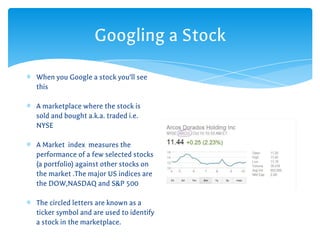

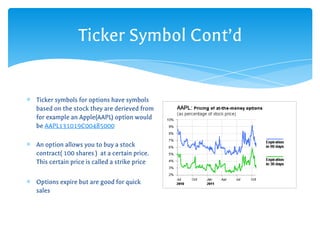

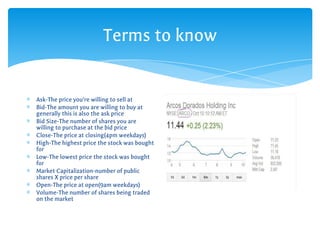

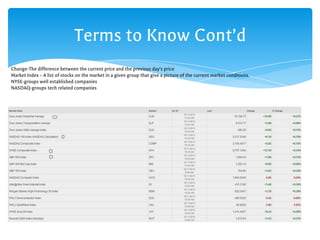

This document serves as a beginner's guide to stocks, explaining what stocks are, the types (common and preferred), and important terms related to trading. It covers essential concepts such as market indices, ticker symbols, options, dividends, and investment strategies for both long and short-term. Additionally, it highlights the significance of understanding the stock market's dynamics and provides resources for further learning.