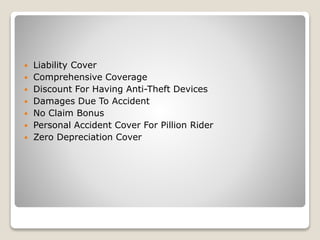

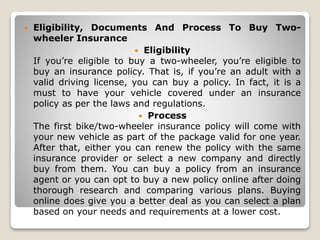

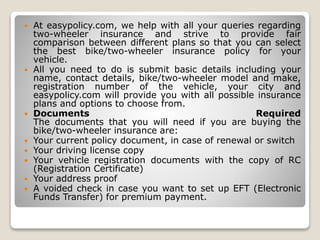

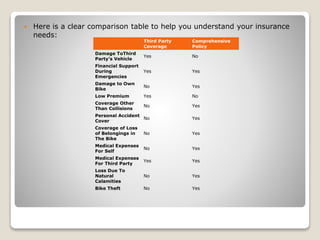

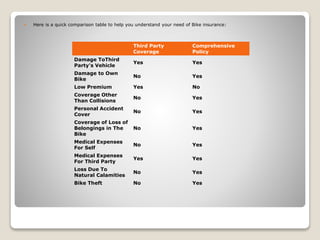

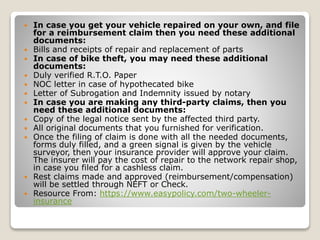

A two-wheeler insurance policy is mandatory under the Motor Vehicles Act, covering financial expenses for accidents, thefts, and natural disasters. It includes various types, such as third-party liability and comprehensive coverage, with options for add-ons like zero depreciation and accident cover for pillion riders. The document emphasizes the importance of timely renewal, provides guidelines on purchasing insurance online, and highlights the benefits of having adequate coverage for peace of mind.