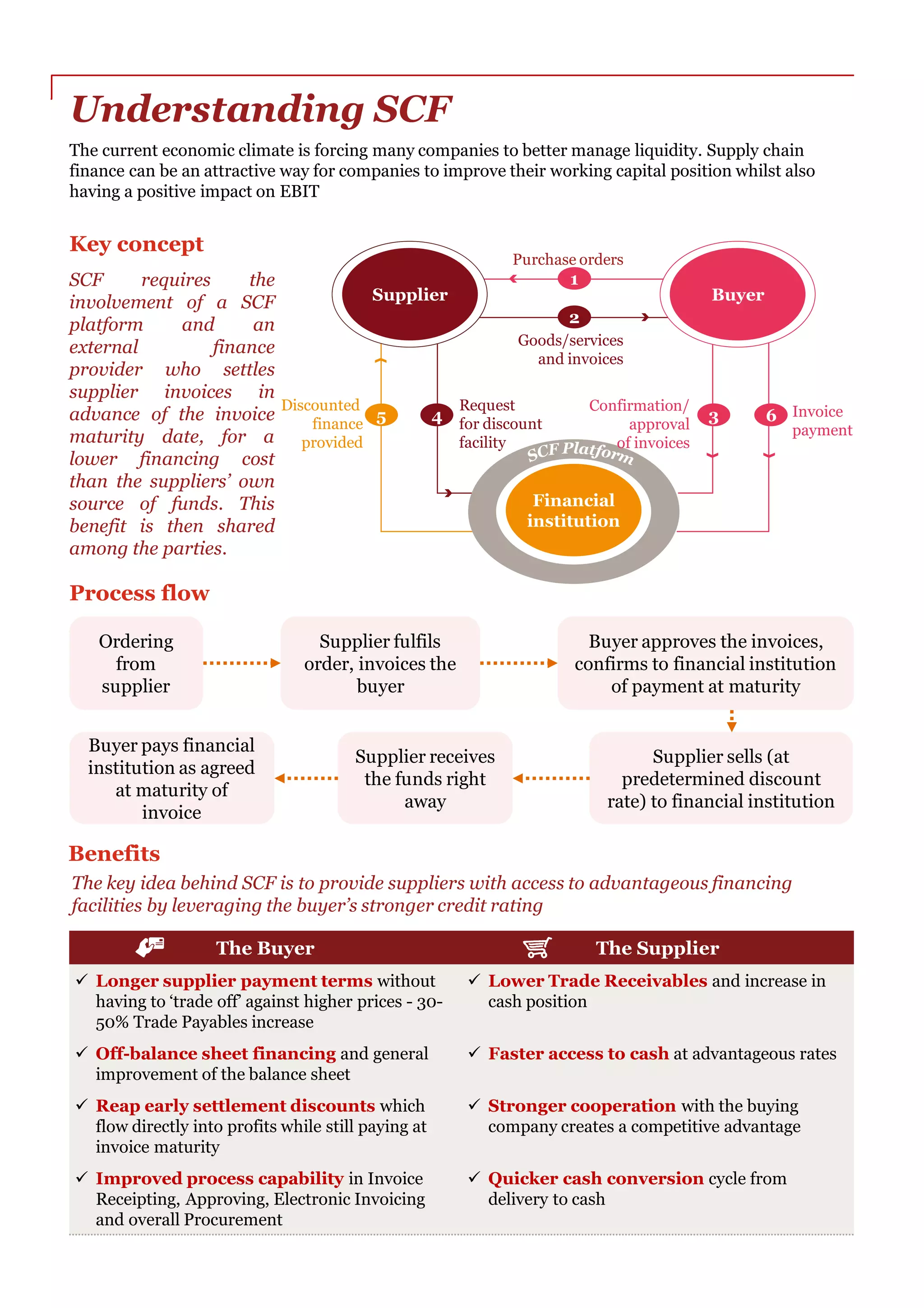

Supply chain finance (SCF) involves an external finance provider settling supplier invoices in advance of the due date at a lower cost than the suppliers' own financing. This benefits both buyers and suppliers. For buyers, SCF can increase payment terms without higher prices and improve cash flow. For suppliers, it provides faster access to cash at advantageous rates. Implementing an SCF program requires selecting technology and financing partners and integrating it with procure-to-pay processes to maximize benefits like improved working capital and stronger supplier relationships.