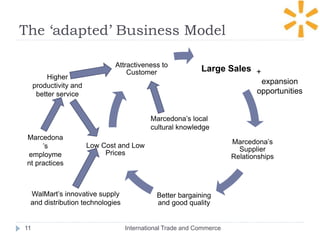

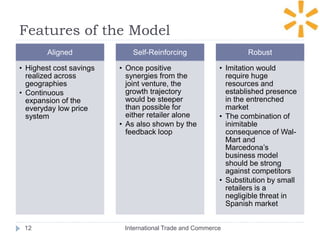

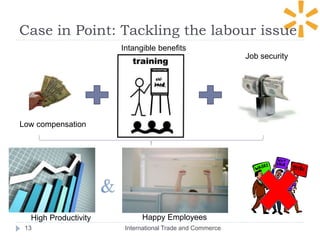

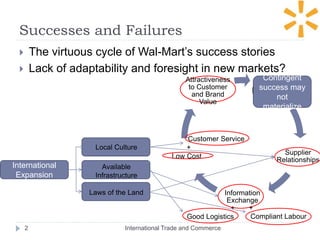

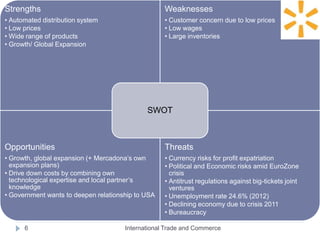

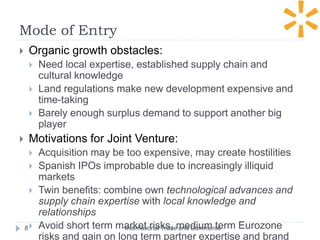

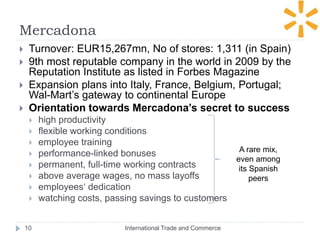

Walmart is considering entering the Spanish retail market through a joint venture with Mercadona, Spain's largest retailer. A SWOT analysis found strengths in Walmart's distribution system and scale but also weaknesses in its low wages. Opportunities exist in Spain's growing population but threats include economic risks. The joint venture could combine Walmart's supply chain expertise with Mercadona's cultural knowledge and strong supplier relationships. The adapted business model would aim to achieve the highest cost savings across geographies through an "everyday low price" approach while also implementing Mercadona's employment practices focusing on job security, training and above-average wages to increase productivity.

![Recommendations

Leading European retail format = discounters (low priced

stores with limited assortment but good quality for certain

target groups) [Pfohl and Roth, 2008]

Market stagnant: aim to grab competitors’ market share

Capitalize on the downturn sentiment

Participate in social causes for community benefit and visibility

Crisis => lower ability to pay => prices a critical factor => EDLP

rules

Population density rising, improved accessibility more

important than new establishments

Target new formats (eg. neighbourhood stores) at untapped

areas

Place supermarkets in areas more accessible to tourists

Experiment with Marcedona‘s employment practices in other

EU markets

International Trade and Commerce9](https://image.slidesharecdn.com/walmartinspain-131214211204-phpapp021-150517144223-lva1-app6892/85/Walmart-PESTLE-15-320.jpg)