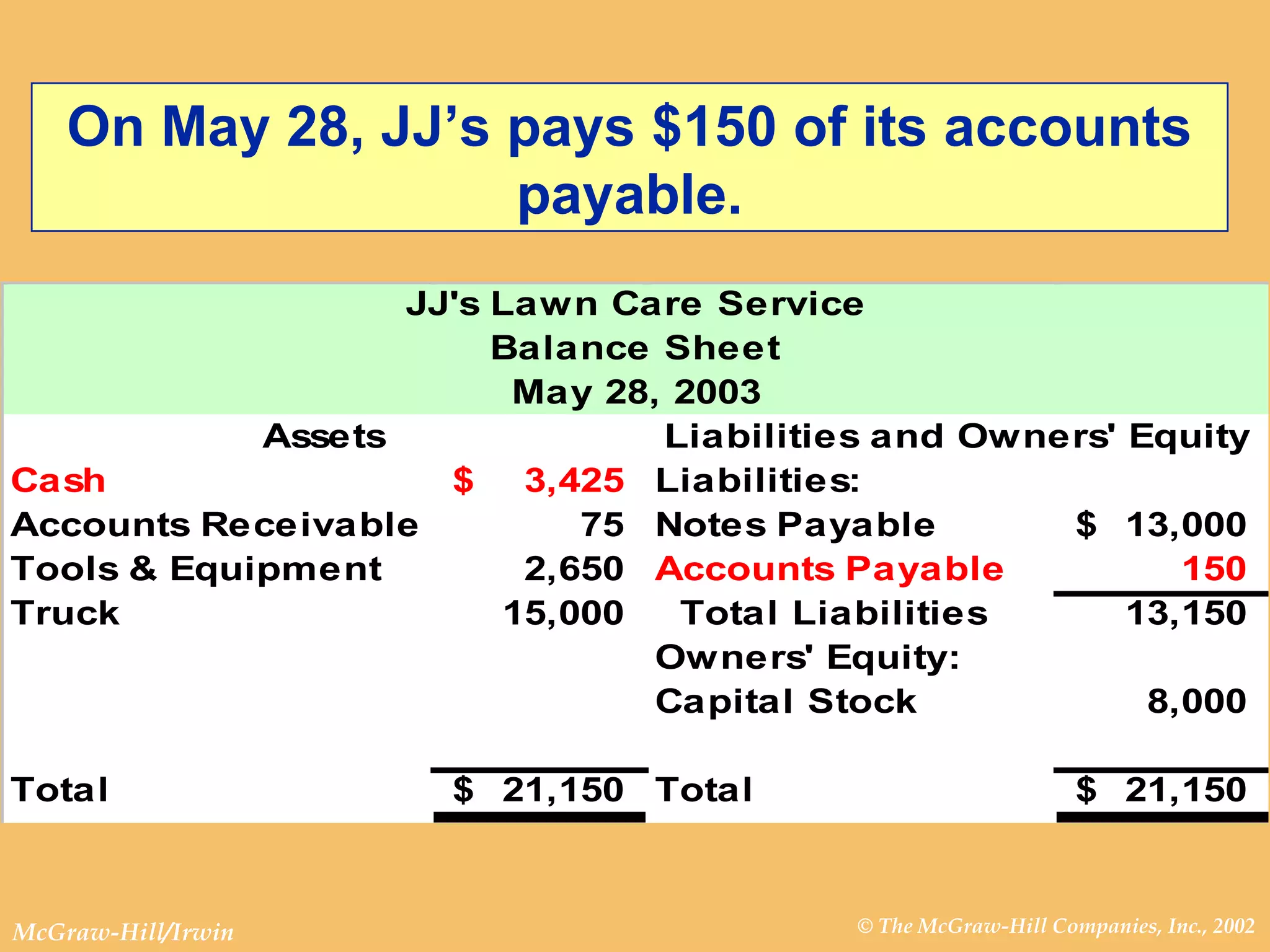

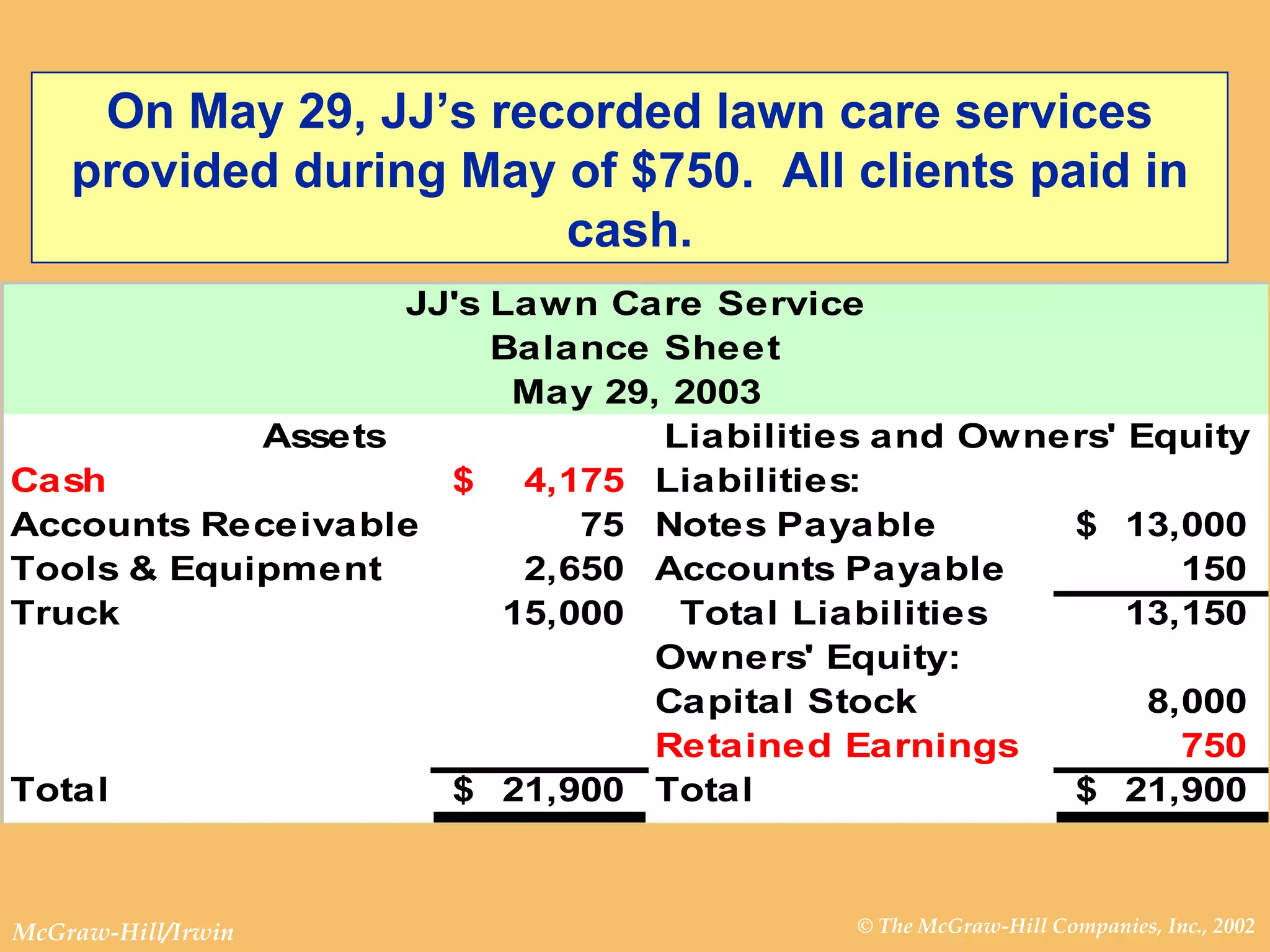

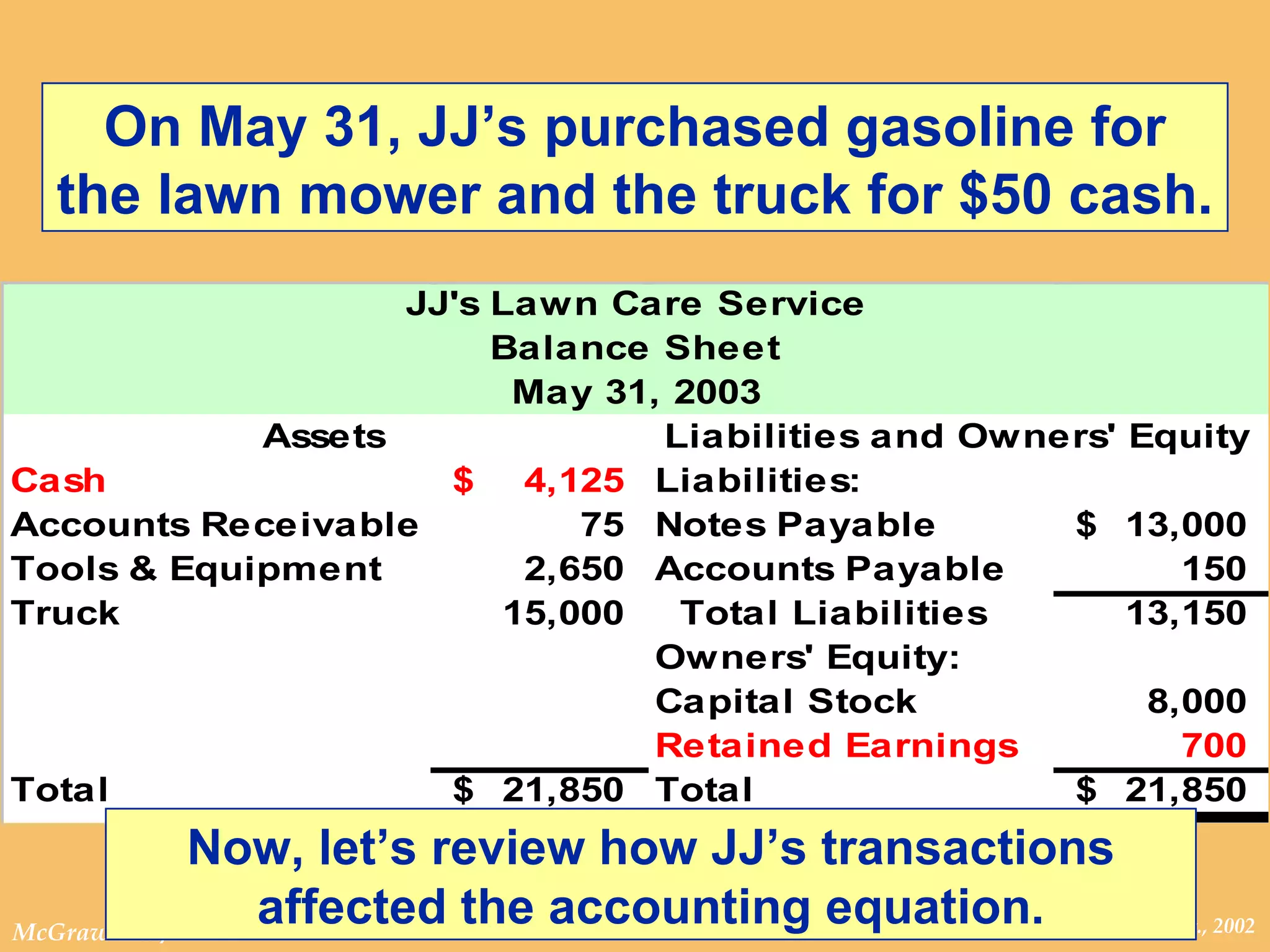

