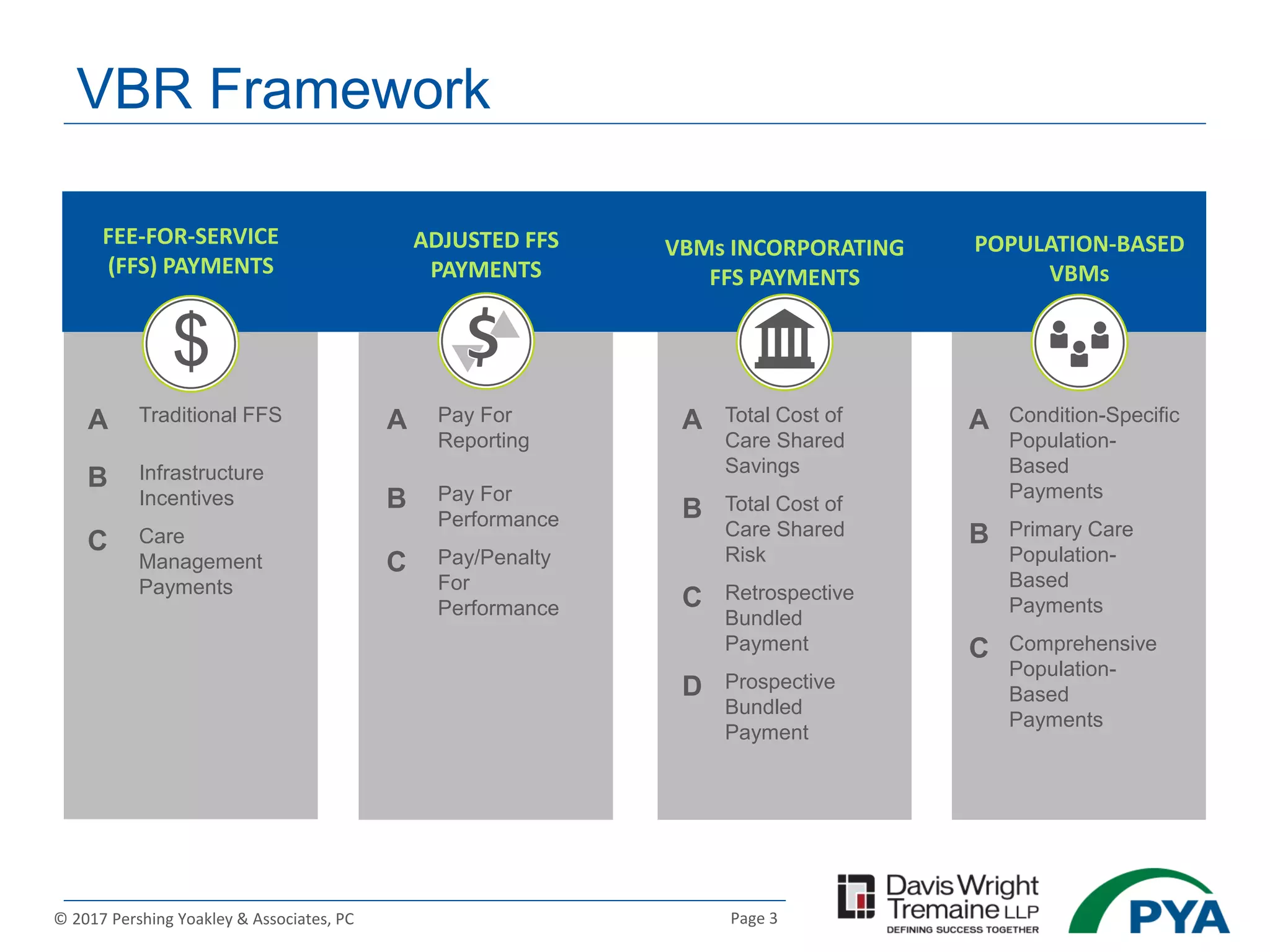

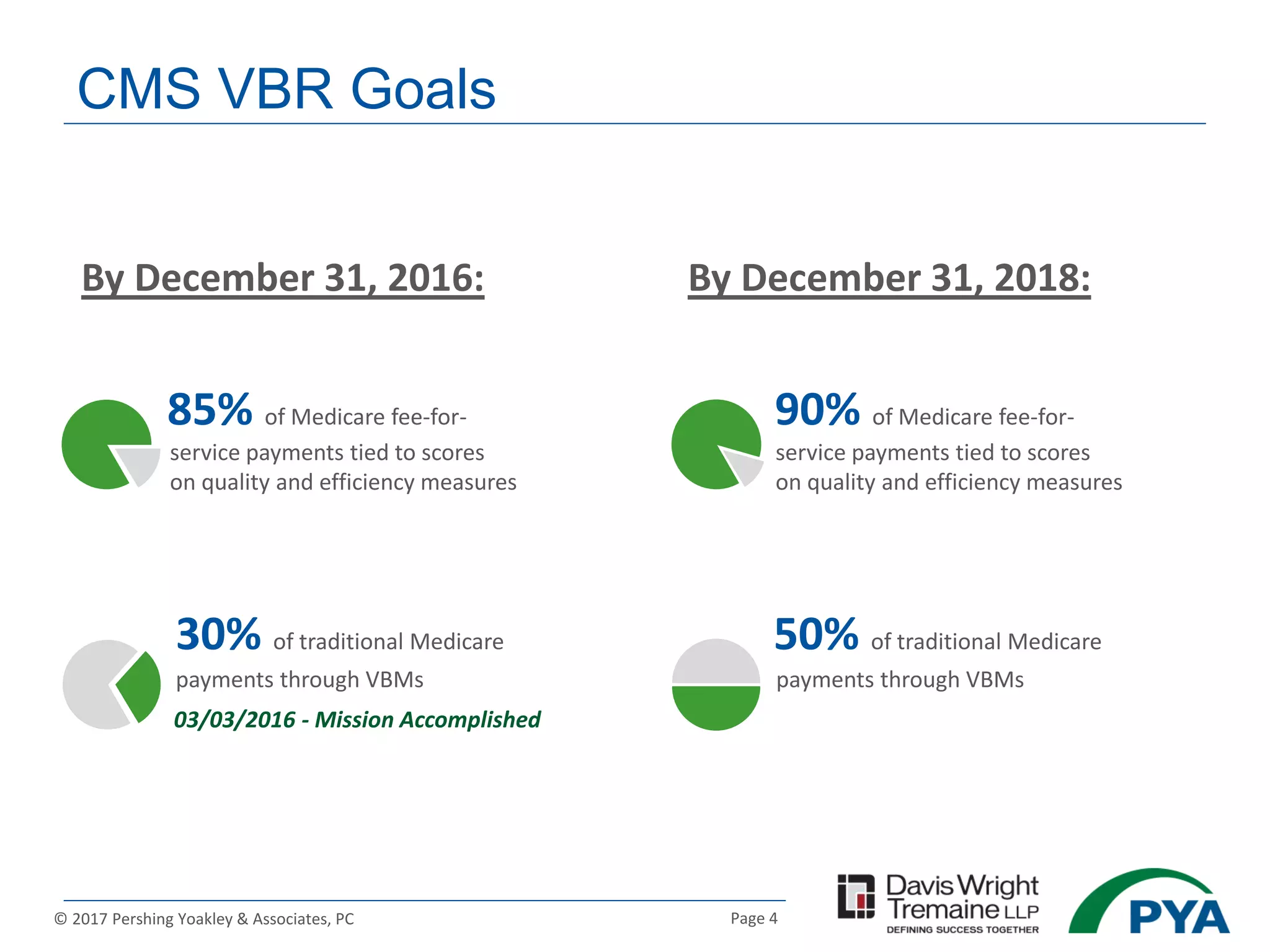

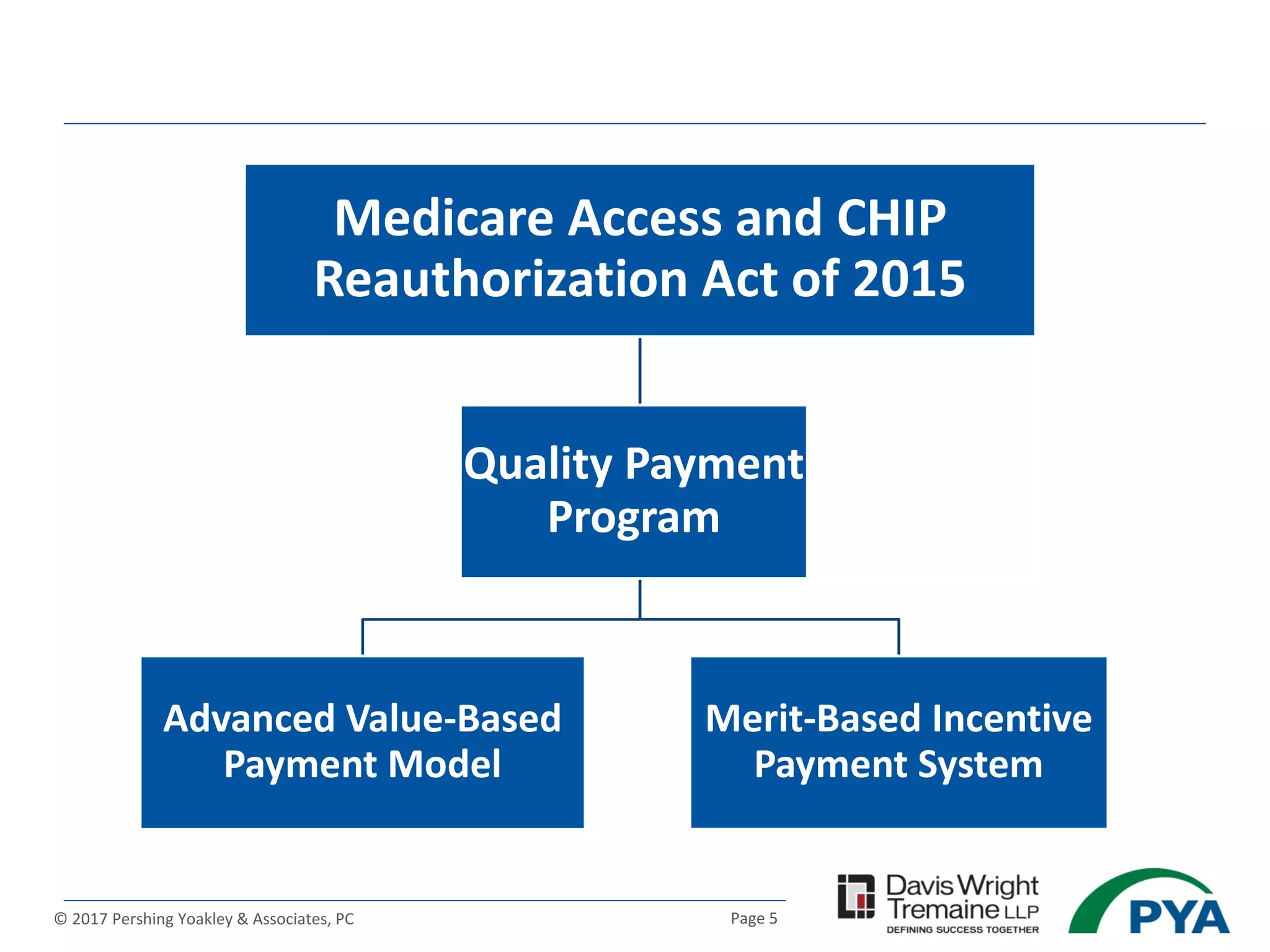

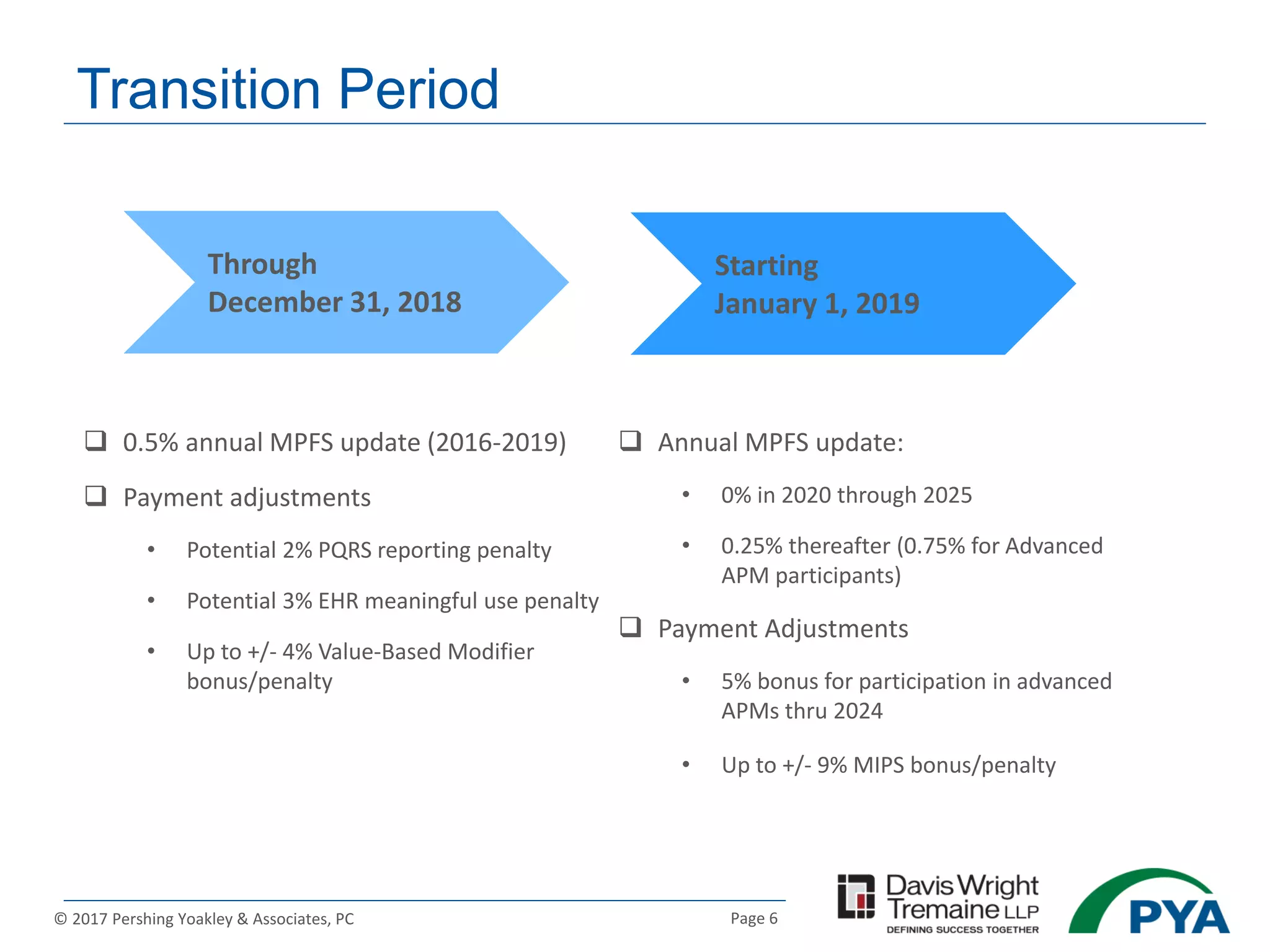

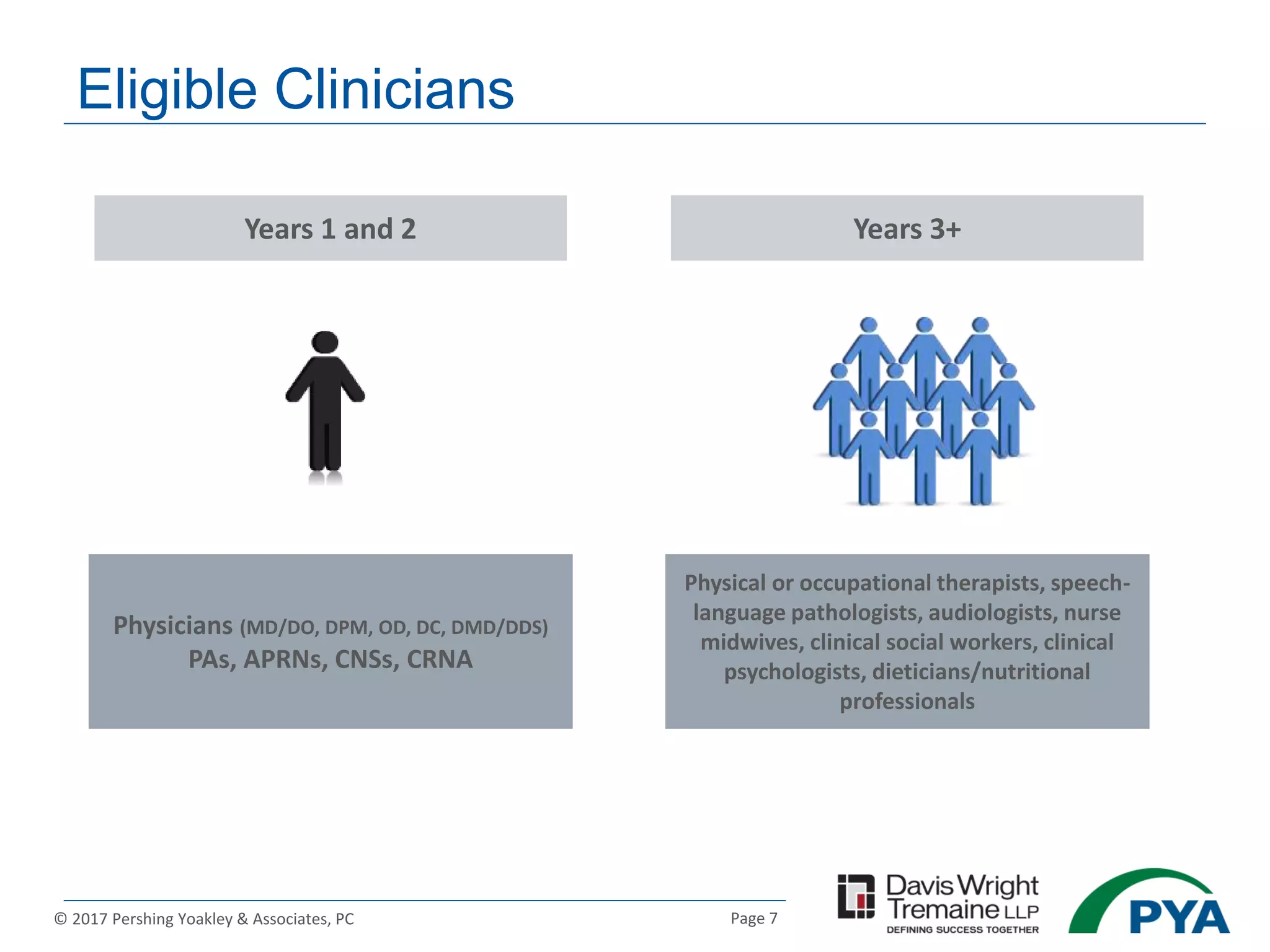

