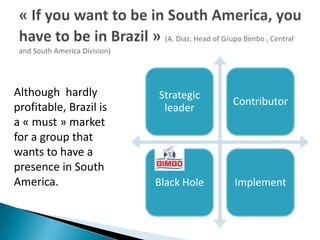

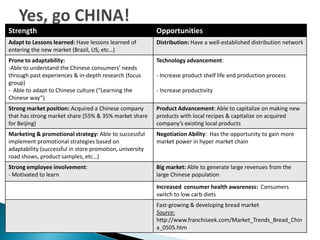

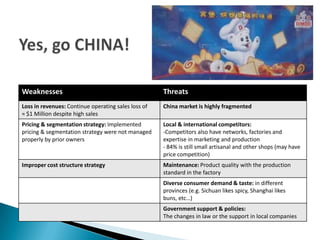

Grupo Bimbo faced challenges entering the Brazilian market by wrongly assuming it was similar to Mexico. Some key differences included much lower overall bread consumption in Brazil, a tradition of artisanal fresh bread, different tastes preferences, intense price competition, and an unsuitable distribution strategy. While not profitable, Brazil is an important market for Bimbo's presence in South America. Bimbo can recover by controlling costs through an adapted distribution strategy, improving revenue with new suitable products, and making Brazil a lab for innovation.