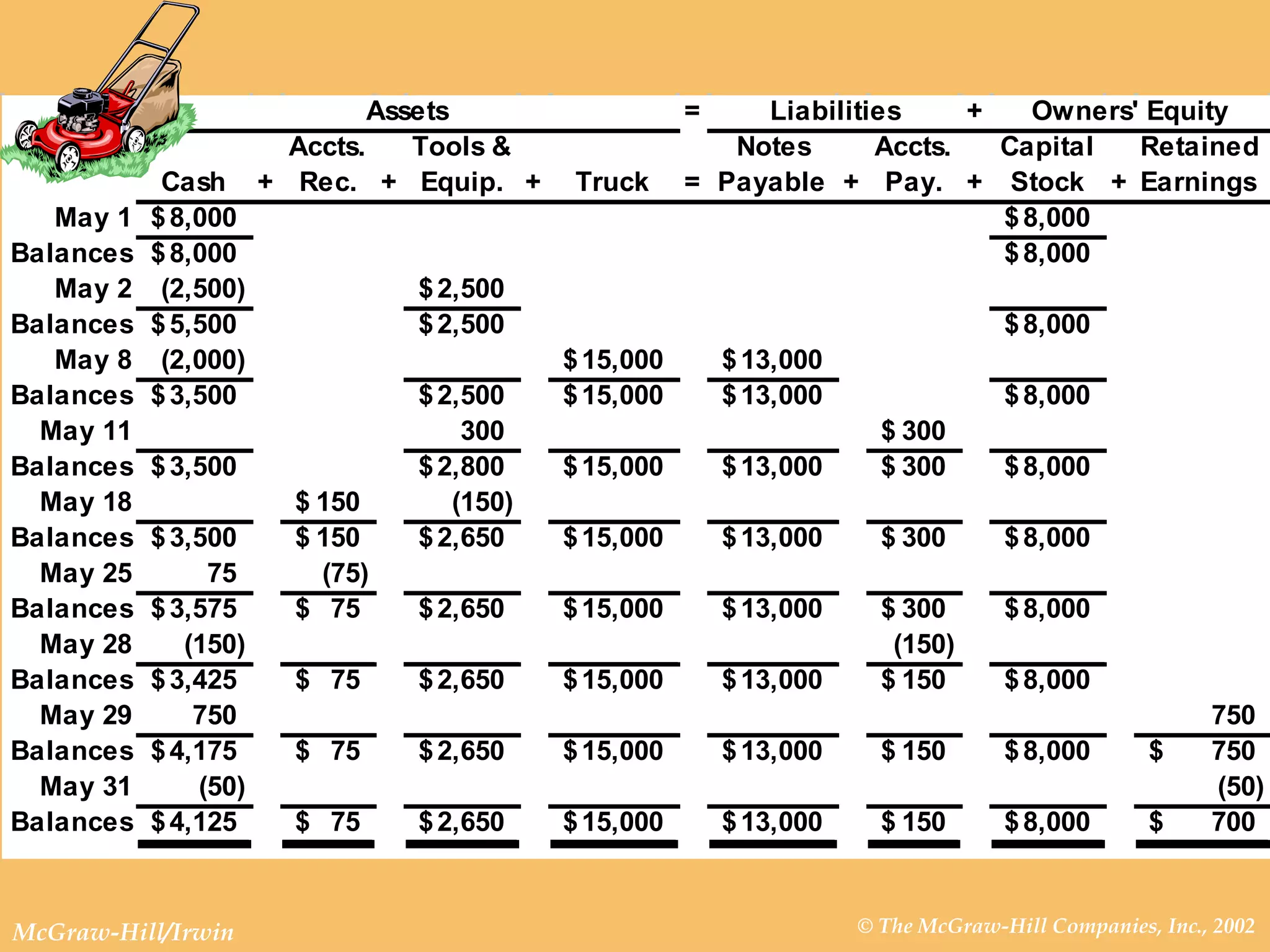

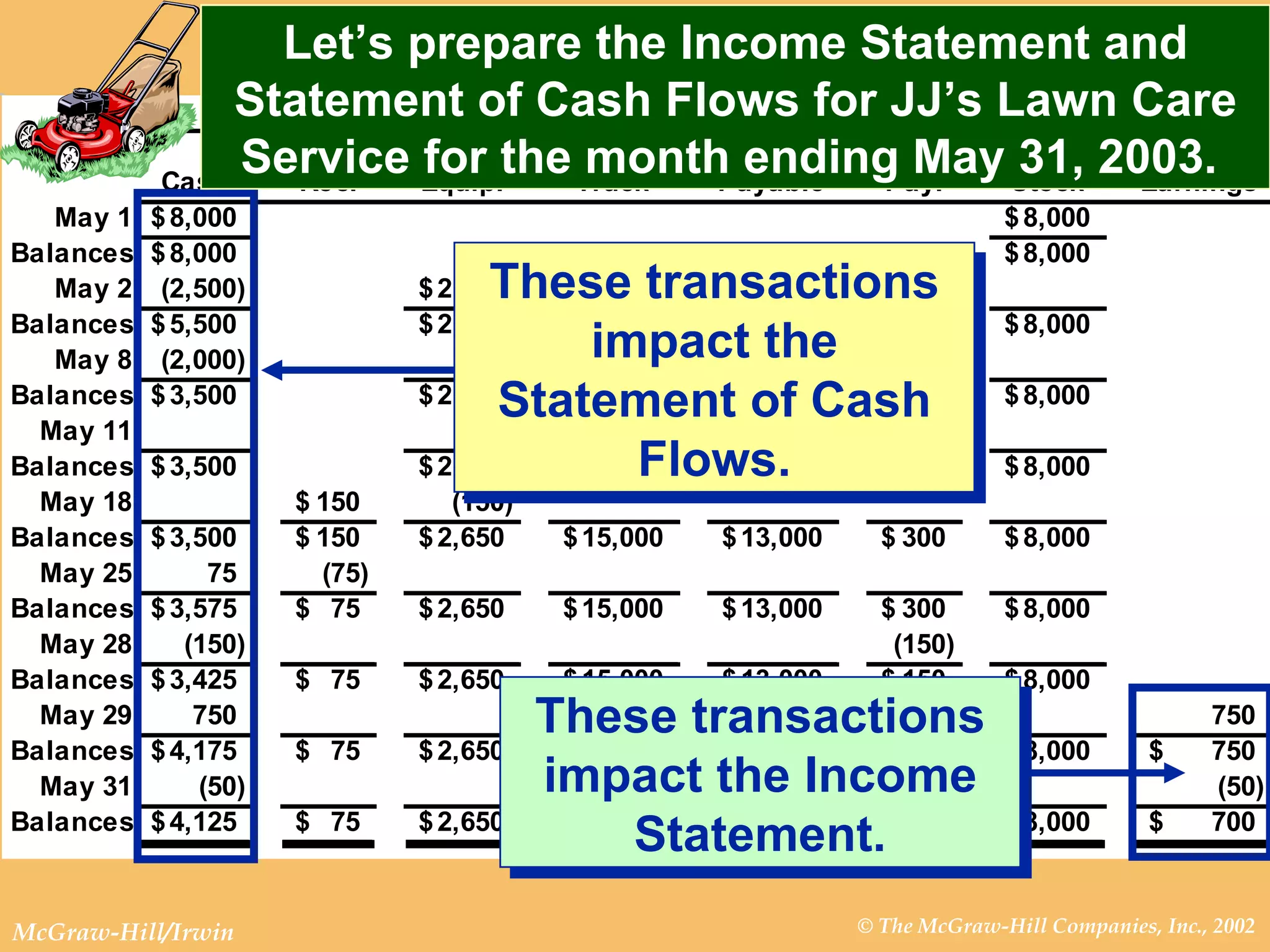

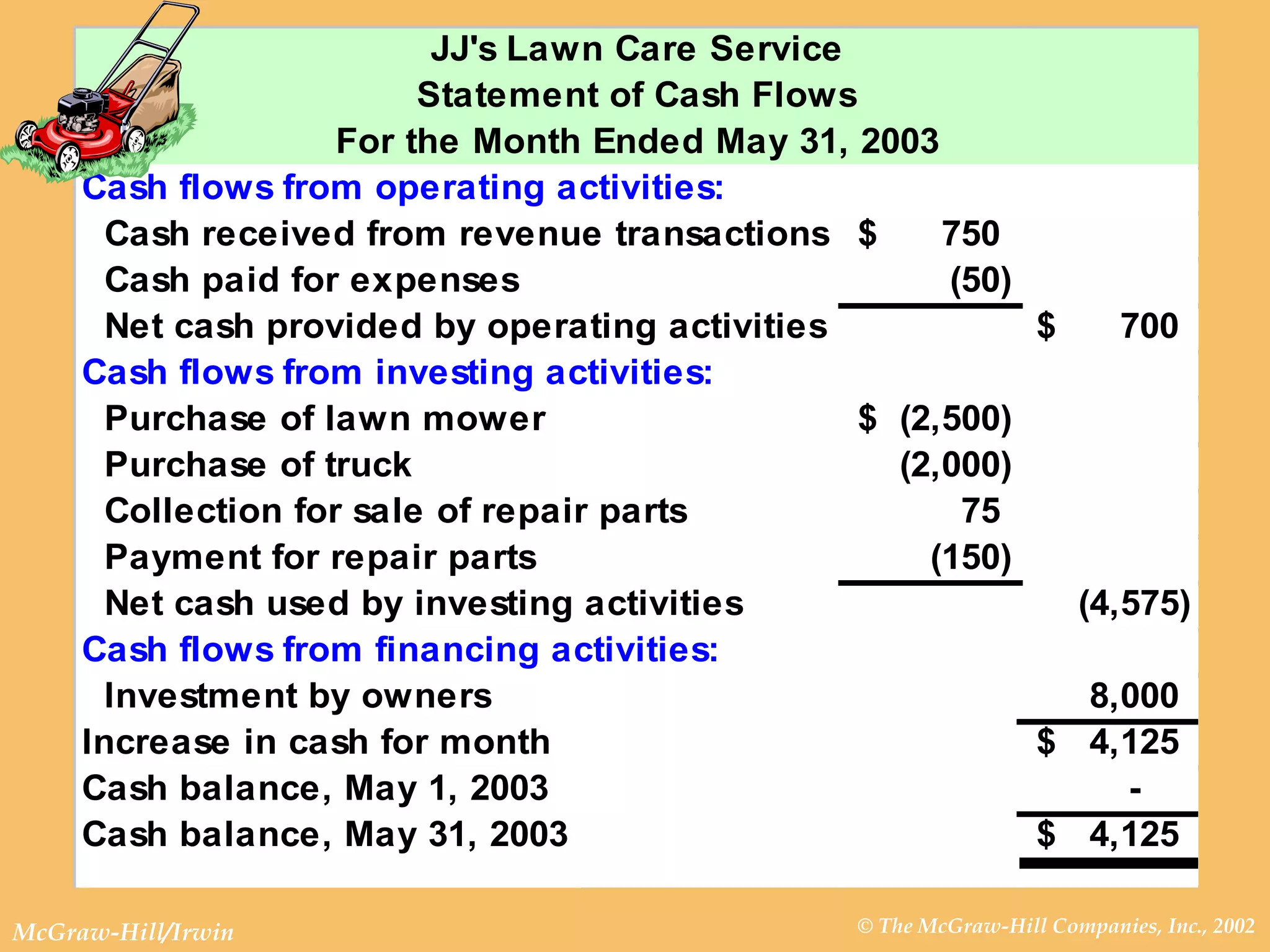

