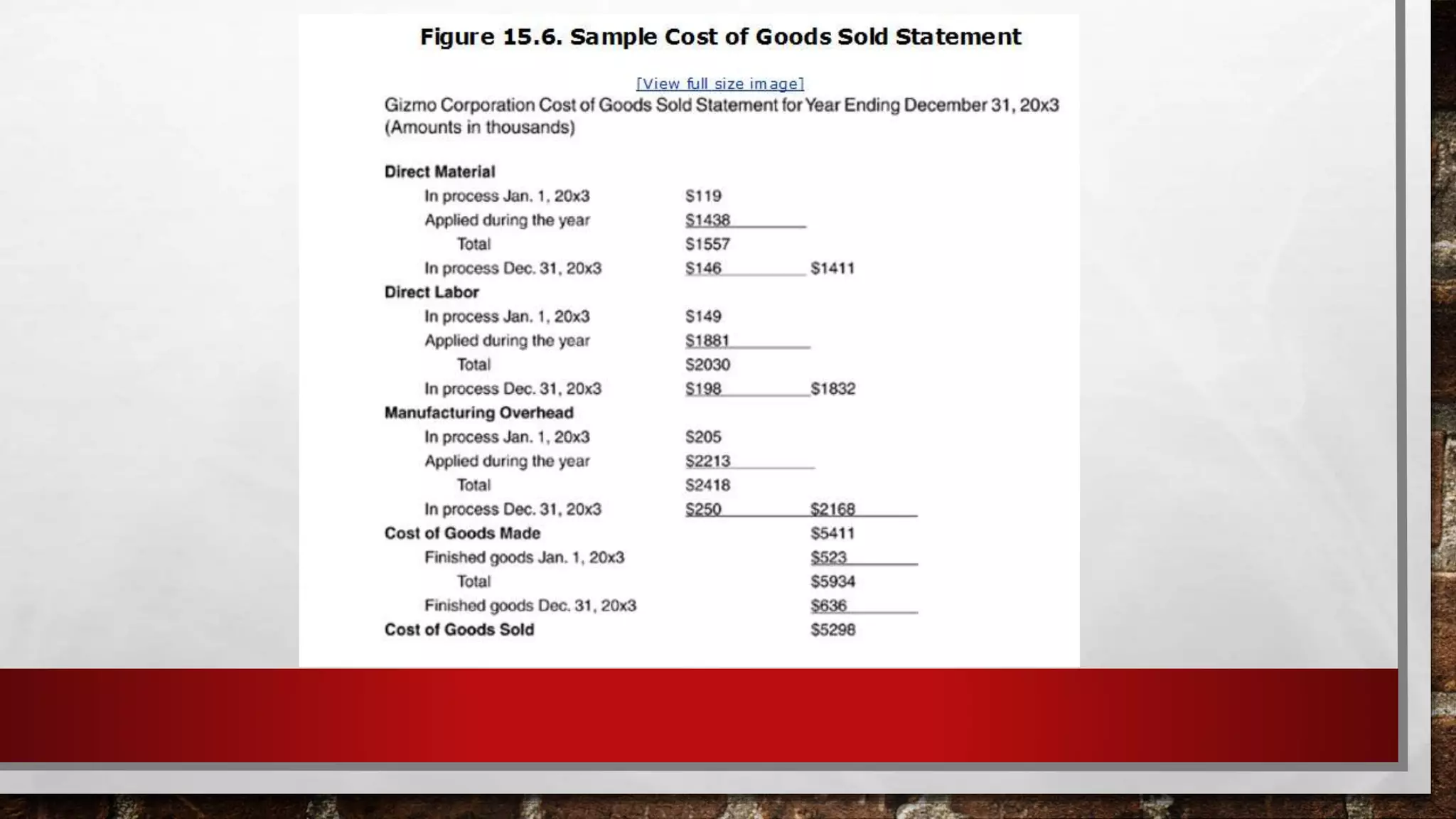

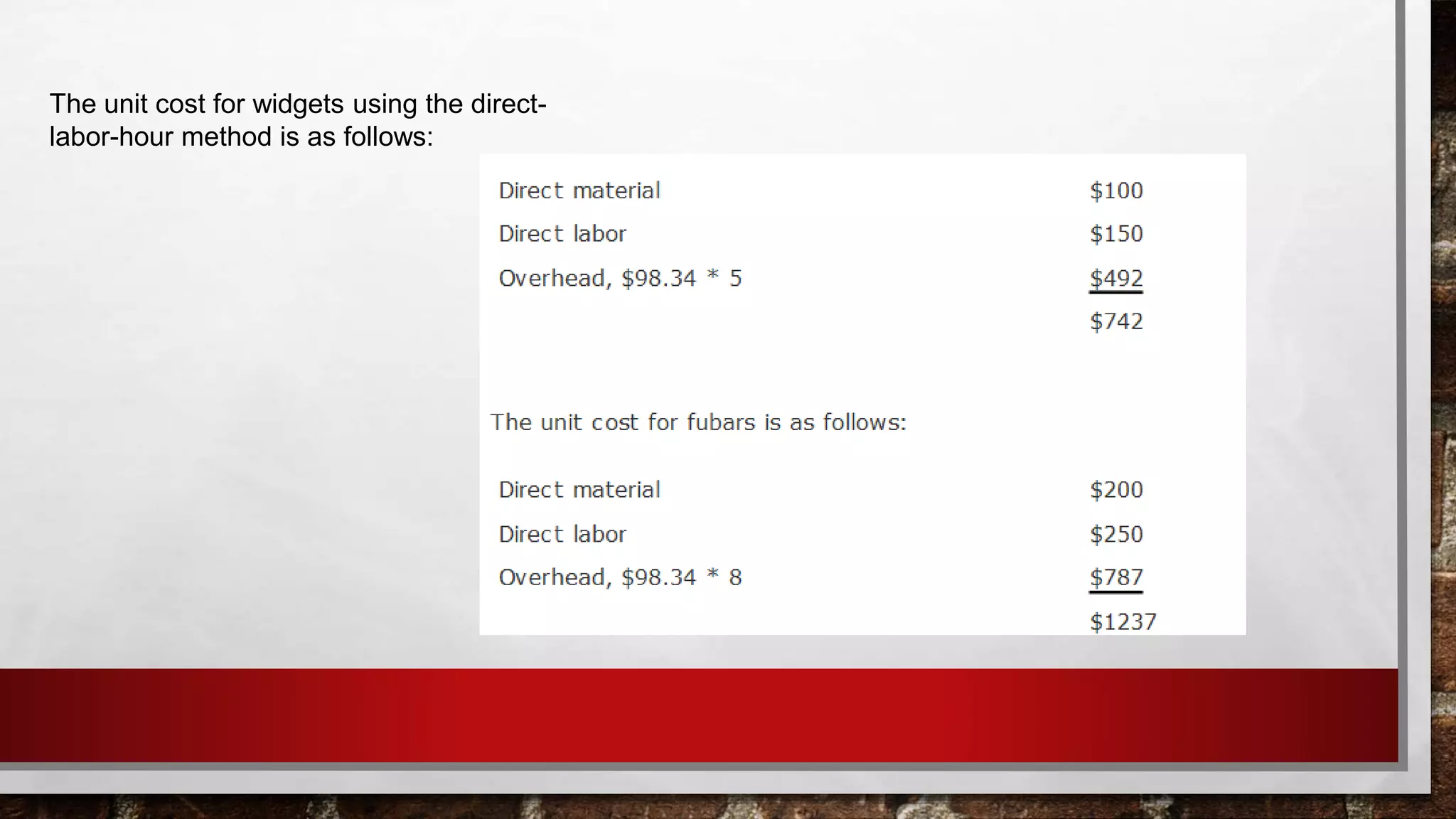

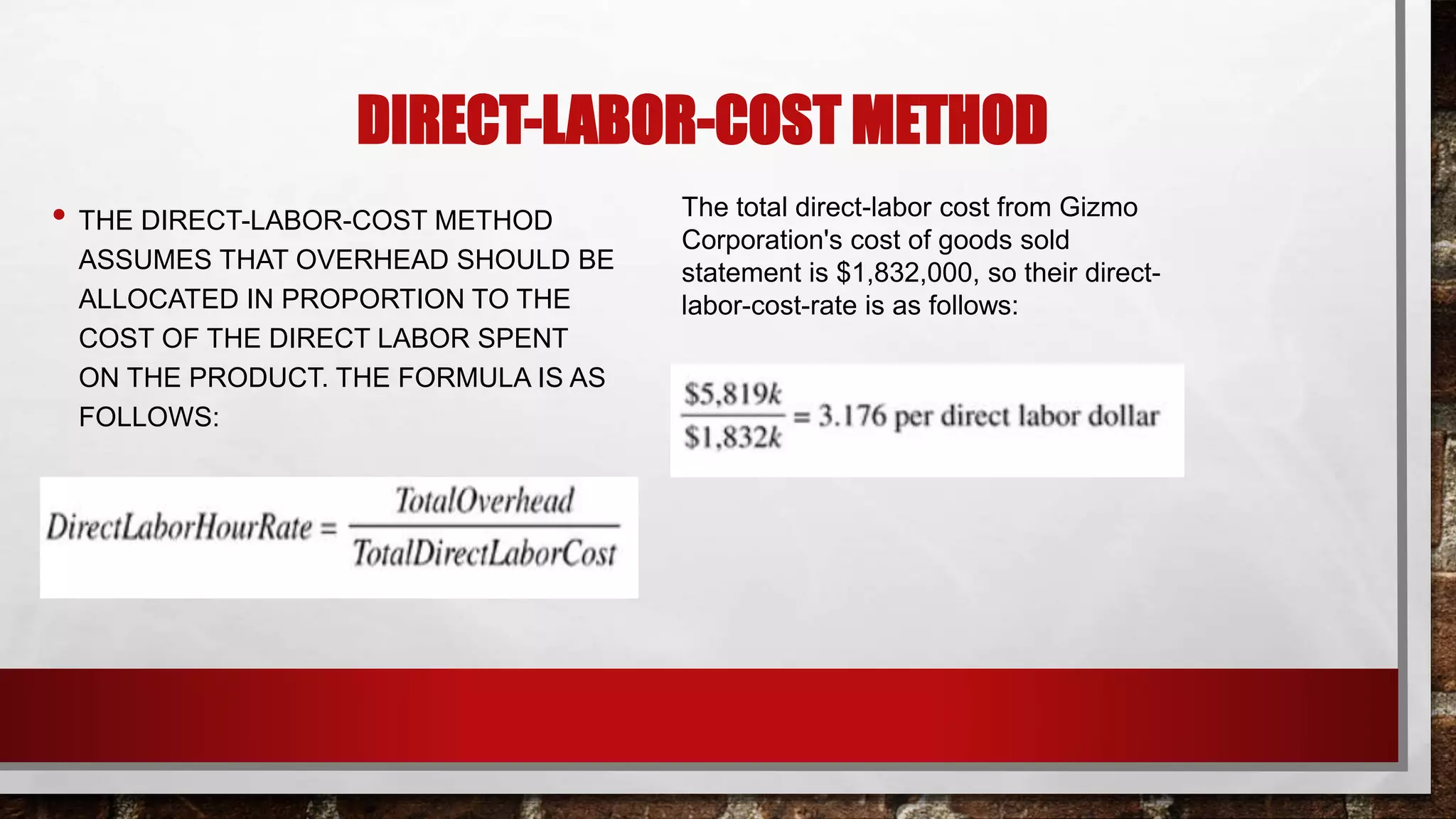

