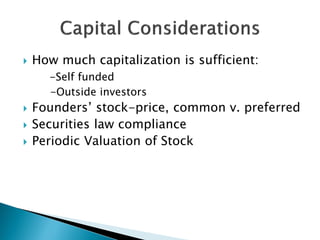

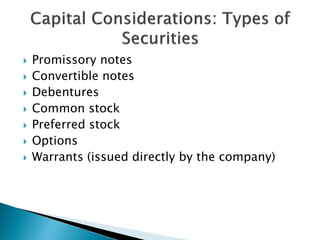

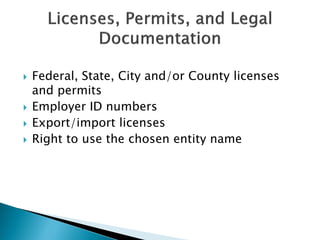

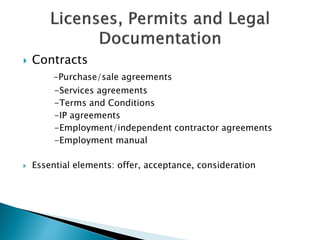

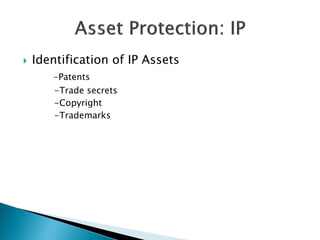

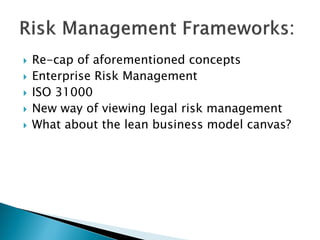

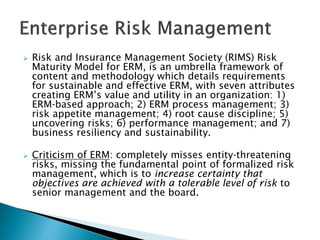

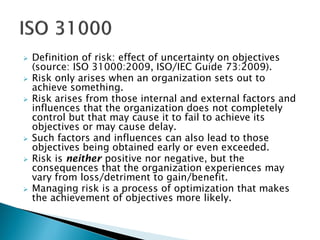

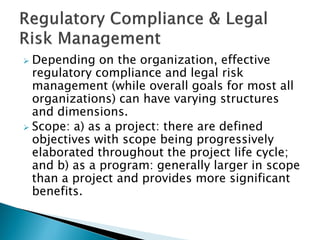

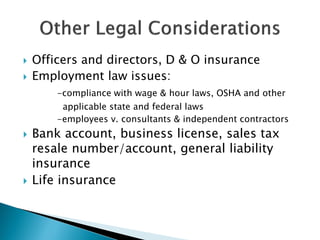

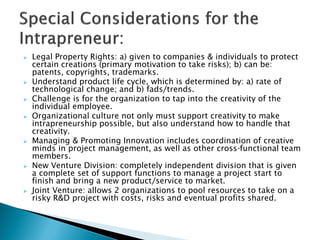

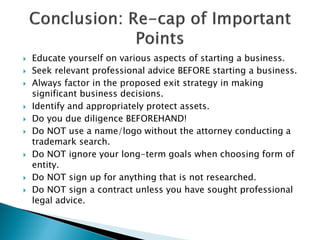

This document provides guidelines and educational insights on the importance of compliance and legal risk management for organizations. It emphasizes establishing effective compliance programs, understanding legal implications of contracts, and the need for a proactive culture around risk management. Attendees are advised to seek professional legal counsel before making business decisions, especially when it comes to compliance, asset protection, and contractual obligations.