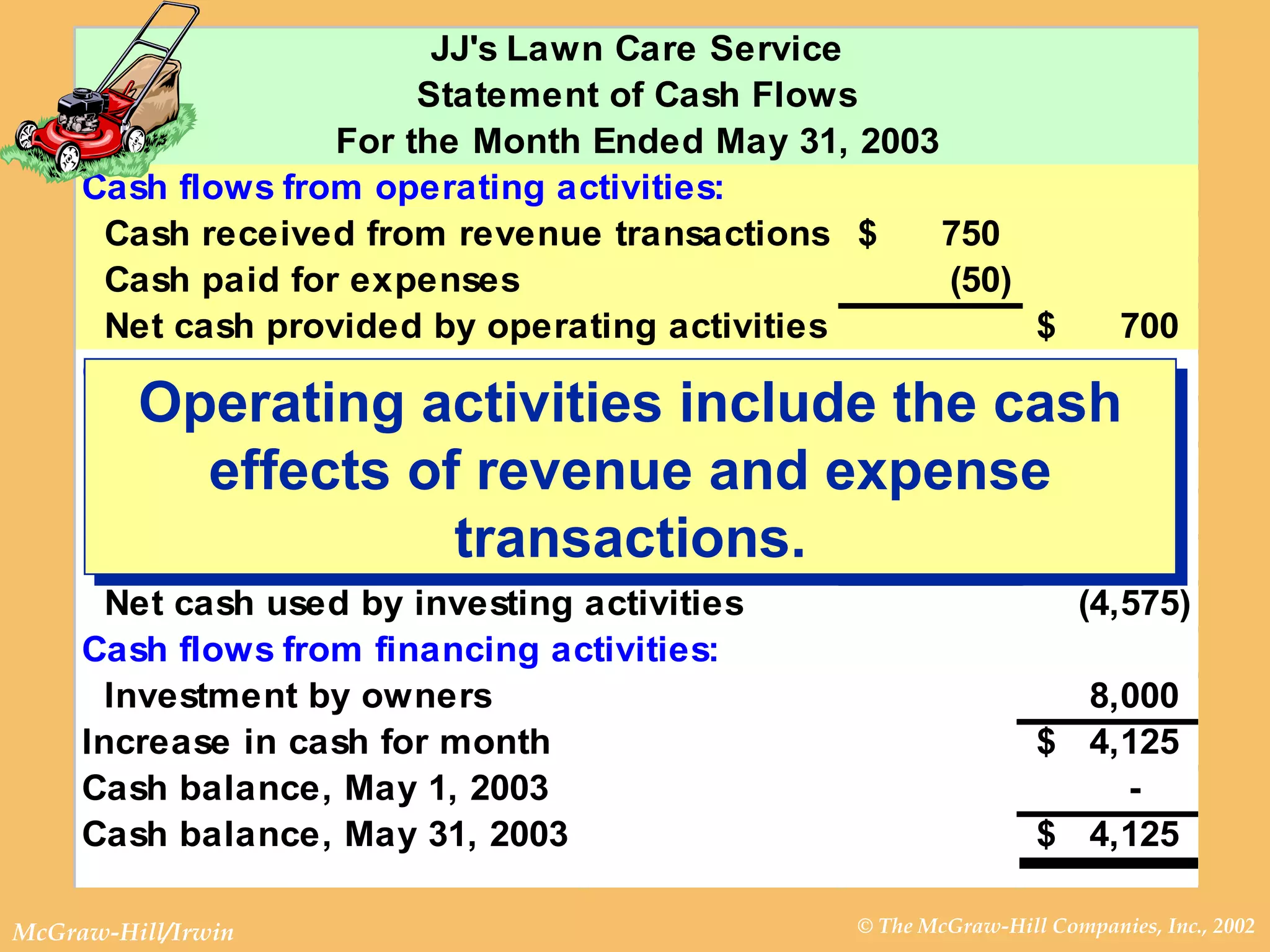

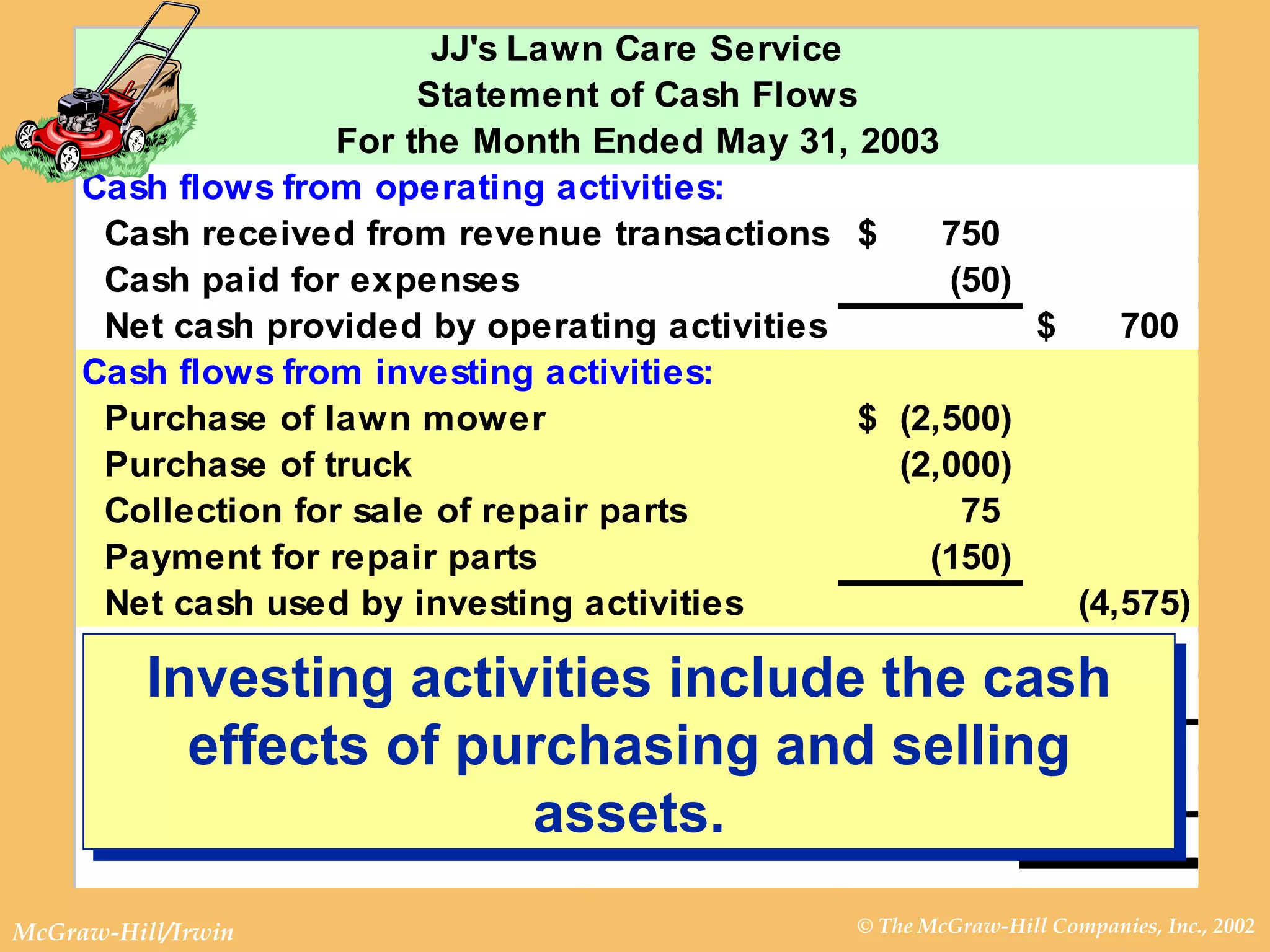

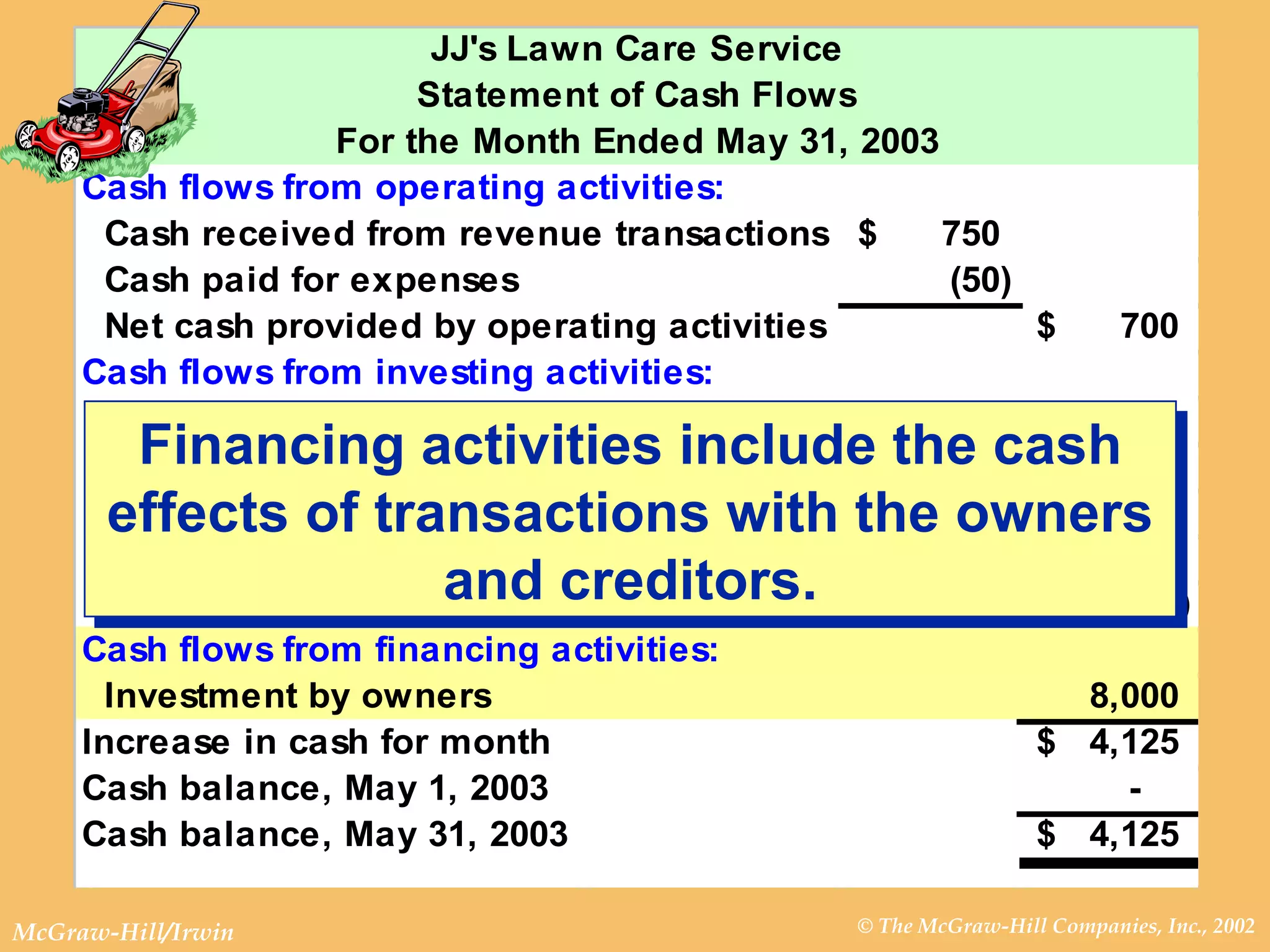