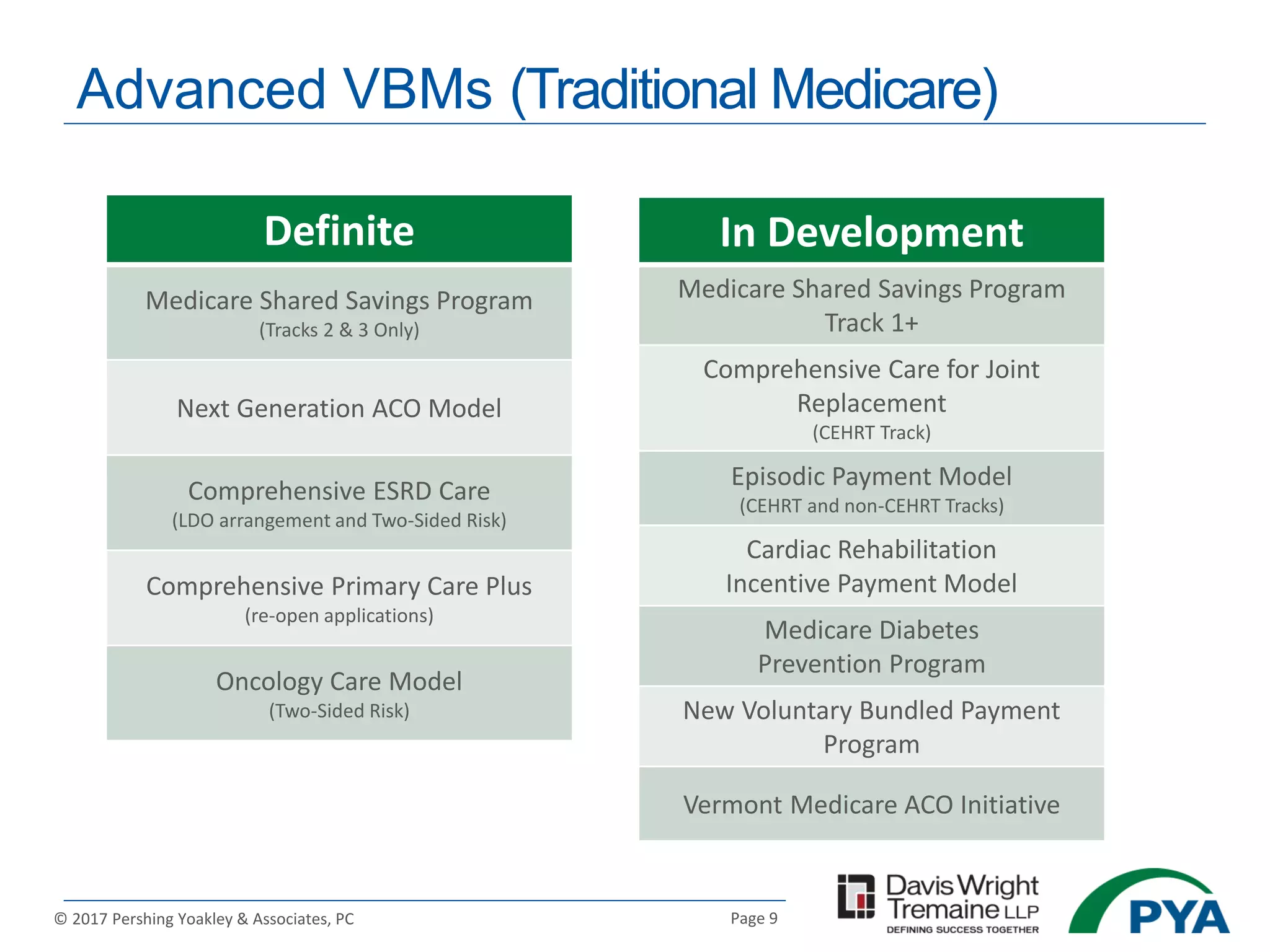

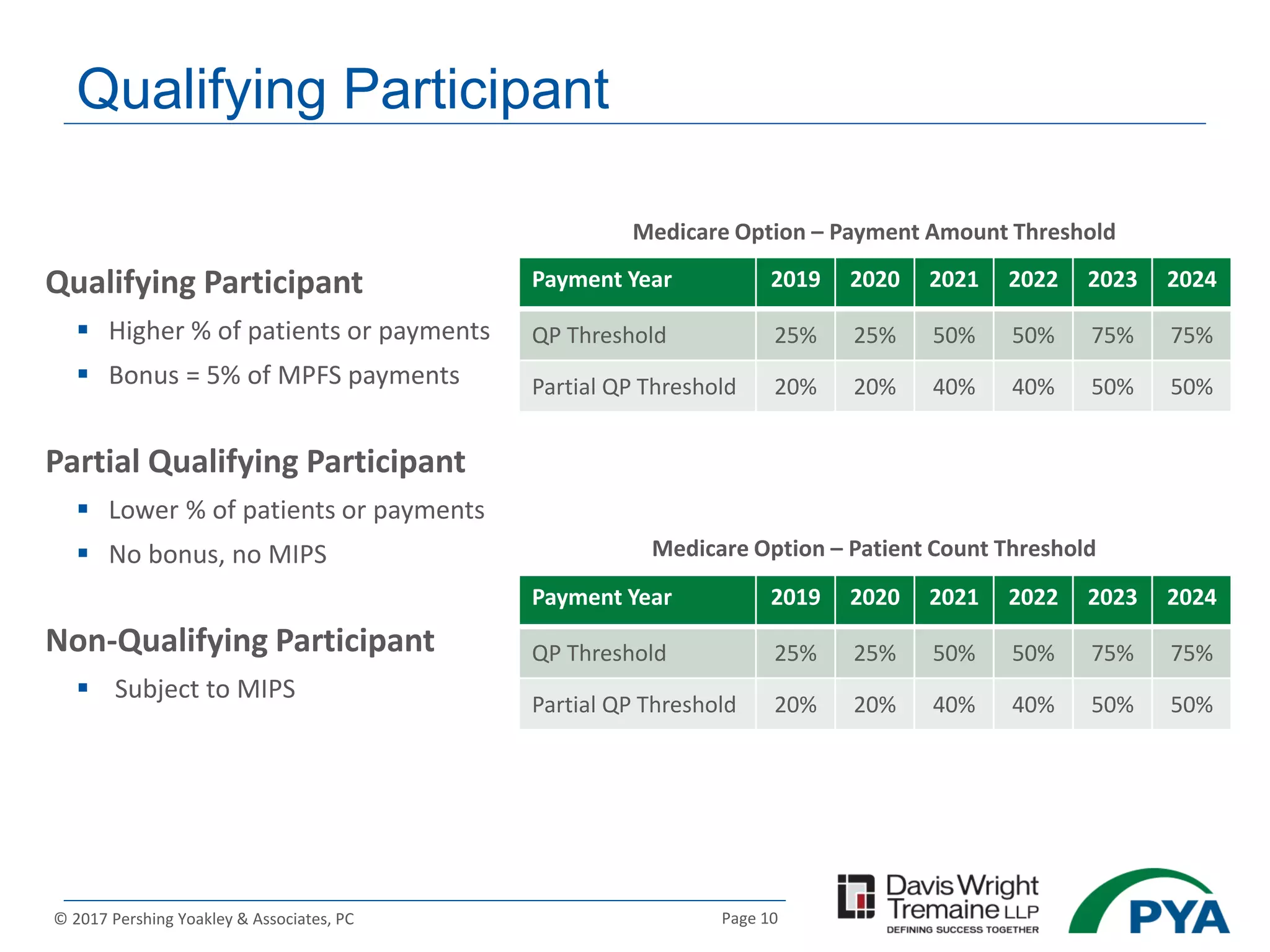

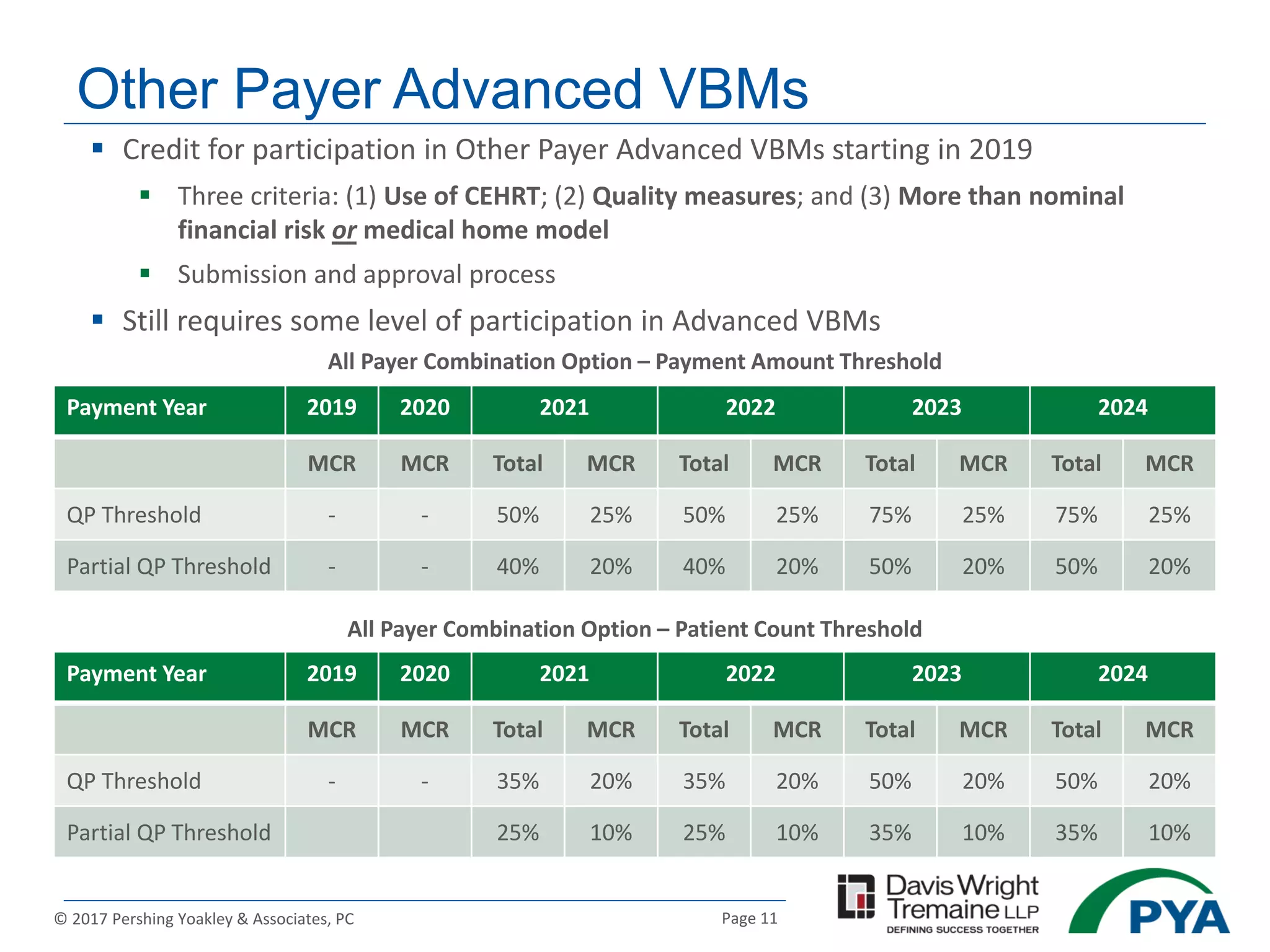

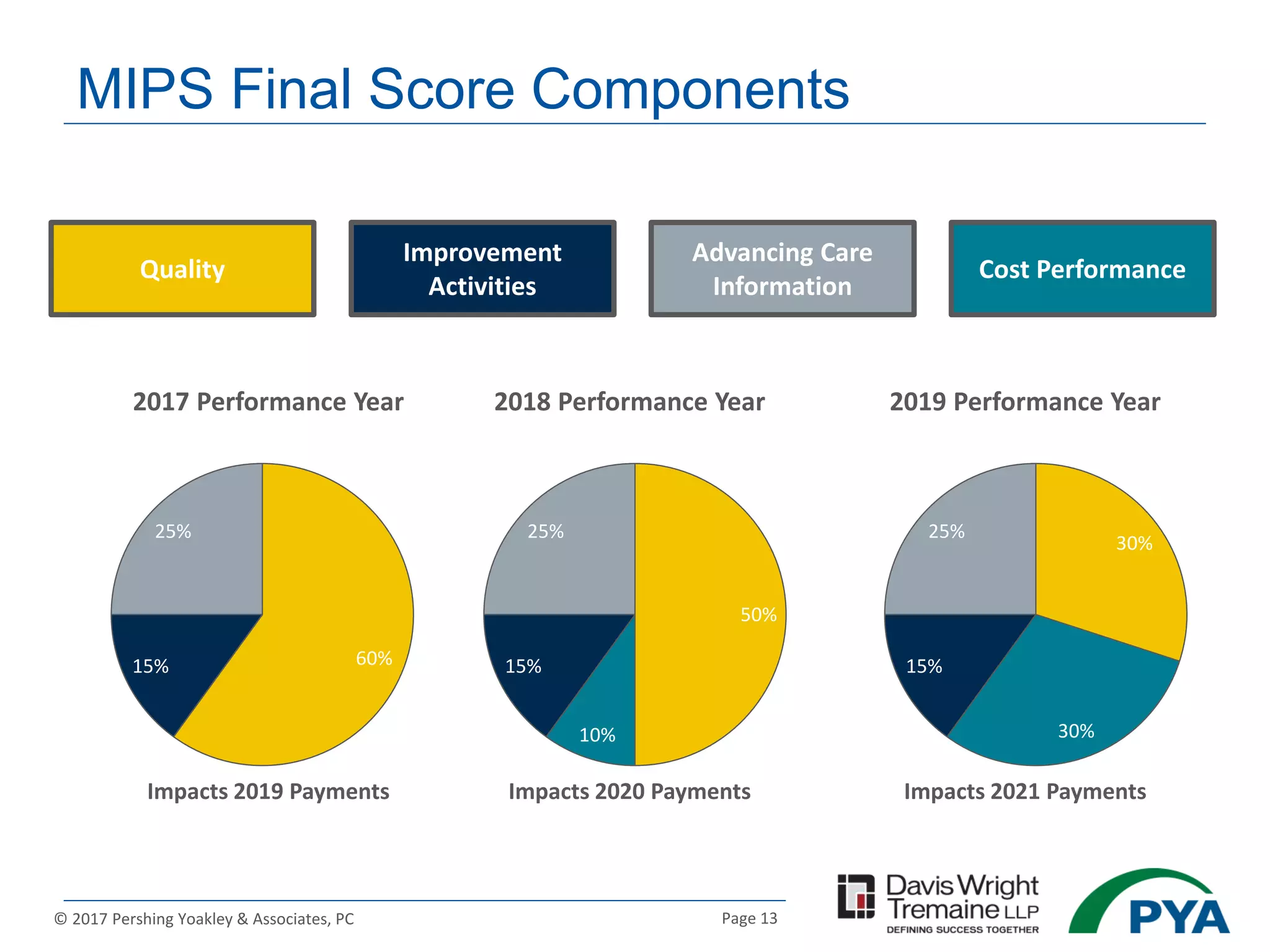

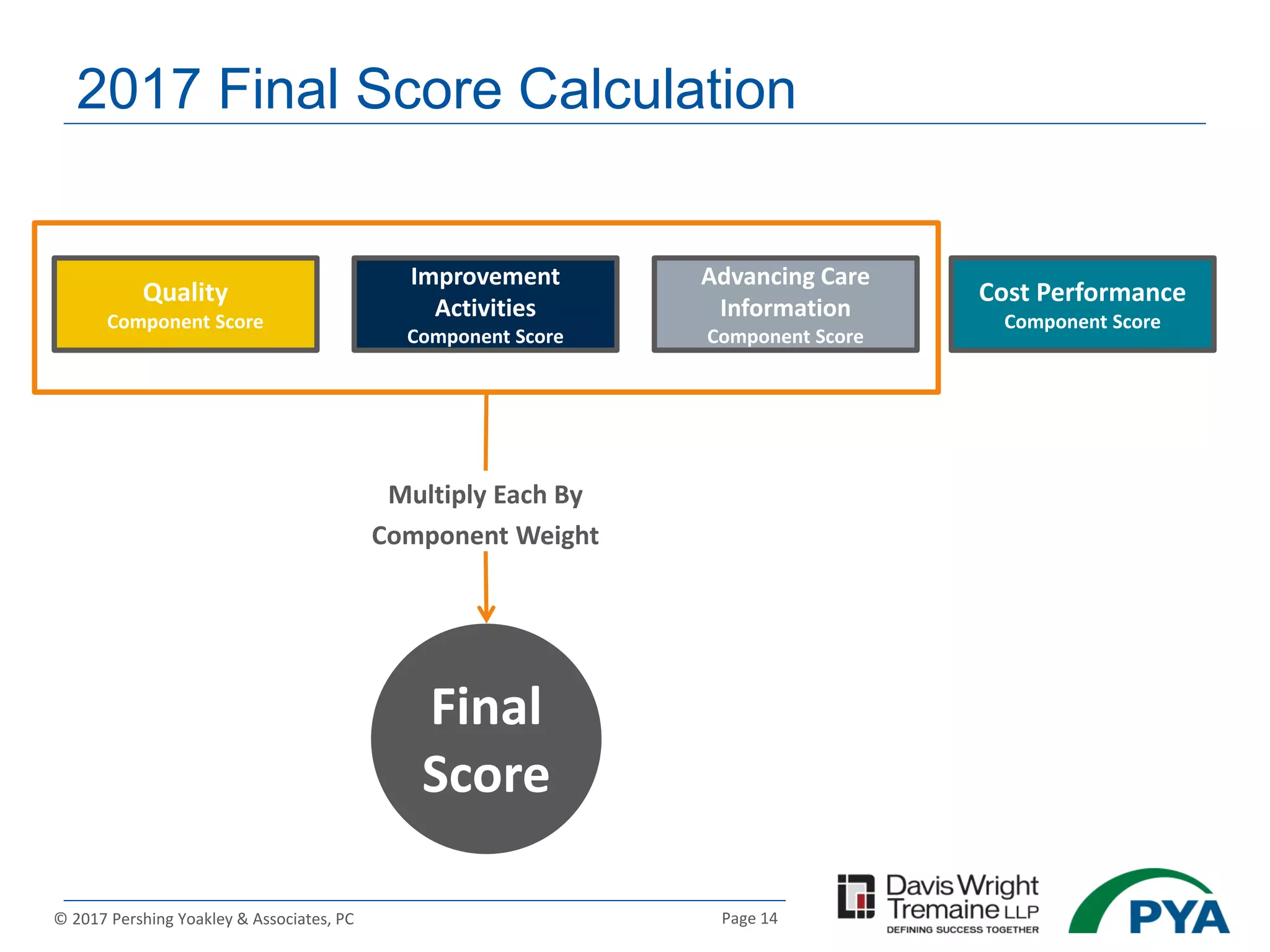

