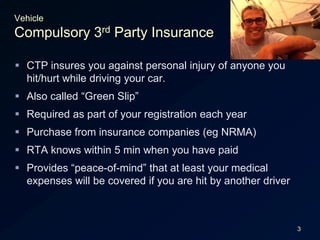

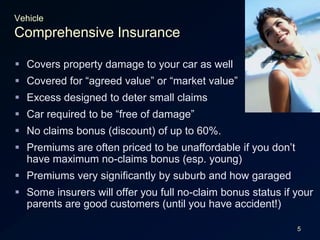

This document discusses various types of motor vehicle insurance. It explains that compulsory third-party insurance, also called a "green slip," is required by law and covers medical expenses if you injure someone while driving. It recommends taking out third-party property insurance to cover damage to others' vehicles or property. Comprehensive insurance covers damage to your own vehicle. The document provides tips on saving money on insurance such as buying an inexpensive car, not speeding or driving aggressively, and bundling home and car insurance. It stresses the importance of insurance to avoid financial hardship in worst-case scenarios and warns against lying on insurance applications.