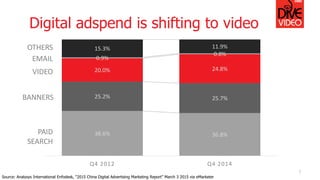

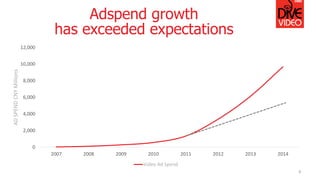

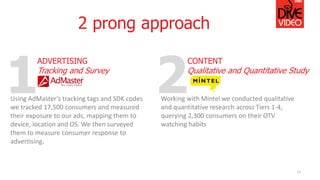

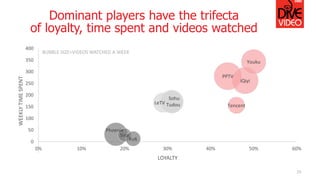

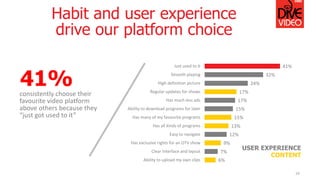

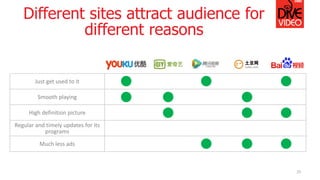

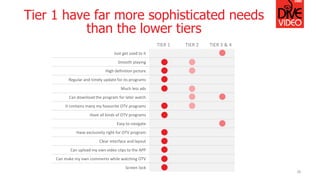

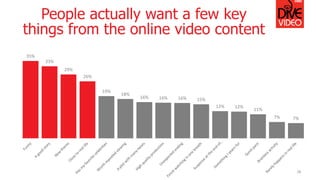

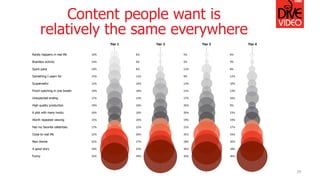

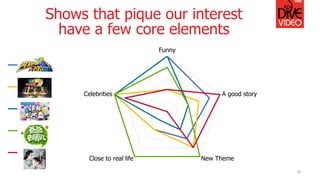

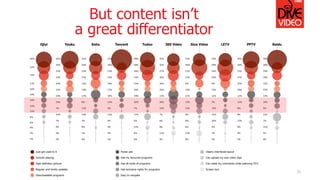

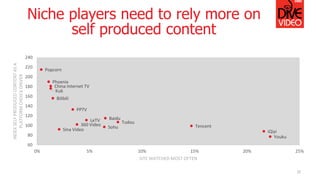

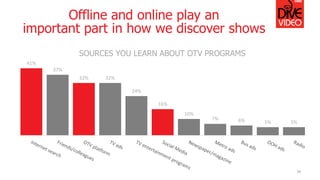

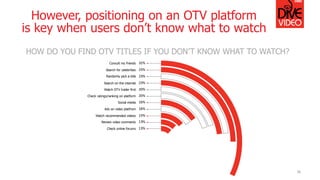

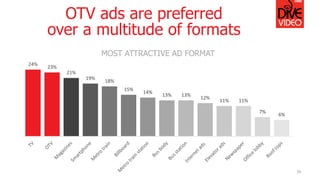

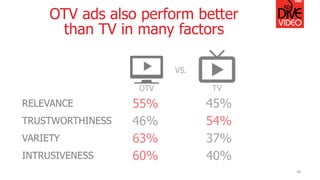

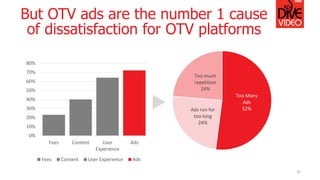

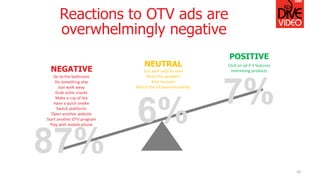

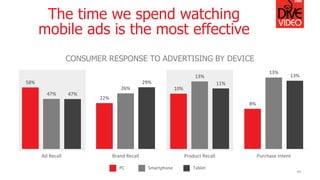

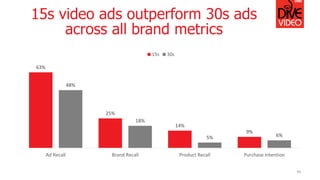

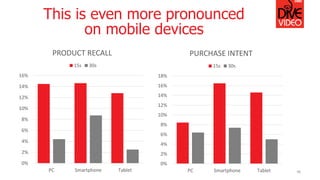

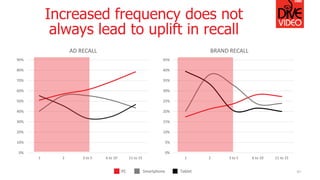

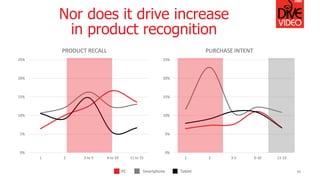

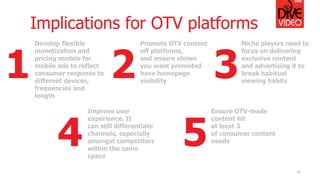

The document presents 'Dive Video,' the final installment of the OMD dive series, which explores the rapid growth and challenges of China's digital video market, with digital video viewers expected to surpass 500 million in 2015. It details a two-phase research approach to uncover consumer behaviors and preferences regarding online video and advertising effectiveness, emphasizing the importance of shorter ads and mobile optimization. The findings aim to guide advertisers, video platforms, and agencies on how to enhance video marketing strategies and consumer engagement.