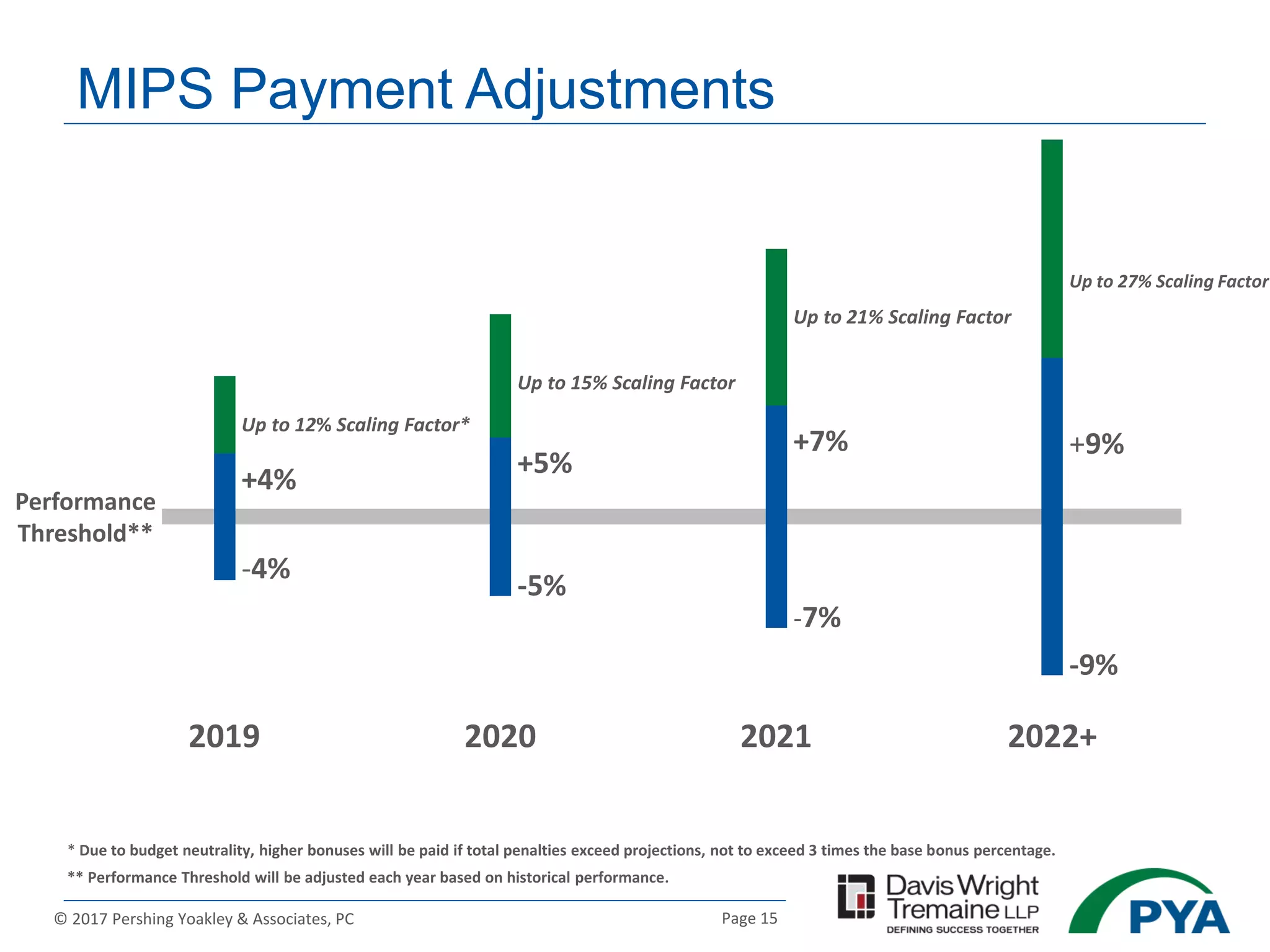

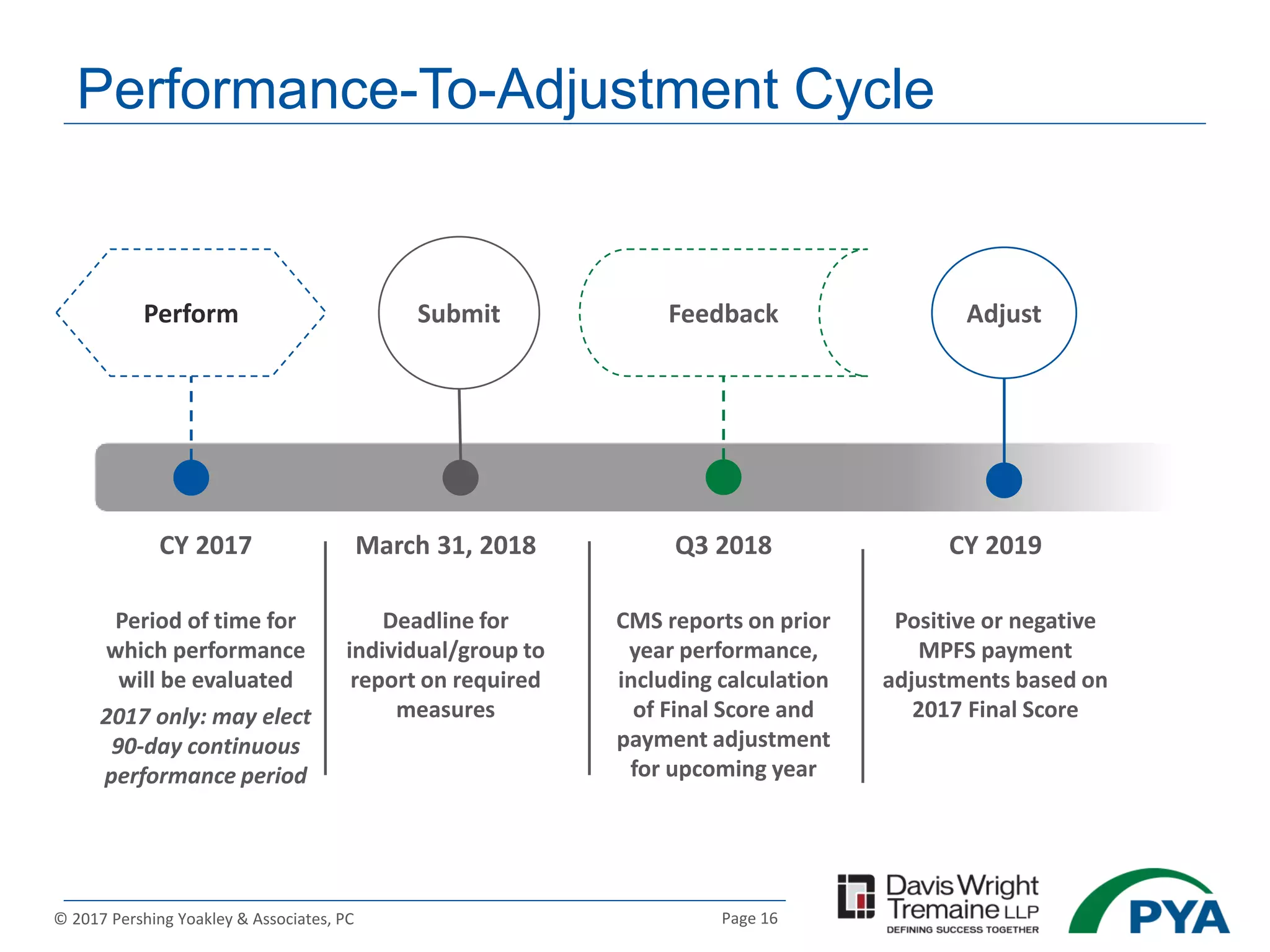

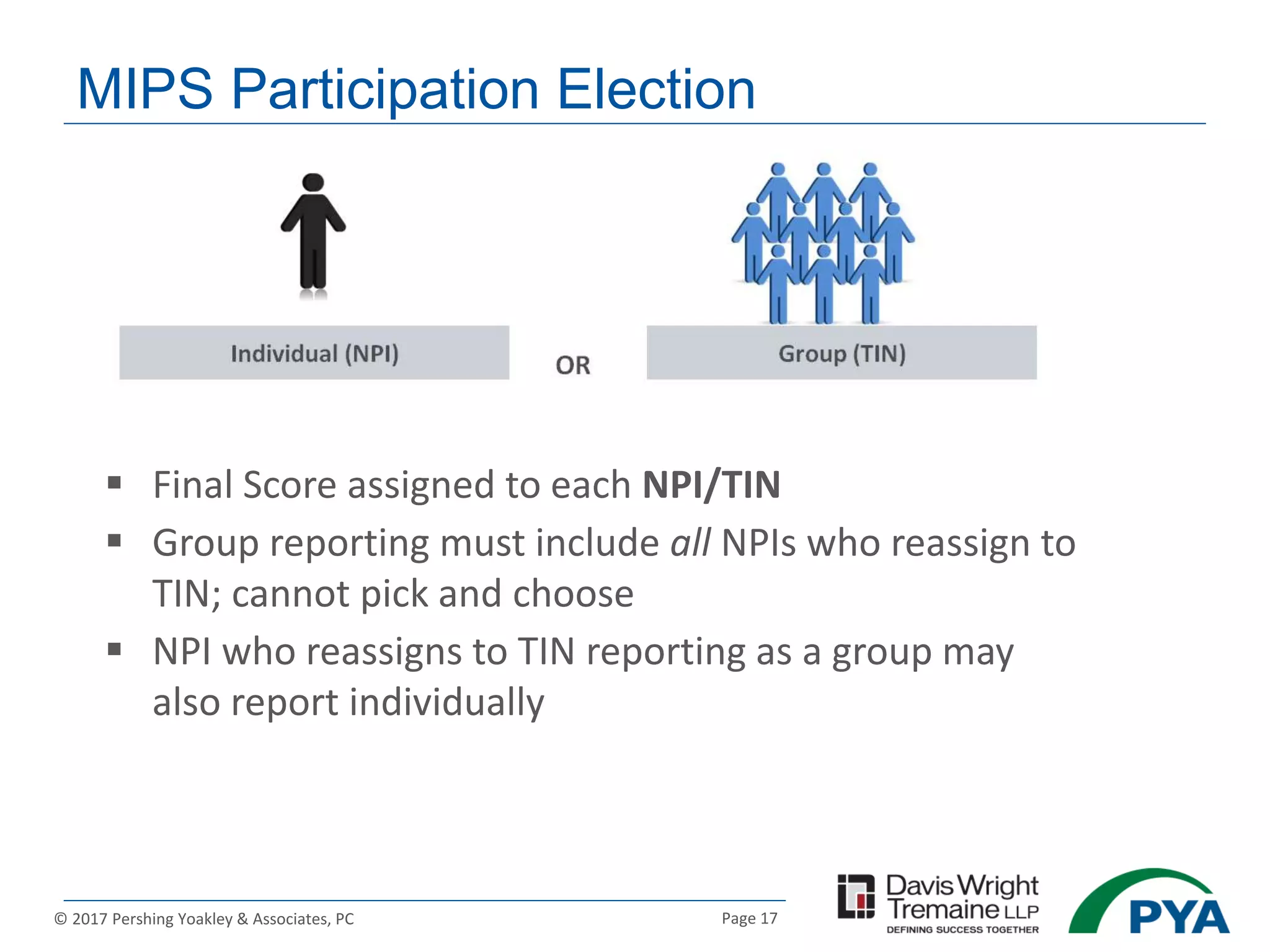

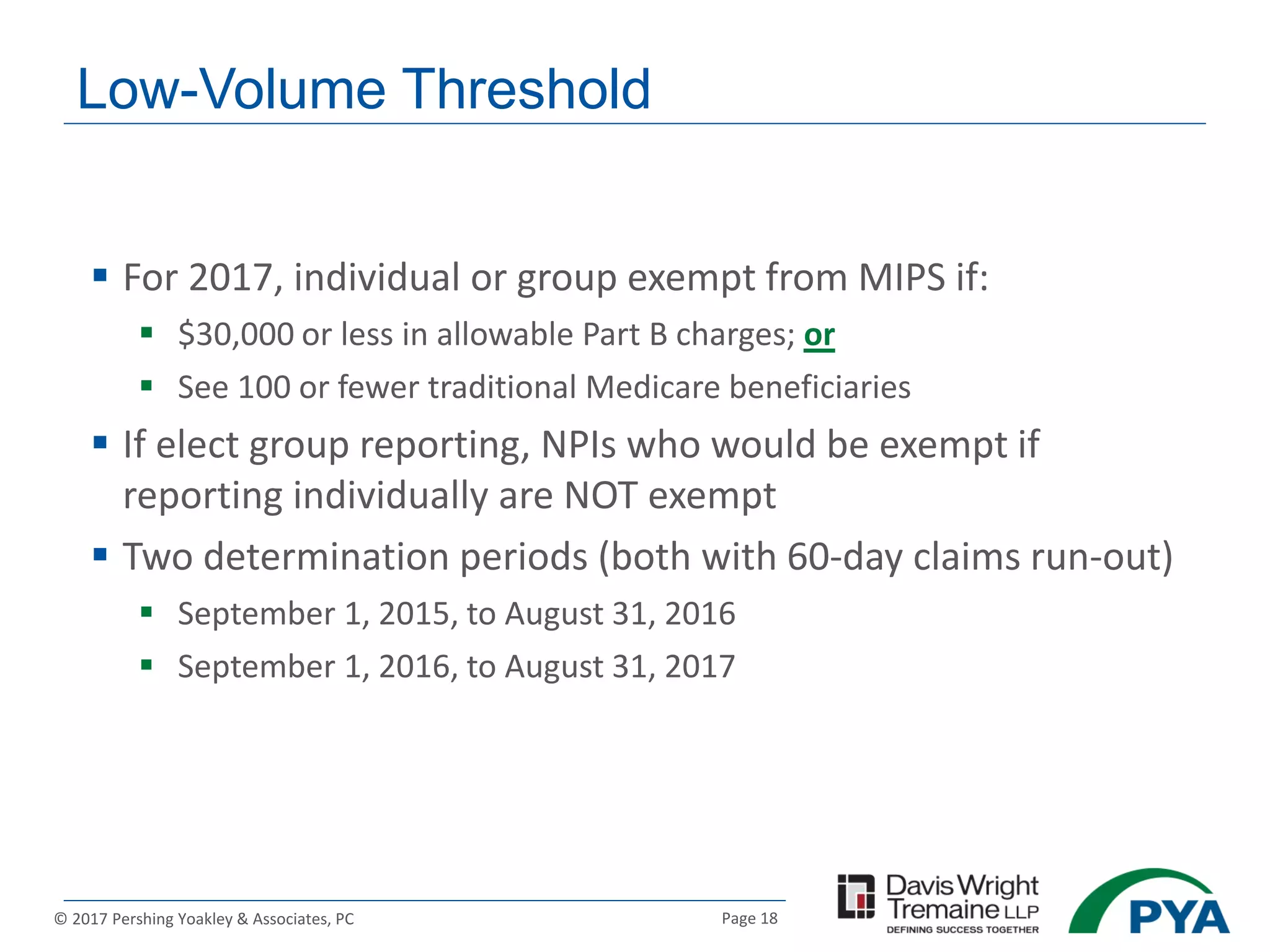

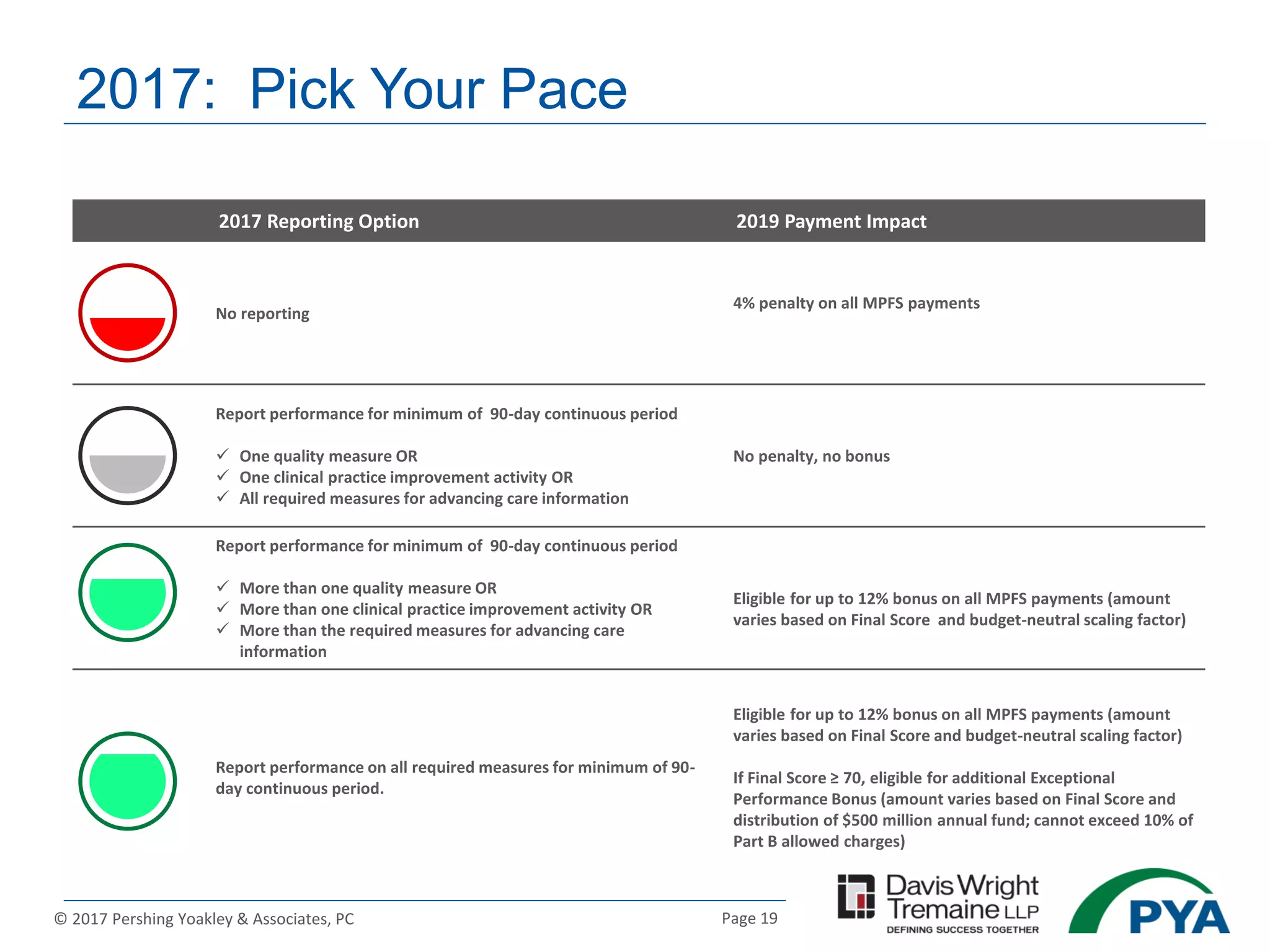

