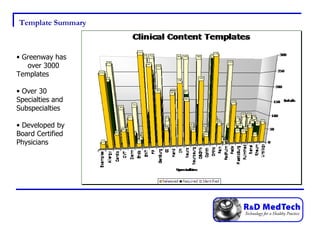

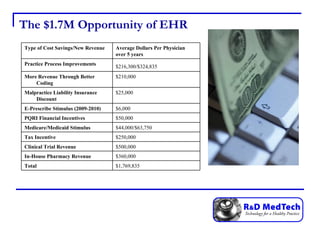

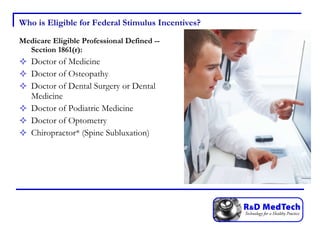

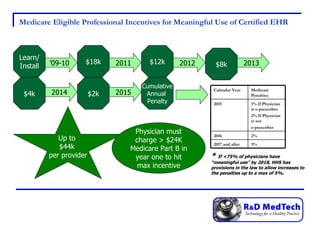

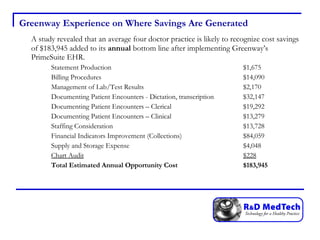

R&D Med Tech is an Oklahoma LLC that provides EHR software and services to physician practices using Greenway's PrimeSuite EHR. The document discusses the financial incentives available for physicians to adopt EHRs, including stimulus payments up to $44,000 per eligible professional from Medicare and up to $63,750 from Medicaid. It also outlines cost savings practices can see from improved coding, reduced billing costs, and lower malpractice insurance rates that provide doctors with incentives to adopt EHRs.

![Questions? Contact: Rob Raasch [email_address] 918-682-2285 www.RDMedTech.com](https://image.slidesharecdn.com/stimuluspresentation-12694705260272-phpapp02/85/Stimulus-Presentation-24-320.jpg)