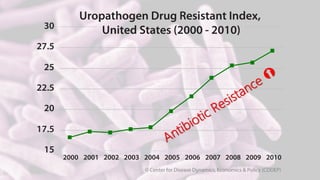

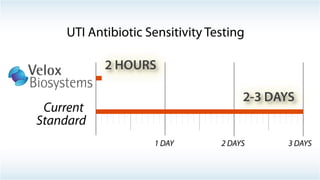

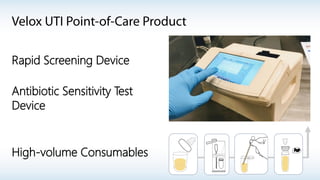

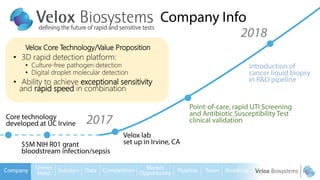

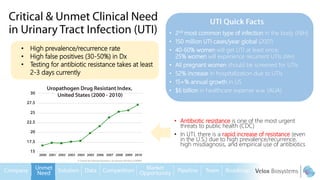

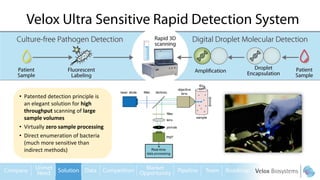

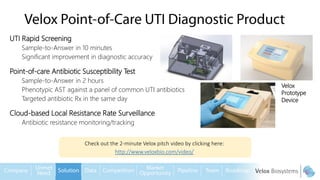

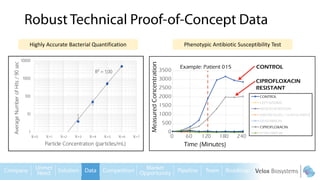

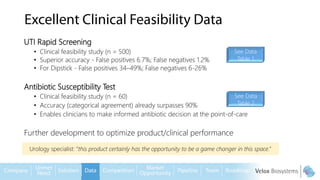

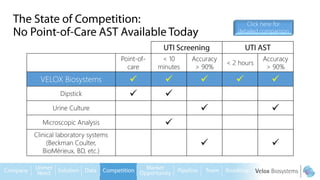

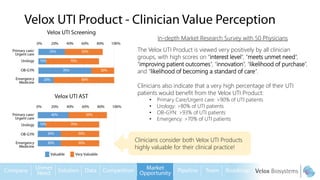

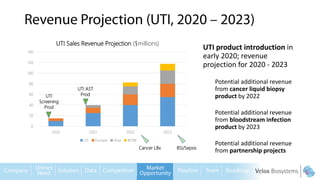

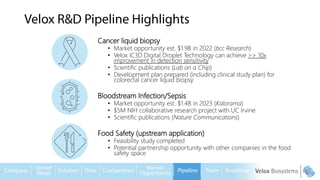

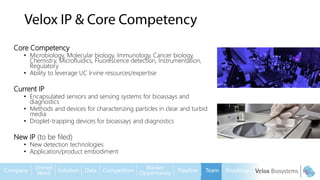

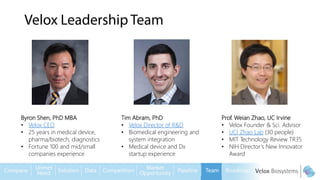

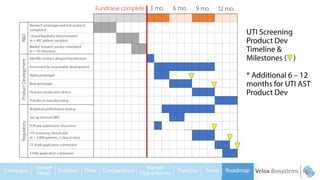

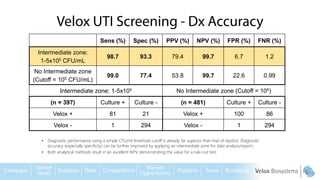

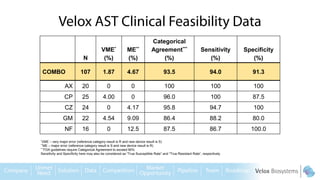

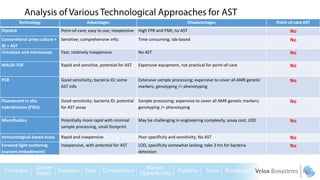

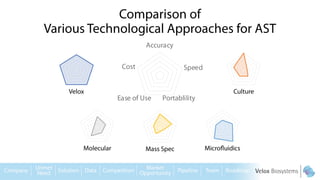

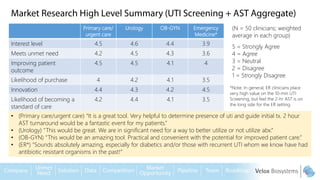

Byron Shen, CEO of Velox Biosystems, presents a startup pitch detailing their innovative technology for rapid, accurate detection of urinary tract infections, sepsis, and cancer. The pitch outlines the historical context of exploration and investment, highlighting Velox's capabilities in outperforming current diagnostic technologies through its patented molecular detection methods. With a promising product pipeline and a substantial market opportunity, Shen emphasizes the potential for Velox to revolutionize medical diagnostics and achieve significant market value.