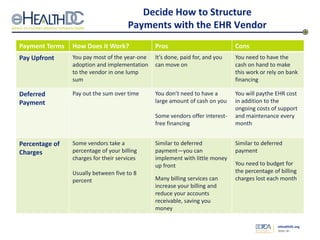

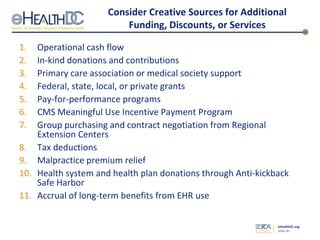

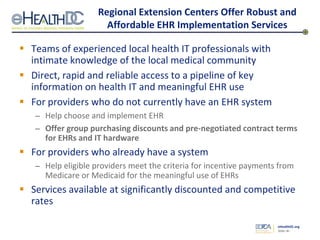

This webinar discussed financing options for electronic health record (EHR) adoption. It began with introductions of the panelists and their experience in healthcare and EHRs. The webinar then covered considering the full range of EHR costs, different licensing models, payment structures with EHR vendors, and low-cost financing from banks. Additional funding sources discussed included grants, incentives from CMS, and services from regional extension centers. Tax incentives and malpractice premium relief for EHR users were also reviewed. The webinar concluded with a discussion of the long-term benefits and cost savings of EHR use based on studies.