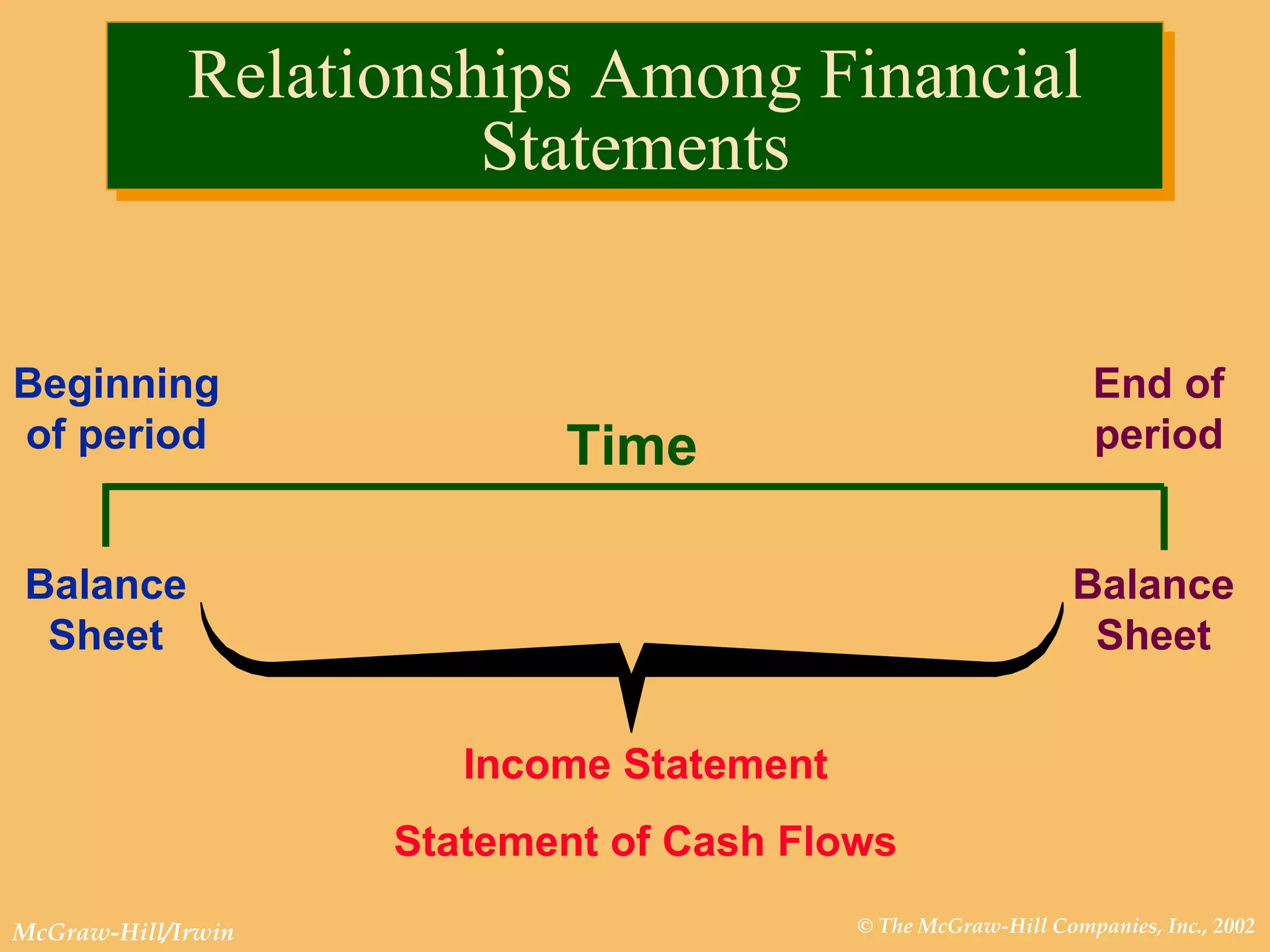

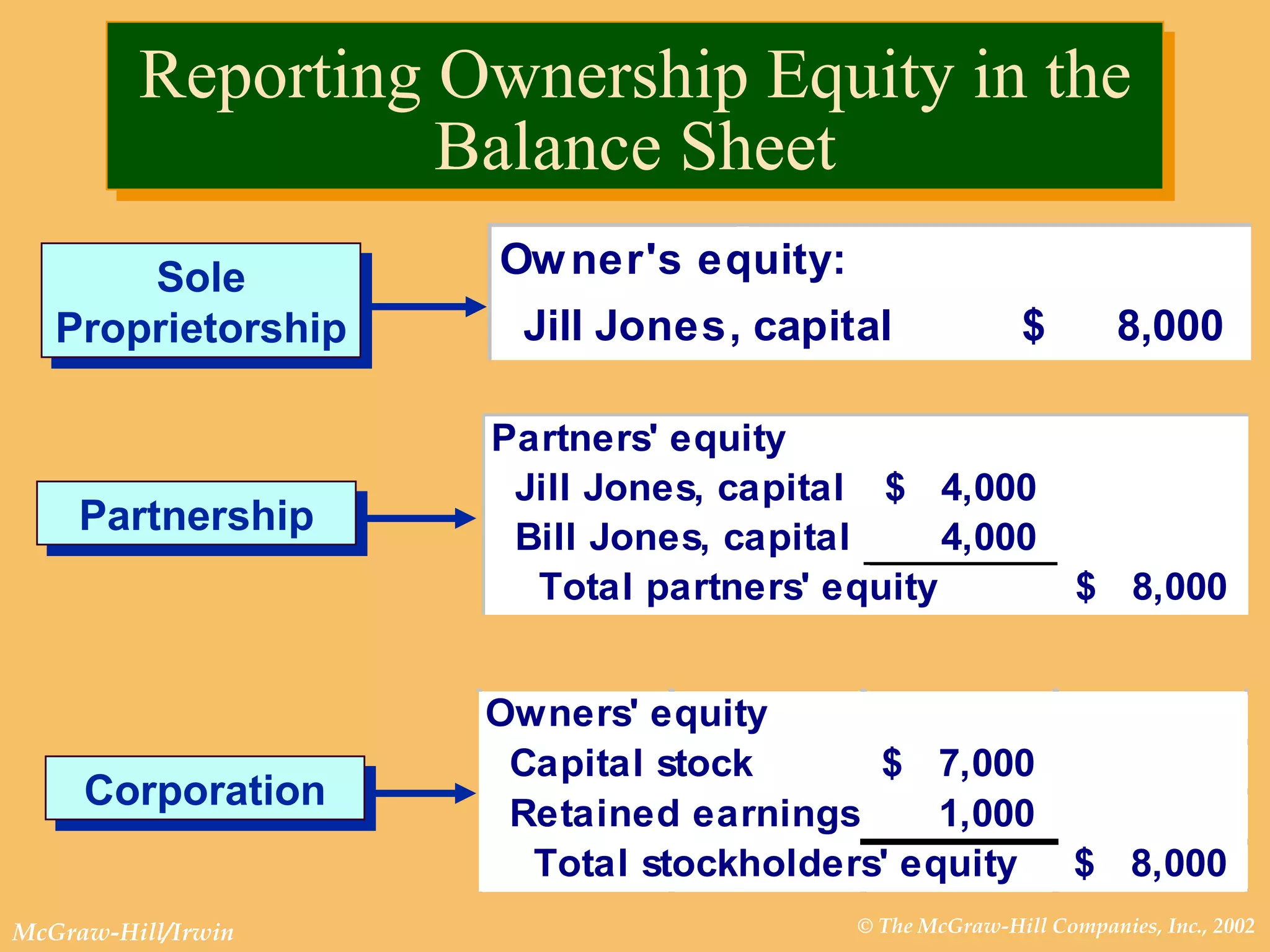

The document discusses the three primary financial statements that companies prepare: the income statement, balance sheet, and statement of cash flows. It provides an overview of each statement, including that the income statement depicts revenues and expenses over a period of time, the balance sheet presents a company's financial position at a point in time, and the statement of cash flows shows cash inflows and outflows. It also discusses key accounting concepts like assets, liabilities, owners' equity, and transactions that impact the accounting equation.