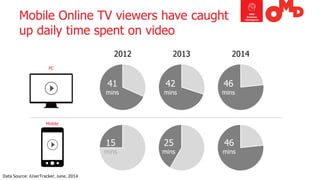

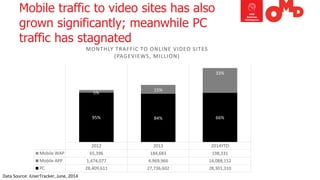

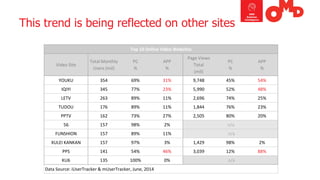

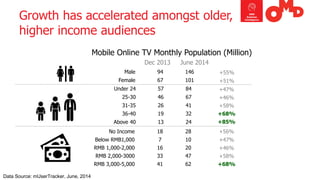

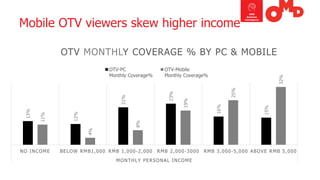

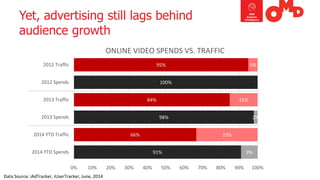

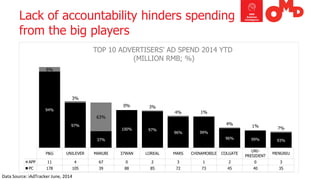

The document presents insights on the rise of mobile online TV consumption in China, highlighting that mobile viewers have caught up with PC viewers in terms of daily video viewing time. It notes that 32% of mobile online TV viewers earn over RMB 5,000 monthly, with significant growth coming from older, higher-income demographics. However, advertising investments have not kept pace with audience growth, and future advertising spend will only align with PC expenditures once better tracking solutions are implemented.