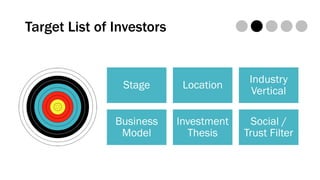

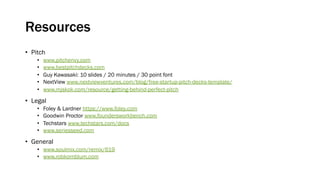

This document provides guidance on fundraising for a seed round of funding. It outlines key steps including preparing financials and pitch materials, identifying target investors, socializing your idea, conducting the fundraising campaign, and closing the deal. Important considerations are determining how much funding is needed based on financial projections, establishing milestones to prove business model risks are mitigated, and negotiating valuation and equity stakes. The process typically takes 3-6 months and success relies on building relationships, finding investors, and addressing their diligence needs.