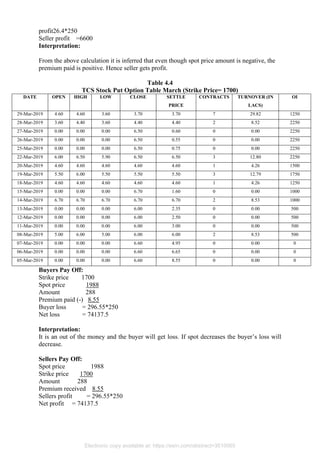

The document analyzes India's derivatives market, specifically futures and options trading. It provides an overview of how derivatives work and the different types, and examines trading data and examples from the TCS stock to illustrate how futures and options can be used and their payoffs. The analysis aims to help investors understand how to use derivatives to manage risks and potentially gain profits in the Indian stock market.