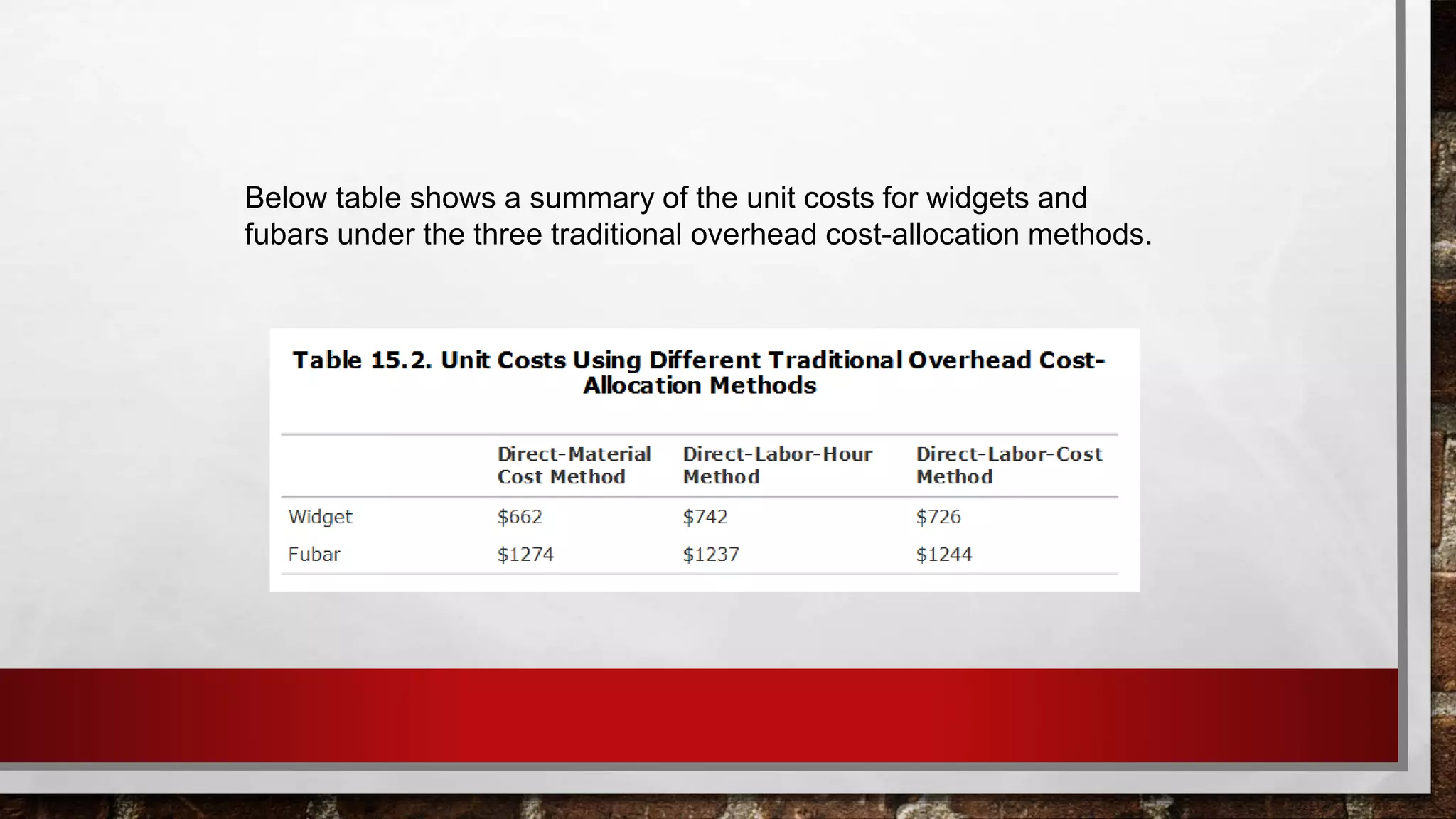

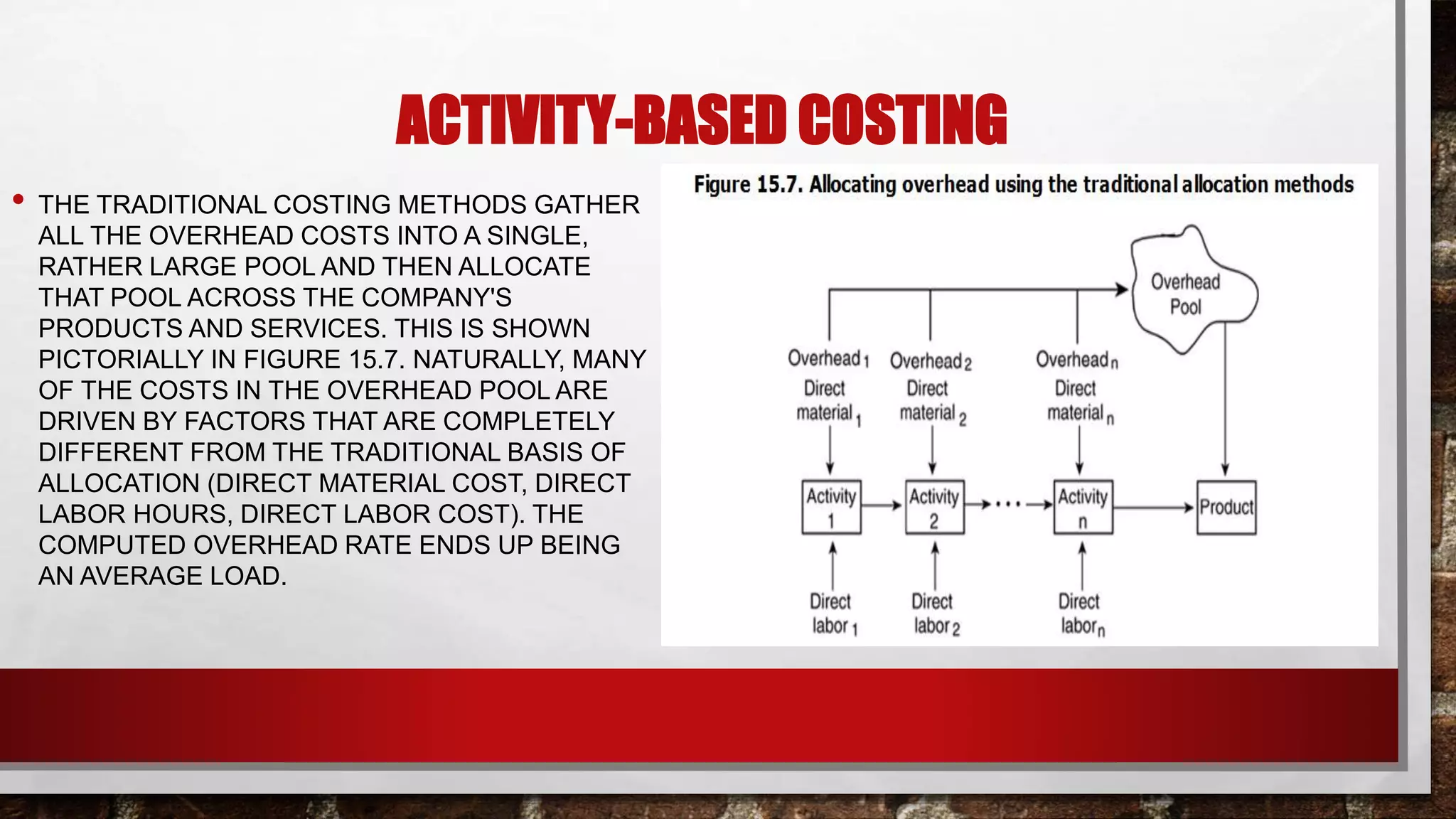

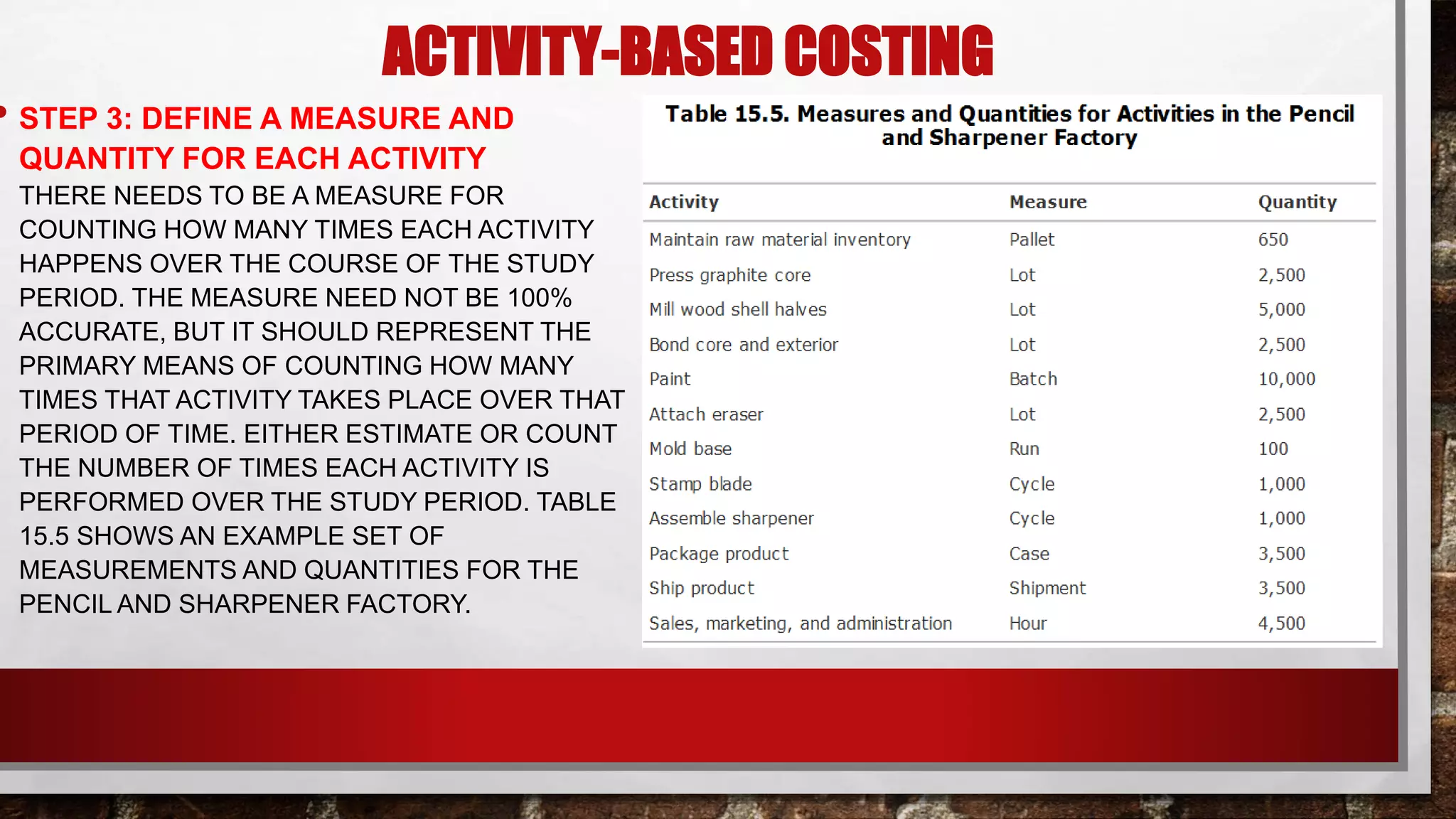