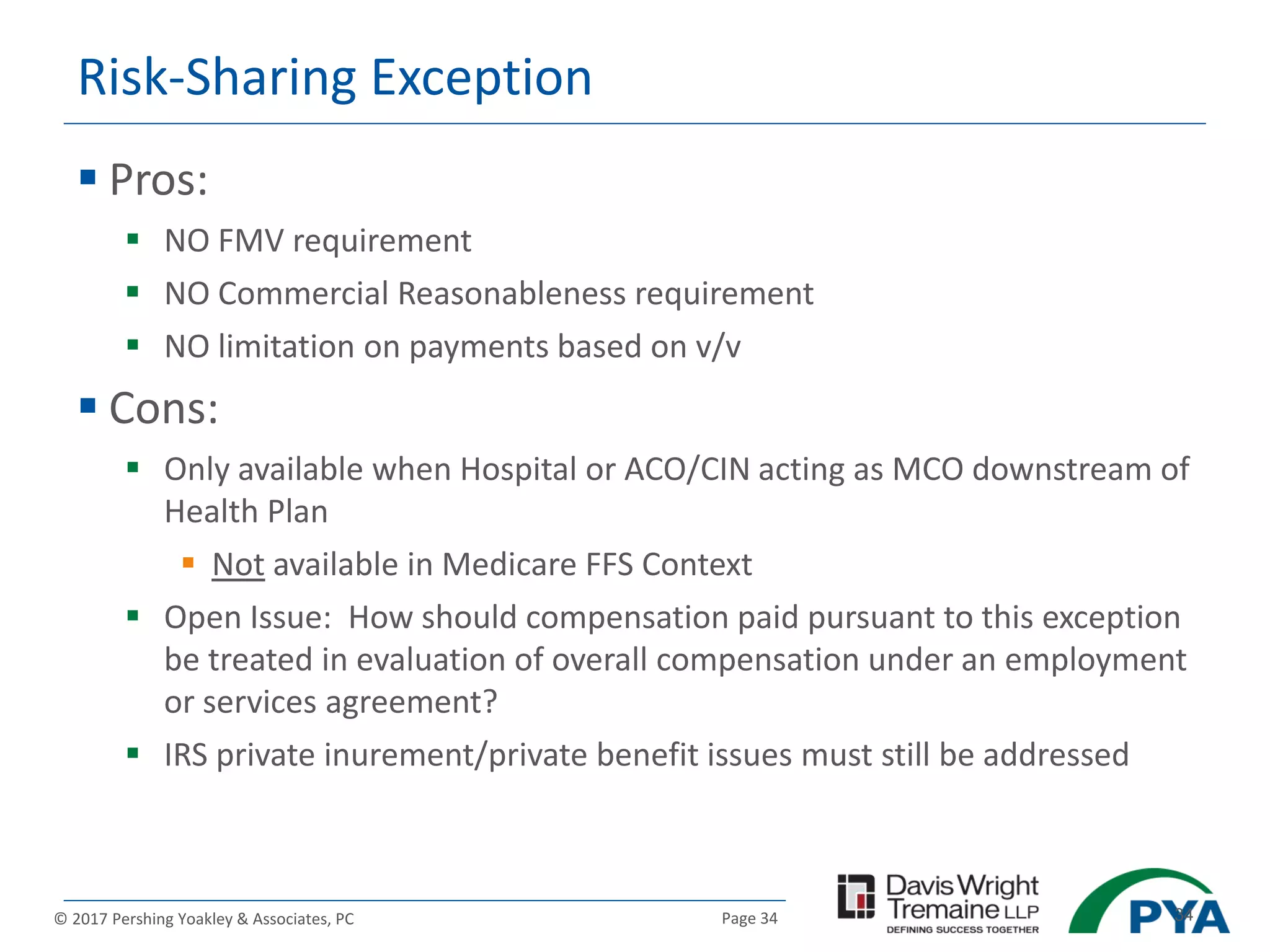

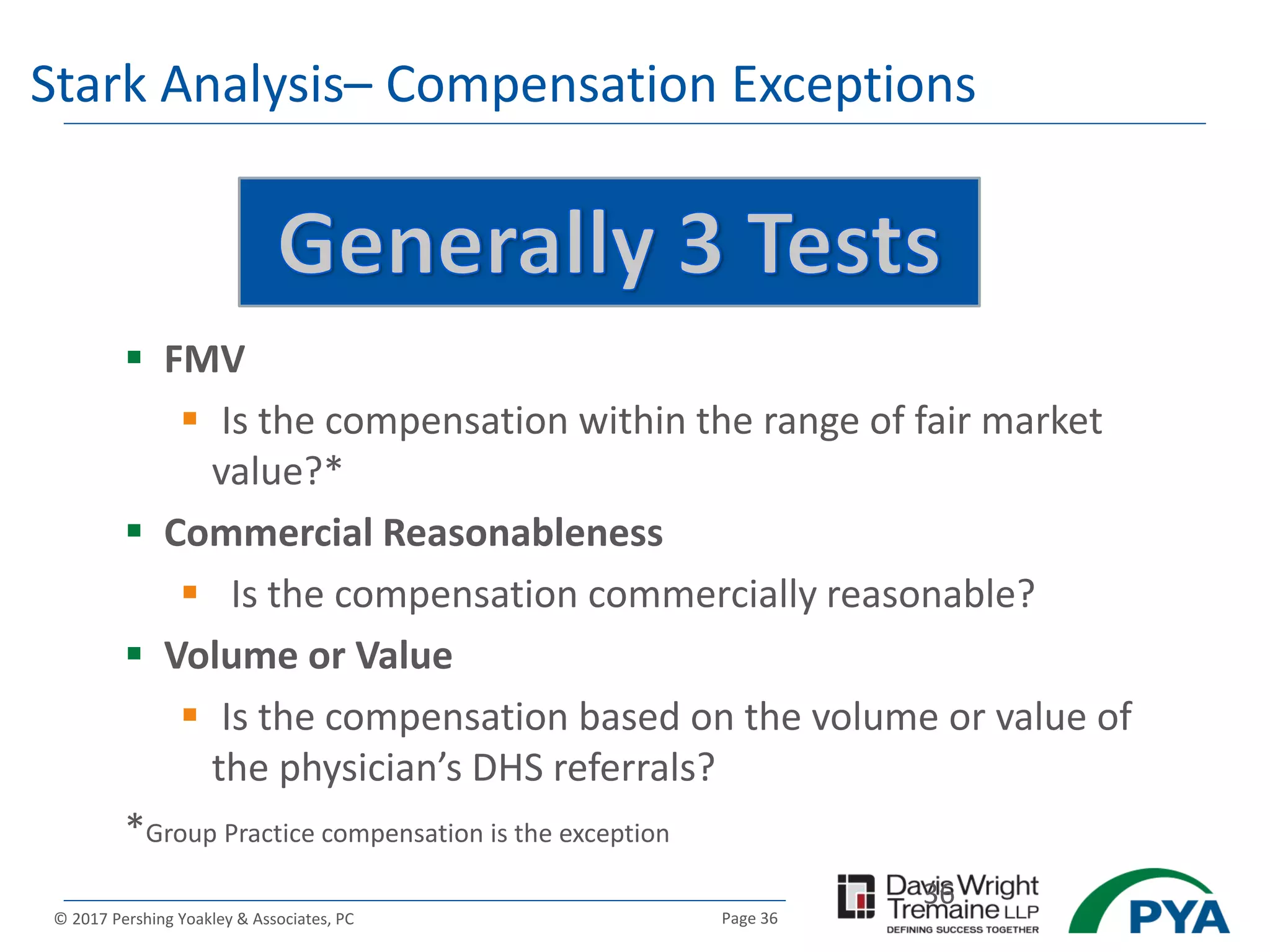

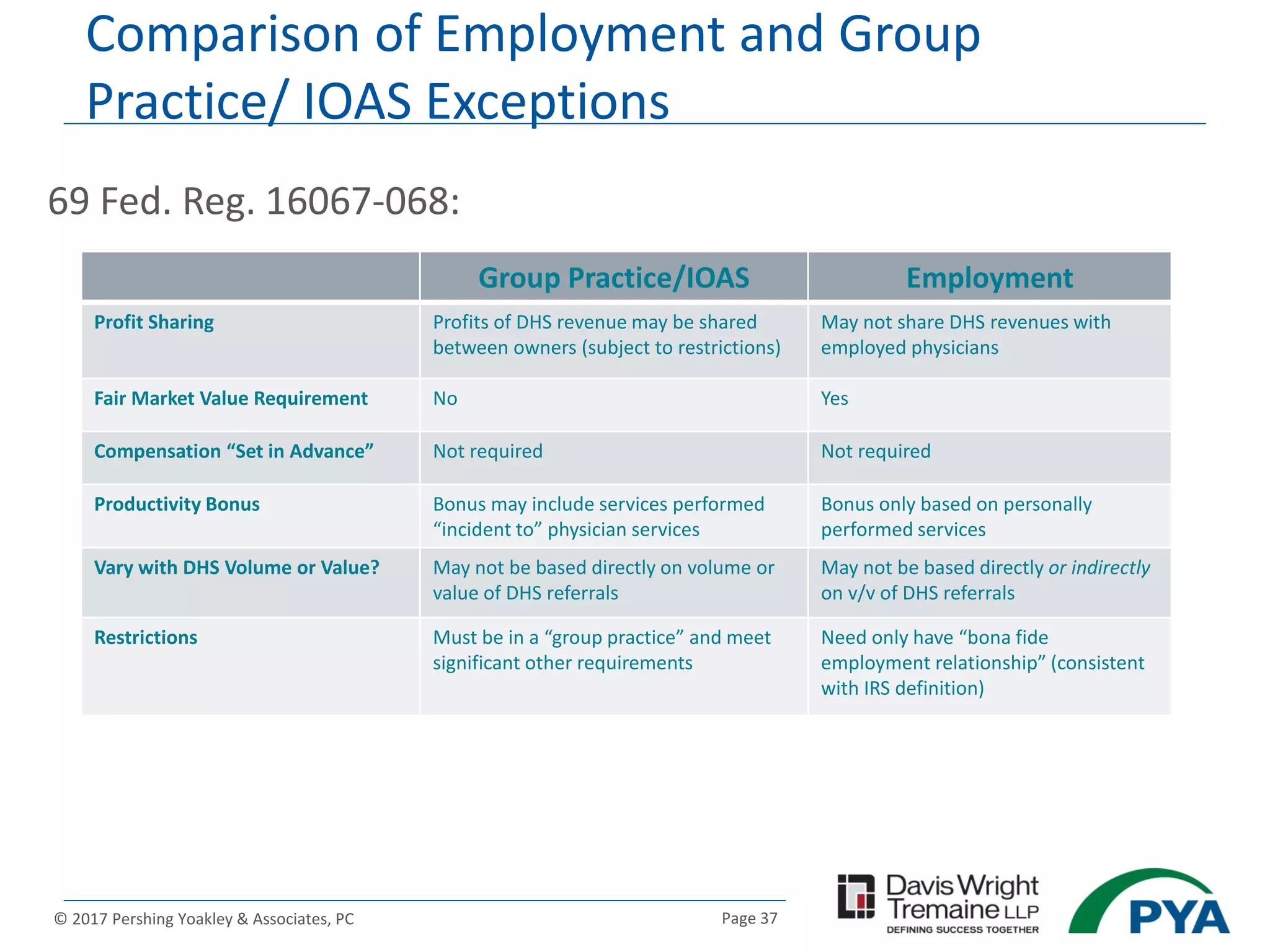

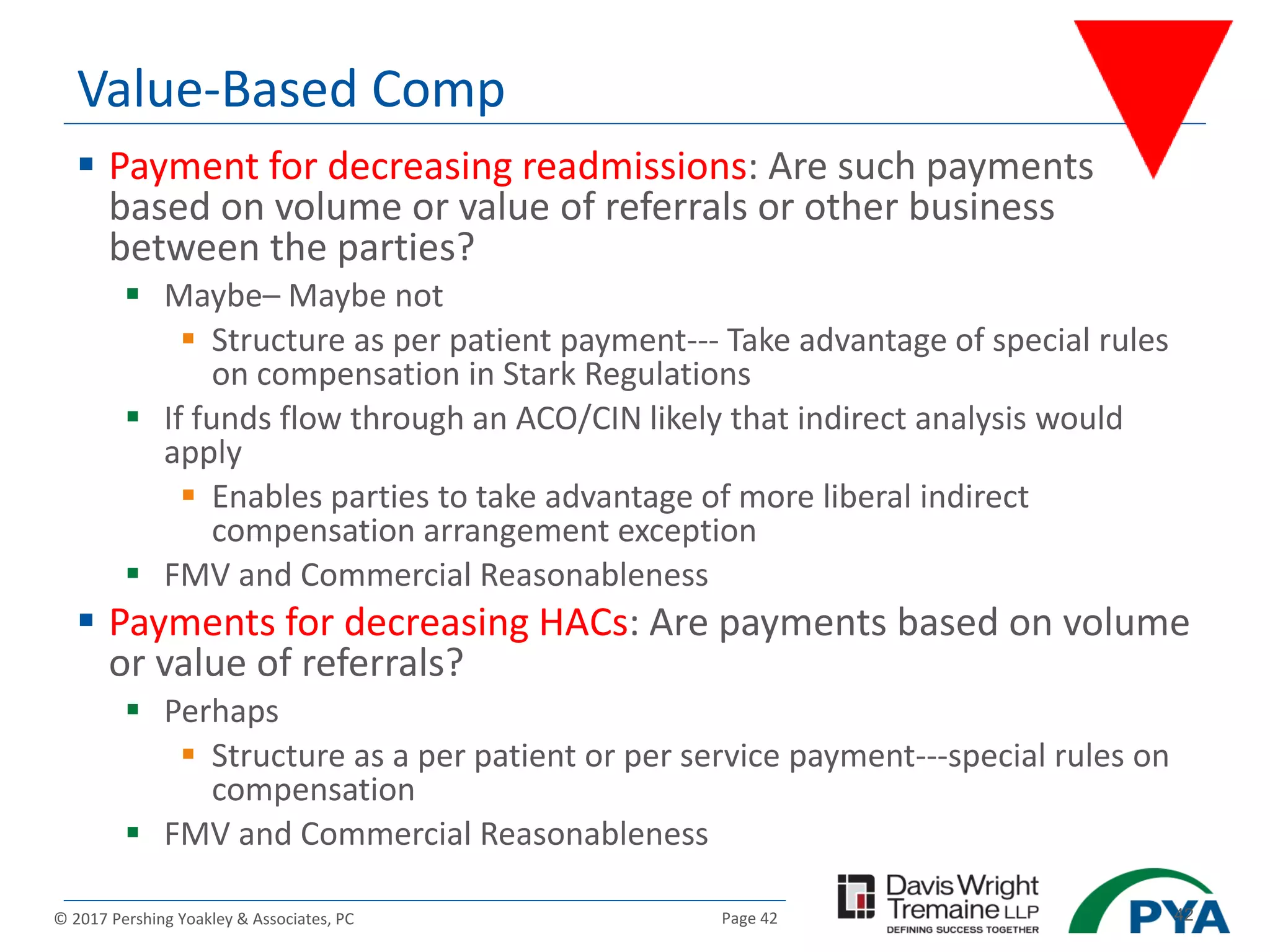

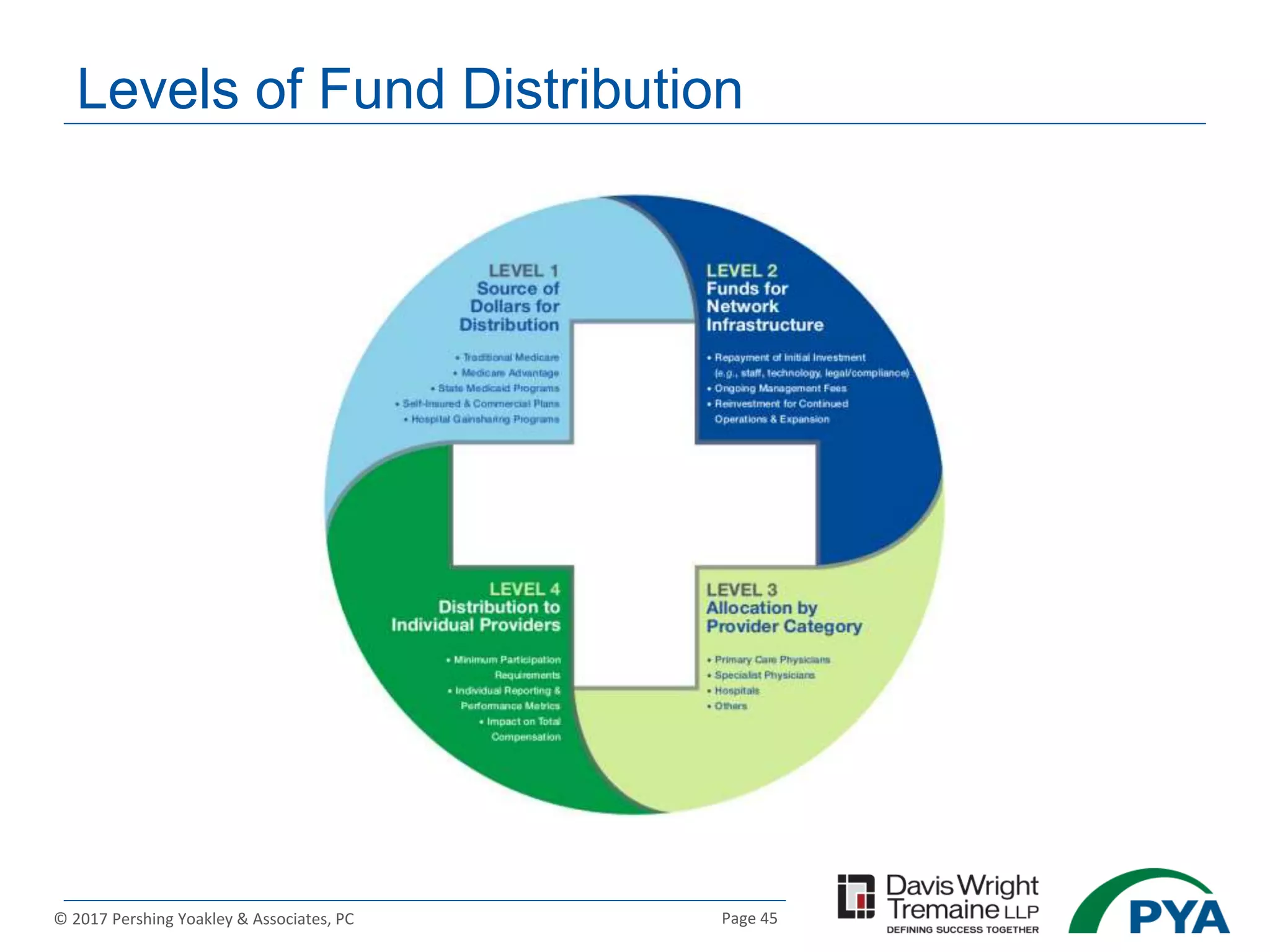

