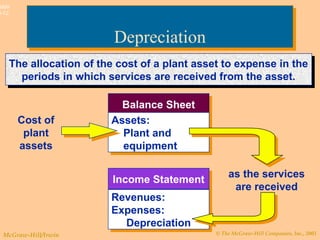

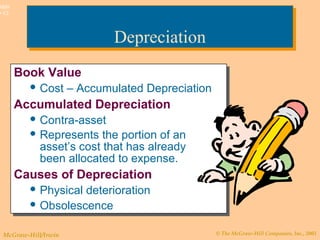

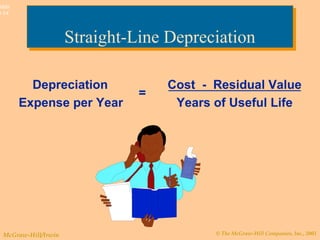

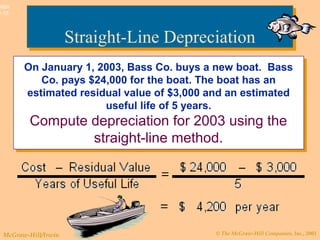

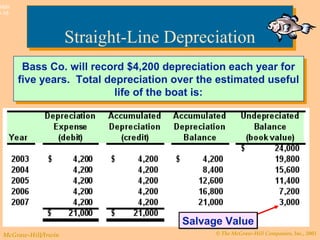

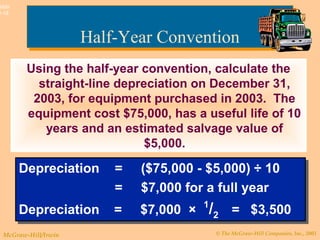

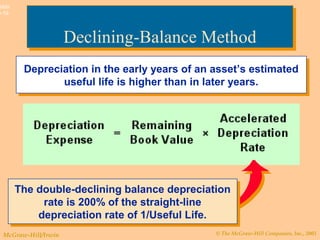

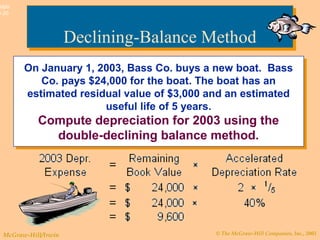

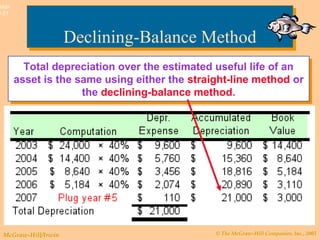

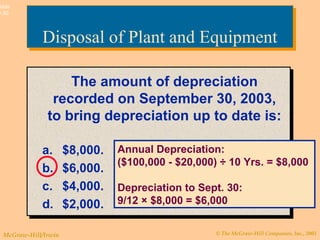

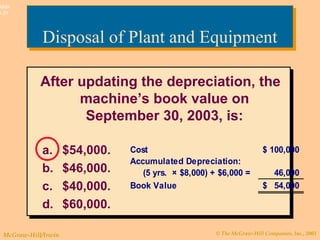

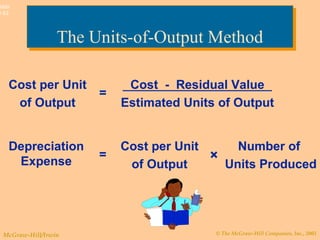

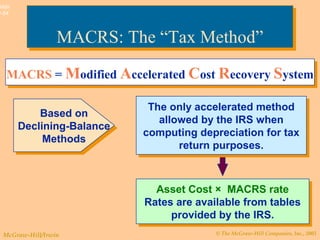

This document discusses different methods for depreciating plant and equipment assets over time. It introduces straight-line depreciation, which allocates the cost of an asset evenly over its estimated useful life. It also covers half-year depreciation conventions for assets acquired during the year, and the double-declining balance method, which takes higher depreciation in early years by using twice the straight-line rate. The document provides examples of calculating depreciation expense using these different methods.