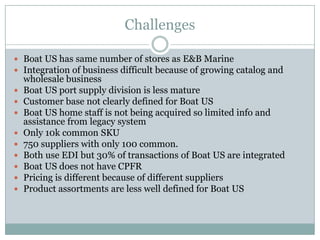

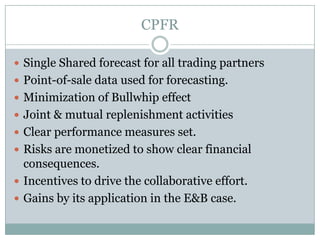

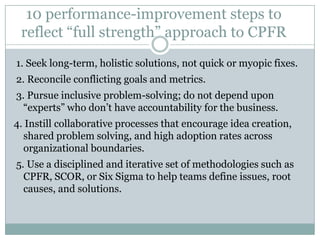

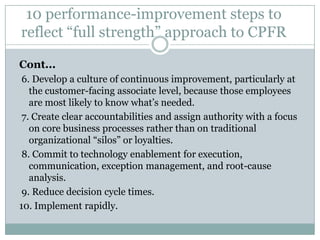

West Marine is looking to drive growth through improving its supply chain management. It recently acquired E&B Marine and is now working to integrate E&B's business, which faces several challenges including differences in supplier relationships, product assortments, and pricing. West Marine is considering either keeping the two brands separate through dual branding or fully merging them. Collaborative planning, forecasting, and replenishment (CPFR) with suppliers could help with integration by establishing shared forecasts and replenishment processes. Internal collaboration between merchandising, planning, and replenishment teams also needs improvement to better coordinate decisions that impact inventory performance. The presentation outlines West Marine's approach to CPFR and gaining supplier buy-in,