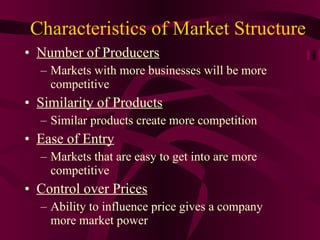

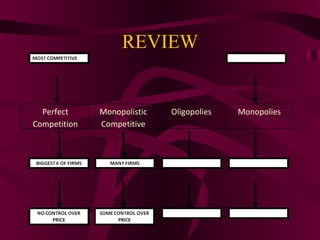

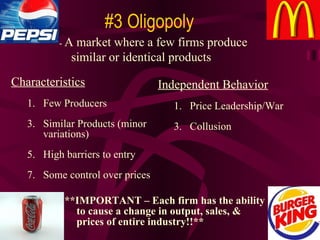

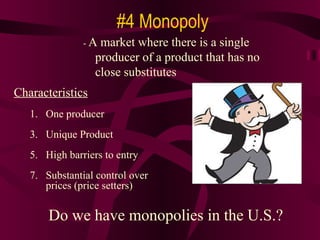

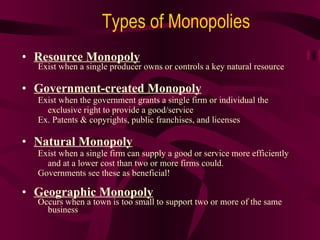

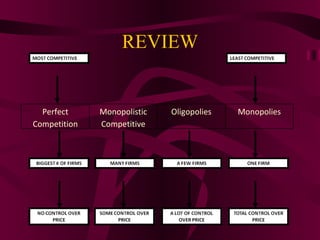

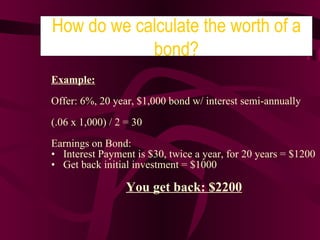

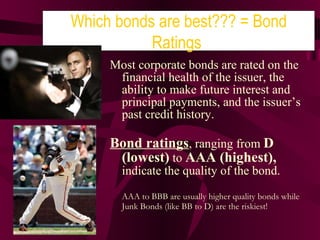

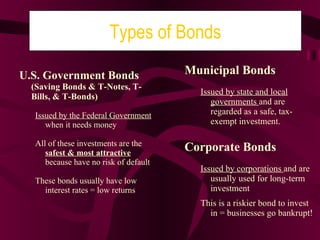

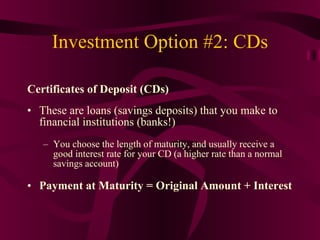

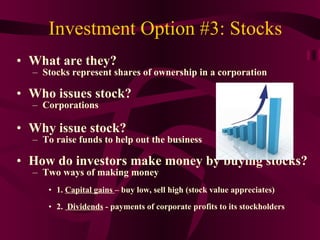

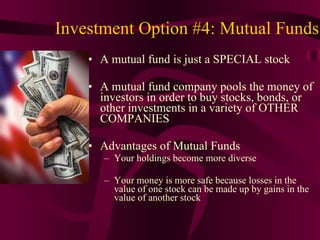

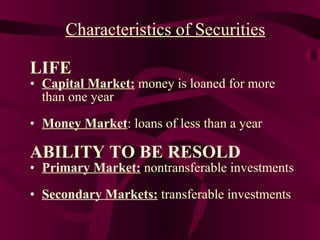

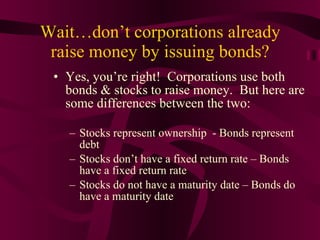

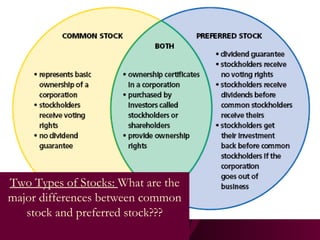

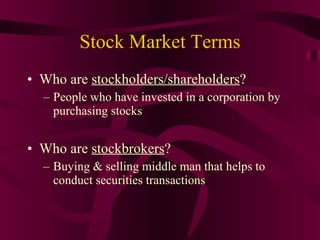

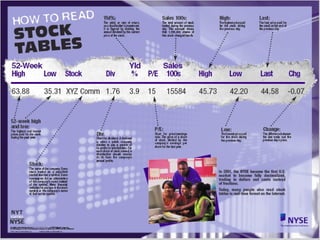

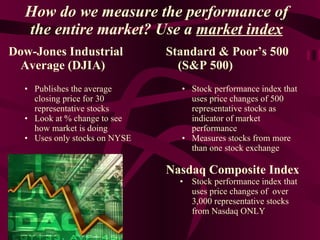

The document discusses different types of market structures and investments. It describes the four main types of market structures - perfect competition, monopolistic competition, oligopoly, and monopoly - based on factors like the number of producers, product similarity, and barriers to entry. It also outlines different investment options like bonds, CDs, stocks, and mutual funds, noting their characteristics, risks, and potential returns. The stock market and different stock types are explained. Overall, the document provides a high-level overview of market structures and common investment vehicles.