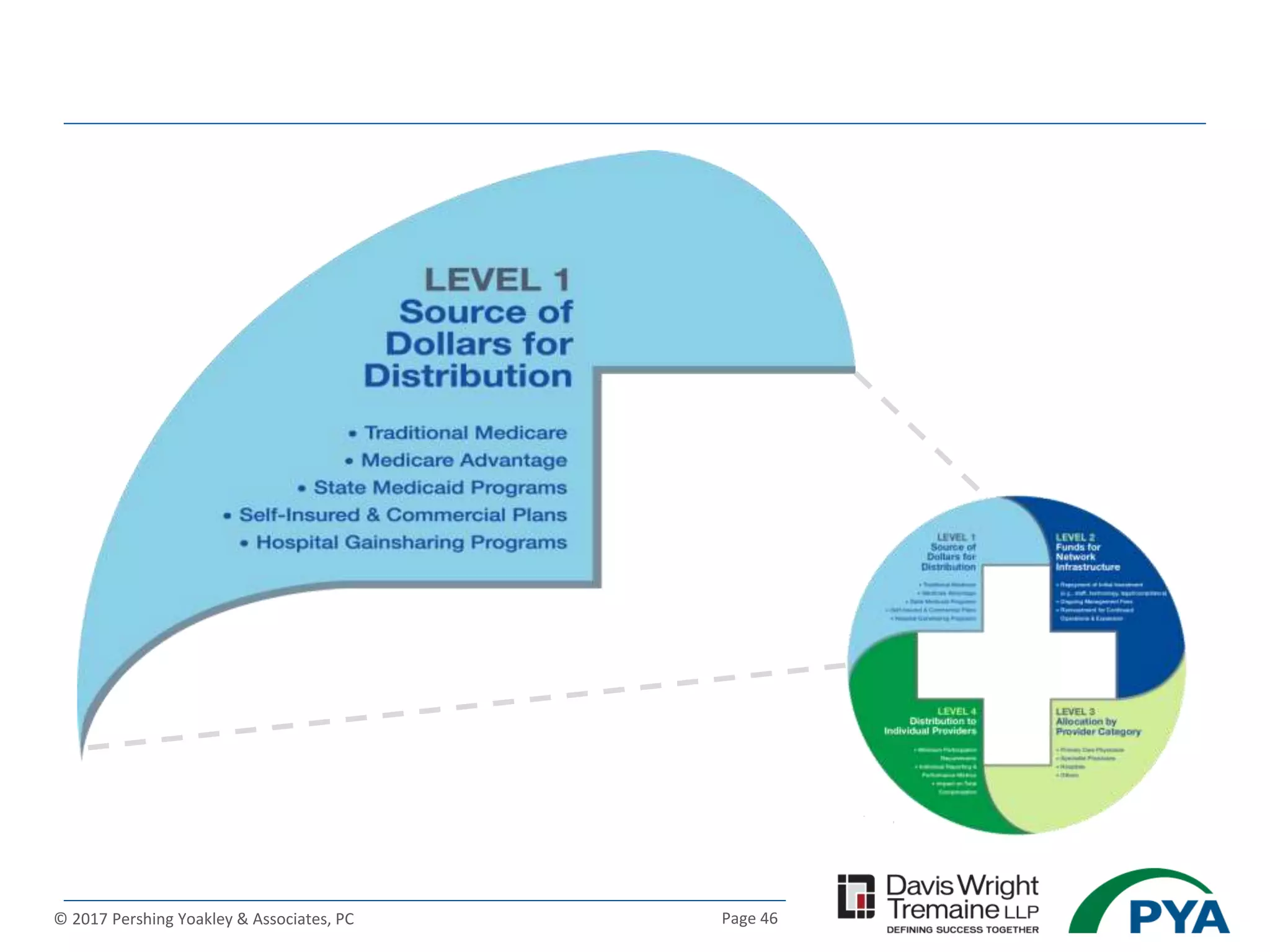

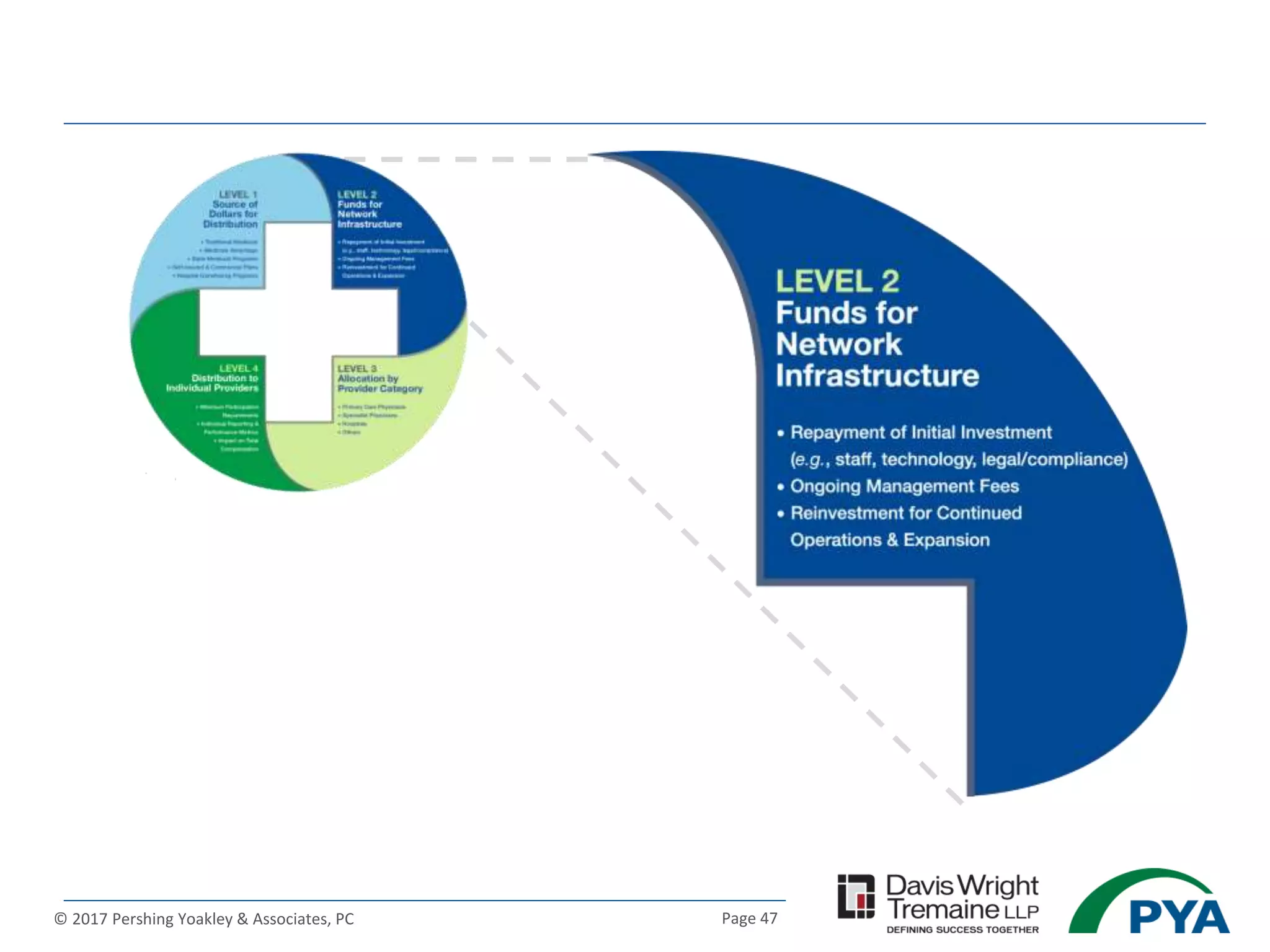

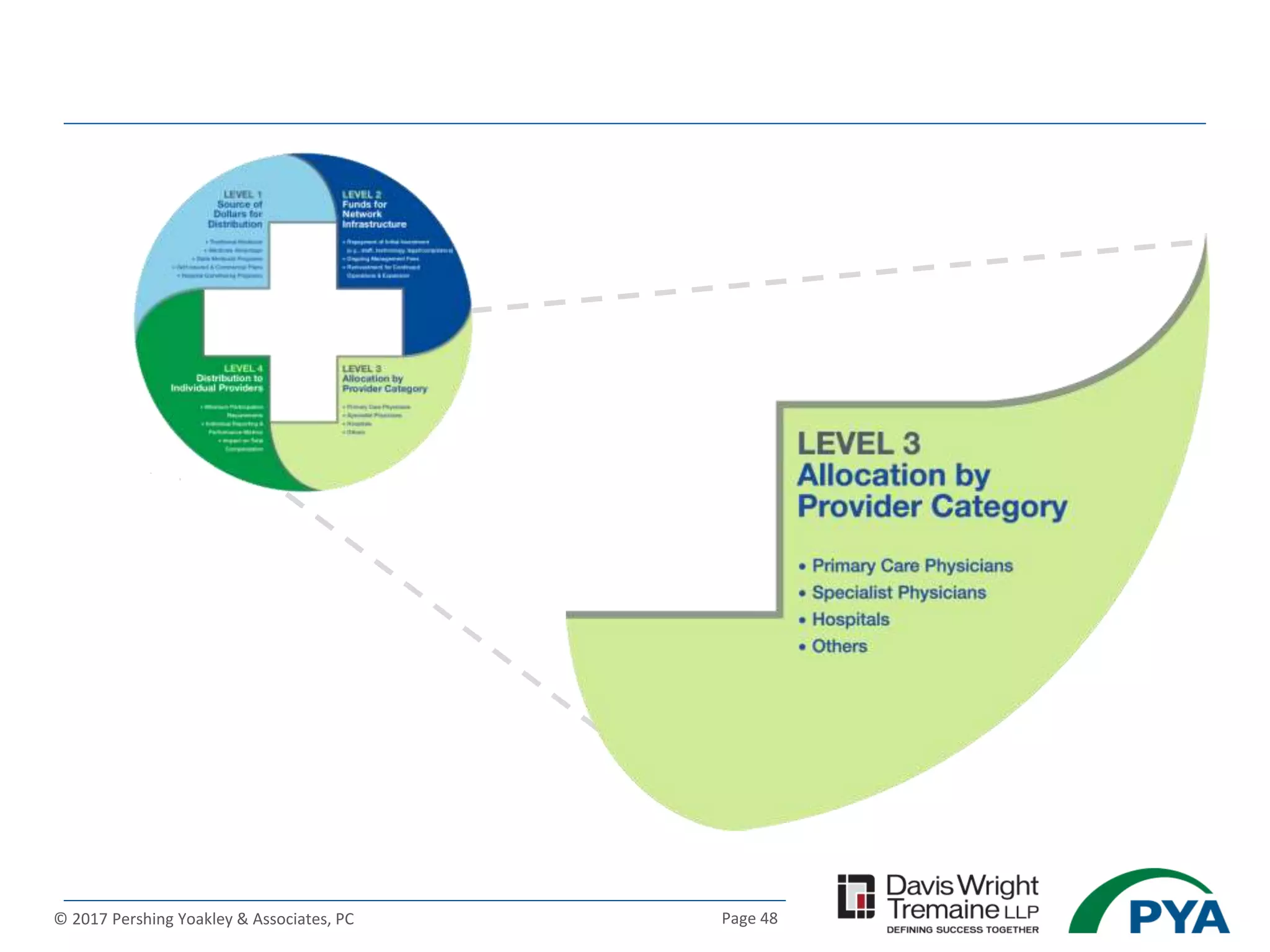

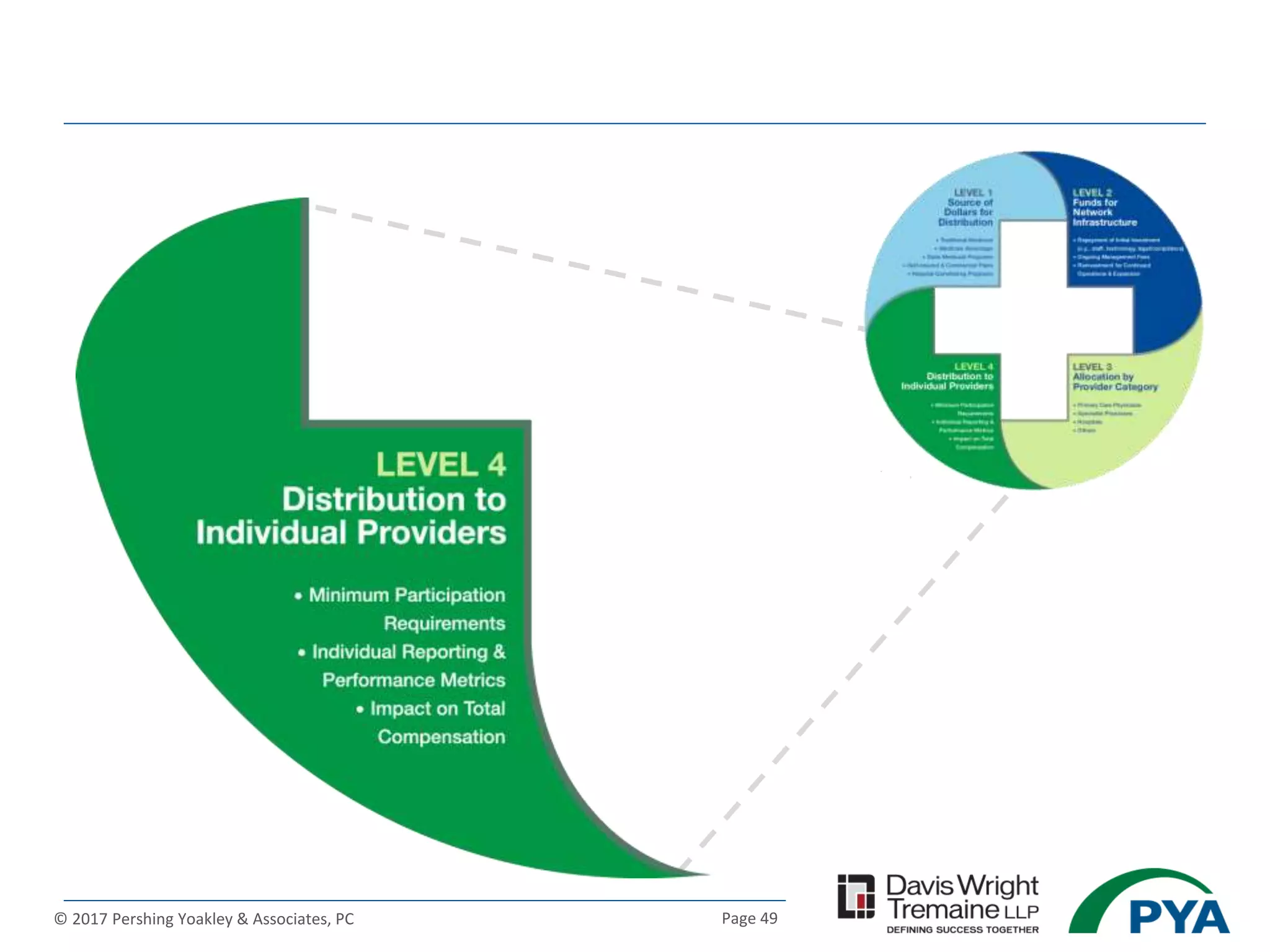

The document discusses the legal and regulatory frameworks surrounding value-based payment models in healthcare, particularly focusing on the implications of fraud and abuse laws, as well as IRS rules. It outlines various advanced value-based payment models established under the Medicare Access and CHIP Reauthorization Act and their eligibility criteria, including the mechanisms for penalties and bonuses related to performance measures. Additionally, it highlights the importance of fair market value and commercial reasonableness assessments in the context of physician compensation and the legal exceptions provided under specific regulatory waivers.