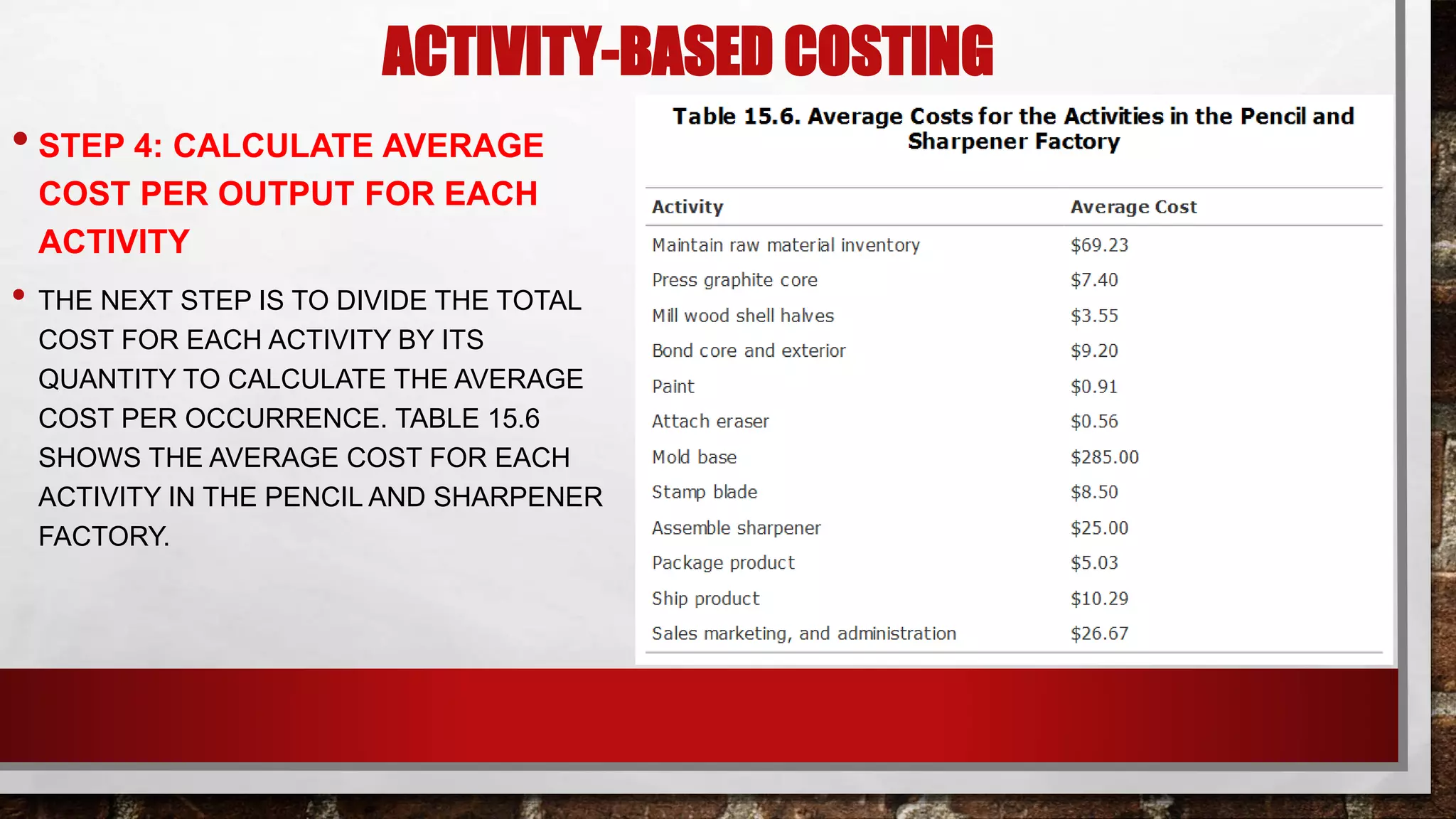

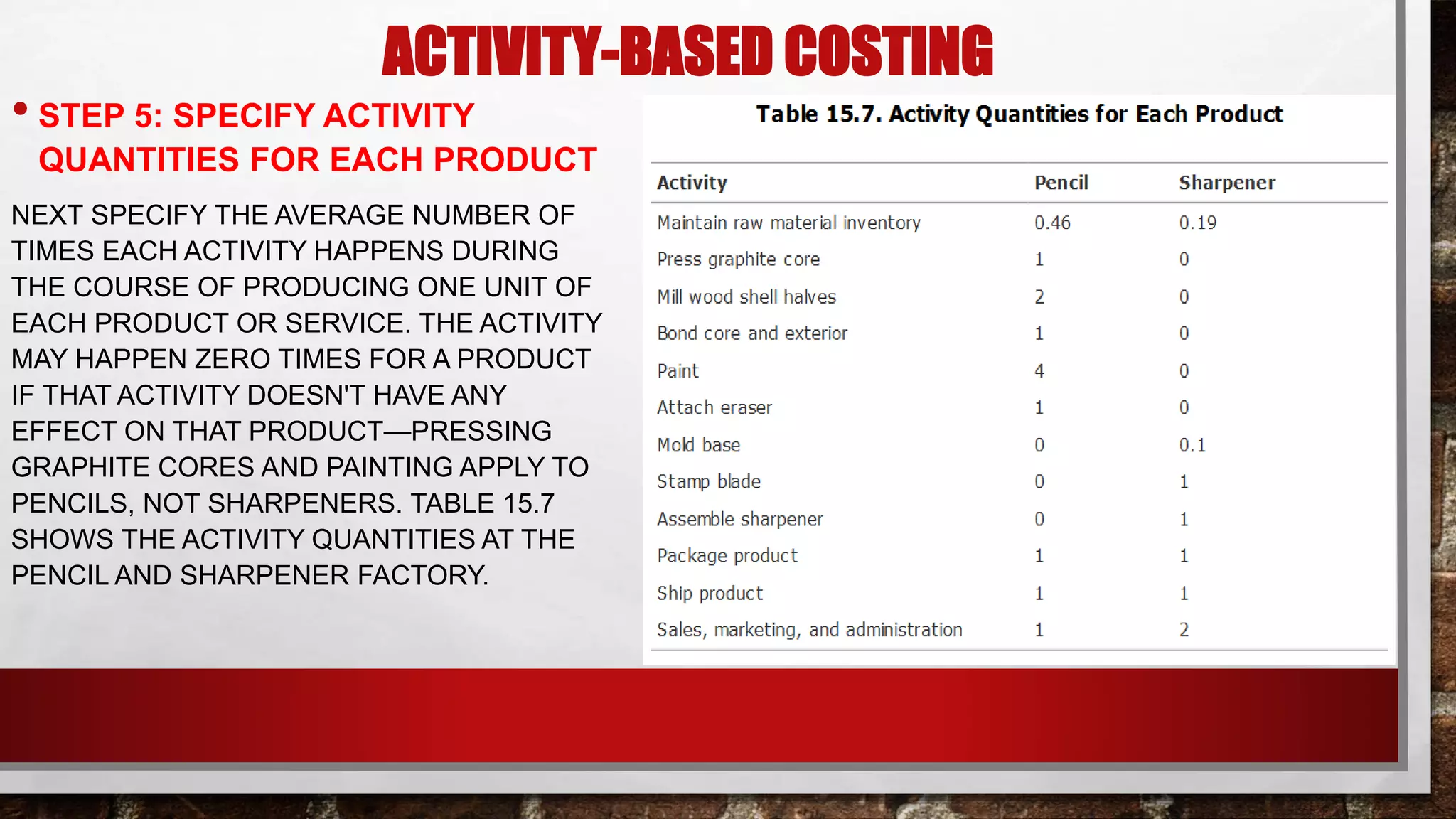

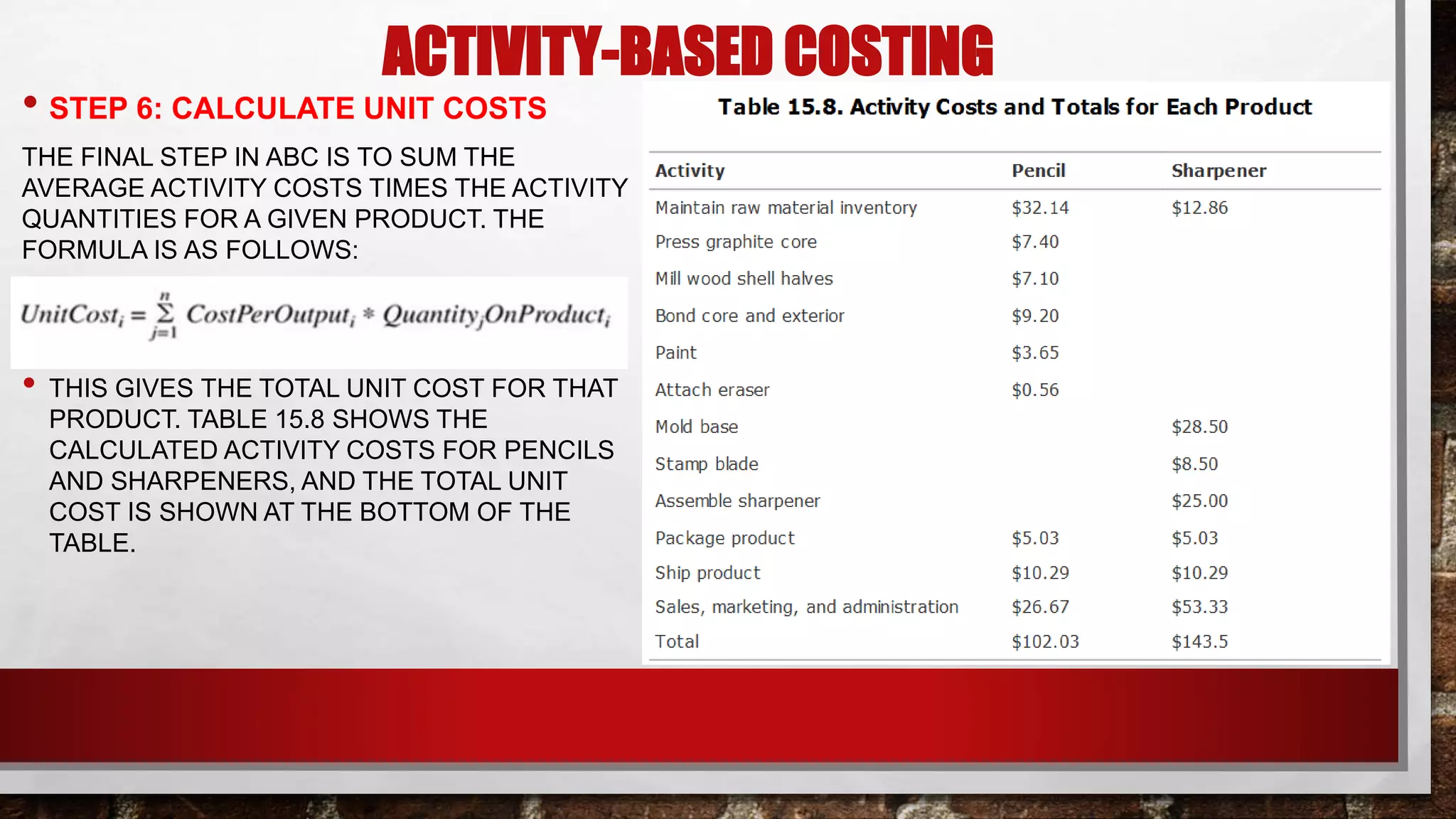

The document discusses unit costs, which are the total expenditures incurred by a company to produce, store, and sell one unit of a product or service, encompassing both fixed and variable costs. It contrasts traditional unit-costing methods, including direct-material, direct-labor-hour, and direct-labor-cost methods, with activity-based costing (ABC), which allocates costs based on specific activities associated with production. The document details the steps involved in ABC, including identifying activities, calculating total costs, and determining unit costs while highlighting the importance of understanding fixed and variable costs.