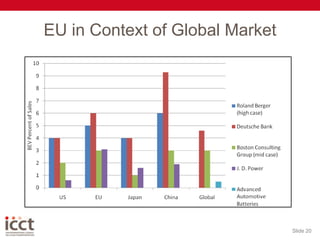

- Vehicle electrification is gaining unprecedented global interest from governments, automakers, and customers due to factors like energy security, climate policy, and pent-up customer demand.

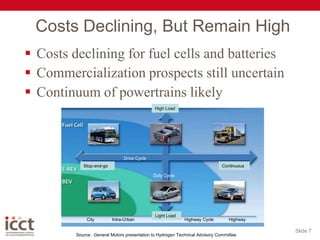

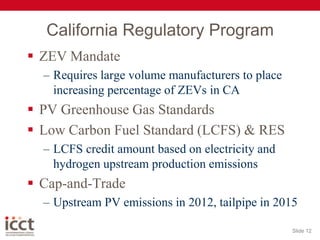

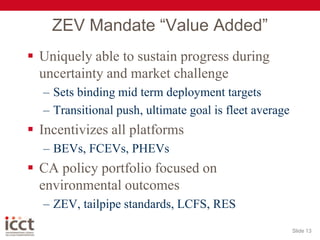

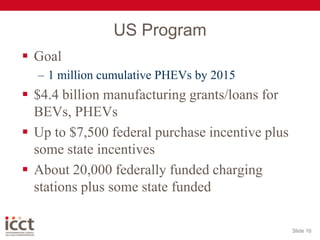

- While costs of batteries and fuel cells are declining, they remain high compared to gasoline vehicles, so electrified vehicles will likely only achieve significant market penetration with supportive policies.

- As early adopters acquire electrified vehicles, policies will need to focus on gaining the trust of more risk-averse "second wave" customers through ensuring reliability, resale value, and sufficient range.

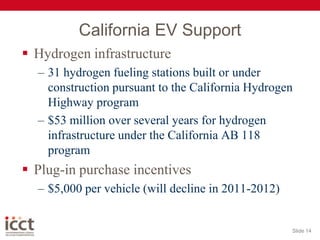

- Infrastructure build-out for hydrogen and electric vehicle charging will be crucial to support more widespread adoption of electrified vehicles.